COVID Concerns, Crude Collapse, & Quad-Witch Craziness Spark Stock Swoon

Tyler Durden

Fri, 06/19/2020 – 16:01

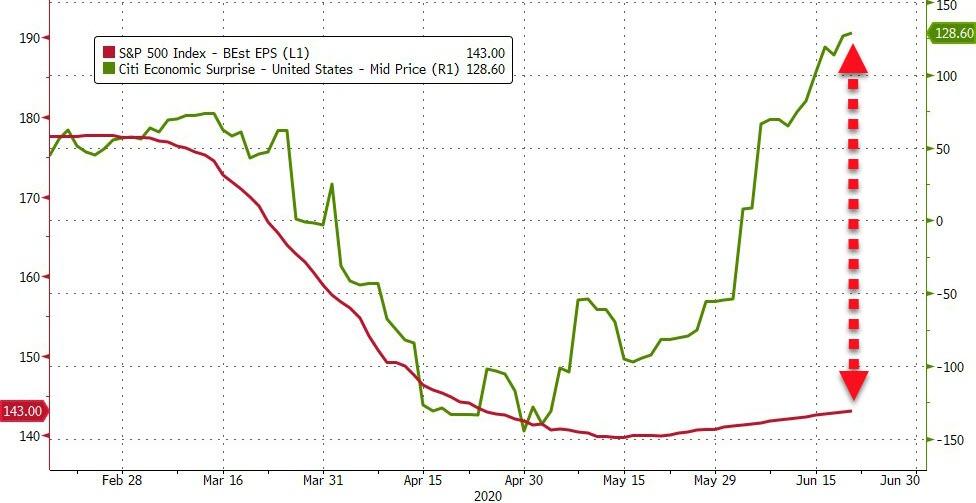

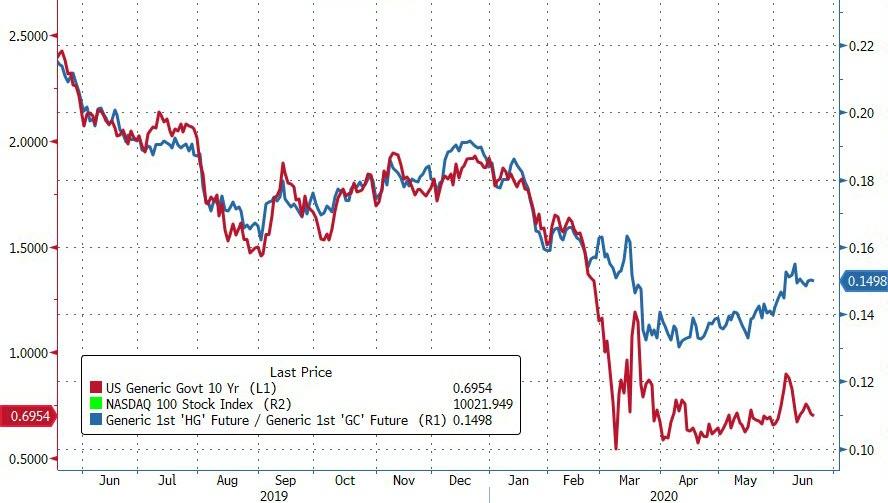

Well that was a week of worrisome headlines (from World War 3 to global COVID reawakenings), awe-inspiring US macro-economic beats (which lose all context in relation to the collapse) as earnings outlooks remain just “off the lows”, and a stock market that refuses to go down despite bonds, the dollar, and commodities all signaling anything but strong growth ahead…

Given the mean-reverting nature of the US macro surprise index (3 standard deviations above the mean), this could be as good as it gets…

