Key Events In The Coming Week: The Worst Jobs Report Since The Depression, ECB, Brexit And More

Tyler Durden

Mon, 06/01/2020 – 09:37

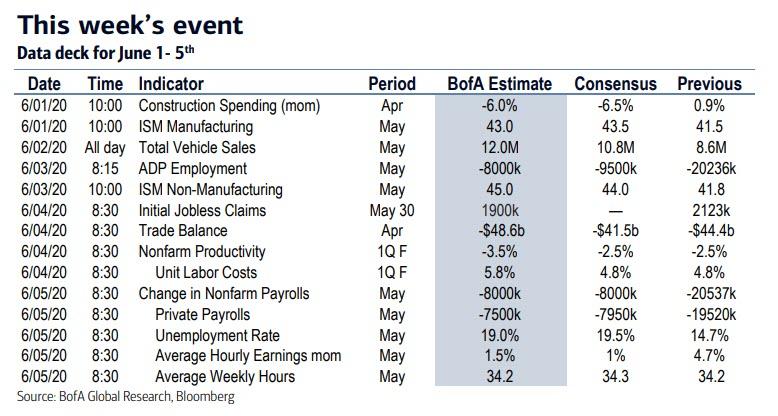

It’ll be a reasonably busy week ahead, DB’s Jim Reid writes (hot in pursuit of a new office desk) with the US jobs report on Friday the highlight, while also of interest will be the ECB’s latest decision on Thursday and whether they’ll announce more policy action, along with the release of PMIs (Monday – manufacturing and Weds/Thurs – services) from around the world. Finally, Brexit will return to the headlines as another negotiating round between the UK and the EU takes place. The most violent US riots in decades may also continue indefinitely.

Looking ahead to the key market moving events this week, for payrolls the consensus on Bloomberg is currently expecting -8000k job losses and the unemployment rate to rise to 19.6%, the highest level since the Great Depression in the 1930s, and up from the 14.7% reading in April. Within this it’ll be worth looking at the sectoral breakdowns for an idea of which industries are being hit the hardest. For example, in April the level of employment in leisure and hospitality fell by 47%. Meanwhile young people are being hit especially hard, and the teenage unemployment rate (for 16 to 19 year olds) rose to an astonishing 31.9% in April. Elsewhere PMIs (and the ISMs) will be important but the diffusion nature makes it incredibly difficult to calibrate to growth at extreme turning points. For the Fed, they meet next week so we’re now in blackout period so don’t expect to hear much from the committee members.

On the ECB meeting on Thursday DB expects large downward economic revisions to the staff forecasts more towards our house view. This supports calls for a doubling of the PEPP to €1.5tn and an extension to mid-2021 (this may be problematic to achieve if the Bundesbank ends up being constitutionally barred from participating in the ECB’s QE). The risk is a soft commitment to increase but no firm numbers until the next meeting on July 16th. There is also a clash between the PEPP being temporary policy and for it to be permanent enough to allow reinvestment. However, a lengthening of the “crisis” period means reinvestment until at least the end of 2022 would be appropriate to avoid a premature tightening of financial conditions. Expect all to be announced on Thursday. Also expect lots of press conference questions on the German Constitutional Court hearing.

Over in the political sphere, Brexit negotiations between the EU and the UK on their future partnership will continue via videoconference from tomorrow to Friday. This is the fourth round now, and thus far there hasn’t been a great deal of progress. Indeed, at the end of the third round in May, the UK’s chief negotiator, David Frost, said that “we made very little progress towards agreement on the most significant outstanding issues between us”. This is the last negotiating round before a high level meeting in June where the two sides will be taking stock of progress. It’s also important as if the two sides want to extend the transition period that concludes at the end of 2020, they only have until the end of June to agree.

Courtesy of Deutsche Bank, here is a day-by-day calendar of events

Monday

- Data: May manufacturing PMIs from Australia, South Korea, Japan, China, India, Russia, Turkey, Italy, France, Germany, Euro Area, UK, South Africa, Brazil, Canada, United States and Mexico, Japan Q1 capital spending, May vehicle sales, US April construction spending, May ISM manufacturing

Tuesday

- Data: Japan March all industry activity index, final April machine tool orders, Germany June GfK consumer confidence, France May business confidence, US March FHFA house price index, April Chicago Fed national activity index, new home sales, May Conference Board consumer confidence, Dallas Fed manufacturing activity

- Central Banks: Reserve Bank of Australia monetary policy decision

- Politics: Fourth UK-EU future relationship negotiating round begins

Wednesday

- Data: May services and composite PMIs from Australia, Japan, China, India, Russia, UK, Brazil and United States, Germany May unemployment change, Italy preliminary April unemployment rate, Euro Area April PPI, unemployment rate, US weekly MBA mortgage applications, April factory orders, final April durable goods orders, nondefence capital goods orders ex air, May ADP employment change, ISM non-manufacturing

- Central Banks: Bank of Canada monetary policy decision

Thursday

- Data: May services and composite PMIs from Italy, France, Germany and the Euro Area, May construction PMIs from Germany and the UK, Euro Area April retail sales, Canada April international merchandise trade, US April trade balance, final Q1 nonfarm productivity, weekly initial jobless claims

