Where Used Car Prices Are Crashing The Most In The US

Tyler Durden

Mon, 06/15/2020 – 05:30

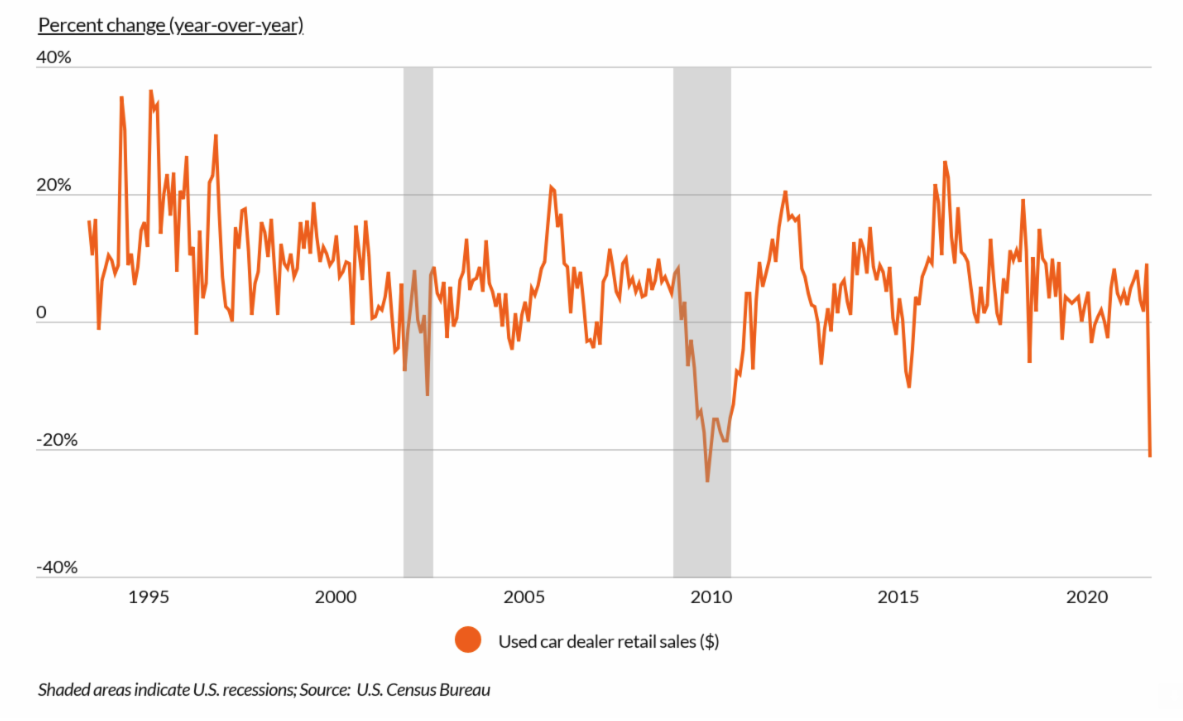

Since the coronavirus pandemic began grinding the global economy to a halt, we have been keeping a close eye on the auto market. The auto market was mired in recession prior to the virus and therefore has been disproportionately affected by the slowdown in the global economy.

In January, prior to the virus shutdowns, auto companies set the tone for the year, starting 2019 just as miserably as 2018 ended, with major double digit plunges in sales from manufacturers like Nissan and Daimler. Since then, things have only worsened, with major markets like China and the U.S. seeing sales fall off a cliff as consumers have been forced to stay home.

We have recently noted that U.S. auto manufacturers are teeing up sizeable incentives to get buyers back into showrooms. Europe is following suit, with Volkswagen starting a sales initiative to revive demand, including improved leasing and financing terms.

But at the same time, used car prices have been tanking. Over the last few months we detailed how used car prices were set to cripple what little interest in new cars remains, how dealers are scrambling to desperately offer incentives and how ships full of vehicles are being turned away at port cities due to a lack of space and inventory glut.

Today, we want to take a look at where the used car price plunge – which continues to put pressure on the industry – is having the biggest impact. A new report from CoPilot, a car shopping app, looks at the recent drop in used car prices in the U.S.

Research firm Manheim has indicated that wholesale prices dropped as much as 11% in April, but also that this price drop hasn’t fully hit the retail market yet. The report predicts that since “dealers have largely avoided purchasing new inventory in recent weeks, they aren’t in a rush to cut prices as a way to move their existing inventory.”

It also predicts a sharp drop in retail prices in the coming weeks, stating that “a combination of record supply, damaged consumer confidence, and new car incentives will ultimately create a perfect storm causing retail prices to drop sharply in the coming weeks.”