Source: Bloomberg

Leaving the gap between macro and micro at its greatest ever…

Source: Bloomberg

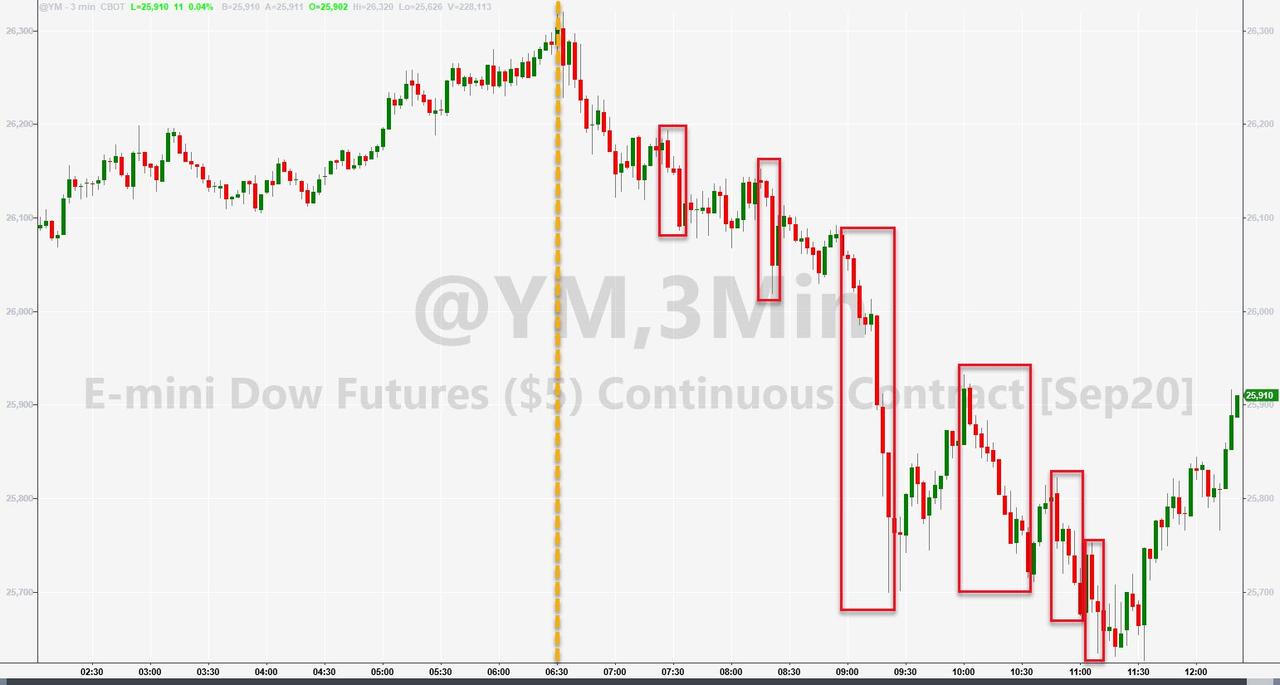

All hell broke loose this morning as the June S&P futures contract expired…

The market started lower the moment the June contract expired, but there were a number of triggering headlines for the legs lower…