- Central Banks: ECB monetary policy decision

Friday

- Data: UK final May GfK consumer confidence, Japan April household spending, preliminary April leading index, Germany April factory orders, Italy April retail sales, US May change in nonfarm payrolls, unemployment rate, average hourly earnings, April consumer credit, Canada May net change in employment

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Monday, the ISM non-manufacturing index on Wednesday, the jobless claims report on Thursday, and the employment report on Friday. There are no scheduled speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, June 1

- 09:45 AM Markit US manufacturing PMI, May final (consensus 40.0, last 39.8)

- 10:00 AM Construction spending, April (GS -5.5%, consensus -6.0%, last +0.9%): We estimate a 5.5% decrease in construction spending in April, with scope for broad-based declines in both non-residential and residential construction.

- 10:00 AM ISM manufacturing index, May (GS 44.5, consensus 43.7, last 41.5): Our manufacturing survey tracker increased by 5.2pt to 38.7 in May, following somewhat stronger regional manufacturing surveys on net. We expect the ISM manufacturing index to rebound by 3.0pt to 44.5 in May.

Tuesday, June 2

- 5:00 PM Lightweight motor vehicle sales, May (GS 11.8m, consensus 11.0m, last 8.6m)

Wednesday, June 3

- 08:15 AM ADP employment report, May (GS -6,000k, consensus -9,500k, last -20,236k); We expect a 6,000k decline in ADP payroll employment, reflecting lower jobless claims than in April and higher oil prices. While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 09:45 AM Markit US services PMI, May final (consensus 37.4, last 36.9)

- 10:00 AM Factory orders, April (GS -13.0%, consensus -14.2%, last -10.4%); Durable goods orders, April final (last -17.2%); Durable goods orders ex-transportation, April final (last -7.4%); Core capital goods orders, April final (last -5.8%): Core capital goods shipments, April final (last -5.4%) We estimate factory orders fell by 13.0% in April following a 10.4% decrease in March. Durable goods orders fell sharply in the April advance report.

- 10:00 AM ISM non-manufacturing index, May (GS 45.0, consensus 44.5, last 41.8): Our non-manufacturing survey tracker increased by 5.6pt to 39.6 in May, following somewhat stronger regional service sector surveys. We expect the ISM non-manufacturing index to rebound by 3.2pt to 45.0 May report.

Thursday, June 4

- 08:30 AM Trade balance, April (GS -$49.2bn, consensus -$49.1bn, last -$44.4bn): We estimate the trade deficit increased by $4.8bn in April, reflecting a rise in the goods trade deficit.

- 08:30 AM Nonfarm productivity, Q1 final (GS -2.8%, consensus -2.5%, last -2.5%); Unit labor costs, Q1 final (GS +5.1%, consensus +4.8%, last +4.8%): We estimate nonfarm productivity was revised down by three tenths to -2.8% (qoq ar) in Q1. We estimate growth in Q1 unit labor costs – compensation per hour divided by output per hour – was revised up to +5.1% in Q1.

- 08:30 AM Initial jobless claims, week ended May 30 (GS 1,800k, consensus 1,800k, last 2,123); Continuing jobless claims, week ended May 23 (consensus 19,039k, last 21,052k): We estimate initial jobless claims declined but remain elevated at 1,800k in the week ended May 30.

Friday, June 5

- 08:30 AM Nonfarm payroll employment, May (GS -7,250, consensus -8,000k, last -20,537k); Private payroll employment, May (GS -6,750k, consensus -7,650k, last -19,557k); Average hourly earnings (mom), May (GS +1.5%, consensus +0.9%, last +4.7%); Average hourly earnings (yoy), May (GS +9.3%, consensus +8.5%, last +7.9%); Unemployment rate, May (GS 21.5%, consensus 19.6%, last 14.7%): We estimate nonfarm payrolls declined by 7.25mn in May, reflecting a continued increase in temporary layoffs and only a gradual reopening from the coronavirus shutdown. Employment surveys showed month-over-month improvement but remained in contractionary territory, while excess initial claims from regular state programs totaled almost 12mn during the May payroll month. Although alternative data suggest a modest increase in the number of workers at work sites in the May, some of the earliest workers to return to work likely remained on payrolls during the pandemic. We assume the BLS will adjust its birth-death model to capture the impact of some temporary business closures (as it did in the April report); however we believe the adjustment will again understate the true magnitude of nonfarm payroll declines.

- We expect that workers that the most of the 8.1mn workers that were employed but not at work for “other reasons” in April will be reclassified as unemployed in the May household survey, providing an almost 5pp boost to the unemployment rate. Furthermore, our real-time unemployment tracker—which forecasts the unemployment rate based on jobless claims—suggests unemployment might have peaked around the May survey week. Additionally, we expect the participation rate to decline a bit further on account of the virus. Taken together, we estimate the unemployment rate rose almost 7 points to 21.5%. We estimate average hourly earnings increased 1.5% month-over-month and 9.3% year-over-year, reflecting a composition shift towards higher-paid workers that is boosted by positive calendar effects.

Source: Deutsche Bank, Goldman, BofA

via ZeroHedge News https://ift.tt/2ZUQ8Oy Tyler Durden