Budget Office Finds US Economy Won’t Return To Normal Until 2030

Tyler Durden

Mon, 06/01/2020 – 19:32

There goes the V-shaped recovery.

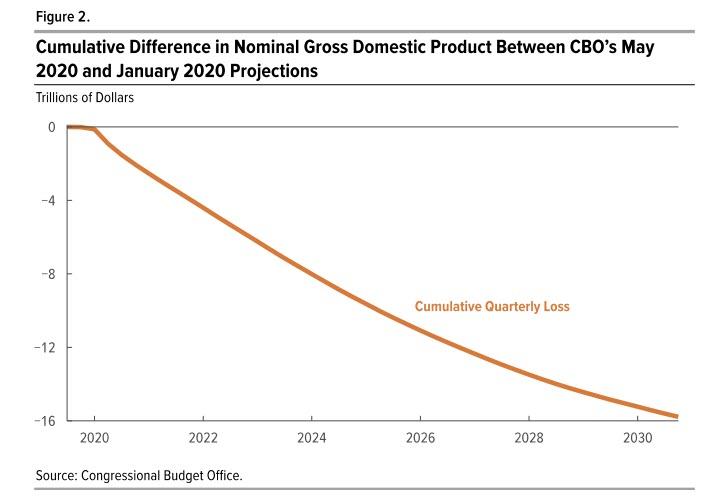

In its first official forecast incorporating the impact from the coronavirus shutdowns, today the Congressional Budget Office said that over the 2020–2030 period, cumulative GDP will be $15.7 trillion, or 5.3%, less in nominal dollars than what the agency projected in January. Putting that number in context, the nominal GDP of the US today is $21.5 trillion, in other words over the next decade, the Coronavirus will have wiped out almost one full year of output potential from the US economy.

In real, or inflation-adjusted dollars, some $7.9 trillion in economic activity over the next decade will be lost even with the trillion of rescue funding being poured in to offset the pandemic’s impact.

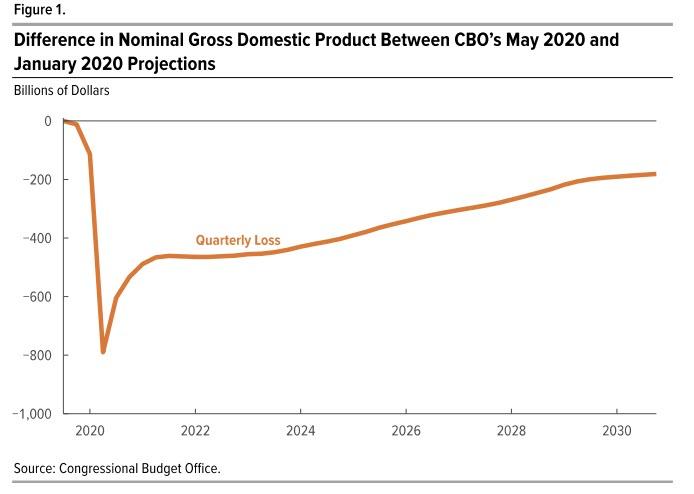

Comparing its interim, May 2020 projections to the last official forecast made in January 2020, the CBO said that the level of nominal GDP in the second quarter of 2020 would be $790 billion (or 14.2%) lower than the agency had previously forecast in January 2020 (a number which unfortunately will only grow larger with time especially if the Atlanta Fed’s 52% GDP drop forecast is accurate). Subsequently, the difference between those projections of nominal GDP narrows from $533 billion (9.4% lower in the latest projection) ) by the end of 2020 to $181 billion (2.2 percent lower) by 2030.

