US Consumer Credit Crashes As Americans Repay A Record Amount Of Credit Card Debt

Tyler Durden

Fri, 06/05/2020 – 15:47

One of the striking changes to US consumer behavior spawned by the economic shutdowns from the coronavirus pandemic, was the unprecedented surge in personal savings which as we learned last week, exploded to a record 33% of disposable personal income…

… as the annualized amount of Personal Savings soared by a mindblowing $4 trillion in May, rising from $2.1 trillion to $6.1 trillion.

Now, thanks to the latest consumer credit data released by the Fed, we know what much of that saving went to: paying down debt.

According to the Fed’s latest G.19 statement, in April total consumer credit plunged by a record $68.8 billion, smashing expectations for a modest $20 billion drop sparked by last month’s $6.8 billion (revised) drop, and more than 3x greater than the biggest consumer credit drawdown observed during the financial crisis.

Just like March, the bulk of the credit repayment took place in revolving credit although to a far greater degree as Americans repaid a record $58 billion on their credit card bills as US consumer society literally went into reverse and instead of spending wildly as it does every other month, usually spending what it can’t afford, US consumers repaid the most on their credit cards ever.

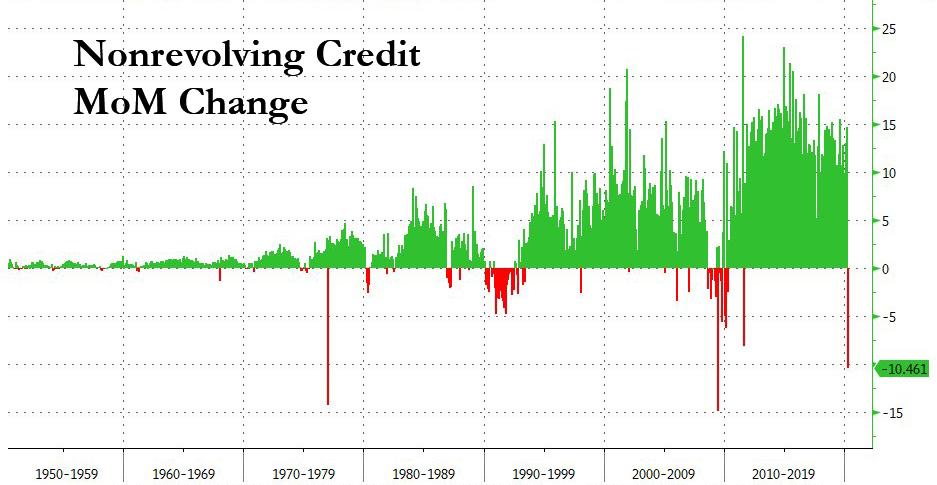

However, in perhaps a more notable departure from March when total consumer credit also tumbled even as non-revolving credit rose, in April non-revolving credit – auto and student loans – also posted a sharp drop. In fact, the drop, while not the biggest on record, was the biggest since the financial crisis. It wasn’t immediately clear if this particular drop was due to shrinkage in student or auto loans: the full detail will be published in two months time when the Fed reveals the quarterly change in those two series.

And that’s how the US consumer died with a bang: because in a time of virtually no visibility on job prospects and how the pandemic is resolved, instead of doing what they do best, i.e. spend, Americans not only saved money but also went into credit paydown mode, crippling an economy where 70% of total output is a direct result of consumer spending; and needless to say, the tens of millions of Americans (depending on whether one believes the initial claims or the BLS jobs report) who have lost their jobs are not going to go out and spend like drunken sailors any time soon.

So how long until this shocking plunge in consumer spending reverses? The answer is that nobody knows, but until US consumers feel comfortable enough to once again “charge it”, there can be no recovery.

What we find most surprising, however, is that in this day and age when the Fed has effectively institutionalized moral hazard and where failure is no longer punished as capitalism is now officially dead and zombie existence is rewarded, Americans still care enough about their credit rating to pay down their own debt even as corporations and the country go on a historic debt issuance spree which everyone knows will never be repaid.

Our advice to Americans with credit cards: go crazy, after all if everyone defaults it’s the same as nobody defaulting.

via ZeroHedge News https://ift.tt/2A8CAEF Tyler Durden