-

1055ET *FLORIDA COVID CASES +4.4% VS. PREVIOUS 7-DAY AVG. 3.2%

-

1125ET *ARIZONA REPORTS A RECORD 3,246 NEW VIRUS CASES: ABC-15

-

1215ET *APPLE TO CLOSE SOME U.S. STORES AGAIN DUE TO COVID-19 SPIKES

-

1302ET *Fed’s Quarles Says Market Reaction to Covid-19 Is Not Over

-

1345ET *CRUISE LINES SUSPEND TRIPS OUT OF US PORTS TIL SEPT. 15: CNBC

-

1405ET *CALIFORNIA RECORDS LARGEST SINGLE-DAY INCREASE OF COVID CASES

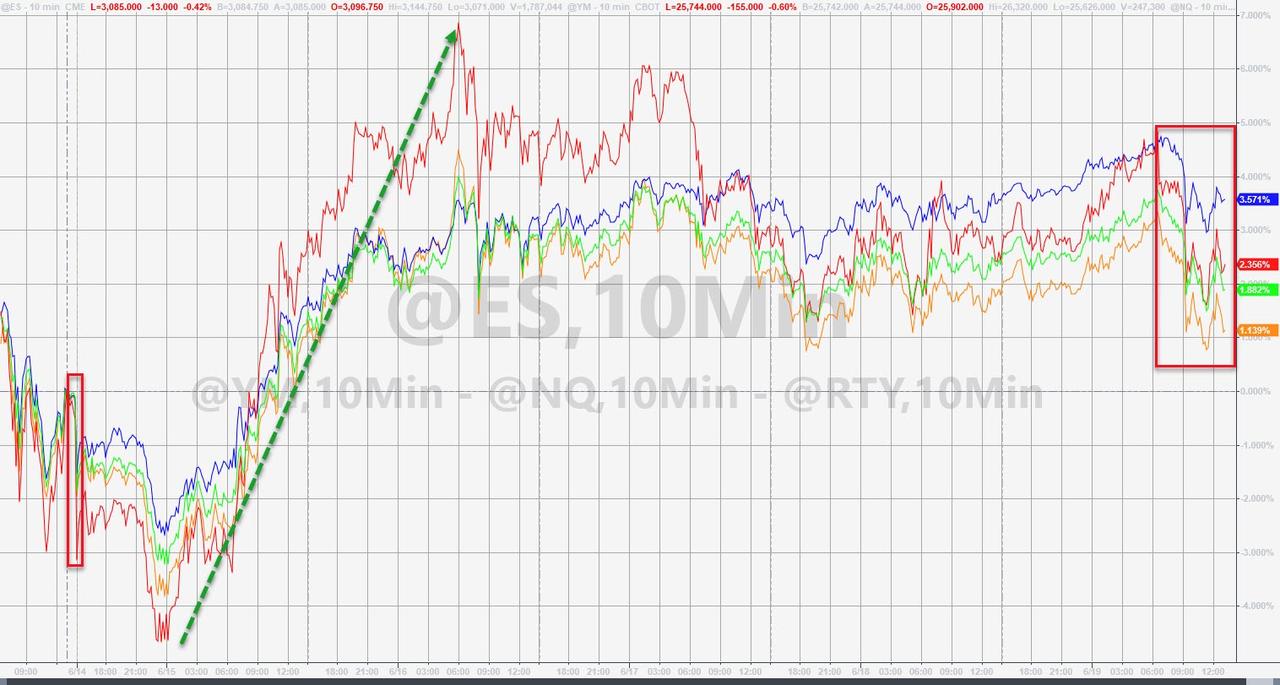

On the week, all the US majors were higher with Nasdaq leading and The Dow lagging…

On the day only Nasdaq managed to close green…

With the late-day panic…

Nasdaq is up 6 days in a row and up 17 of the last 20 days…

The Nasdaq Biotech index spiked 3.5% today to new record high…

The Virus Fear Trade picked up again this week…

Source: Bloomberg

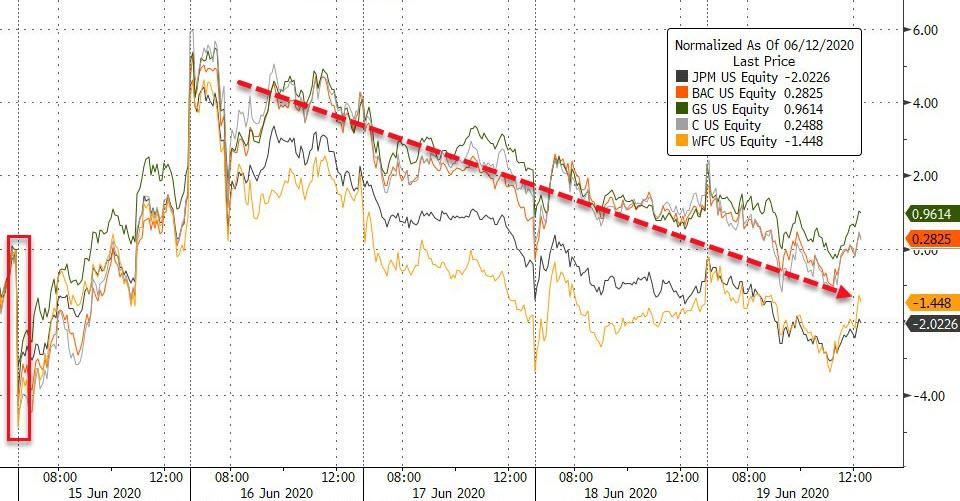

Banks started the weak with a panic-bid off opening weakness but that faded as the week proigressed and yields slid…

Source: Bloomberg

Crude prices crashed intraday, accelerating on heavy volume at 1230ET (After AZ,FL case counts) before bouncing back dramatically (as USO tumbled into red)…

