Will The Market Break Out Higher? According To Nomura, It Depends On This One Thing

Tyler Durden

Fri, 06/19/2020 – 10:26

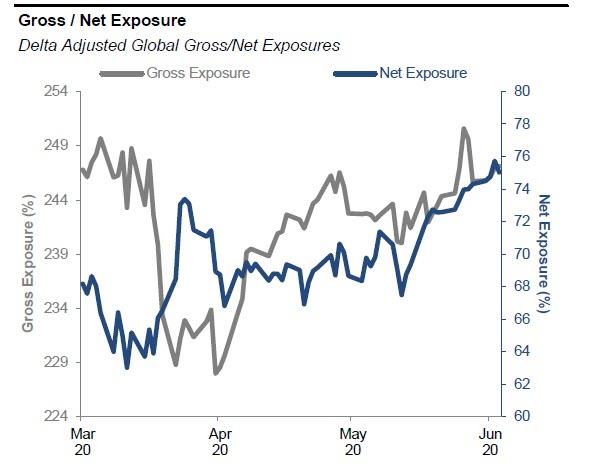

While retail traders -and now, hedge funds – both rushing into stocks…

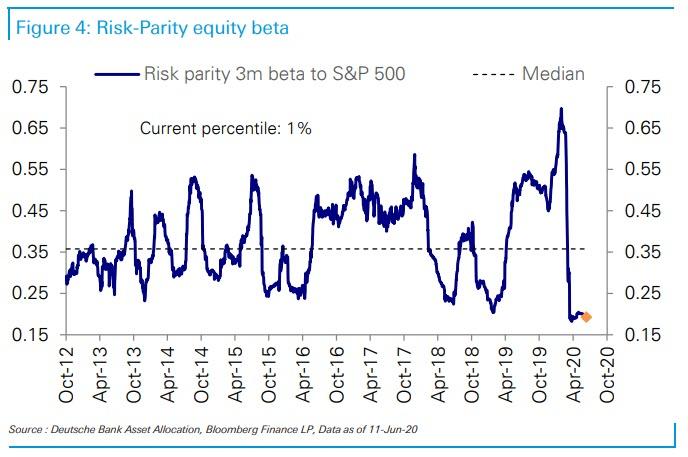

… one group of investors remains stubbornly out of the market: we are talking about large institutions, including risk-parity funds…

