FOMC To Continue “Approximately” $120BN In QE, No Negative-Rates Or Rate Hikes Signaled, Slashes GDP Forecast

Tyler Durden

Wed, 06/10/2020 – 14:05

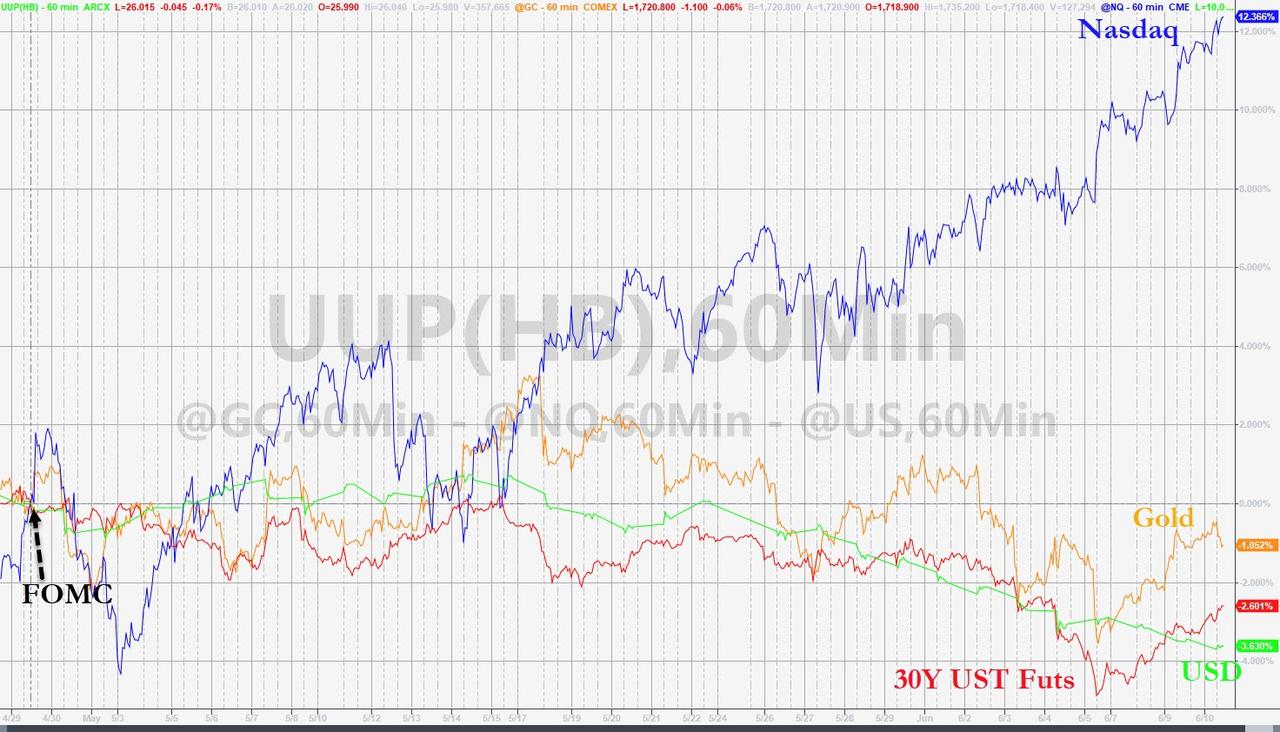

Since The Fed’s last statement, on April 29th, one “asset class” has done particularly well as bonds, bullion, and the greenback have slipped lower. Spot the odd one out…

