“Here’s Your ‘V’!” – No, The Market Is Not Forward-Looking

Tyler Durden

Sat, 06/06/2020 – 19:30

Authored by Sven Henrich via NorthmanTrader.com,

In this week’s edition of Straight Talk Guy Adami, Dan Nathan and I are diving into the surprising jobs report, the hot topics of the widening wealth gap and social unrest, the Fed’s role in all of it, the implications of the widening rift on our society, the risks of a building record rift between asset prices and the real economy and we also offer a heartfelt discussion of the reasons of why we do what we do, offer our often contrarian and critical opinions.

Markets closed the week at a red flag screaming 151% market cap to GDP. There is no history, none, that shows valuations above 150% market cap to GDP are sustainable. None.

But this is what you get when you have a market that treats a phase one trade deal as something better than the trade volumes that were in place before the trade war ever started. This is what you get when a market treats phase one Covid vaccine trials as an actual vaccine already in place. This is what you get when a market prices in a perceived uptick in employment from a total collapse as an economy already having returned to full employment. This is what you get when a market perceives the injection of trillions of dollars as a substitute for actual growth in the economy.

This is what you get:

Welcome to the first massive financial asset bubble inside of a recession.

— Sven Henrich (@NorthmanTrader) June 5, 2020

A financial asset bubble the likes we have never seen before. Asset bubbles happen at the end of a business cycle. Now we have one with nothing, absolutely nothing, on a extended proven growth path and the global economy still in a recession.

What bubble do we have in store for when the economy actually emerges from the recession?

Fact is the China US relation is frayed, the phase one trade deal in shambles in terms of actual volumes. There is no vaccine and while we’ve had a slowing of infections of wave 1 of the virus it is still ravaging in places such as Brazil and Mexico and back on the uptick in countries that have reopened their economies. The jury is still out.

And employment?

Here’s your “V”. pic.twitter.com/DLlipDOyOv

— Sven Henrich (@NorthmanTrader) June 5, 2020

Companies continue to make layoff announcements and more are to come.

There is little doubt the trillions in liquidity injections by the Fed and other central banks have juiced asset prices to levels that pretend to convey that nothing has happened.

New all time highs on the Nasdaq in the most vertical and aggressive “V” shaped rally ever.

$SPX back to levels last seen during the fleeting January 2020 lows when GDP growth was expected to be 2%, earnings growth deemed to be 5%-8% and unemployment at 3.5%.

Markets pretend that nothing’s happened and things are back to normal:

But they aren’t. Far from it, but that’s the illusion purposefully propagated by central banks. Millions unemployed with permanent job losses on the horizon but American billionaires having increased their wealth by $565B since March 18. This is America.

George Carlin once said:

When you are born to this world you get a free ticket to the freak show and if you are born in America you get a front seat. Welcome to the freak show that works for fewer and fewer people.

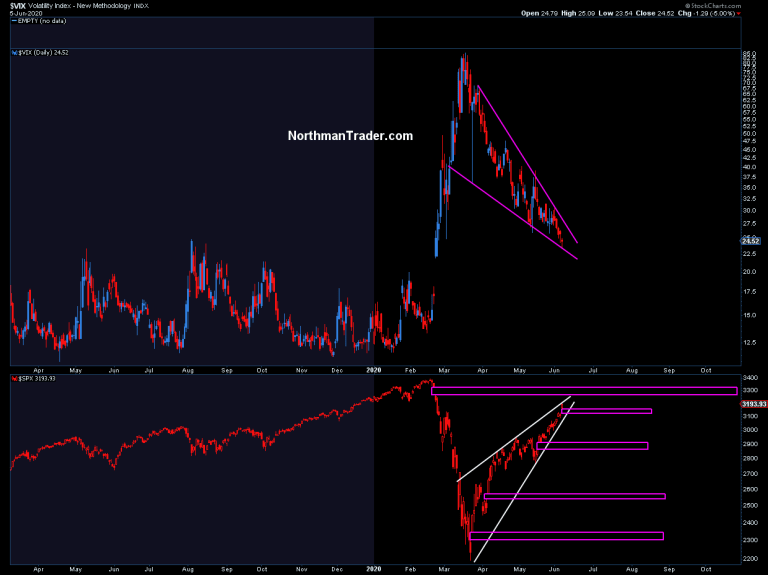

No, the market is not forward looking its blindly chasing liquidity and by doing so has blindly gone vertical and embraced an, in my view, unsustainable path of historical valuations overly reliant on overnight unfilled gaps:

A path that keeps building risks of future gap fills to come, especially in context of ever tightening price patterns not only on the market charts, but also the $VIX:

The building disconnects and the societal rifts are subjects dear to our hearts.

For out latest perspectives please join please join Guy Adami, Dan Nathan and I in this week’s edition of Straight Talk:

* * *

For the latest detailed technical review on markets please see Market Videos. For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

via ZeroHedge News https://ift.tt/3h32Qks Tyler Durden