Default By Mall-Owner CBL Sparks Another Manic-Bid By Robinhood Daytraders

Tyler Durden

Fri, 06/12/2020 – 18:05

As we have previously noted, a bearish trade emerged on Wall Street several years ago and received the moniker “The Next Big Short.” The trade was simple: short shopping malls by going long default risk via CMBX 6 (BBB- or BB) or otherwise shorting the CMBS complex. As we describe below, the first major US shopping mall operator could be on the brink of bankruptcy as it would suggest the commercial real estate bust is underway.

Mall operator CBL & Associates fired a warning shot on June 5 that said tenants across 108 of its properties paid just 27% of April’s rent. Many retailers skipped out on rent payments during the COVID-19 lockdowns, forcing CBL to default on a secured credit line, significantly raising bankruptcy risk.

The Chattanooga, Tennessee-based commercial real estate company, owns 108 properties in the Northeast, Southeast, and Rust Belt, breached a covenant on its $1.185 billion credit facility after recently over-drawing on the credit line, which is backed by 17 malls and three other commercial properties.

CBL properties

Administrators at the credit facility notified CBL about default but have yet to expedite maturity on the debt. CBL has said that it is seeking a waiver.

The mall operator also skipped an $11.8 million interest payment due on its 2023 unsecured bonds on June 1, though it has chosen to use the one month grace period.

If CBL files for bankruptcy, it could unnerve commercial real estate investors by suggesting a bankruptcy wave of mall operators has begun.

According to the International Financing Review (IFR), CBL mall properties have been chopped up and packaged into CMBSs. At least $1.7 billion in CMBS exposure across 24 loans of the mall operator, with $937 million of these loans with special servicers and two loans in foreclosure.

About half of CBL’s CMBS loans are tracked via CMBX indexes, with the series 6 having the most significant exposure at $447 million.

“Given the severity of the COVID downturn, coupled with its high levels of indebtedness, CBL may face difficulty in meeting its debt obligations,” a Wells Fargo report said this week.

If CBL were to file for bankruptcy, it would be the first mall operator during the pandemic. Coresight Research warned that 25,000 retail stores could close in 2020, something that would undoubtedly lead to other mall operators coming under severe financial distress.

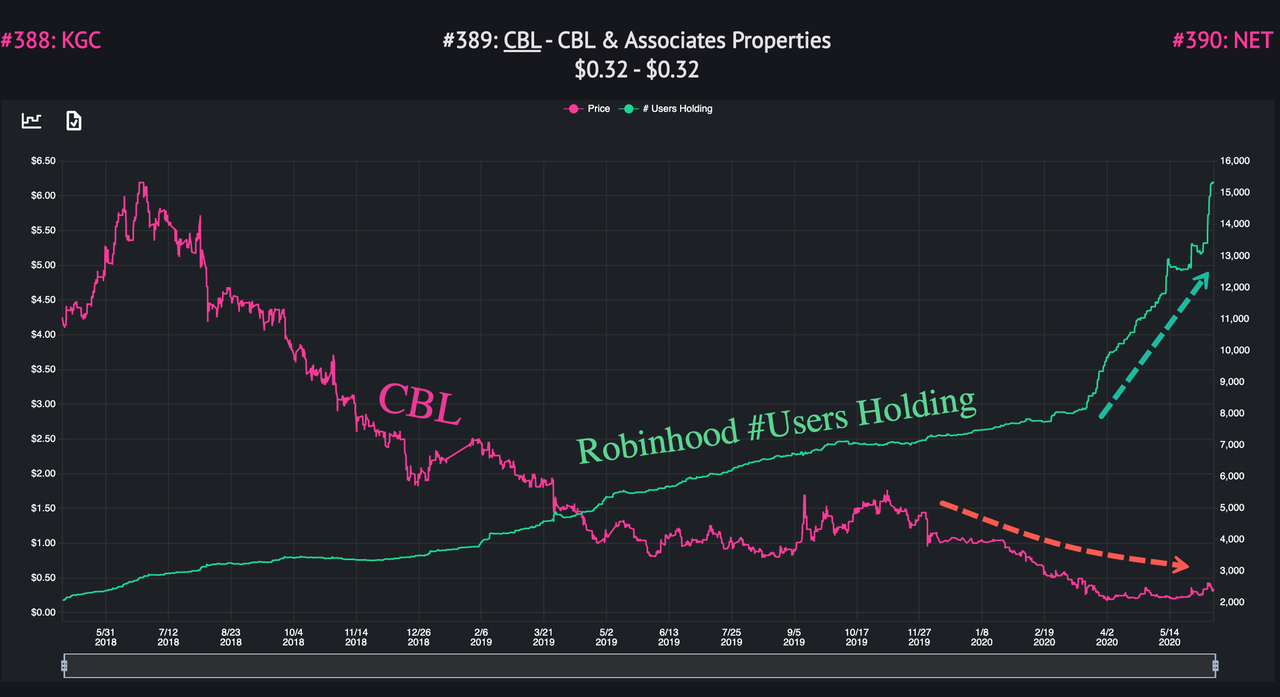

With CBL on the brink of bankruptcy, Robinhood traders have been piling into the stock since March. Accounts holding CBL stock nearly doubled in the last three months, from 8,100 holders (mid-March) to 15,300 (June 12).

CBL should take note of what’s happening with the Hertz bankruptcy, issue a bunch of stock and drain the equity, along with all the Robinhood daytraders in it.

via ZeroHedge News https://ift.tt/37wkysj Tyler Durden