“Everything Is Telling You “No, It’s Not OK”, And Then You Look At The S&P 500 – It Keeps Going Up”

Tyler Durden

Wed, 06/03/2020 – 22:26

There’s a lot of confused traders out there.

That’s the conclusion from reading some of the trader quotes in Bloomberg’s article about how “The Things That Used to Matter to Stock Investors Don’t Anymore” and which, as the title suggests, explains that “neither rising earnings, nor economic growth, nor bargains matter” in the rally that has swept markets since March.

We find all of that surprising, because while Bloomberg is right and neither earnings, nor economics, nor valuation matter, what does matter is what Bill Dudley finally admitted to today, namely that the Fed is “basically creating a little bit of moral hazard” and since moral hazard is a binary condition – it is either there or it isn’t – what happened is that as Scott Minerd said, the Fed “sent the world a buy signal“ and the world responded as requested.

But don’t take our word for it – look at what the companies themselves are doing. Having drastically slashed buybacks and takeovers to just $12 billion last month, the second-lowest level in the past decade, according to TrimTabs, corporations have unleashed a record stock selling spree, pushing the total to a record $94 billion.

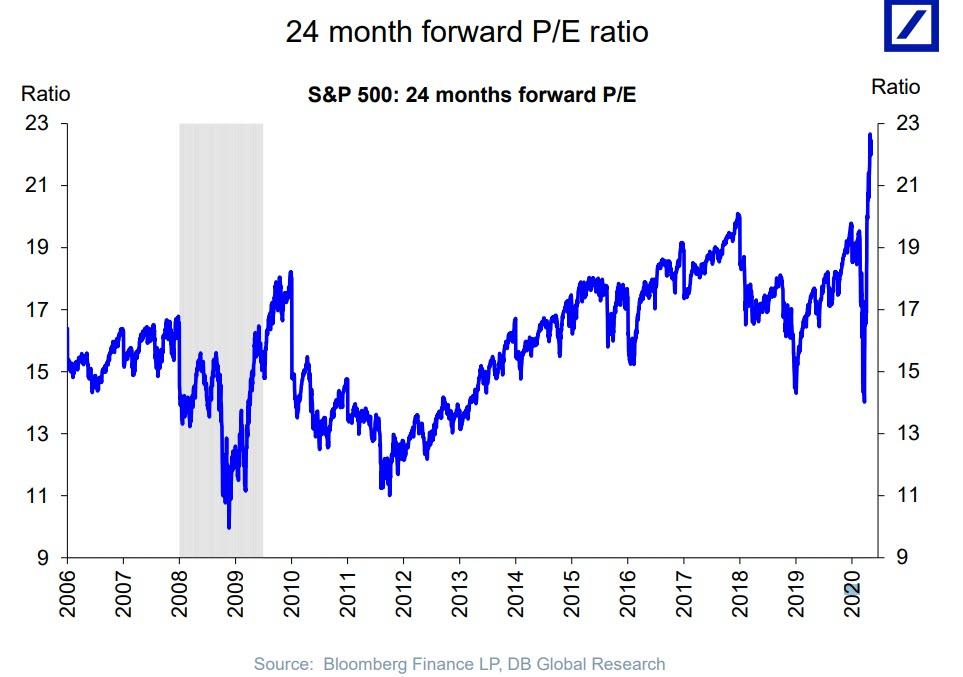

Cash-strapped, some would say insolvent, firms from airlines to cruise lines rushed to take advantage of the euphoria and sell shares to shore up their balance sheets. Companies including Warner Music Group and ZoomInfo Technologies launched IPOs, seeking to raise money and take advantage of a market multiple that’s expanded to a record high. As a result, equity sales in May more than tripled the 12-month average, according to TrimTabs.

Yet this clearest sign of a top – after all who knows their own stock prospects better than the companies themselves and they are dumping to sell – has been completely ignored, as retail daytraders and systematic funds have continued to chase momentum in a market where according to Bloomberg calculations, $9 trillion was added to equity values in 10 weeks, with the Nasdaq 100 surging 38% since its March low and briefly eclipsed its all-time closing high on Wednesday.

Yet while it all makes sense if one just accepts that only the Fed matters, some traders still seek strands of logic and reason in a market that disconnected with underlying data a decade ago:

“All those things are telling you everything is not OK, and then you look at the S&P 500 – it keeps going up,” said Jerry Braakman, chief investment officer of First American Trust in Santa Ana, California. “The market doesn’t care about valuations. With the Fed continuing to step in, the right bet has been to bet with the Fed. The trends are your friends right now, just keep riding it higher and it’s almost a little bit like, stick your head in the sand.“

Yes Jerry, that’s right, just stick your head in the sand and buy: the Fed’s got your back, so what can possibly go wrong?

Well, for one, the euphoria eventually dry up and companies may no longer be able to “distribute” their shares to gullible momentum chasers.

“The staggering volume of new offerings should be of concern to market participants,” said Winston Chua, an analyst with TrimTabs. “The more shares in the marketplace, the harder it is for existing shares to move higher, all else being equal.”

The risk, as we laid out two weeks ago in “Companies Call The Market Top With Most Stock Sales In Eight Years“, is that sooner or later, investors will reverse their stance to join corporations in unloading stocks, as Goldman warned recently when it said that with buybacks fizzling, the market is vulnerable to shocks, unlike years past when companies helped keep equity losses from snowballing by launching massive buybacks at inflection points. To wit, the market’s bottom in February 2018 came in a week when Goldman Sachs’s corporate-trading desk saw the busiest buyback orders ever.

And while a top is certain, the question is when.

For now, it’s just the opposite as investors appear to have run out of “safe” megacaps and are chasing increasingly riskier exposure, snapping up banks and small caps, companies seen benefiting most from an economic rebound (how ironic, considering that an economic rebound is the worst possible outcome for traders as it would mean an end to the Fed’s massive stimulus). No surprise that Citigroup’s sentiment model, which tracks factors such as fund flows and options trading, is pointing to a state of euphoria among investors.

Why? The answer is simple: the Fed has created the biggest legalized casino in the world, and with everyone winning who would want to leave when the fun is just starting.

“The talks from Federal Reserve officials and other government officials that basically they’re willing to take whatever it takes to make sure the economy can get back on track gives investors the feeling that there is really no significant risk in stocks,” said Michael Ball, managing director of Denver-based Weatherstone Capital Management. “Things like fundamentals and buybacks don’t matter until they matter, and people over-correct for that.”

* * *

Yet while everyone is confused as to why the Fed can continue doing what it does (as Eric Peters said over the weekend, “Stocks Are Going Parabolic For All The Wrong Reasons: The Fed Made A Massive Mistake“), including professional investors, there do occasionally emerge nuggets of clear insight such as the following excerpt from Benjamin Bowler:

“Perception can become reality, as investors heavily trained since the GFC to not fight the trend, feel forced to chase. A risk then is succumbing to reflexivity – that is inferring fundamentals from prices and believing markets are correctly forecasting a rosy future, despite much needing to go right for that to be the case… Hence, the key in our view is appreciating the more likely drivers of markets here (a feedback loop fuelled by the perception of quant + promise of policy + the fear of missing out) rather than letting buoyant prices seed overconfidence that markets can truly shrug off the worst recession since the great depression (something not seen in 90yrs).”

via ZeroHedge News https://ift.tt/2XuVtun Tyler Durden