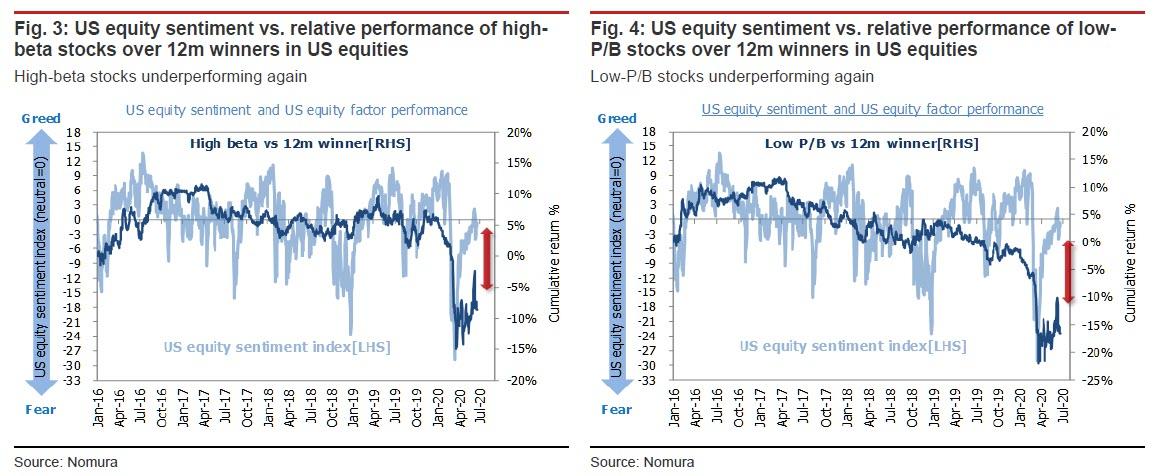

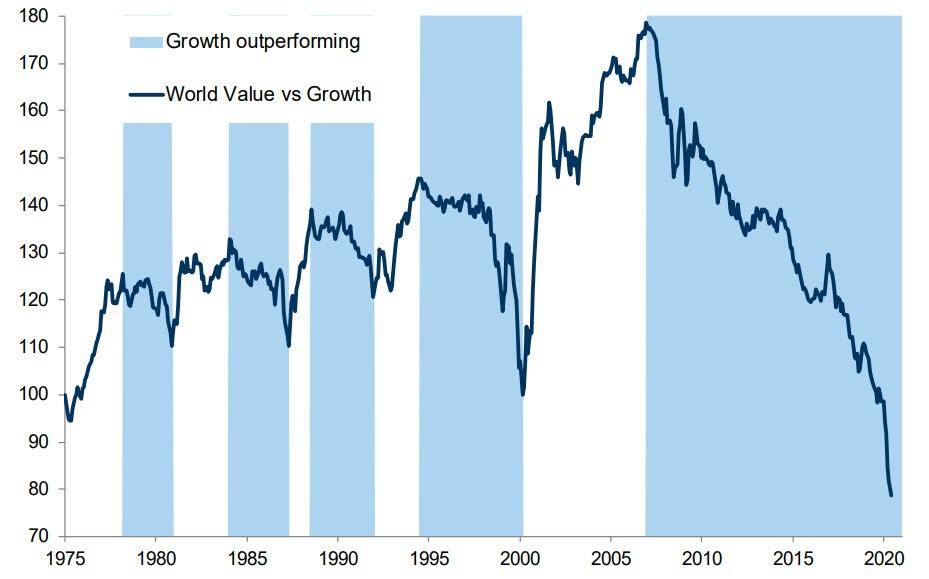

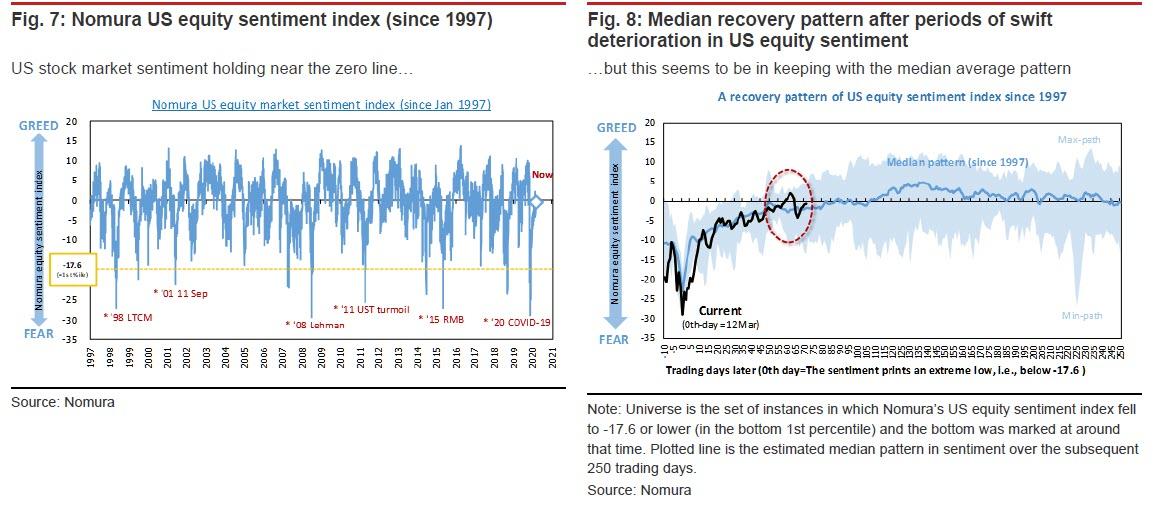

… and CTAs. Confirming this muted sentiment, Nomura’s Masanari Takada writes overnight that “factor trends in US and DM equities indicate that risk appetite is more muted now than it was in early June” or as he puts it “to some extent, investors appear to have gone back to selling value, buying momentum, and buying low-vol.”

As a result, if the “momentum into value rotation” trade is once again abandoned, and one look at the long term chart suggests this is the most likely outcome…

… should investor sentiment continue to straddle the line between bullishness and bearishness, and “if good and bad news continues to net out in the way it has been, with little change in external circumstances”, investors will probably proceed to sell value and buy momentum as a matter of course, according to Nomura which warns that “by falling back into familiar “pattern ruts”, these trends would give the surface appearance of a market becoming progressively more risk-off.”

