Key Events This Week: Central Banks Try To Talk Up Stocks

Tyler Durden

Mon, 06/15/2020 – 09:29

While markets will be paying very close attention to the resurgence in virus cases in China as well as the rising infections in the US to determine if the V-shaped recovery is over, there are quite a few other things to keep track of this week. As DB’s Jim Reid writes, central banks will feature highly on the agenda, with decisions from the Bank of Japan (tomorrow), the Bank of England (Thursday) and a number of others, while Fed Chair Powell will also be testifying before Congress (tomorrow and Wednesday).

European politics will also be in focus, with a European Council meeting taking place on Friday where the recovery fund will be discussed, as well as talks between Prime Minister Johnson and EU leaders on today about their future relationship. Meanwhile we’ll get an increasing number of hard data releases for May, offering further insight into how different economies have fared as various lockdown measures have been eased.

Starting with central banks while the BoJ (tomorrow) is likely to see no policy change, the Bank of England (Thursday) are expected by DB to ramp up QE by a further £125bn with more QE likely over the course of the year. Their decision comes against the backdrop of Friday’s data showing UK GDP contracting by -20.4% in April, following its -5.8% decline in March, and with the country still only slowly easing lockdown restrictions.

Another central bank highlight will be Fed Chair Powell’s appearances before the Senate Banking Committee tomorrow and the House Financial Services Committee on Wednesday. He’ll be delivering a testimony as part of the semiannual Monetary Policy Report that’s submitted to Congress. It’ll be interesting to hear what he has to say on the outlook and how he sees the recovery progressing given his remarks in the most recent press conference that “we’re not thinking about thinking about raising rates”. So close to last week’s FOMC there is unlikely to be much new news but his tone will be closely watched as many in the market have criticised his downbeat nature at last week’s press conference. Rightly or wrongly, markets like a bit of sparkle from their central bank leaders and didn’t feel they got enough last week. Finally, central banks elsewhere will also be making a number of decisions next week, including in Switzerland, Norway, Indonesia, Russia and Brazil.

At the end of the week, the European Council summit on Friday will be of particular importance, with EU leaders due to discuss the recovery fund to deal with covid-19, along with the EU’s new long-term budget. Last month, Commission President von der Leyen presented a proposal for a €750bn recovery fund, which would include a mixture of grants and loans to member states. As part of this, the Commission would borrow from markets on behalf of the EU. However, the plans would require unanimity among the member states, and there are differences of views between them, not least on the extent to which the fund should be balanced between grants and loans. However, talks on the issue are expected to keep going into July, when Germany will take over the rotating EU Presidency.

Staying on European politics, and Brexit will return to the headlines as a high-level meeting between UK Prime Minister Johnson and the Presidents of the European Commission, Council and Parliament takes place by video conference this afternoon. The two sides have now agreed to an intensified timetable for negotiations on a free-trade agreement, with talks in each of the 5 weeks from the week commencing 29 June to the week commencing 27 July. The question will be whether today’s high-level talks can provide fresh impetus for the negotiations.

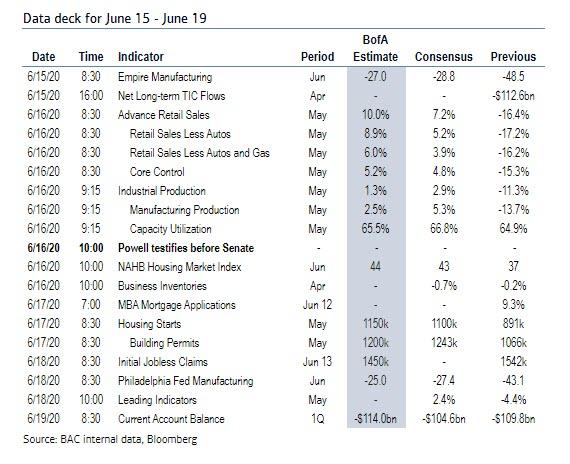

On the data front, it isn’t a particularly eventful week. The US will be releasing more hard data for May, with retail sales, industrial production and capacity utilisation figures coming out tomorrow, before housing starts and building permits for May are released on Wednesday. Our economists believe the trough of activity was in early May where their tracker showed YoY growth of -11%. It’s now around -9%. Moving across the Atlantic, here in the UK, this week sees inflation, retail sales and unemployment data released. For more on the rest of the week’s calendar see the day by day week ahead at the end.

Day-by-day calendar of events courtesy of Deutsche Bank

Monday

- Data: China May industrial production, retail sales, Japan April tertiary industry index, Italy final May CPI, Euro Area April trade balance, Canada April manufacturing sales, May existing home sales, US June Empire State manufacturing survey, April foreign net transactions

- Central Banks: Fed’s Kaplan and Daly speak

- Politics: Meeting between UK Prime Minister Johnson and the Presidents of the European Commission, Council and Parliament.