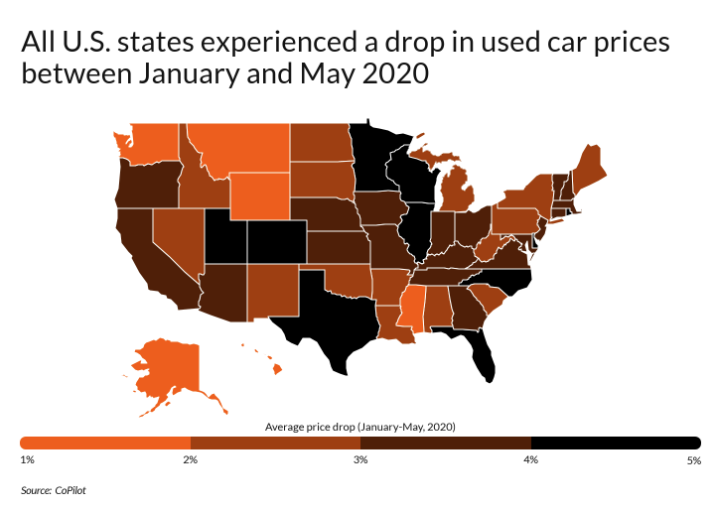

Between January and May, individual U.S. states experienced price drops ranging from 1% to 5%, the report shows.

The CoPilot report does a good job parsing out on both a state-wide level and metropolitan area-level, where used car prices are falling the most. The app “analyzed its proprietary dataset of more than 6 million auto listings in the United States and created a ranking based on each location’s change in average listing price between January and May 2020.”

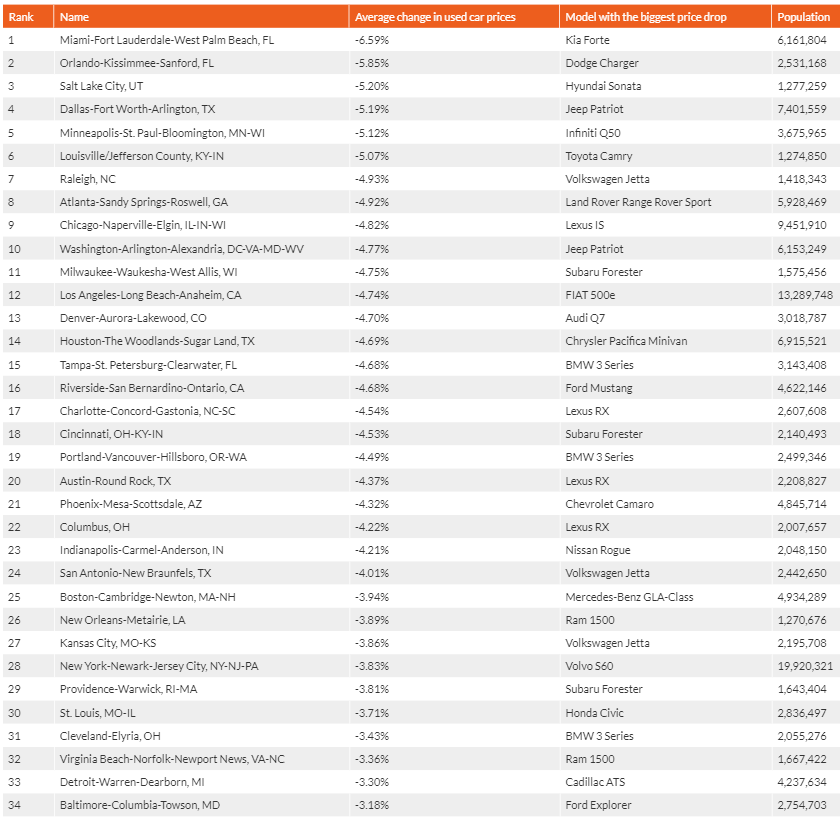

The top 5 metro areas that saw price declines included:

-

Miami-Fort Lauderdale-West Palm Beach, FL: Average change in used car prices: -6.59%

-

Orlando-Kissimmee-Sanford, FL: Average change in used car prices: -5.85%

-

Salt Lake City, UT: Average change in used car prices: -5.20%

-

Dallas-Fort Worth-Arlington, TX: Average change in used car prices: -5.19%

-

Minneapolis-St. Paul-Bloomington, MN-WI: Average change in used car prices: -5.12%

You can view the full list of all metro areas here:

