Why One Bank Thinks Retail Euphoria Will “Force The Fed’s Hand” To End The Meltup

Tyler Durden

Tue, 06/09/2020 – 11:06

You know the euphoria gripping stock markets is off the charts when retail investors have now taken over the market, as we first posted three weeks ago in, “How Retail Investors Took Over The Stock Market” and as Bloomberg repeated today with “Everywhere You Look Under Surging Stocks Is Fervid Retail Buying.” And while there is nothing wrong with a little healthy speculation in a market in which the Fed has eliminated most – if not all – risk, when the frenzied daytrading mob sends the stock of bankrupt Hertz 10x higher on massive volume, pushing its market cap to just shy of $1 billion, it’s becoming a problem for marketplace integrity. After all, everyone remembers the retail infatuation with cryptos in late 2017/early 2018 which pushed bitcoin to $20K only to see the crypto plunging, resulting in massive losses for retail investors.

Does Powell really want to risk turning off another generation of retail investors from stocks when the latest melting-up asset bubble – which is far greater than either the dot com or the housing bubble – bursts with catastrophic consequences for middle class net worth?

According to SMBC Nikko’s Masao Muraki the answer is no, and as the strategist writes, “soaring risk asset prices (ie imbalances) have reached a point where the Fed may be forced into some kind of action.”

Muraki explains his non-consensus below in his latest note, why “soaring equity/credit prices could force Fed action”

Melt-up on equity and credit markets

Prices of risk assets are soaring as resumption of economic activity stokes expectations for a V-shaped recovery in corporate profits.

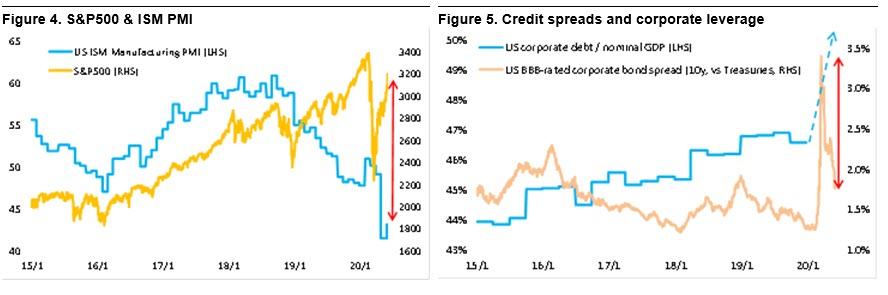

Divergence between the US ISM Manufacturing index/PMI and the S&P500 and between the US corporate debt-GDP ratio and corporate bond spreads is now wide and we think the melt-up (surging asset prices and battle for risk assets) that we anticipated in our 7 April 2020 report is occurring.

We attribute the melt-up to 1) a resumption of unavoidable risk-taking by pension funds, life insurers, and individual investors, 2) delays in removing fiscal, monetary, and credit policy measures, and 3) expectations for additional measures to tackle second waves of infections.

