Goldman Turns Bearish On Oil Again, See Brent Dropping Back To $35/bbl

Tyler Durden

Mon, 06/08/2020 – 09:12

Yesterday, when commenting on the latest developments in the oil market, including the OPEC+ agreement to extend supply cuts by one month and the Aramco decision to boost oil export prices by the most on record, we said that “the problem for OPEC+ is that after the February/March supply glut turned into a shortage as demand rebounded, the biggest risk for oil prices is back, with the WSJ reporting that as oil prices continue to rise, American oil producers are reopening the spigots, and companies including Parsley Energy and WPX Energy are starting to turn some of those wells back on, even as they continue to put off most new drilling. The result will be a surge in new output which will reverse the benefit from the OPEC+ output cuts, and once again shift the equilibrium in the global oil market to one of oversupply.”

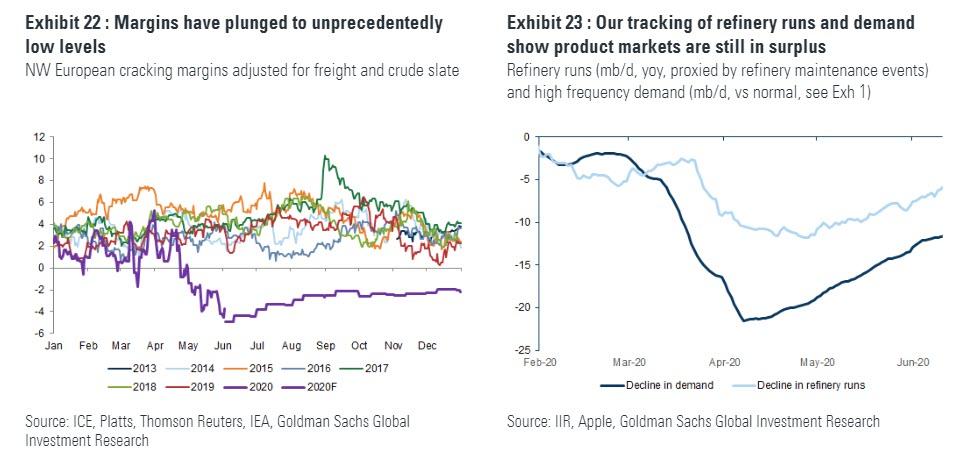

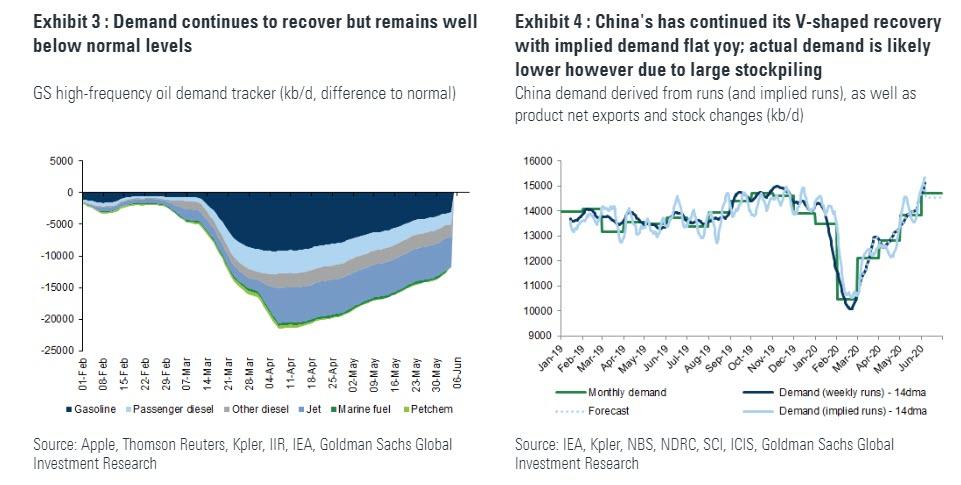

Well, just 24 hours or so later, Goldman’s energy analyst Damien Courvalin, who on May 1 turned bullish on oil (after being one of the first in mid-March to correctly warn that negative oil prices are coming) expecting a jump in prices from record lows due to a sharp reversal in supply/demand dynamics in the oil market, has agreed with us, and in a note discussing the latest fundamental drivers in the oil market, says it has turned “short-term bearish” on oil, for the following four reasons: i) the unprecedented collapse in oil margins to unprecedented lows (which is reflective of both over-valued crude prices as well as a more moderate demand recovery); ii) demand expectations are running ahead of a more gradual and still highly uncertain recovery; iii) shale and Libyan shut-in production are coming back online, and iv) prices are at levels where OPEC supply cuts should ease and Chinese purchases slow.