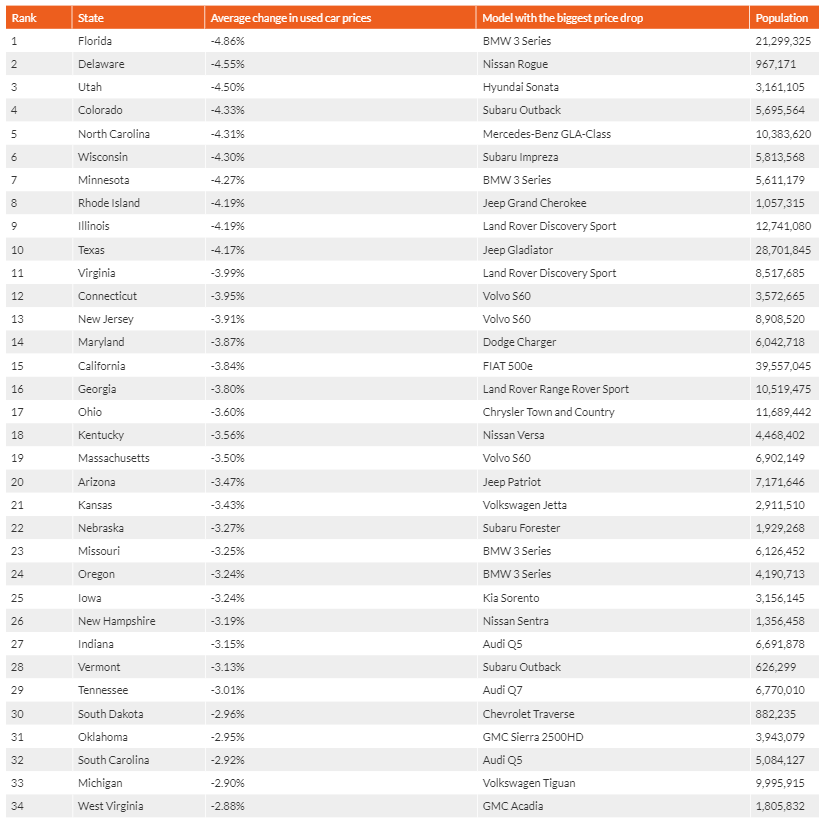

And the top 5 states that saw price declines included:

- Florida, -4.86%

- Delaware, -4.55%

- Utah, -4.5%

- Colorado, -4.33%

- North Carolina, -4.31%

You can view the full list, by state, here:

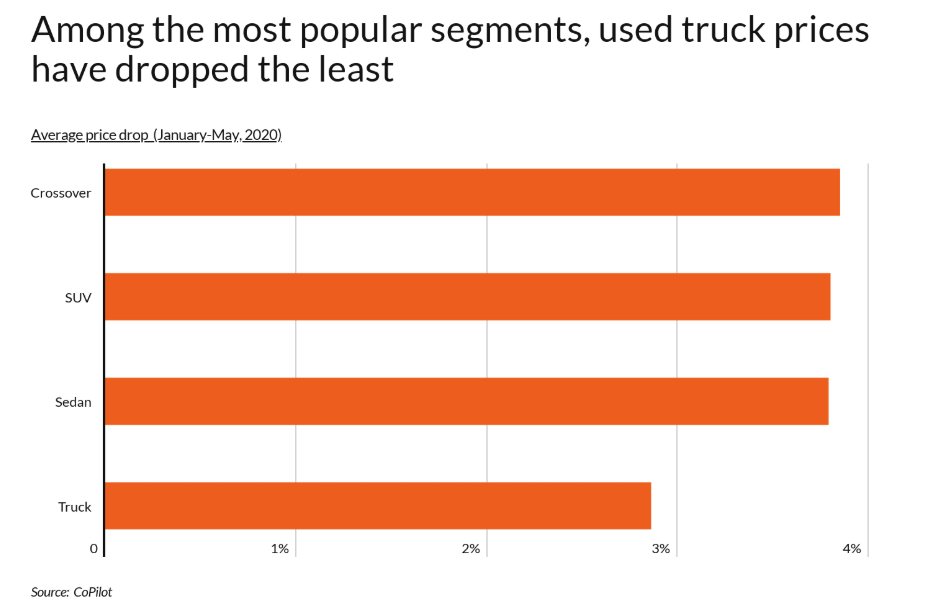

The report also found that “Trucks have seen the smallest decline in average sale price so far, at only 2.9 percent compared to 3.6 percent for all used vehicles. This is consistent with the fact that demand for trucks typically increases when gas prices and interest rates drop, trends which make owning a truck more affordable.”

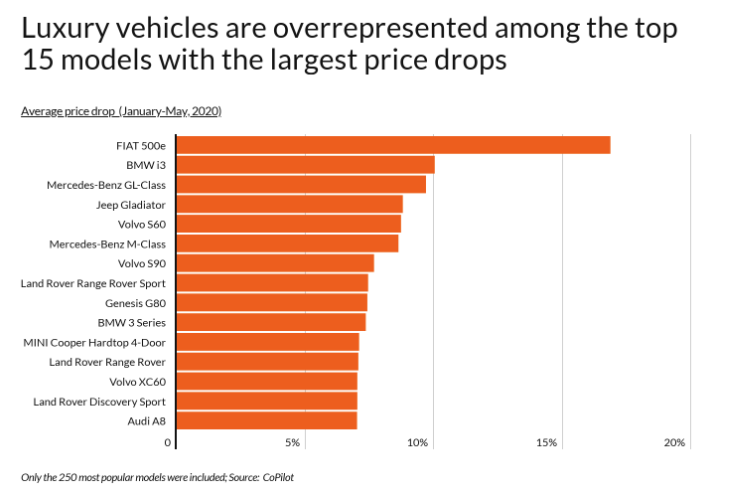

“Luxury vehicles and electric vehicles are disproportionately represented among the top 15 models with the biggest drop in used car prices so far,” the report also concluded.

via ZeroHedge News https://ift.tt/2UO5Aca Tyler Durden