China New Car Sales Fall 10% Year-Over-Year And 20% Sequentially For The First Week Of June

Tyler Durden

Thu, 06/11/2020 – 21:05

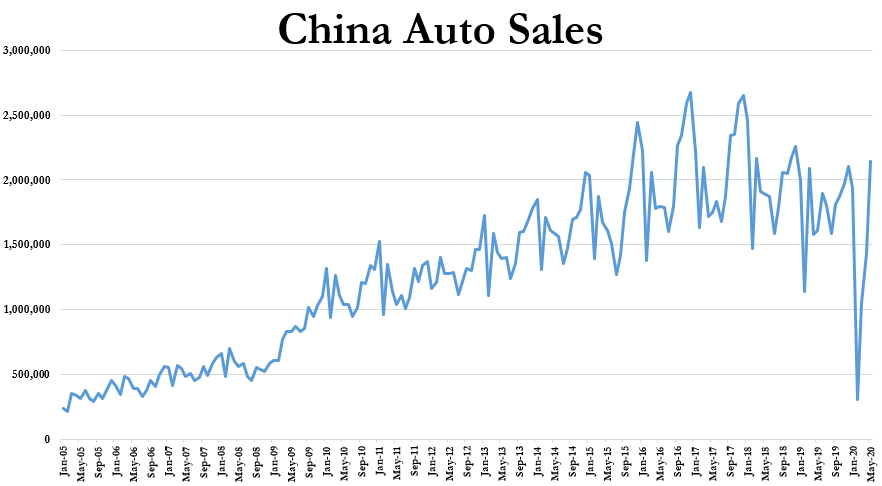

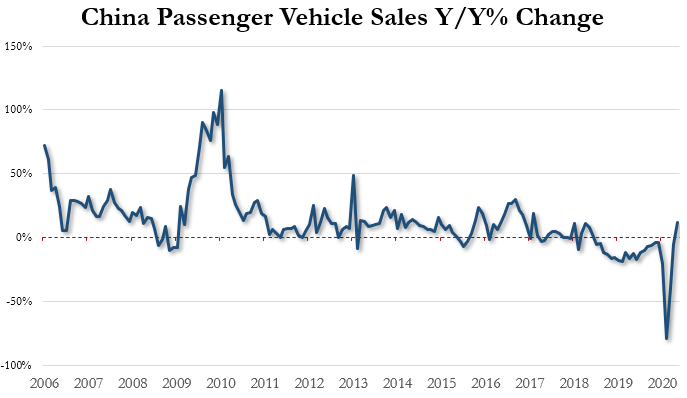

It’s going to be tough to peddle the narrative that things are back on an upswing with the auto industry in China after retail car sales fell 10% year over year – but more importantly 20% from the same period in May – in the first week of June.

This comes after what looked like the beginning of a rebound for the industry in May, to the extent that we can trust the numbers coming out of Beijing. According to Bloomberg, China’s PCA now expects that retail sales will decline in June in part to what is being called “seasonal factors”.

This news comes despite better than expected results in May, where sales showed a 12% increase year over year.

According to The Detroit Bureau, premium and luxury passenger car retail sales led the charge in May, rising 28% last month compared with year-ago results. Those vehicles accounted for 1.61 million of the month’s 2.14 million vehicles sold.

Tesla helped along with China’s May luxury sales number, selling 11,065 Model 3’s during the month compared to just the 3,635 vehicles it sold in April. However, that hasn’t stopped the company’s VP of Business Development in China, Robin Ren, from leaving the company, according to Bloomberg.

The China Association of Automobile Manufacturers, or CAAM, had predicted an 11.7% jump for May, including commercial vehicle sales in its results. Predictions for June look ominous: the CPCA has said that June sales will decline in part because June 2019 was such a strong month for the industry.

Meanwhile, the Chinese government is on the cusp of attempting to spur demand with new policies aimed at enticing buyers, according to Bloomberg, citing an unnamed automotive industry group in China.

Recall, we have recently noted that U.S. auto manufacturers are teeing up sizeable incentives to get buyers back into showrooms. Europe is following suit, with Volkswagen starting a sales initiative to revive demand, including improved leasing and financing terms.

Outlook for the year in China remains less-than-optimistic. The CAAM predicts that sales will drop 15% to 25% for the year, depending on whether or not the country is able to further slow the spread of the virus.

via ZeroHedge News https://ift.tt/3femY1q Tyler Durden