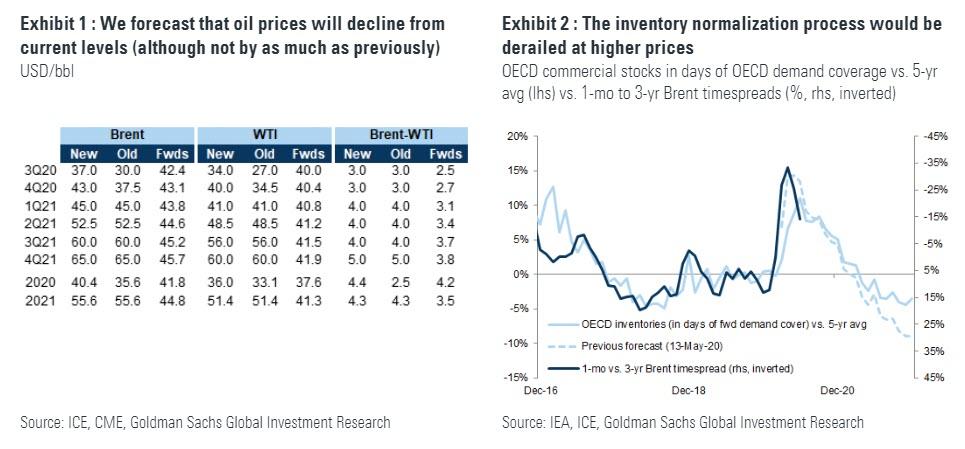

As a result, Goldman now sees a tactical “pull-back in prices in coming weeks with our short-term forecast of $35/bbl vs. Brent spot prices of $43/bbl.”

Below are the key excerpts from Courvalin’s note:

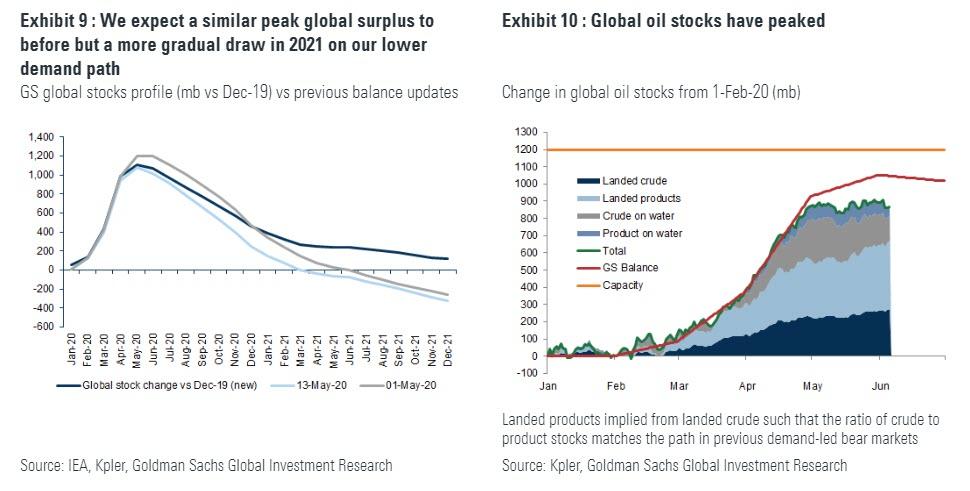

The oil market only moved into deficit late May and still faces the daunting challenge of normalizing a billion barrels of excess inventories. Yet, the oil relief rally remains unfazed, with prices doubling and exceeding our year-end price target just six weeks after the likely cycles lows.

This rebound has been fueled by a macro risk-on backdrop and a policy induced Chinese crude import binge yet fundamentals are turning bearish: demand expectations are running ahead of a more gradual and still highly uncertain recovery, shale and Libyan shut-in production are coming back online, and prices are at levels where OPEC supply cuts should ease and Chinese purchases slow.

With OPEC’s latest cut already more than priced in, we now forecast a pull-back in prices in coming weeks with our short-term Brent forecast of $35/bbl vs. spot prices of $43/bbl. Just as strengthening physical oil prices led us to turn constructive on the oil market on May 1, very poor refining margins and the recent sharp decline in US crude bases now comfort us in our sequentially bearish outlook.

When we turned constructive on the oil outlook last month, we argued that after the initial relief rally, the second stage of the oil market recovery – the cyclical tightening – would be gradual as the inventory normalization takes time and requires patience. We reiterate this view as it is rooted in the binding reality of excess inventories for a physical asset like oil, with the overhang set to break the recent high correlation with anticipatory financial assets.