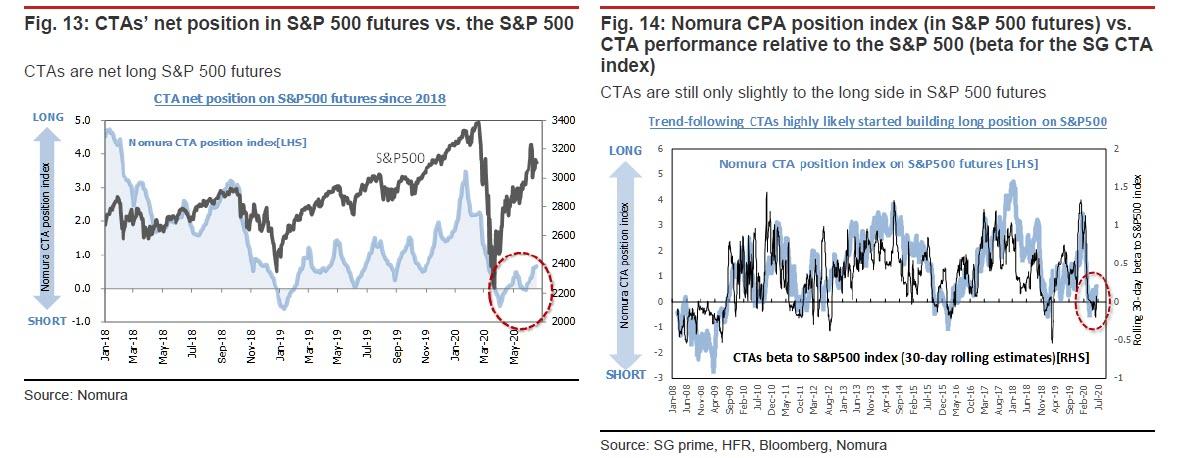

Perhaps as a result of the recent mangling of momentum trades which suffered dramatic losses in the past two weeks, one big missing link that could enable a substantial risk off episide, is the abovementioned absence of the trend-following investor class such as CTAs.

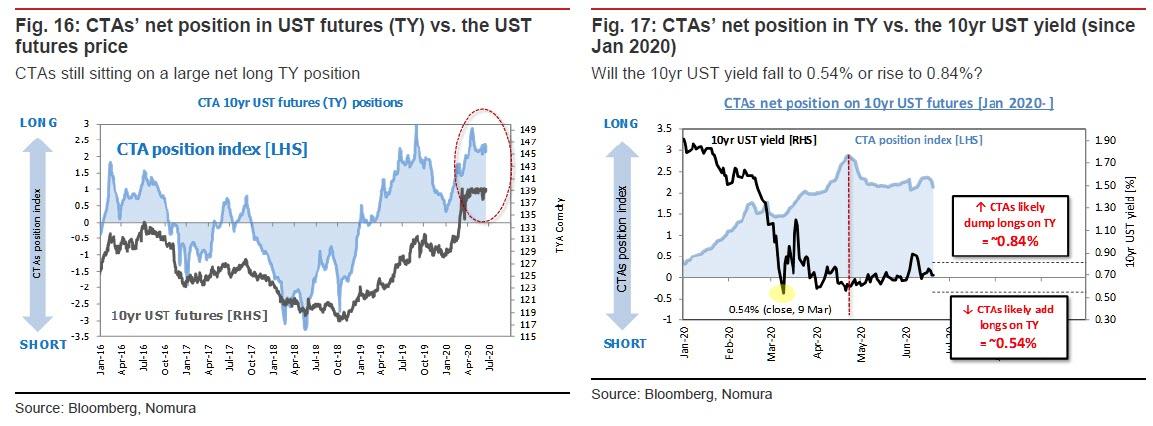

But why CTAs aren’t buying more equity futures? According to Takada the answer is simple: 10yr UST yield staying consistently low.