Interest rates rising worldwide

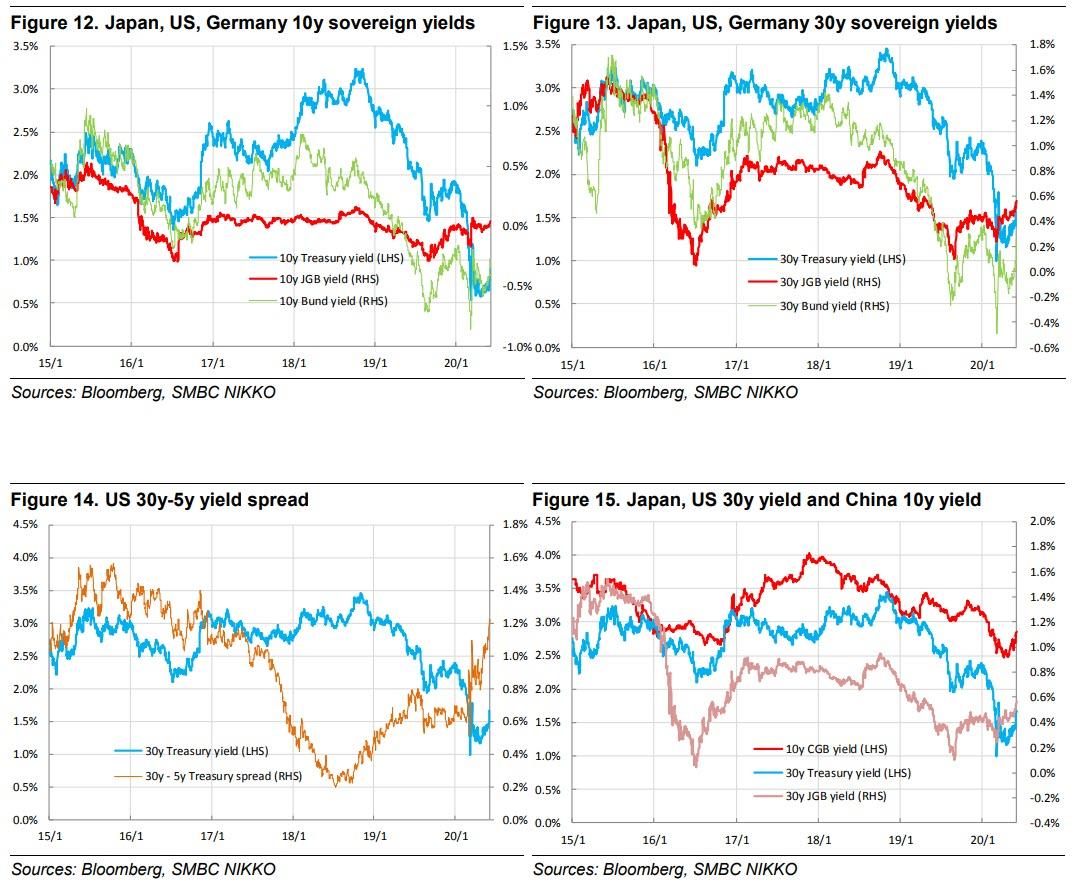

With a melt-up in progress, there is upward pressure on long-term interest rates in the US, Europe, Japan, and China, which had been stable at low levels.

Yield curves have steepened notably for maturities of over 10 years. We believe upward pressure on interest rates reflects

- expectations for recoveries in economic conditions (ISM/PMI),

- pressure from long-term debt issuance due to fiscal stimulus,

- speculation regarding Fed monetary policy plans, and

- a squeeze on positions of investors and financial institutions anticipating flattening yields.

