Bankrupt-Hertz Hit & Bolton-Book Headlines Hammer ‘Homegamers’, Bonds Bid

Tyler Durden

Wed, 06/17/2020 – 16:00

More concerns at home and abroad on a second-wave of the pandemic and mixed housing data (mortgage apps up, starts and permits disappoint) were not enough to shake the unwavering confidence that everything will be fine.

Nasdaq outperformed again (of course), Small Caps sank as Dow and S&P held the flat line for most of the day. However, markets came a little unglued around 1500ET on the Bolton book headlines… and then when the party ended in HTZ, it seems the market lost it’s momo-mojo…

Everything was awesome until the last hour:

-

1455ET *BOLTON SAYS TRUMP ASKED CHINA’S XI FOR REELECTION HELP: NYT

-

1514ET *HERTZ SUSPENDS PLANS TO SELL $500M SHARES ON SEC REVIEW

-

1547ET *TRUMP SIGNS UIGHUR RIGHTS BILL IN REBUKE TO CHINA

The Dow was glued to its 50DMA…

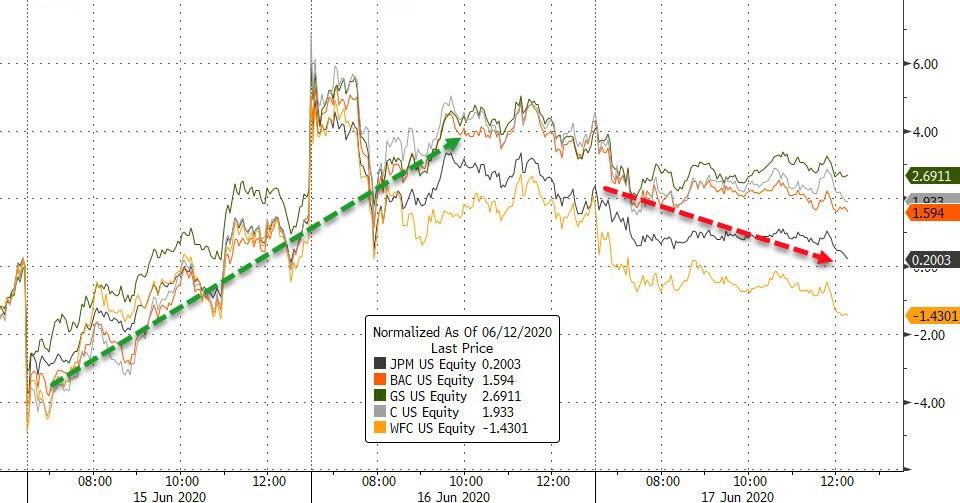

Bank stocks sank today with WFC back in the red for the week…

Source: Bloomberg

Momentum and Value factors flip-flopped once again today…

Source: Bloomberg

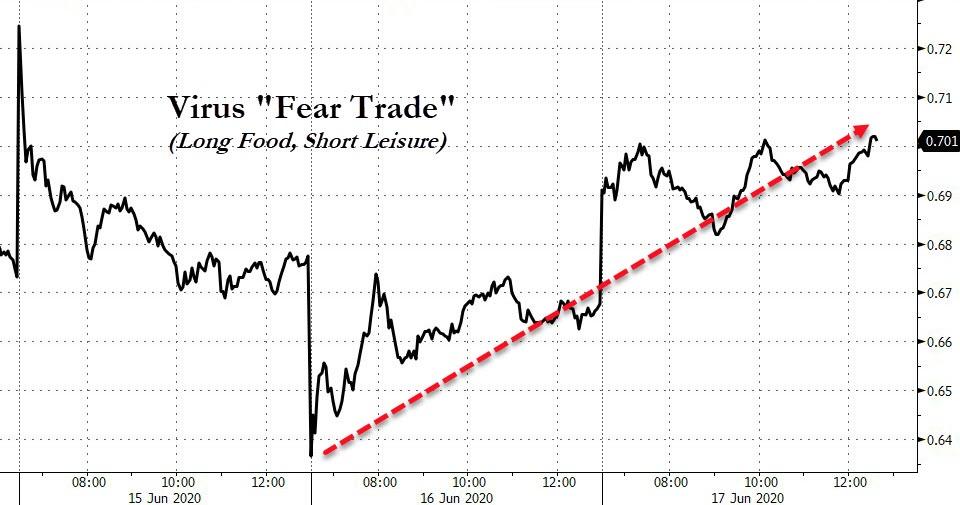

The Virus ‘fear trade’ is back…

Source: Bloomberg

And while stocks were mixed, other markets were peculiarly flat until the last few minutes:

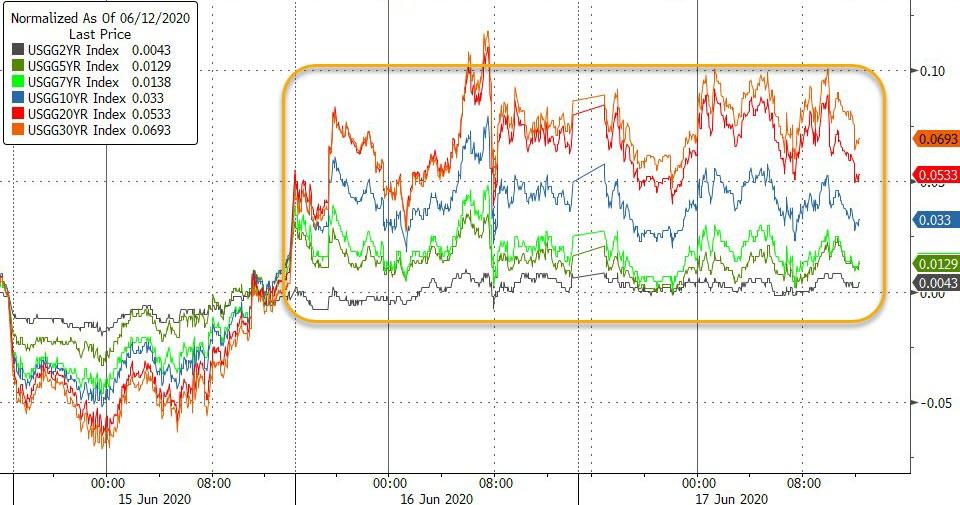

Treasury yields were very modestly lower… (20Y outperformed, down 4bps, after a strong auction)