Treasury yields fell today to end the week unch…

Source: Bloomberg

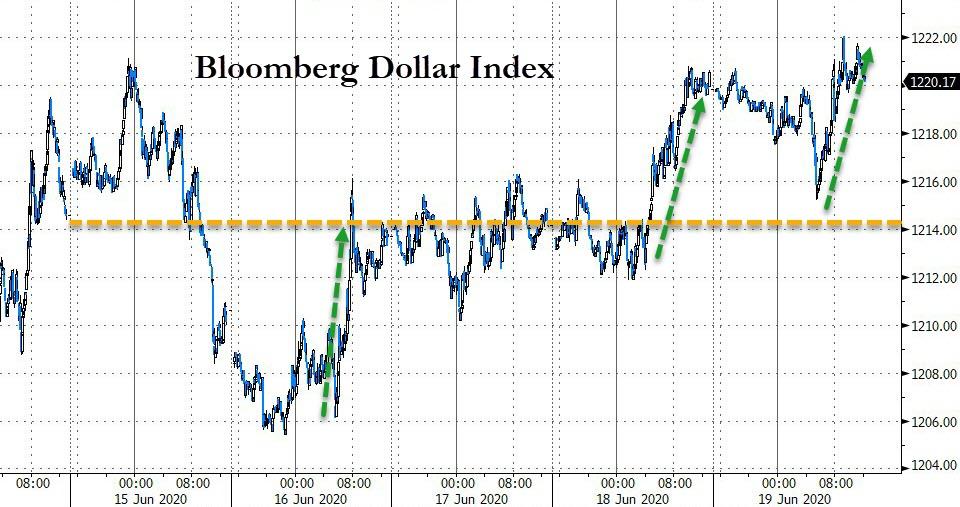

The dollar ended the week higher (up 6 of the last 7 days and 2nd up-week in a row)

Source: Bloomberg

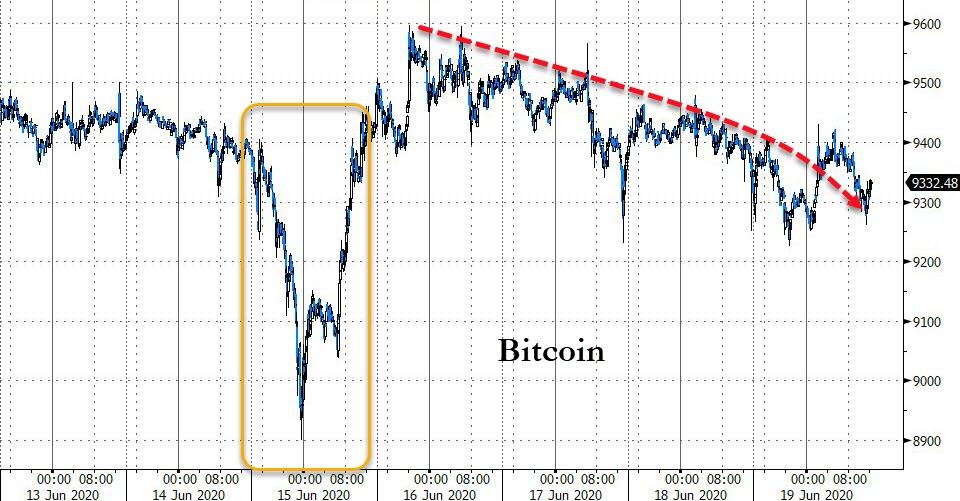

Bitcoin ended the week lower but apart from Monday’s dump and pump, traded in a narrow range…

Source: Bloomberg

Gold surged today, back above $1750…

Silver rallied but failed to hold $18…

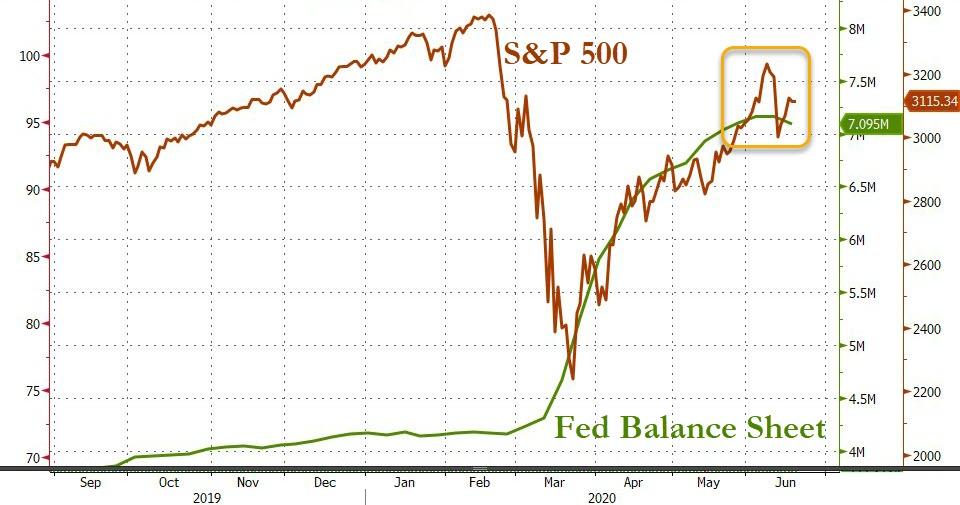

And finally, don’t forget, The Fed’s balance sheet shrank the most since 2009 this week…

Source: Bloomberg

Either TSY yields are dramatically too low or Dr.Copper is way over his recovery skis relative to gold…

Source: Bloomberg

Is volatility about the be resurrected?

And here’s a little context…

Source: Bloomberg

via ZeroHedge News https://ift.tt/2YOo3GA Tyler Durden