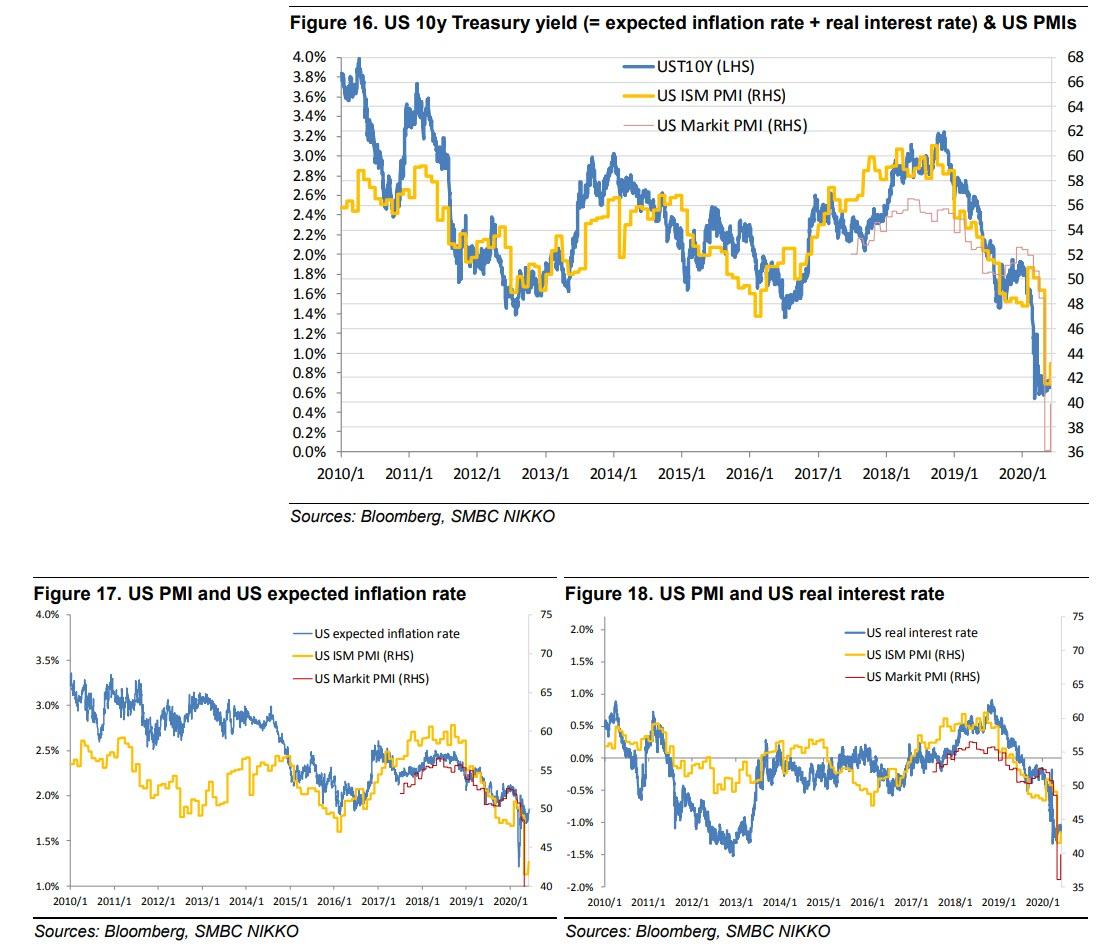

For 1), economic sentiment (ISM/PMI) has been the main determinant of US 10-year interest rates (Figures 16-18), suggesting that further upward pressure on interest rates is possible if PMIs pick up quickly (even if followed later by a second bottom).

For 2), soaring risk asset prices (ie imbalances) have reached a point where the Fed may be forced into some kind of action.

Fed cutting pace of asset purchases

The Fed’s irregular policy response since March has had five main goals:

- subduing the liquidity crunch,

- lowering funding costs for companies and households by depressing the risk-free rate,

- lowering funding costs for companies by depressing risk premia,

- generating wealth effects by depressing risk premia, and

- partially averting corporate bankruptcies and lay-offs resulting from cash-flow difficulties.

Monetary policy has been sufficiently effective for goals 1-4, but it has not necessarily done enough for 5). Still, the Fed only aims to provide limited support given issues with funding and moral hazard (issue of bailing out large and mid-tier companies that were taking excessive financial risk). While there is upward pressure on interest rates amid expectations for large-scale Treasury issuance, the NY Fed continues to cut back its Treasury purchases (average of $50bn daily over 6-9 Apr -> $5bn daily over 26-29 May -> $4bn daily over 8-12 Jun).

Countering side-effects and normalizing monetary policy: 2 focus points

We focus on whether the Fed expresses concern over soaring share prices and how it moves to counter side-effects and normalize monetary policy.

1. B/S policy

We think the first key point is whether the Fed continues to reduce purchases of long-term Treasuries and MBS, which it is already tapering.

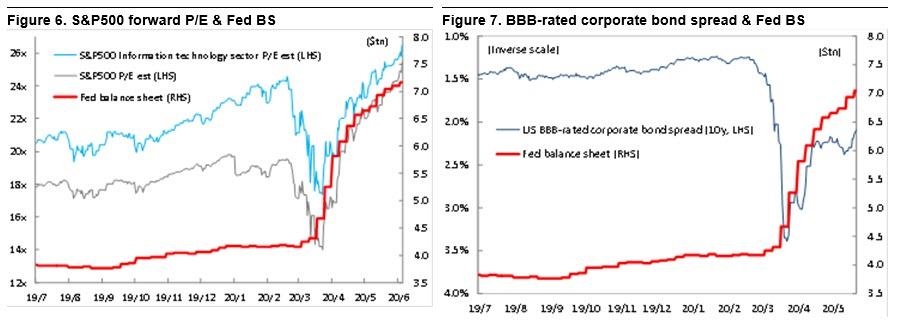

Fed B/S expansion has clearly been inflating equity and credit market valuations (Figures 6-7).