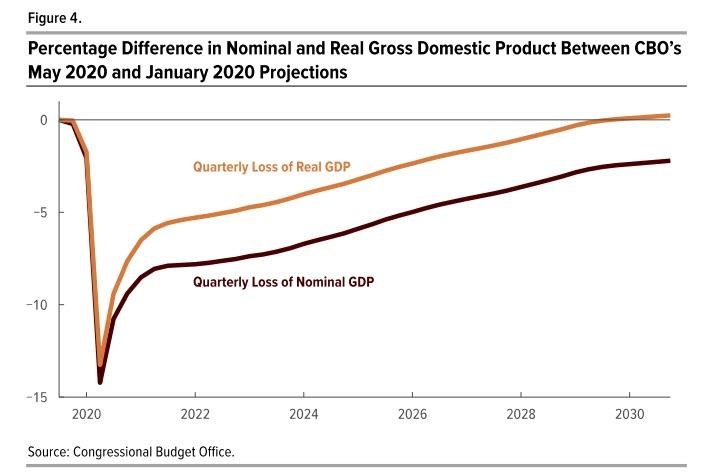

In real terms, the difference between those projections of real GDP shrinks, to $422 billion in 2019 dollars (7.6% lower in the more recent projection) by the end of 2020 and roughly disappears by 2030. In other words, it will take a decade for the impact of the coronavirus to fully fade away and for the economy to return to its pre-coronavirus normal.

The difference between the CBO’s January baseline and the nominal and real cumulative GDP projections is shown below. Curiously, while on a real basis the economy takes a decade to revert to normal, in nominal dollars it appears the US can’t ever recover its previous trendline.

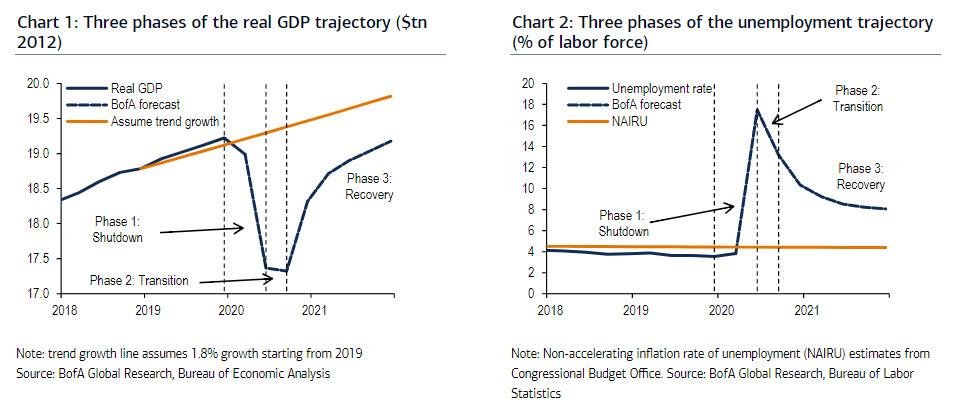

The permanent loss in output in the US economy was shown by BofA two weeks ago when the bank laid out the pre-covid trend growth and compared it to is base case recovery.

“Business closures and social distancing measures are expected to curtail consumer spending, while the recent drop in energy prices is projected to severely reduce U.S. investment in the energy sector,” said CBO Director Phillip Swagel in a written response to an inquiry from Senator Chuck Schumer. “Recent legislation will, in CBO’s assessment, partially mitigate the deterioration in economic conditions.”

In response, Schumer quickly pivoted the conversation to get even more government stimulus money out of the current crisis, saying the CBO estimates emphasize the case for quick action on another spending bill.

“In order to avoid the risk of another Great Depression, the Senate must act with a fierce sense of urgency to make sure that everyone in America has the income they need to feed their families and put a roof over their heads,” Schumer said in a statement.

The CBO also said it was marking down its longer-run estimate for growth due to expected low levels of inflation, despite all off of the public spending and further rescue lending from the Federal Reserve, and cautioned that further adjustments to its projections are likely as more is known about the coronavirus’ path, its ultimate economic damage and the impact of congressional funding measures.

“An unusually high degree of uncertainty surrounds these economic projections, particularly because of uncertainty about how the pandemic will unfold this year and next year, how the pandemic and social distancing will affect the economy, how recent policy actions will affect the economy, and how economic data will ultimately be recorded for a period when extreme changes have disrupted standard estimation methods and data sources,” Swagel wrote.

via ZeroHedge News https://ift.tt/3eGtrlr Tyler Durden