Chaotic COVID Response Sparks Revival In Once Despised Plastics Industry

Tyler Durden

Sat, 06/06/2020 – 21:00

We penned a piece last week describing how the Centers for Disease Control and Prevention (CDC) recommended single-use disposable items (i.e., plasticware: plastic cups, dishes, straws, and utensils) to all restaurants across the country for reopening.

It certainly seemed odd, and a little illogical, that, somehow, single-use food-service items would replace traditional restaurant ware, all because the government said it would limit the spread of COVID-19.

Maybe Gov. Gavin Newsom was right when he questioned surface transmission of the virus and blamed plastic and petrochemical manufacturers for “trying to influence CDC guidelines for reopening food establishments in their favor.”

If you’ve noticed, the use of plastics has increased during the pandemic, from restaurants to grocery stores, plastic is back in a very big way because the government says its more sanitary.

While COVID-19 seemingly survives on all surfaces, including plastic, plasticware at restaurants is no safer than ceramic dishware and metal utensils, which, by the way, are properly cleaned and sanitized.

So if that’s the case, there must be another reason why the CDC is pushing the use of plastics, using the pandemic as a cover, and the reason is simple, as Newsom said above: plastic and petrochemical manufacturers are influencing government guidelines.

Why would the government allow big oil to influence policy? Well, President Trump has been a cheerleader of the energy sector, pledging several months ago when crude prices crashed into negative territory for the first time in history to “never let the great U.S. Oil & Gas Industry down.”

The energy industry’s bet on a petrochemical boom to support future sales growth has proven disastrous as an already saturated plastic market was hit by a virus demand shock.

Domestic and international plastic prices have been in a several-year decline, even before the pandemic, which as of recent, forced Dow Inc to idle three US plants producing polyethylene, the base material for plastic bags and bottles.

“The petrochemicals world has been hit by a double whammy,” said Utpal Sheth, Executive Director, Chemical and Plastics Insights at data firm IHS Markit.

“Capital investment has been slashed by all companies. This will delay the projects under construction and new projects,” Sheth said.

A Royal Dutch Shell’s plastics project in Pennsylvania, touted by President Trump last year, is facing severe oversupply conditions as plastic prices tumble.

“Even before the coronavirus outbreak, we were already expecting to see various petrochemical value chains … heading into an oversupply situation,” said Catherine Tan, principal analyst at Wood Mackenzie.

Despite the bearish outlook for the plastics industry (because there’s no V-shaped recovery in the global economy this year), the government’s recommendation for the entire restaurant industry to use plasticware to combat the virus certainly suggests big oil influenced the new guidelines. Further, it’s still debatable if wearing a mask can completely shield the wearer from COVID-19, but if you didn’t know — polypropylene is the main ingredient in surgical and 3M N95 masks.

