Schizophrenia? A Record 78% Of Wall Street Professionals Think Stocks Are Overvalued As They Flood Back Into Markets

Tyler Durden

Tue, 06/16/2020 – 09:38

After two months of downright apocalyptic sentiment on Wall Street as revealed by the monthly Bank of America Fund Manager Surveys (FMS), the latest poll of 212 panelists managing $598 billion in AUM conducted by BofA Chief Investment Strategist Michael Hartnett showed a sharp reversal in sentiment with i) growth expectations jumping, ii) cash levels collapsing, and iii) risk appetites surging;

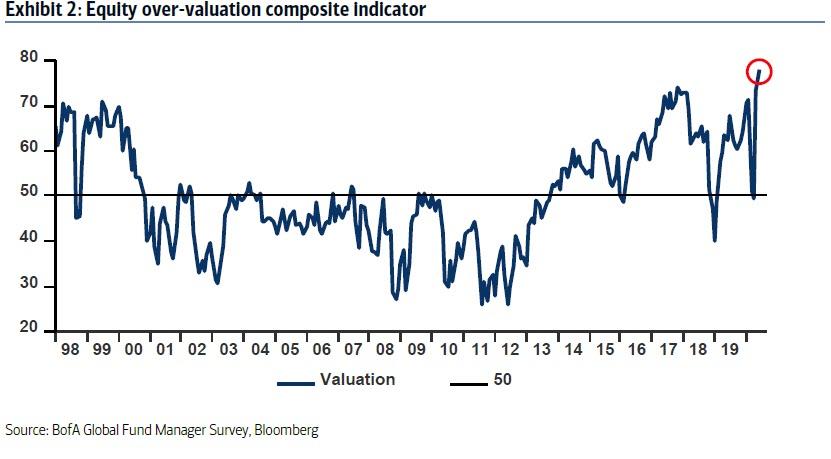

Yet despite this surge in economic optimism, not even Wall Street’s traditional bulls can reconcile just how far ahead the market has lept, with the largest number of FMS investors since 1998 – some 78% of respondents – saying that the stock market is “overvalued.”

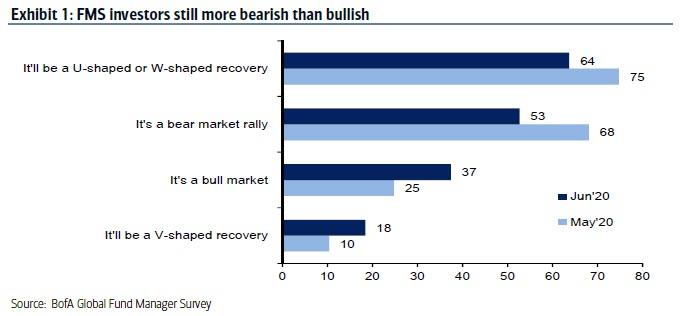

Also, even as doomsday sentiment ebbs, only 18% if Wall Street pros expect a V-shaped recovery vs 64% expecting U- or W-shaped according to the latest FMS; and while 37% now say “it’s a bull market”, 53% majority still say “it’s a bear market rally”.

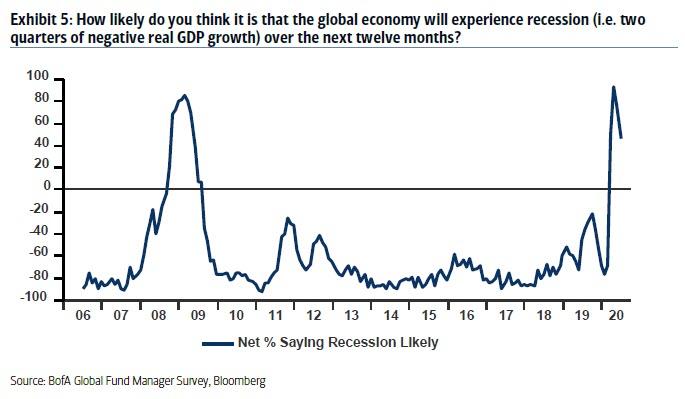

According to Hartnett, sentiment shifted as GDP & EPS expectations jumped as lockdowns ended, resulting in a big drop in fears of prolonged recession which dropped to just net 46% in June (vs 93% in April).