Tuesday

- Data: UK April unemployment rate, Germany final May CPI, June ZEW survey, Canada April international securities transactions, US May retail sales, industrial production, capacity utilisation, June NAHB housing market index

- Central Banks: Bank of Japan monetary policy decision, Fed Chair Powell appears before Senate Banking Committee, Fed’s Clarida speaks, RBA release minutes of June policy meeting

Wednesday

- Data: Japan May trade balance, UK May CPI, EU27 May new car registrations, Italy April industrial sales, industrial orders, Euro Area final May CPI, US weekly MBA mortgage applications, May housing starts, building permits, Canada May CPI

- Central Banks: Brazil monetary policy decision, Fed Chair Powell appears before House Financial Services Committee, Fed’s Mester speaks

Thursday

- Data: Italy April trade balance, Canada April wholesale trade sales, US June Philadelphia Fed business outlook, weekly initial jobless claims, May leading index

- Central Banks: Monetary policy decisions from the Bank of England, Swiss National Bank, Norges Bank and Bank Indonesia, ECB publishes Economic Bulletin, Fed’s Mester speaks

Friday

- Data: Japan May nationwide CPI, UK May retail sales, public sector net borrowing, Germany May PPI, Euro Area April current account balance, US Q1 current account balance, Canada April retail sales

- Central Banks: Central Bank of Russia monetary policy decision, BoJ release minutes of April meeting, Fed’s Powell, Quarles, Mester and Rosengren speak

- Politics: European Council meet via videoconference

Finally, here is Goldman focusing on the US, where the most important economic data releases next week are the retail sales and industrial production reports on Tuesday and the jobless claims report on Thursday. There are several scheduled speaking engagements by Fed officials this week, including Chair Powell’s congressional testimony on Tuesday and Wednesday.

Monday, June 15

- 10:00 AM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will take part in an online discussion hosted by the Money Marketeers at New York University.

- 12:30 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will take part in an online discussion on monetary policy hosted by the National Press Club. Prepared text is expected. Media and audience Q&A are expected.

Tuesday, June 16

- 08:30 AM Retail sales, May (GS 9.5%, consensus +8.0%, last -16.4%); Retail sales ex-auto, May (GS +7.5%, consensus +5.3%, last -17.2%); Retail sales ex-auto & gas, May (GS +7.5%, consensus +5.0%, last -16.2%); Core retail sales, May (GS +7.0%, consensus +5.8%, last -15.3%): We estimate that core retail sales (ex-autos, gasoline, and building materials) rebounded by 7.0% in May (mom sa), reflecting a partial reopening of the economy indicated by sharp gains in credit card spending and other high-frequency data. We believe the April and May reports received a boost from non-response among the hardest hit retailers, and we note scope for downward revisions as additional responses are received. In May, we expect even strong sequential gains in the higher level aggregates in this week’s report reflecting rebounding spending at restaurant and car dealerships. We expect a 9.5% increase in the headline measure and an 7.5% rise in ex-auto.

- 09:15 AM Industrial production, May (GS +4.5%, consensus +3.0%, last -11.2%); Manufacturing production, May (GS +6.5%, consensus +5.0%, last -13.7%); Capacity utilization, May (GS 67.5%, consensus 66.9%, last 64.9%): We estimate industrial production rose by 6.5% in May, reflecting a rebound in manufacturing output after last month’s plunge. We estimate capacity utilization rose by 2.6pp to 67.5%.

- 10:00 AM Fed Chair Powell appears before the Senate Banking Committee: Fed Chair Jerome Powell will deliver the semi-annual policy report before the Senate Banking Committee. Prepared text is expected.

- 04:00 PM Fed Vice Chair Clarida (FOMC voter) speaks: Fed Vice Chair Richard Clarida will give a speech on the outlook for the US economy and monetary policy at a Foreign Policy Association dinner. Prepared text is expected.

Wednesday, June 17

- 08:30 AM Housing starts, May (GS +25.0%, consensus +23.5%, last -30.2%); Building permits, May (consensus +17.3%, last -20.8%): We estimate housing starts rebounded by 25.0% in May following coronavirus-related declines in April and March.

- 12:00 PM Fed Chair Powell appears before the House Financial Services Committee: Fed Chair Jerome Powell will deliver the semi-annual policy report before the House Financial Services Committee. Prepared text is expected.

- 04:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will take part in an online discussion hosted by the Council for Economic Education. Prepared text is expected. Audience Q&A is expected.

Thursday, June 18

- 08:30 AM Philadelphia Fed manufacturing index, June (GS -23.0, consensus -25.0, last -43.1): We estimate that the Philadelphia Fed manufacturing index increased by 20.1pt to -23.0 in June.

- 08:30 AM Initial jobless claims, week ended June 13 (GS 1,300k, consensus 1,290k, last 1,542k): Continuing jobless claims, week ended June 6 (consensus 19,650k, last 20,929k): We estimate initial jobless claims declined but remain elevated at 1,300k in the week ended June 13.

- 12:15 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will take part in a virtual discussion hosted by the Global Interdependence Center. Audience Q&A is expected.

- 07:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will deliver a commencement address to the Preuss School at UC San Diego. Prepared text is expected.

Friday, June 19

- 10:15 AM Boston Fed President Eric Rosengren (FOMC non-voter) speaks: Boston Fed President Eric Rosengren will take part in a webinar on the US economy and current financial conditions hosted by the Greater Providence Chamber of Commerce. Prepared text is expected. Audience Q&A is expected.

- 12:00 PM Vice Chair for Supervision Quarles (FOMC voter) speaks: Federal Reserve Board Vice Chair for Supervision Randal Quarles will discuss stress testing at a Women in Housing and Finance Policy Event. Text is expected. Moderated Q&A is expected.

- 01:00 PM Fed Chair Powell (FOMC voter) and Cleveland Fed President Mester (FOMC voter) speak: Fed Chairman Jerome Powell and Cleveland Fed President Loretta Mester will speak via video on building a resilient workforce in the era of Covid at a Youngstown Community Event. Text is expected.

Source: DB, Goldman, BofA

via ZeroHedge News https://ift.tt/3e6KSM7 Tyler Durden