US Shale Faces Bankruptcy Wave Amid “Long And Arduous” Global Downturn

Tyler Durden

Wed, 06/10/2020 – 22:05

The US shale industry could be on the verge of destruction due to the drastic decline in demand and falling energy prices brought on by coronavirus pandemic, a new report says.

The Institute for Economics and Peace (IEP) published its 14th edition of the Global Peace Index on Wednesday — outlining how the virus-induced downturn of the energy market and a price war between Organization of the Petroleum Exporting Countries (OPEC) and Russia — could result in a “collapse” of US shale.

“The sharp fall in oil prices will affect political regimes in the Middle East, especially in Saudi Arabia, Iraq and Iran, which may result in the collapse of the shale oil industry in the US, unless oil prices return to their prior levels,” IEP warns.

The report goes on to say “this global recession will be long and arduous,” outlining how weakness in commercial, travel and industrial activity will persist for an extended period, indicating oil prices will remain subdued:

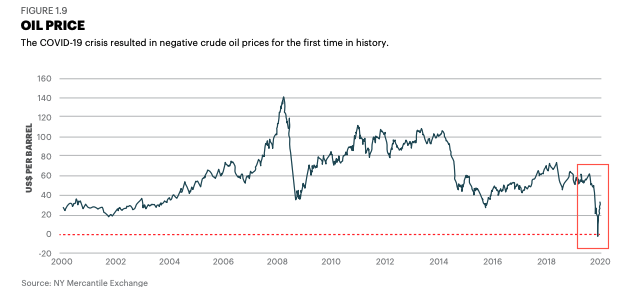

“These markets were already effected by an over-supply, emanating from Russia and Saudi Arabia who could not agree on production curbs. On April 20 the price of crude oil turned negative for the first time in history, as seen in Figure 1.9. Demand had collapsed so rapidly that overstocked producers were willing to pay buyers to take away excess inventory. The negative price was a short-lived technicality, due to the way futures contracts are written; with oil prices soon returning to positive territory. Nevertheless, the unprecedented episode highlighted the severity of demand collapsing worldwide.”

Crude prices stabilized in April after OPEC+ agreed to production cuts. Last weekend, an extension of the 9.7 million barrels per day (bpd) cuts were seen through July. The cuts equal about 10% of global supply, which has led to a 172% rise in Brent crude futures over the last 33 trading sessions. Despite the extension in cuts, Brent crude prices have stalled in the 43-40 level, now at risk of reversing.

Goldman Sachs warned in a Tuesday note that a tactical “pull-back in prices in the coming weeks with our short-term forecast of $35/bbl vs. Brent spot prices of $43/bbl.”

The oil market only moved into deficit late May and still faces the daunting challenge of normalizing a billion barrels of excess inventories. Yet, the oil relief rally remains unfazed, with prices doubling and exceeding our year-end price target just six weeks after the likely cycles lows.

This rebound has been fueled by a macro risk-on backdrop and a policy-induced Chinese crude import binge yet fundamentals are turning bearish: demand expectations are running ahead of a more gradual and still highly uncertain recovery, shale and Libyan shut-in production are coming back online, and prices are at levels where OPEC supply cuts should ease and Chinese purchases slow.

With OPEC’s latest cut already more than priced in, we now forecast a pull-back in prices in the coming weeks with our short-term Brent forecast of $35/bbl vs. spot prices of $43/bbl. Just as strengthening physical oil prices led us to turn constructive on the oil market on May 1, very poor refining margins and the recent sharp decline in US crude bases now comfort us in our sequentially bearish outlook. – Goldman’s energy analyst Damien Courvalin wrote in the note.

Courvalin outlined four reasons why fundamentals could drag crude prices lower in the near term:

The oil rally remains unfazed, however, with Brent prices doubling and exceeding our year-end price target just six weeks after the likely cycles lows. We see three reasons behind this rebound: (1) a macro risk-on backdrop with oil rallying with equities and dollar depreciation, (2) a policy-induced Chinese crude import binge, and (3) frictions in releasing crude from storage as the deficit starts.

While positioning leaves room for this rally to continue, we see four reasons why fundamentals are likely to set the stage for a pull-back in coming weeks:

(1) demand expectations are running ahead of a more gradual and still uncertain rebound,

(2) both shale and Libyan shut-in production are currently restarting,

(3) prices are nearing levels where OPEC supply cuts should ease and Chinese purchases slow, and

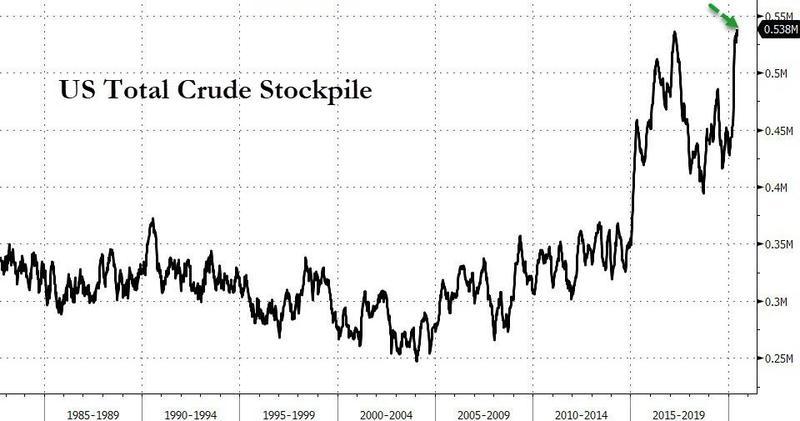

(4) the inventory overhang remains daunting with our latest deep dive still pointing to 1 bn in excess stocks.