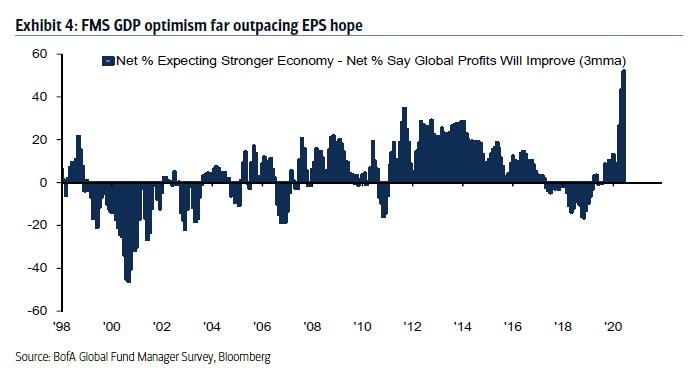

However, as BofA observes, this new trend of GDP optimism is still far outpacing EPS hope “driven by GDP +ve fiscal stimulus vs. EPS –ve politics.”

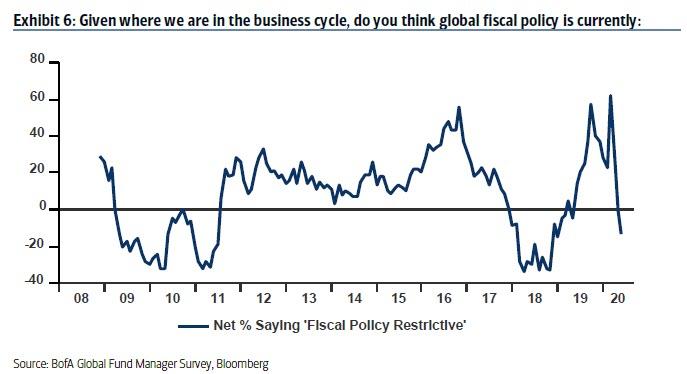

There is little confusion what Wall Street believes is the source for this solid rebound in the economy: a net 13% of FMS investor fiscal policy is currently too stimulative, which according to Hartnett, “raises the question on whether marginal stimulus will be seen as “new positives”; last time investors felt fiscal policy was too stimulative was May ’19.”

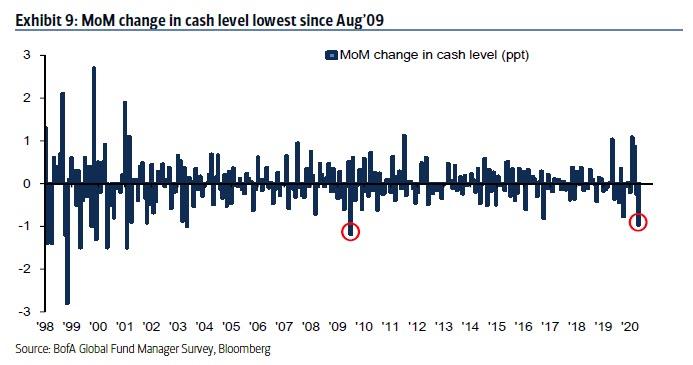

Yet while sentiment may be fickle, and will likely change one government stimulus checks stop at the end of July, Wall Street isn’t waiting and after fleeing markets, in June FMS cash level down from 5.7% to 4.7%, the biggest drop since Aug’09 (led by institutional not retail investors)…

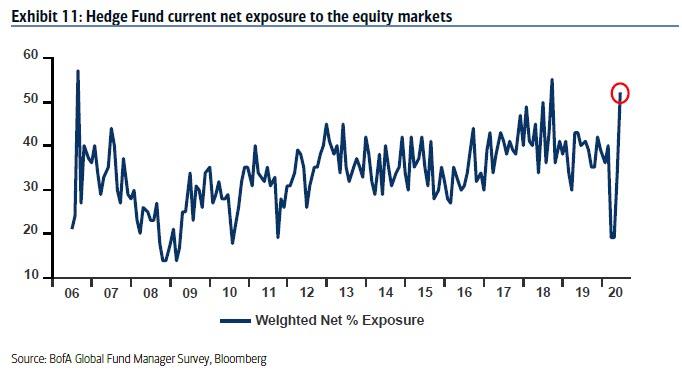

… meanwhile FMS hedge fund net equity exposure soared to 52% from 34%, highest since Sept’18 as hedge funds chased retail investors.