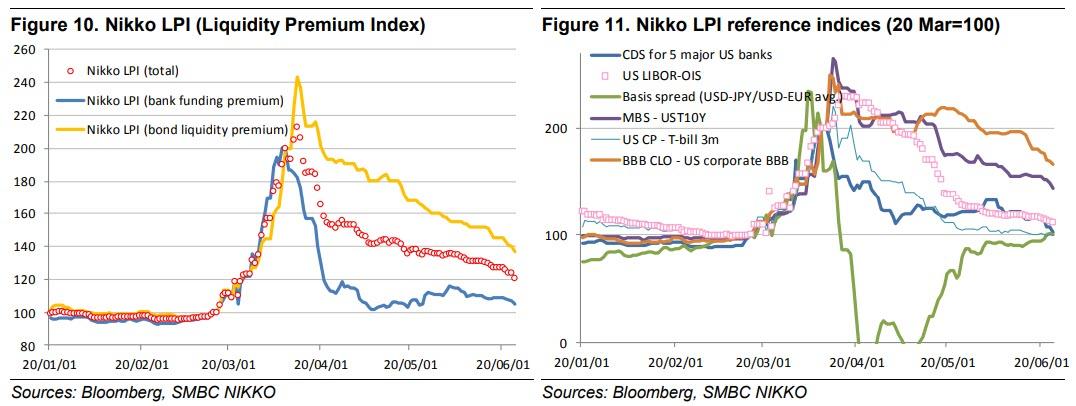

The Fed was forced to respond to the first liquidity crunch (expansion of funding cost premia for banks and risk premia for high-rated bonds) since the GFC in Feb-Mar, but expansion of the Fed B/S, which swelled rapidly due to the liquidity support measures, is slowing as bank financing stabilizes and liquidity premia improve (Figures 10-11).

We expect the focus of B/S policy to shift from liquidity support to provision of credit to corporations (eg MSLP) and then back to conventional QE.

2. Monetary policy: Fed’s ideal yield curve

We think the second key point will be when the Fed adopts yield curve control (YCC) and the maturities that it targets.

Since introducing YCC (through 10y), the BOJ has intervened on multiple occasions to steepen the curve by encouraging yields in the over-10y zone to move higher with a view to mitigating side-effects of falling super-long yields for life insurers and pension funds. In the US, excessive declines in long-term (over 5y) yields are becoming an issue due to the side-effect of excessive risk-taking by investors with fixed required rates of investment return (pension funds, life insurers, individuals).

At its October 2019 FOMC meeting, the Fed held comprehensive discussions on monetary policy instruments to address the issue of the effective lower bound (ELB: situation where declines in natural rate of interest mean that easing effects are insufficient even if short-term rates are cut to zero). The Fed ultimately ruled out negative interest rates for the time being while highlighting YCC (capping medium-term rates) as a promising option. YCC has also been discussed more recently as a future option. The current asset-price imbalances may influence discussions over whether to introduce YCC and whether to shorten the target maturity (2y rather than 5y). YCC design and B/S policy are factors that could lead to changes in long-term interest rates.

Risk of sharp declines in risk asset prices

The biggest risk that could trigger declines in prices of risk assets is delayed improvement in economic conditions or a return to deterioration. European/US bank managements are cautioning that markets are pricing in an overly optimistic scenario at present and that fiscal and monetary policy support could be exhausted as the economic recovery turns out to be W-shaped (see our 29 May 2020 report). In addition, fundamentals in emerging markets continue to worsen.

Furthermore, we can no longer ignore risk that rising asset prices in developed economies will lead to a negative chain where interest rates in developed economies rise, hitting economic conditions and asset prices in developed economies and EM currencies and commodity prices.

via ZeroHedge News https://ift.tt/37jNPX1 Tyler Durden