More Hedge Funds Move To Outsource Trading As COVID-19 Crisis Revives 2-Way Market Swings

Tyler Durden

Mon, 06/01/2020 – 21:50

Most people who haven’t worked in the financial services industry probably wouldn’t understand the distinction between being a ‘hedge fund analyst’ and a ‘hedge fund trader’. But the two rolls are completely different. And while one of them – the analyst – might benefit from a shift in skill-set preferences and the ongoing retrenchment in sell-side research shops, the other – the trader – is increasingly seeing their jobs outsourced to a handful of major sell-side players who are offering a new service effectively allowing clients (ie counterparties whom these banks are also trading against) to outsource trading operations.

And according to a Monday report published by Bloomberg, the coronavirus outbrek is reportedly accelerating this shift toward ‘outsourced’ trading roles in the hedge fund world.

At this point, only the largest hedge funds even bother to build their own in-house operations. Staffing at smaller and boutique shops is typically no frills: limited to only a small team of analysts and maybe some researchers, led by a portfolio manager or two (or more). This is intentional: it allows star PMs to hog those juicy fees.

But in the age of COVID, even the bigger shops are outsourcing, and smaller firms are expanding their use of these services, as wealthy investors demand that money managers keep one eye on the exit at all times. Recent crashes of retail platforms like Robinhood and Charles Schwab are worrying reminders about what can happen to retail investors when a real market panic gets going.

Here’s more on the trend from BBG:

As the pandemic unleashes unprecedented operational risks, asset managers are joining peers who have flocked to these services in recent years to keep up with new technologies and to cut costs — while liquidity gets ever-more fragmented.

Among the more established names, Outset Global LLP says its client list has grown 45% in the year through April. Tora Trading Services Ltd. says sales increased 105% in the first three months of the year from the prior period, as existing clients expanded usage and new ones signed on. Tourmaline Partners LLC, an outsourcing firm based in Stamford, Connecticut, just clinched a majority investment from a private equity firm that will help expansion plans.

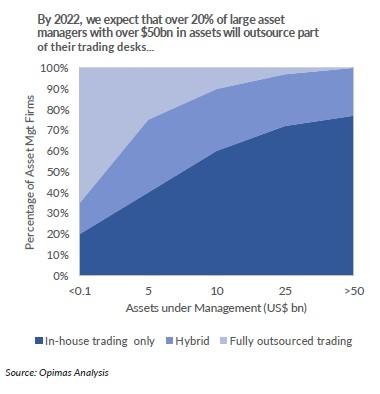

While smaller firms often outsource all of these responsibilities to their prime brokers, larger firms with in-house operations are increasingly outsourcing more to these upstart shops and established players.

At this point, some of you might be wondering: what’s the difference between offering prime brokerage services, and trading services? These trading operations don’t just execute buy and sell orders; the services they offer are often so comprehensive, they can allow clients to “set it and forget it” – leaving specific instructions with traders to execute in Asian or European hours while traders in New York are asleep – or vice versa.

It’s part of a broader shift in trading that has allowed greater levels of automation to creep into the market. Even if you’re skilled enough to program your own trading algorithms, wouldn’t you sleep better knowing a human was somewhere nearby, keeping one eye on the tape?

While some smaller funds opt to outsource entirely, many larger managers use such services to supplement their own operations, like buying and selling Asian stocks when their traders in New York are asleep.

Unlike agency or prime broking, outsourced players conduct relationships with the sell side on behalf of the client and offer more comprehensive services including monitoring exposures and providing market color.

“It does appear there has been increased interest in outsourced trading,” said Shane Swanson, an analyst at consultancy Greenwich Associates. “That does go hand-in-hand with the explosion in technology we’ve seen across the past 10, 15 years — in particular in how that has been utilized as part of this response to the Covid crisis.”

He calls the recent turmoil a “proof of concept” for outsourcing for a host of new managers.

Market analytics firms told BBG that some of the biggest players in this space – Cantor Fitzgerald and Jeffries – have seen their trading businesses expand by more than 45% over the last year.

Outsourced traders essentially act as a middleman between the buy side and sell side in handling trading flows. Some outsourced trading divisions are run inside bigger financial services firms, like Jefferies Financial Group Inc., while others operate as small, standalone shops. Their pitch to asset managers: Ensuring best execution with an extensive network of brokerages and high-speed technology, which can be expensive for smaller funds to maintain on their own.

“We’ve seen folks add our outsourced trading team just to be able to say that they have systems in place and a set-up in place should their traders get sick with Covid,” said Bobby Croswell, head of U.S. outsourced trading at Cowen Inc. The firm’s outsourcing revenue more than doubled in the first quarter compared with the same period in 2019.

Volatility has undoubtedly accelerated this trend, which is widely expected to continue.

On the subject of whether this trend is a waste of money, or an overreaction to the recent shock selloff, we suspect all the 20- and 30-something year-old traders running the market these days could probably use a little hand-holding. As far as market stability is concerned, it’s probably not a bad thing.

In other new, Bloomberg says, stock market participants want a reduction in the world’s longest trading hours, which they say can improve liquidity and industry diversity, according to the results of a London Stock Exchange survey.

via ZeroHedge News https://ift.tt/2TV9fEz Tyler Durden