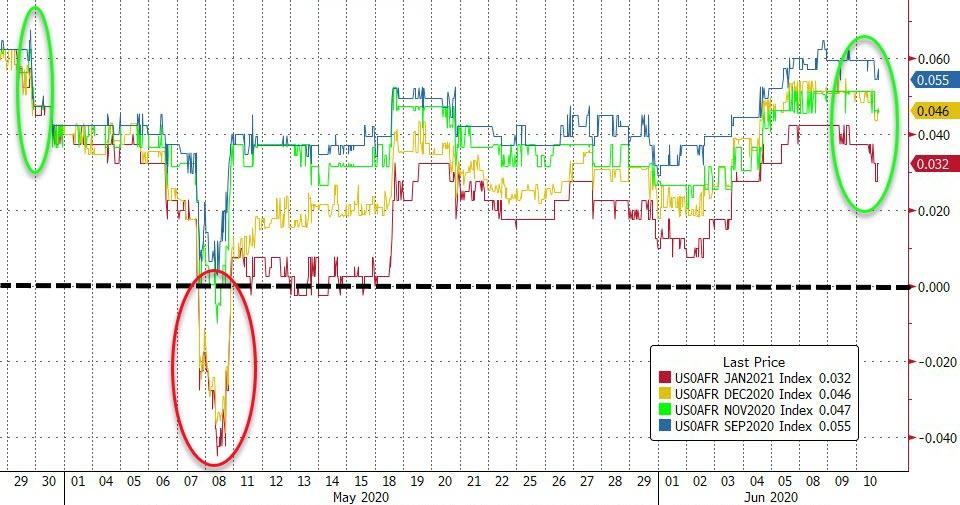

Rate trajectory expectations have had a wild ride in the six weeks since the last FOMC (drifting ionto negative rate expectations at one point) but are now back to being modestly ‘easier’ than at the last meeting…

Source: Bloomberg

As we detailed earlier, the Fed is likely to focus on forward guidance on rates and asset purchases: it is a given that rates are on hold until normal economic service has been resumed, and then some, and also that the FOMC will continue to expand its special lending facilities even further despite the fact that the worst of the economic downturn is already behind us. However, the markets are only really going to be focused on four things:

-

Will the Fed open the door even a crack to negative rates? The Fed does not seem to be in a hurry to tweak the IOER rate, even though that would help reduce the occurrence of negative implied Fed Funds rates and thus quell some of the speculation about negative US rates in our view. However, despite market chatter we believe that European- and Japanese-style negative rates are a no-go for the Fed.

-

Will we see Yield Curve Control (YCC)? If so, which parts of the US Treasury curve will, Japanese- and Aussie-style, cease to function as a real market? Would it just be the short end of the curve? That leaves the door open for curve steepening of the kind seen in recent sessions, which carries the risk of real pain for borrowers. Moreover, with the massive expansion of US Federal debt, YCC out to 2 years would mean issuance at the short end and constantly having to roll it over. In other words, raising the Fed Funds rate again would not be possible until public debt was under more control – which realistically means never. Or might YCC be longer, say out to 7 years? This would give greater room to spread the looming trillions that will flow, and perhaps enough time for some optimists to presume an economic turn-around within that period is possible. Yet could we even see that financial totem of all totems, the US 10-year, under YCC? If so the global debt benchmark is not looked at, but sat on like a bench. Japan is already doing it.

-

Can the Fed manage to do either of the above without the US Dollar falling out of bed? The structural bull argument for USD is still there, but current momentum is such that hinting at negative rates and/or pegging US yields could easily push it down. The Fed aren’t responsible for the USD, but they certainly know that is true. The question is whether they are either desperate enough about the outlook not to care, or are happy about a currency weakness they can pretend is nothing to do with them. Hello FX Wars! Join the queue behind the trade war (as China cancels some shipments of US goods already en route) and the Cold War (as the US senate de facto opens the door to banning all Chinese telcos from the US market). That said, there is also an emerging argument –one we have put forward since 2017– that in a Cold War it is a strong USD and not a weak one that is the greater US weapon. There is still unlikely to be a line of communication between China hawks in DC and the Eccles Building where the FOMC sit, but it’s still worth remembering what the geopolitical backdrop is.

-

Can the Fed find a way to do even more than it already is without encouraging what many see –even by the standards of the mind-blowingly stupid examples around the word in recent decades– as an epic, lunatic, *dangerous* stock-market bubble? Indeed, can they do so without stocks tumbling down on top of the retail money arriving late to the party? “Excessive exuberance”: anyone recall how many years and bubbly Fed Chairs ago that was?