The scale of the rally and the size of the inventory overhang are two challenges for OPEC+, threatening the higher prices, volumes and market-share targeted through 2021. While large cuts are needed to normalize excess inventories, too long a cut instead benefits competing high-cost producers, with US E&P HY debt issuance restarting. As we have argued, this should point to OPEC soon targeting higher output before shale activity inflects. If successfully carried-out, such a strategy should weigh on long-dated prices, helping achieve the backwardation that benefits low-cost producers.

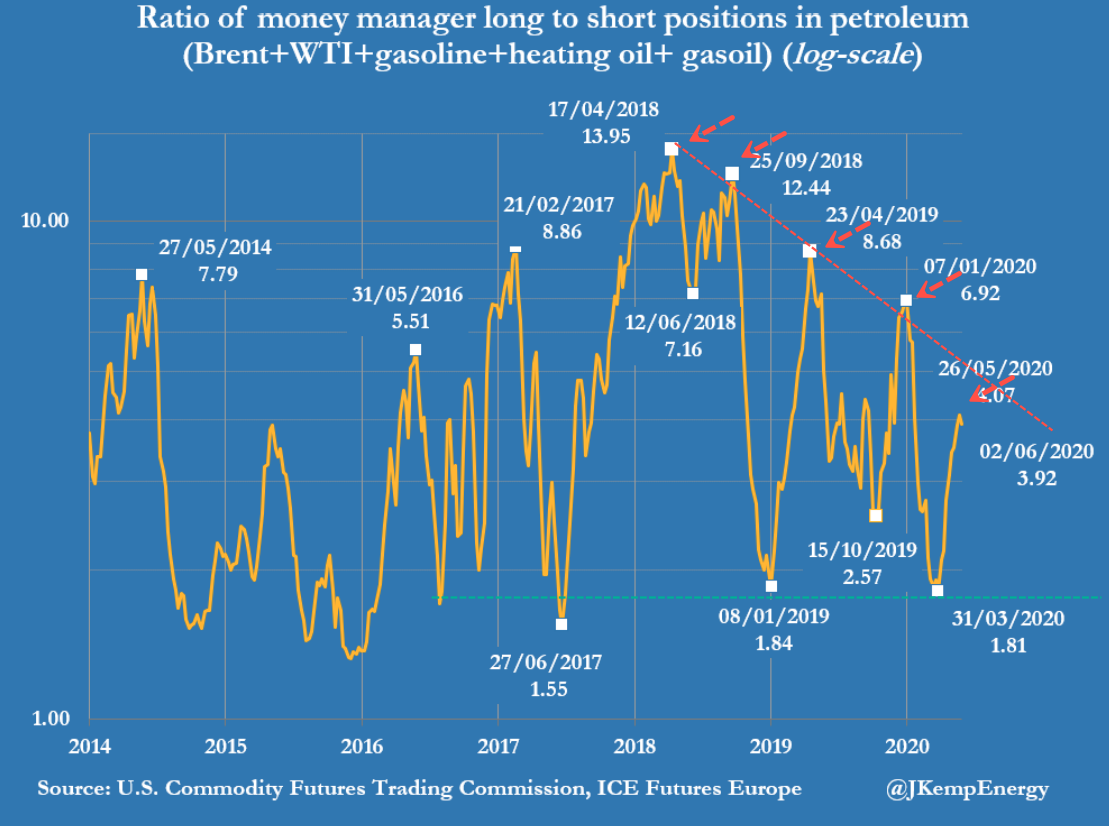

As Goldman gets bearish on energy, hedge fund positioning in crude futures last week suggest the rally is running out of steam.

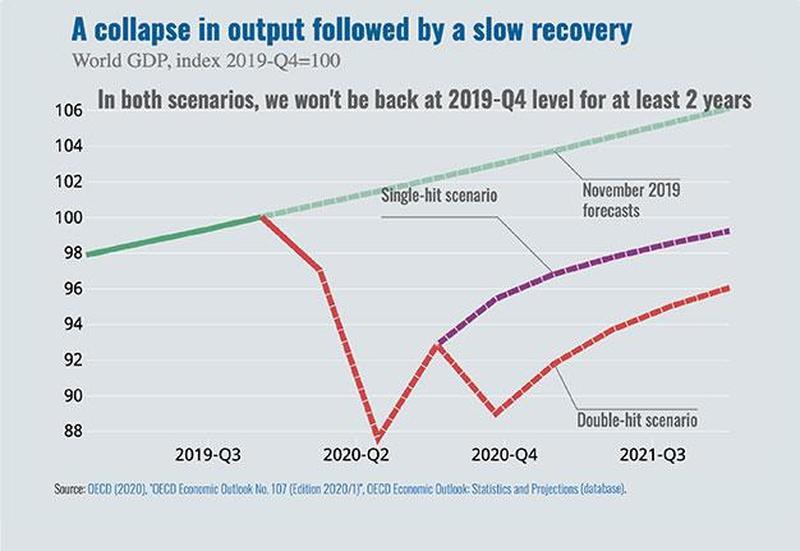

Perhaps the bearishness building in crude extends from lackluster global demand and continued oversupply conditions, due mostly because there will be no V-shaped recovery in the global economy this year or next, which was highlighted in our piece titled “OECD Warns Of Deepest Global Downturn In Century, Second Virus Wave.”

The latest Energy Information Administration (EIA) report noted Wednesday that US crude stockpiles reached a record high.

With another possible decline in crude prices ahead, it remains to be seen if President Trump can save heavily indebted US shale companies. When prices crashed several months ago, the president struggled to get aid to the collapsing industry.

Lower for longer crude prices, in a global downturn, which could continue through at least 2021 — could be what finally leads to a bankruptcy wave in shale.

via ZeroHedge News https://ift.tt/2zmRh6R Tyler Durden