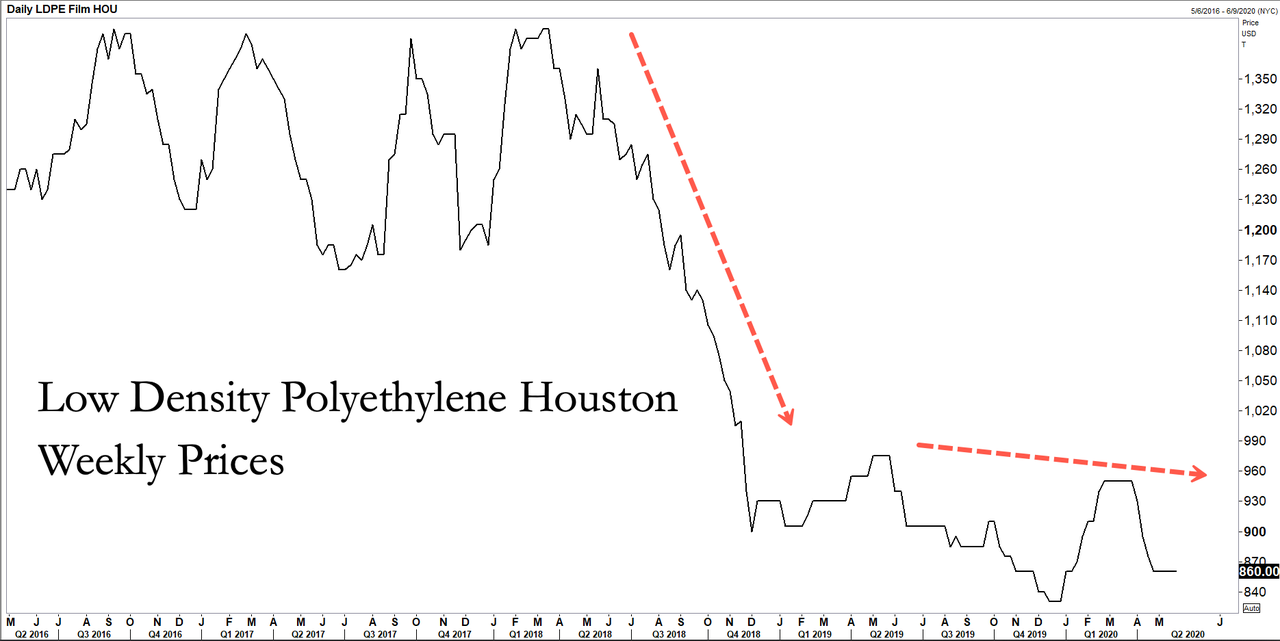

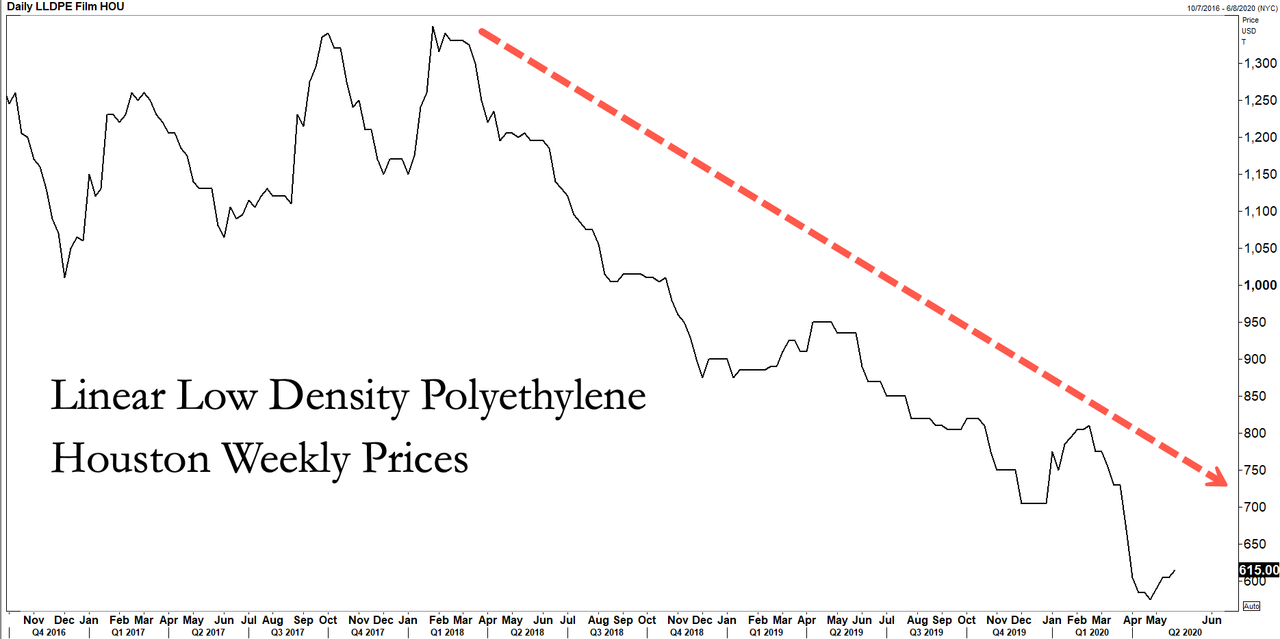

The use of plastics for “personal protective equipment and takeaway food containers has boosted sales of some plastics, it is likely to be only a temporary spike,” Reuters notes. Still, weekly plastics prices in Houston are depressed:

Low Density Polyethylene Houston Weekly Prices (widely used for manufacturing containers, dispensing bottles, wash bottles, tubing, plastic parts for computer components, and molded laboratory equipment; Its most common use is in plastic bags)

Linear Low Density Polyethylene Houston Weekly Prices (widely used for high performance bags, cushioning films, tire separator films, industrial liners, elastic films, ice bags, bags for supplemental packaging and garbage bags)