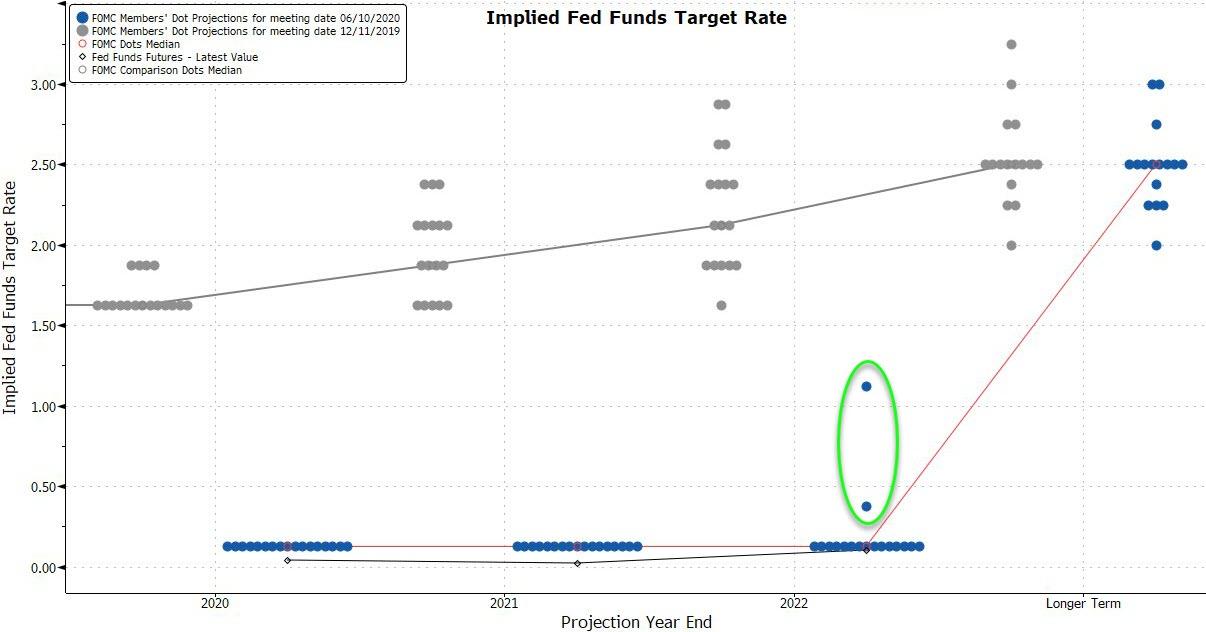

All eyes will be on the dotplots today to see if any Fed heads are forecasting negative rates (and if so prepare for chaos to break out).

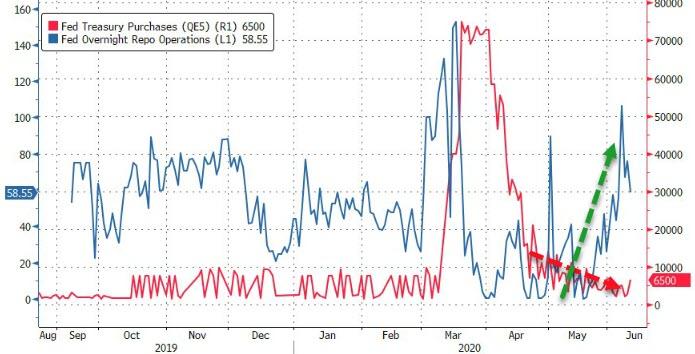

And how Powell will explain The Fed’s tapered bond-buying as repo-liquidity needs are resurging…

Good luck Jay!

And so, the question is, did they deliver what the market was demanding?

The Fed has no plans to raise rates through 2022…

How wrong has The Fed been before? Remember in 2018 they expected 2020 rates to be up at least 3.5%… not ZERO…

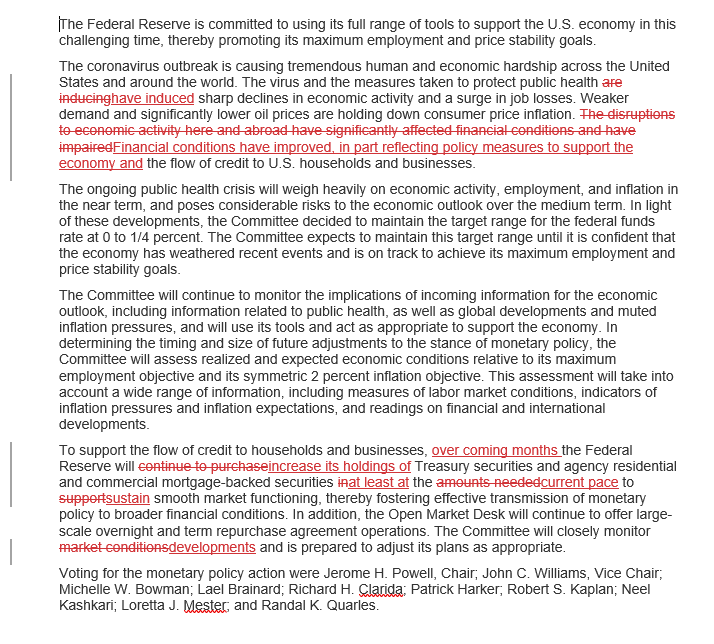

The Fed does not mention Yield Curve Control in the statement (wait for the presser).

The Fed commits to buy Treasuries, MBS, “at least at the current pace.”

