Fed Expands Muni Bailout Facility

Tyler Durden

Wed, 06/03/2020 – 13:11

While municipalities around the nation are demanding more ‘free money’ helicopter drops from the government, The Fed has just stepped up its efforts to bailout America’s states and cities.

Just as The Fed tapers its buying program in US Treasuries, it appears to be dropping down the risk spectrum dramatically by offering to directly monetize primary issuance from states (and up to two cities from each state).

The Federal Reserve Board on Wednesday announced an expansion in the number and type of entities eligible to directly use its Municipal Liquidity Facility (MLF).

Under the new terms, all U.S. states will be able to have at least two cities or counties eligible to directly issue notes to the MLF regardless of population. Governors of each state will also be able to designate two issuers in their jurisdictions whose revenues are generally derived from operating government activities (such as public transit, airports, toll facilities, and utilities) to be eligible to directly use the facility.

In addition to the expanded terms outlined above, the MLF continues to be directly open to U.S. states, the District of Columbia, U.S. cities with a population of at least 250,000 residents, U.S. counties with a population of at least 500,000 residents, and certain multistate entities.

The MLF was established under Section 13(3) of the Federal Reserve Act, with approval of the Treasury Secretary. It will offer up to $500 billion in lending to states and municipalities to help manage cash flow stresses caused by the coronavirus pandemic.

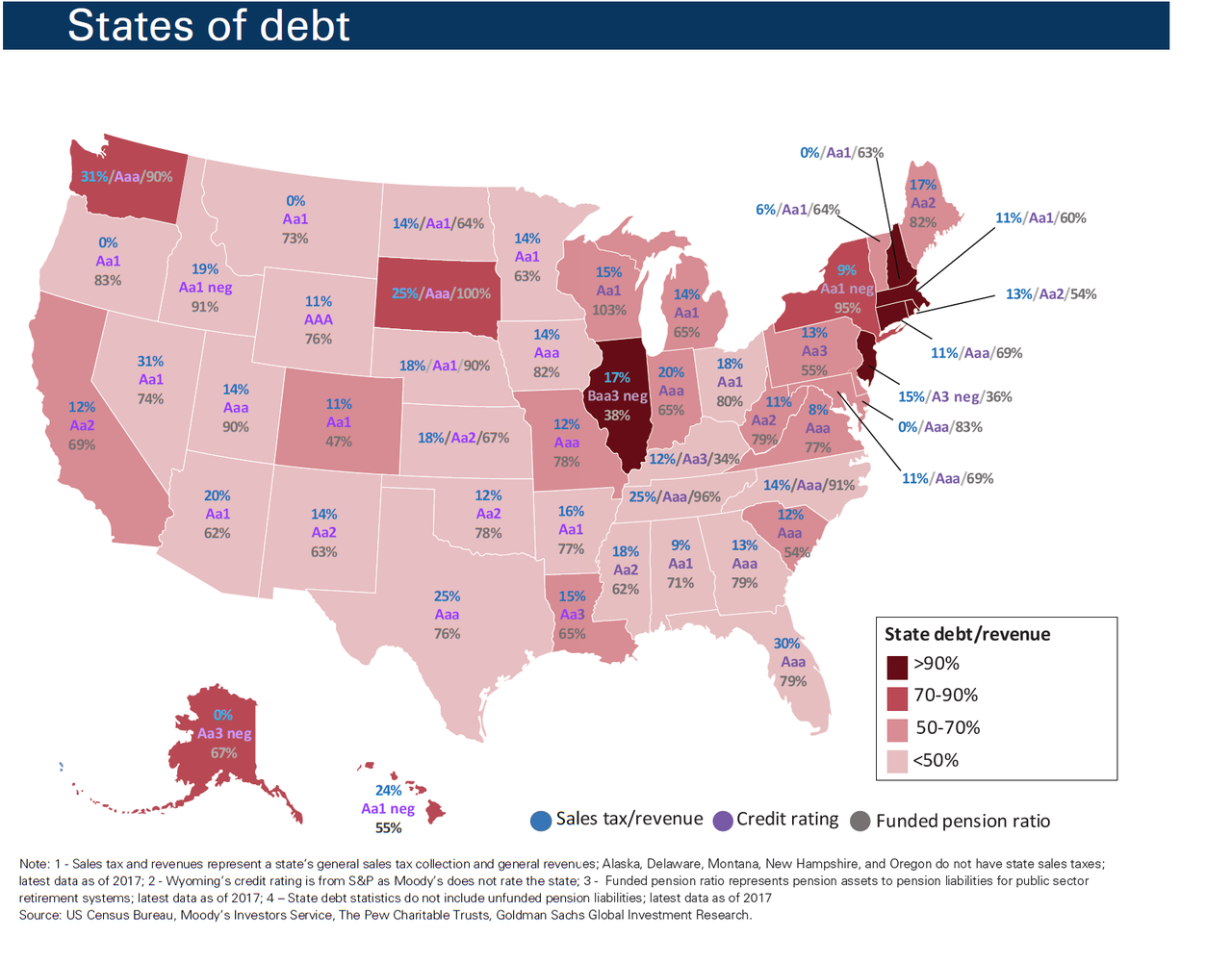

Of course, this “loan” from The Fed is not as much fun to spend on frivolous shit as “free money” from the government but it is clear that State finances are bad and getting bad-er…

And now is not the time to cut the pay of the police force, right?

via ZeroHedge News https://ift.tt/2zW3H5K Tyler Durden