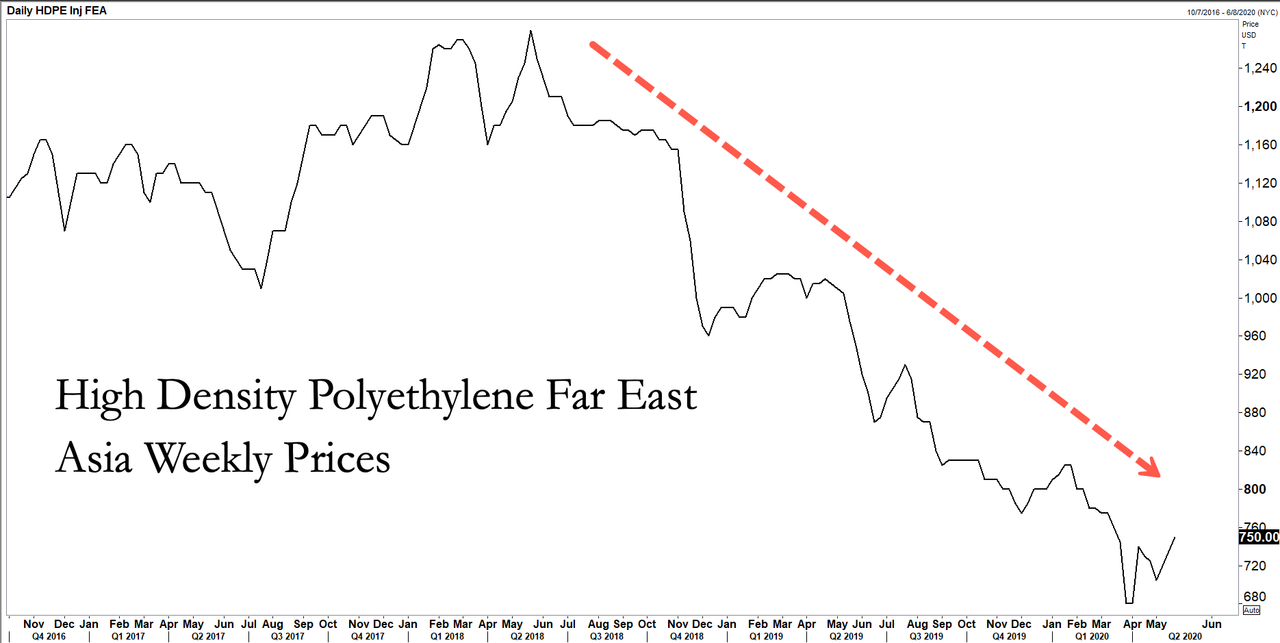

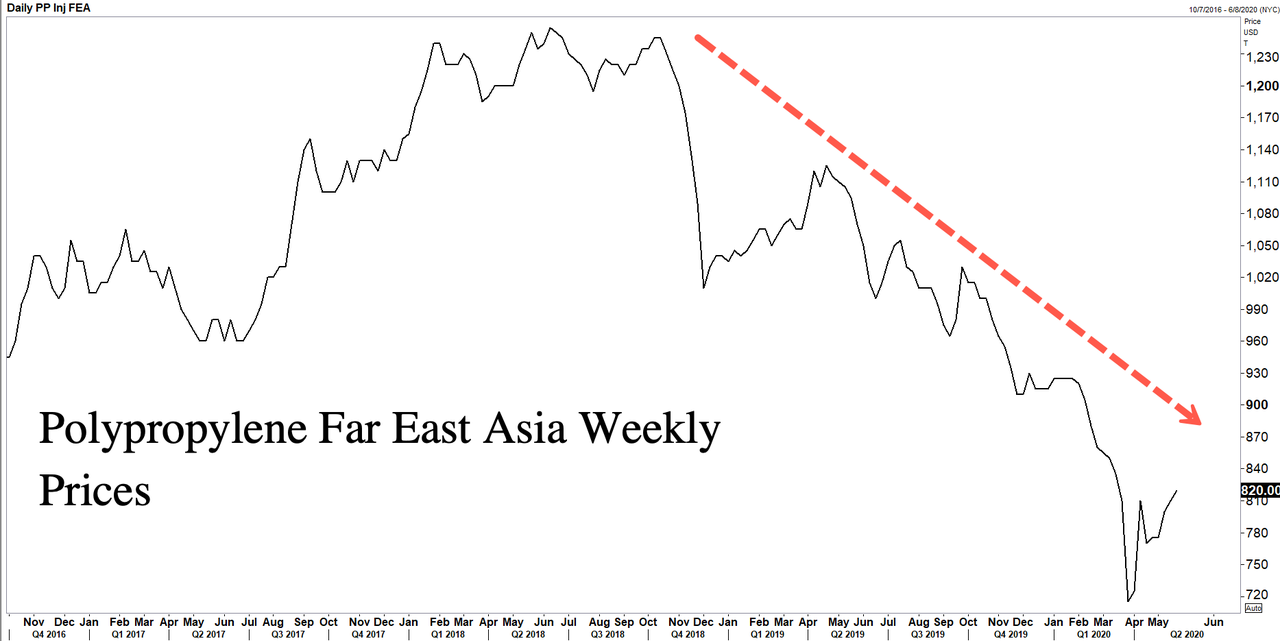

As for the international prices of plastics, the downtrend was very well defined before the pandemic.

High Density Polyethylene Far East Asia Weekly Prices (widely used for the production of plastic bottles, corrosion-resistant piping, geomembranes and plastic lumber)

Polypropylene Far East Asia Weekly Prices (widely used for packaging for consumer products, plastic parts for various industries including the automotive industry, special devices like living hinges, and textiles)

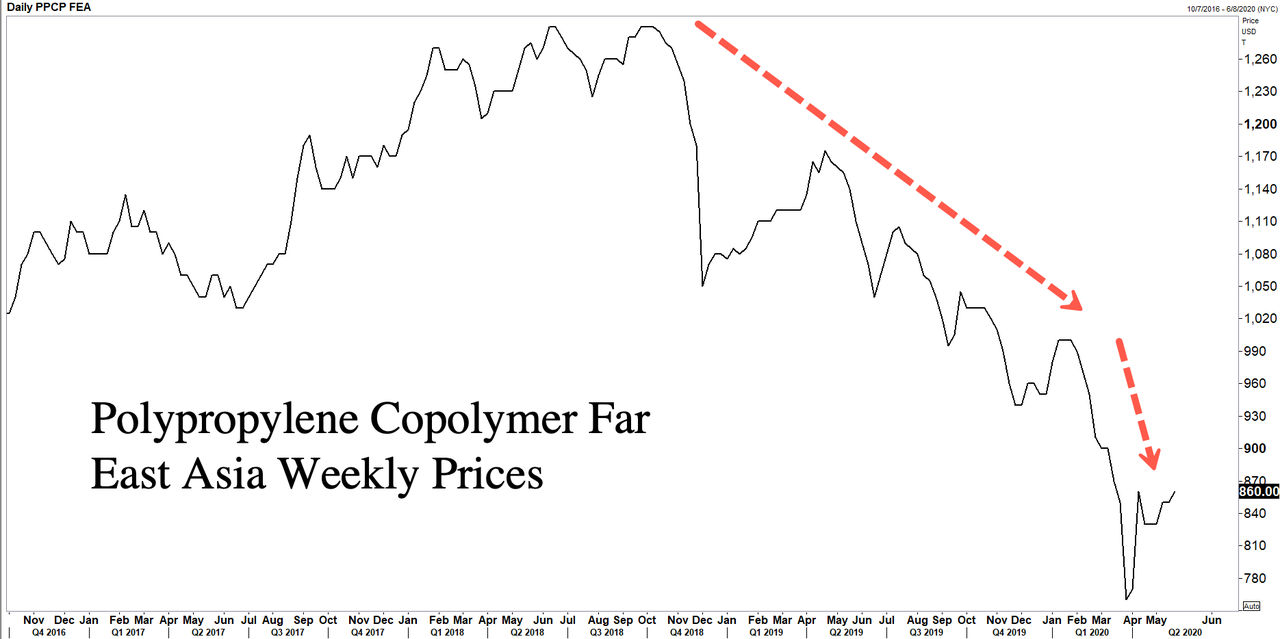

Polypropylene Copolymer Far East Asia Weekly Prices (widely used for packaging, textiles, healthcare, pipes, automotive, and electrical applications)

What could be clear is that big oil is influencing government policies in a post-corona world to increase the use of plastics since the industry has been thrown into oversupplied conditions with plunging prices. Plastic use for automobiles and consumer goods declined way before the pandemic and crashed during lockdowns. So the industry had to find new ways to boost demand — hence, unleash an ingenious psychological operation, perhaps in conjunction with the government, of how plastics will save your life through using plasticware at restaurants and grocery stores and mask-wearing.

via ZeroHedge News https://ift.tt/2XDw7dM Tyler Durden