Caterpillar Sales Plunge Most In A Decade

Tyler Durden

Fri, 06/12/2020 – 14:25

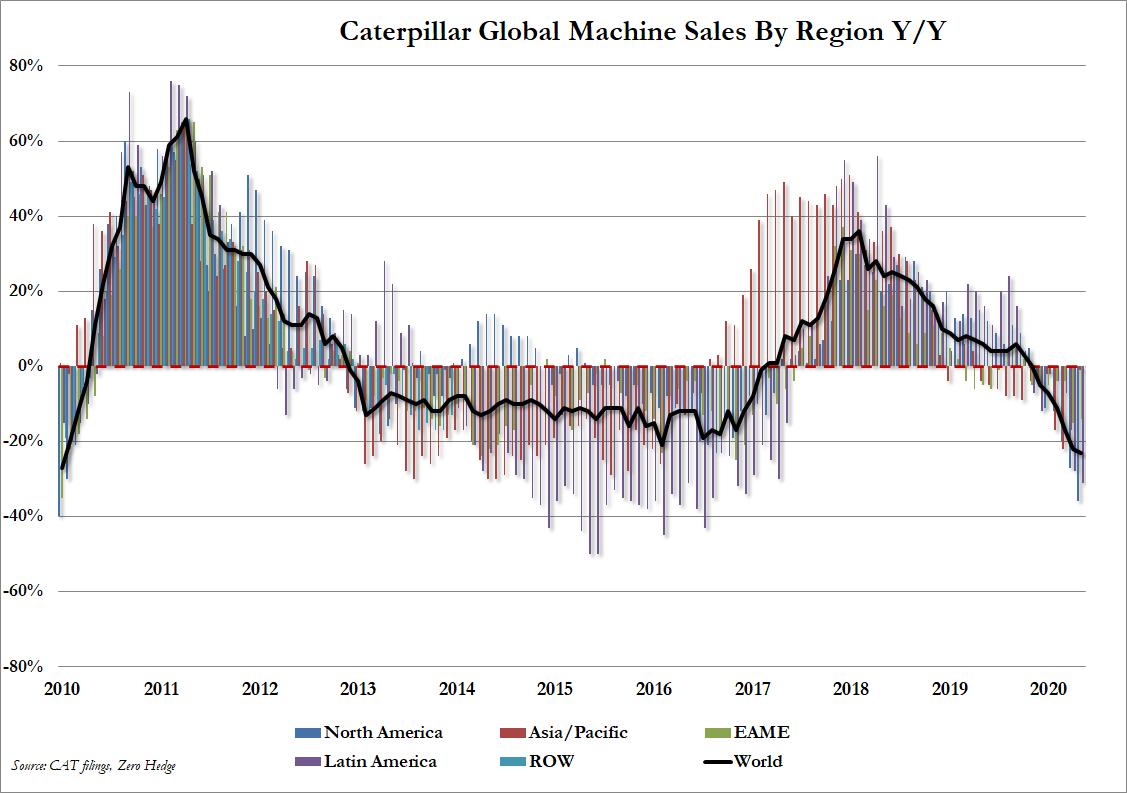

Once upon a time Caterpillar was seen as a harbinger not only for heavy-equipment producers, but – in a simpler time before tech took over – the entire market. And while CAT’s impact may have changed in the past decade, it still remains an important beacon of trends in the industrial and manufacturing economy. And unfortunately based on its latest retail sales published today, a lot of pain is coming.

In May, Caterpillar’s machinery sales dropped by the most in over a decade both across the world and in the Americas, where the company has extended plant shutdowns.

As shown below, North America sales plunged 36% on a rolling three-month basis, the most since January 2010 and far worse than the 27% drop posted in April, while sales in Latin America had the biggest decline since December 2016. And despite a modest slowdown in the deterioration across Asia/Pac which declined by just 1% following a 22% drop in March as China has successfully re-emerged from its February lockdown, overall global sales dropped by the most since the start of 2010.

Today’s data come one day after the company was reported to be keeping some of its plants across North and South America shut for longer than expected due to lack of demand. According to Bloomberg, the figures “underscore concerns over prospects for a halting recovery at the heavy-equipment maker after coronavirus shutdowns dented the profit outlooks for miners and construction companies.”

Ahead of the retail data, BMO analyst Joel Tiss downgraded Caterpillar’s stock to a hold, citing a “catatonic recovery” warning that near-term recovery of the company’s end markets will be challenged by customers’ budgetary constraints and stretched government finances.

“These factors will likely overwhelm the myriad internal improvements occurring at the company, at least for the next few years,” Tiss said in the note.

CAT stock, which clearly is not too popular on Robinhood, is down 16% this year.

via ZeroHedge News https://ift.tt/37qdLR5 Tyler Durden