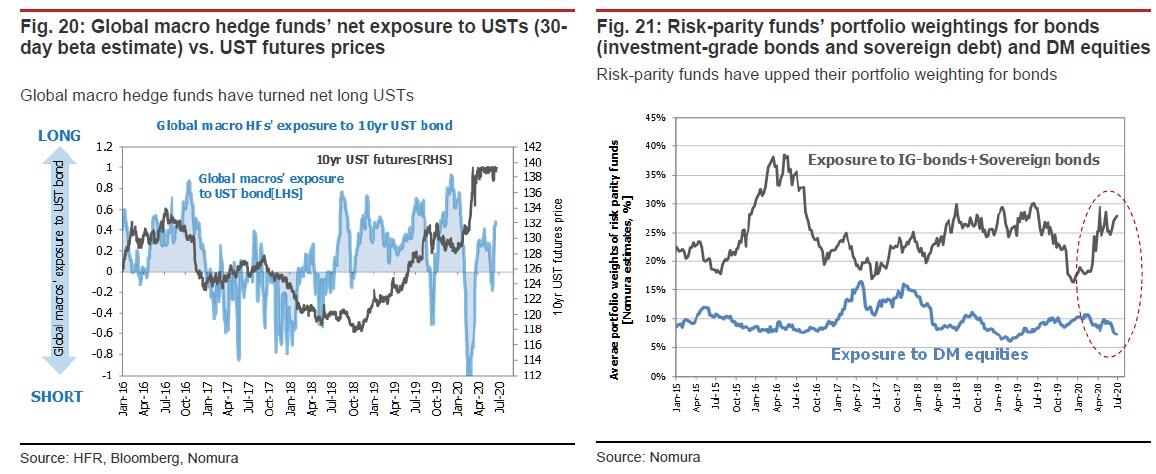

As the Nomura quant explains, “we are not seeing any significant shifts in supply and demand among speculative investors. It is difficult to predict how fundamentals-focused investors exercising discretionary judgment might act, but programmatic traders like CTAs and risk-parity funds appear to be idling their way into asset reallocation (selling bonds and buying stocks).”

And while systematic traders may be on their way to turning properly bullish (as recent observations from Charlie McElligott have hinted), this flow could still end up becoming stuck in the aforementioned “pattern rut” if the incoming good news turns out to be lacking.

So to answer the headline question, whether the market breaks out of its present indecision and allows the resumption of an algorithm-led risk rally, will depends on whether the 10yr UST yield heads up to above 0.84% rather than heading down to below 0.54% (and to a lesser extent whether the VIX falls to below 20.)

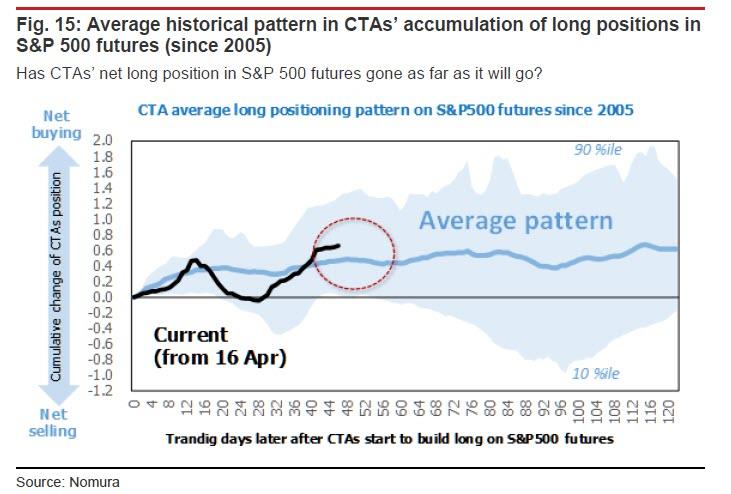

The failure of the 10yr UST yield to break back above 0.84% is putting a damper on the buying of equities by systematic funds in general and CTAs in particular. As Nomura points out, CTAs are only at an early stage of accumulating long positions in US equity futures, and “since their net long positions are not especially large yet, there is still quite a bit of leeway for more net buying.”

For now, however, CTA net buying of US equity futures has not managed to break out of the well-trodden median pattern followed during past periods of accumulation, with the line-apparently leveling off now. The “pattern rut” story seems to apply here as well, according to Takeda.

Digging deeper, from a technical angle, the lack of momentum behind CTAs’ net buying of equity futures can be attributed to what looks like a pause in CTAs’ asset reallocation involving exits from long positions in bond futures, especially 10yr UST futures (TY). In other words, CTAs are past the peak in their accumulation of long TY positions.

So what happens next?

According to Nomura, if the 10yr UST yield climbs back towards 0.84% (rather than heading down to the 0.54% recorded on 9 March), CTAs might well accelerate their selling of UST futures and buying of US equity futures (they are, after all, purely momentum traders). However, global macro hedge funds are currently turning bullish on USTs, and there has been no collapse in risk-parity funds’ exposure to bonds, either. The UST market is looking deadlocked as a result.

via ZeroHedge News https://ift.tt/3hL4M1h Tyler Durden