ETF Launches Are The New Ultimate Contrarian Indicator

Tyler Durden

Sun, 06/14/2020 – 09:55

ETFs have taken over the market and become so widespread that a trend really hasn’t “made it” now unless it has its own ETF. This rush to come up with new ways to generate fees from lazy and unsophisticated investors incapable of building their own portfolios has led to ETFs becoming the ultimate contrarian indicator at times.

For example, the Direxion Fallen Knives ETF, which trades under the ticket NIFE, was launched last Thursday. The ETF follows the Indxx US Fallen Knives Index, a benchmark designed to identify stocks that have fallen precipitously, according to Yahoo.

As if the traders on Robinhood needed an easier way to buy total garbage that has been decimated by the market…

“Fallen knives may offer the opportunity for outperformance within an equity allocation. A systematic approach brings a concentrated basket of the prospective securities within the US stock market,” according to Direxion. “Screening for eligible names that have recently experienced substantial negative returns helps identify differentiated exposure.”

The idea of buying companies that had fallen in value fell apart on the day the ETF launched, Thursday, when the Dow finished the day down almost 2,000 points.

Another ETF that launched recently was the ETFMG Travel Tech ETF, which trades under the symbol AWAY. It invests in online travel companies and was launched on February 12, just days before the entire sector took a massive plunge due to the coronavirus pandemic.

Almost every stock in the travel and leisure category is trading lower than it was on the day the ETF was first launched.

Direxion also recently launched the Direxion Dynamic Hedge ETF recently, which trades under the symbol DYHG.

This product uses futures contracts to manage risk and increases short exposure during volatile environments, while increasing long exposure during times of less volatility. In other words, it’s a backward looking indicator doing the exact opposite of getting ahead of the trade.

We are eager to hear the success stories that traders will pay 0.57% a year to share while transacting this ETF. And while we joke, we sadly know that many RIAs and “investment advisors” have likely already piled into these instruments, furthering a growing illiquidity problem in ETFs that has been widespread across markets for sometime now.

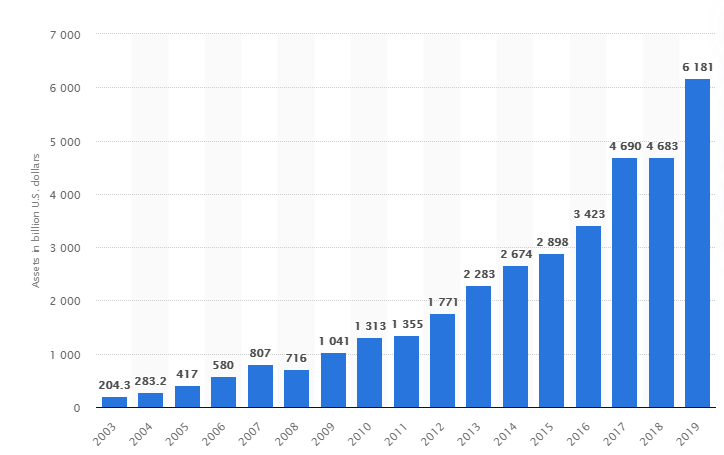

But hey, with the Fed now providing a multi-trillion dollar backstop to the market, does it even matter anymore?

via ZeroHedge News https://ift.tt/2B3iDzk Tyler Durden