The oil market rebalancing continues, with our latest fundamental update pointing to supply and demand improvements likely to have brought the global market into deficit late-May. Despite this notable inflection, the inventory overhang remains significant and uncertainty remains high for the forward supply and demand outlooks.

The oil rally remains unfazed, however, with Brent prices doubling and exceeding our year-end price target just six weeks after the likely cycles lows. We see three reasons behind this rebound: (1) a macro risk-on backdrop with oil rallying with equities and dollar depreciation, (2) a policy induced Chinese crude import binge, and (3) frictions in releasing crude from storage as the deficit starts.

While positioning leaves room for this rally to continue, we see four reasons why fundamentals are likely to set the stage for a pull-back in coming weeks:

(1) demand expectations are running ahead of a more gradual and still uncertain rebound,

(2) both shale and Libyan shut-in production are currently restarting,

(3) prices are nearing levels where OPEC supply cuts should ease and Chinese purchases slow, and

(4) the inventory overhang remains daunting with our latest deep dive still pointing to 1 bn in excess stocks.

The scale of the rally and the size of the inventory overhang are two challenges for OPEC+, threatening the higher prices, volumes and market-share targeted through 2021. While large cuts are needed to normalize excess inventories, too long a cut instead benefits competing high-cost producers, with US E&P HY debt issuance restarting. As we have argued, this should point to OPEC soon targeting higher output before shale activity inflects. If successfully carried-out, such a strategy should weigh on long-dated prices, helping achieve the backwardation that benefits low-cost producers.

Our modeling suggests, in fact, that OPEC’s latest cut is already more than priced in, especially with Libyan production restarting. With the oil relief-rally set to run out of steam and the expected volatility normalization playing out, our tactical market views are now for a pull-back in WTI and Brent prices in coming weeks. As previously, physical oil prices will be key to signaling the inflection lower, as they typically offer the best insight in periods of high fundamental uncertainty. To that end, very poor refining margins globally and the recent sharp decline in US crude bases comfort us in our sequentially bearish outlook.

Our updated supply and demand forecasts as well as the macro repricing of the positive start of the reopening nonetheless point to less downside to current Brent spot prices of $43/bbl than our prior $30/bbl June spot forecast. Our updated short-term Brent price forecast is now $35/bbl with our year-end spot forecast now of $45/bbl, with a similar $6/bbl average forecast increase through 2H20 for WTI.

Although our global inventory path is nearly unchanged, our accounting points to a smaller accumulation in OECD countries, with instead higher EM (especially China) stocks, which are once again helping smooth global oil shocks. On our quantitative pricing model which links the level of OECD inventories to the shape of the Brent forward curve[1], this points to a shallower Brent contango, leading us to raise our spot price forecast from $30/bbl to $35/bbl. Our OECD inventory path – and hence Brent curve shape forecasts – remains unchanged for 2H20, although we now expect higher long-dated prices than previously.

The positive start to reopening does not resolve the uncertainties about a potential second wave of infections or of a more difficult recovery beyond the easier gains of the first few months. However, it does increase the probability of our economists forecasts materializing, which are based on a relatively optimistic view of both of these issues. This has reduced the bearish biases reflected in market forwards, with dollar weakness further raising the marginal cost of non-US production and hence long-dated prices. Accounting for these improvements, we are also raising our forecast for long-dated (3-year forward) Brent prices by c. $6/bbl in 2H20 to $45/bbl – although still below current market forwards.

After their recent rally, we estimate that long-dated prices have, however, more than fully priced in this good news, reaching levels where US producers will re-start shut-in production and contemplate bringing online drilled but uncompleted wells, helped by the collapse in oil service costs. We believe such an activity restart is premature given the exceptional level of OPEC spare capacity and with the inventory overhang barely dented.

When we turned constructive on the oil outlook on May 1, we argued that the second stage of the oil market recovery – the cyclical tightening – would be gradual as the inventory normalization takes time and requires patience, leaving oil to lag other risky assets. We reiterate this view as it is rooted in the binding reality of excess inventories for a physical asset like oil, with the overhang set to break the recent high correlation with anticipatory financial assets. The path of oil prices remains important – lower oil prices need to clear today’s inventory overhang and, as a physical asset, cannot price the expected tightening in fundamentals that we forecast through 2021, where our price forecasts remain unchanged, above market forwards and consensus expectations.

via ZeroHedge News https://ift.tt/2MDVEgL Tyler Durden