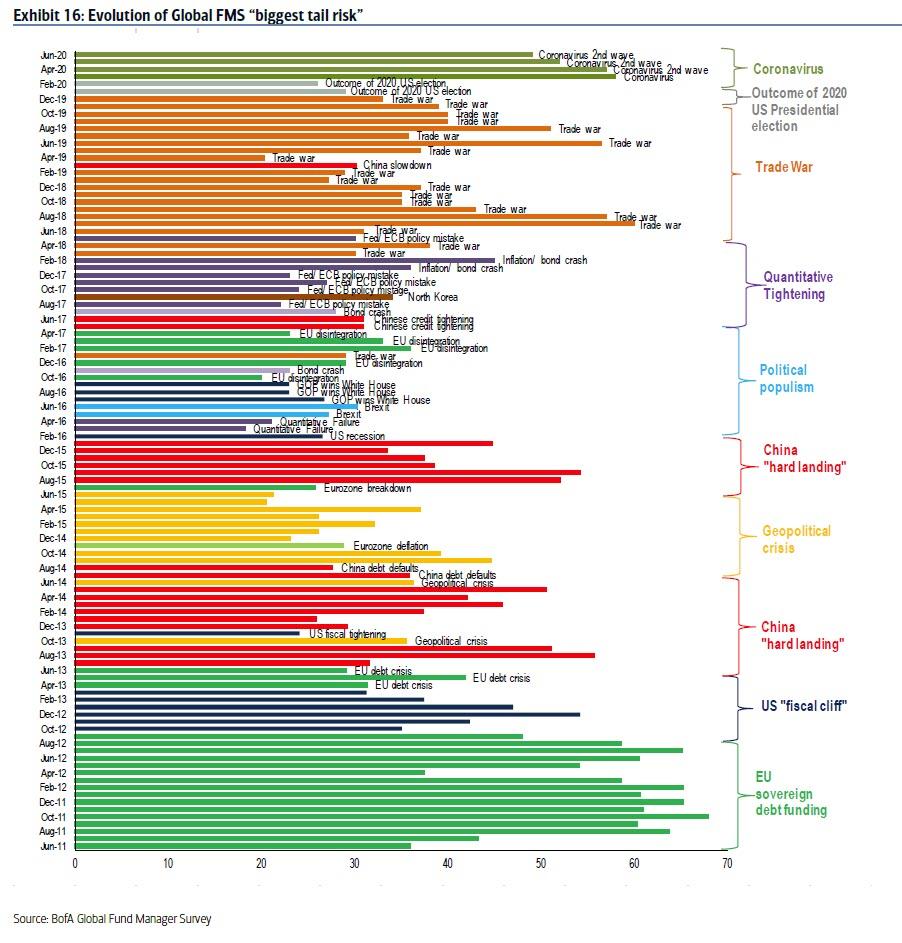

Amid this reversal in sentiment, it will hardly come as a surprise that according to most respondents, the biggest tail risk remains 2nd wave COVID-19 for the 3rd month in a row.

In conclusion, this is Hartnett summarizes the prevailing confused sentiment on Wall St:

past “peak pessimism”; but June optimism fragile, neurotic, nowhere near dangerously bullish…largest number of FMS investors since 1998 think stock market is “overvalued”; BofA Bull & Bear Indicator @ low 1.1.

Hopefully Jerome Powell can provide some more certainty to an army of institutional traders who have never been more confused.

via ZeroHedge News https://ift.tt/2N5m6jH Tyler Durden