Source: Bloomberg

The long-end outperformed… but the move was small

Source: Bloomberg

Corporate bonds fell for the second day…

Source: Bloomberg

The Dollar ended flat…

Source: Bloomberg

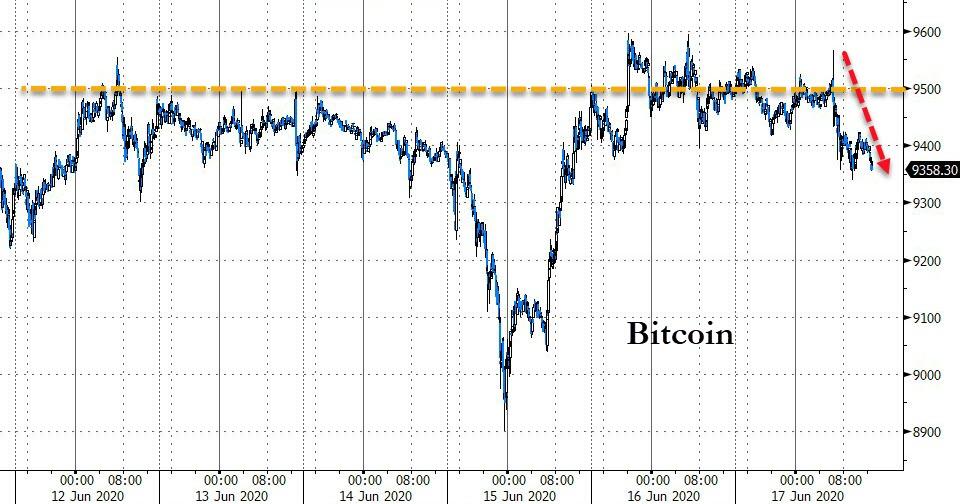

Bitcoin drifted lower on the day…

Source: Bloomberg

And gold was barely changed…

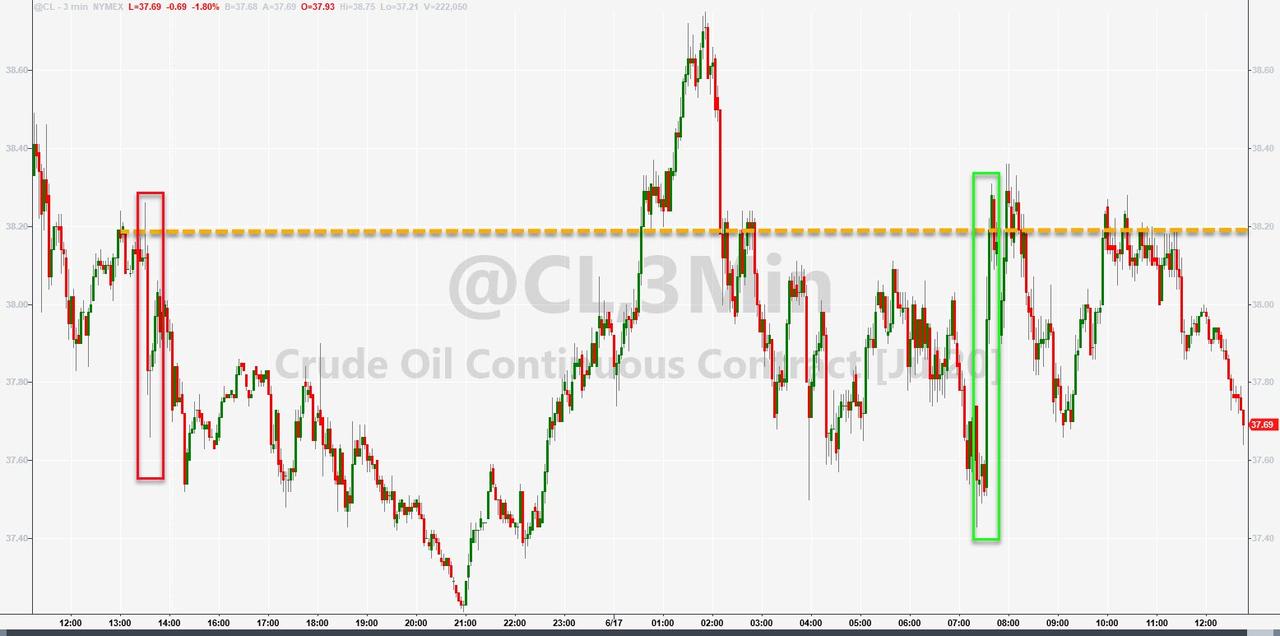

WTI crude prices ended lower on the day despite a spike on the smaller crude build…

Hurtz!

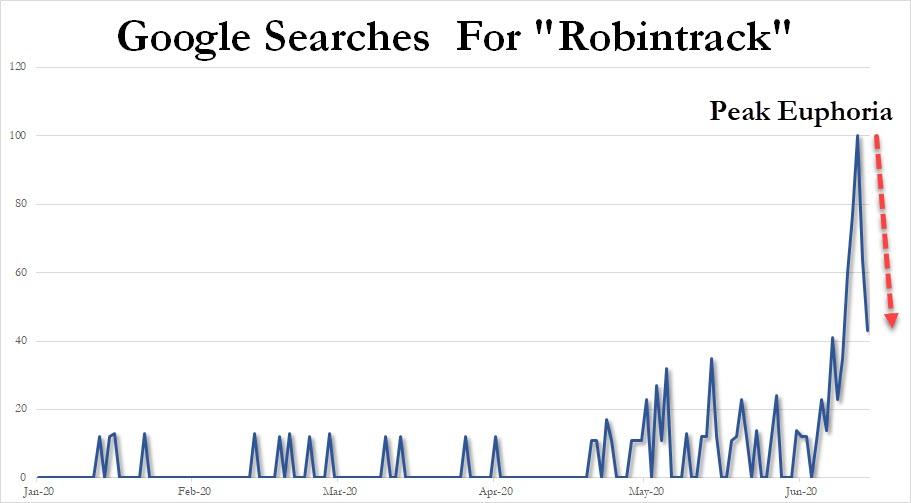

Finally, did bankrupt HTZ abandoning their worthless share offering trigger the end of the party?

via ZeroHedge News https://ift.tt/2UTzg7Q Tyler Durden