The Fed has effectively formalized an $80 billion per month bond buying QE:

Consistent with this directive, the Desk plans to continue to increase SOMA holdings of Treasury securities at the current pace, which is the equivalent of approximately $80 billion per month. Treasury purchases will be conducted on a monthly basis, starting with the period from mid-June to mid-July, and will continue to be conducted across a range of maturities and security types. The Desk will continue to roll over at auction all principal payments from SOMA holdings of maturing Treasury securities.

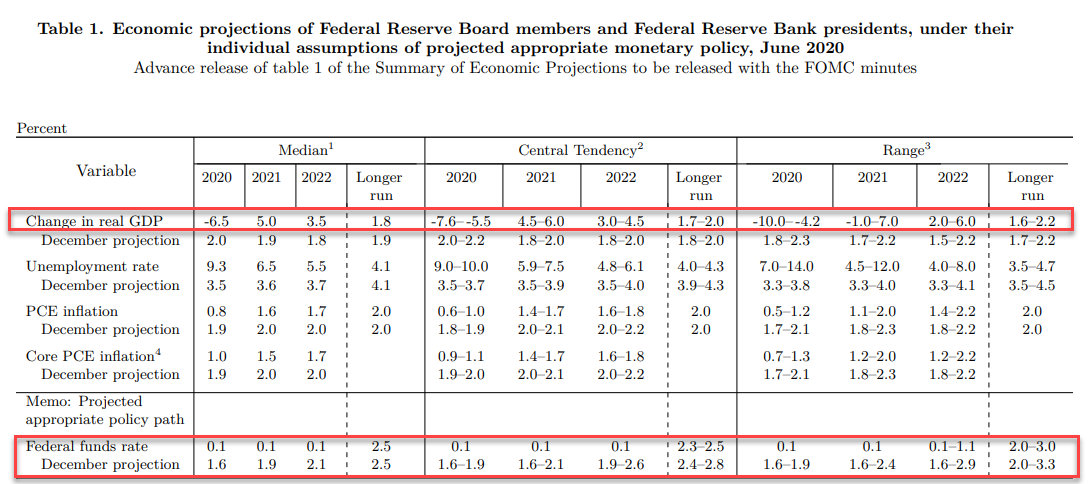

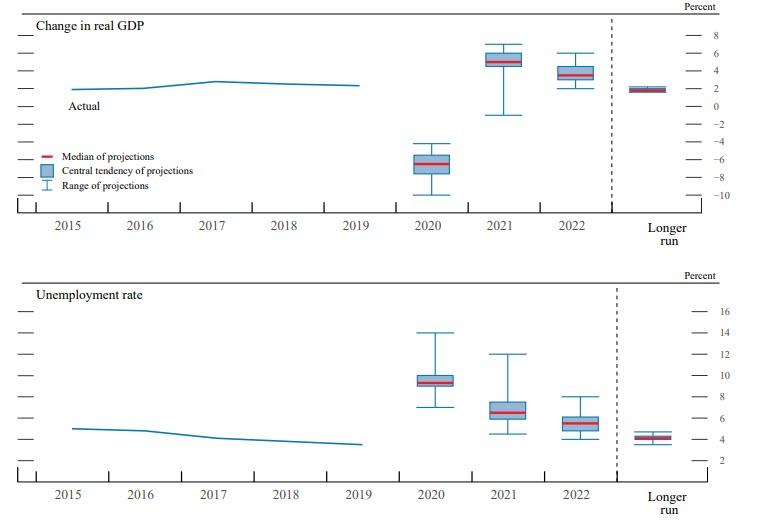

The Fed forecasts 2020 GDP to plunge 6.5% but rebound to 5.0% in 2021 and 3.5% in 2022

Similar with unemployment: the Fed sees 9.3% Unemployment In 2020, 6.5% In 2021, 5.5% In 2022. As Bloomberg notes, a closer look at the unemployment forecasts shows a sizeable range of opinions. The low projection was for 7% by the end of 2020, while the high end was 14%: “That’s a tremendous gap and underscores the level of uncertainty facing policy makers. This continues in the 2021 projections. The range for unemployment there goes from 4.5% out to 12%. Remarkable.”

A similar wide range in the error bars for GDP shows just how unsure the Fed is about the economic future of the US:

As Bloomberg Economics Associate Eliza Winger notes:

“Assuming the economy contracts 37% in the second quarter, in-line with Bloomberg Economics’ projection, U.S. GDP will need to recover by an average pace of 12.6% in the second half of the year to achieve the Fed’s forecast of -6.5% for the year as a whole.”

Full redline below:

via ZeroHedge News https://ift.tt/2Yk3VvW Tyler Durden