Futures Slide In Early Trading

Tyler Durden

Sun, 06/21/2020 – 18:31

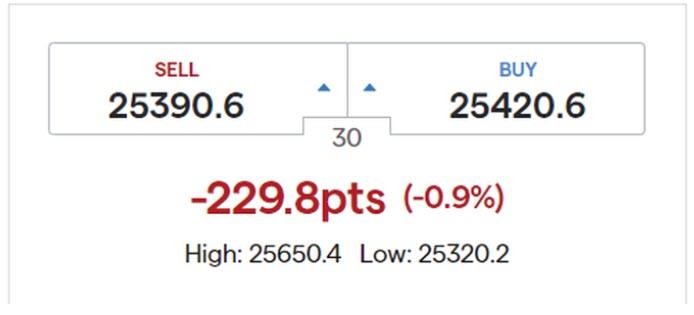

For once, the spreadbetting estimate of where Dow futs would be on Sunday was correct, and with IG expecting a drop of -230 points several hours ahead of the market open…

… that’s precisely what we got at 6pm ET when Dow futs opened down 250, Spoos were -30 and the Naz -80.

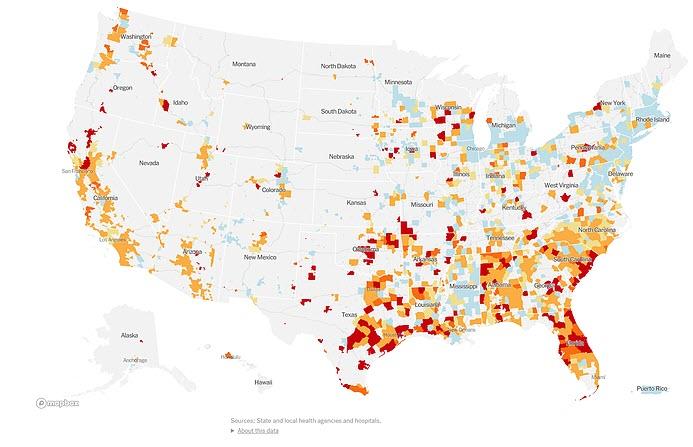

Why the early encounter with gravitation? Because as Amplify Trading writes, the market still remains wary of a second wave of coronavirus with nationwide cases in the US up 15% in the last two weeks and cases rising in 18 states across the South, West and Midwest, according to the NYT. Over the weekend, new cases in California rose by a record (4,515) and Florida infections up 3.7% from a day earlier, compared with an average increase of 3.5% in the previous seven days.

As a reminder, on Friday stocks slumped after Apple said that it will again close almost a dozen stores in the US because of a recent rise in coronavirus infections in the South and West, and although the tech giant can still operate effectively online the move was an ominous sign for brick and mortar retailers across America and a dent to the optimism that the US recovery is in full swing.

A number of Fed officials also remained cautious with Fed’s Rosengren (non-voter) stating on Friday “this lack of containment could ultimately lead to a need for more prolonged shut-downs, which result in reduced consumption and investment, and higher unemployment”, with Neel Kashkari adding “unfortunately, my base case scenario is that we will see a second wave of the virus across the US, probably this fall.”

Two other noteworthy developments on the virus come from Germany where the infection rate has shot up to its highest level for weeks after more than 1,300 abattoir employees tested positive for the virus. The country’s R-naught rate soared to 2.88 on Sunday, from 1.06 on Friday. Meanwhile, China blocked some US poultry imports over clusters at Tyson Foods plants.

What to expect this week

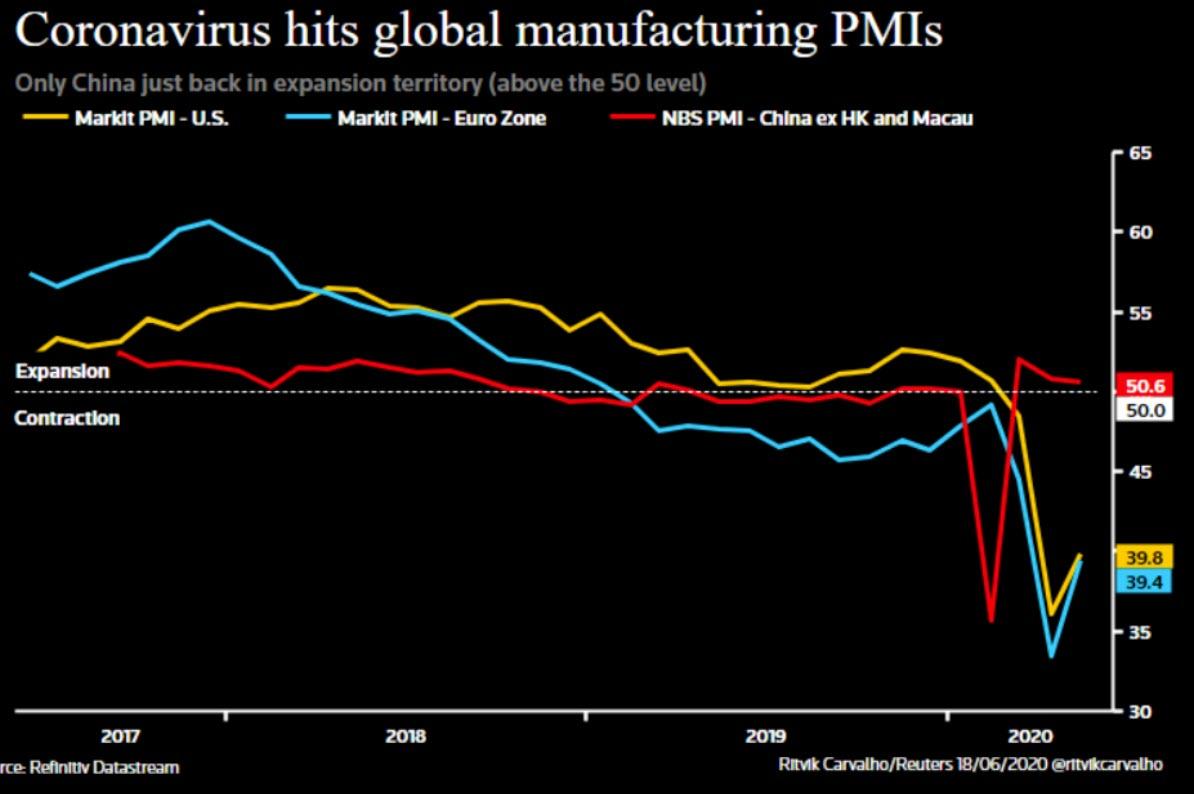

According to Amplify, one of the most important data sets this week is the latest flash PMI data due on Tuesday. While a rising headline number may give some cheer that confidence is returning the data in itself is forward looking which brings about two interesting points.

- It could be highly subject to change depending on the developments of a second wave virus (a la Apple on Friday).

- As analysts at ING note, looking at other data, including Google’s mobility index, the economy still appears to be operating well below its pre-virus level.

Finally, here is a calendar of the week’s events courtesy of NewsSquawk

Monday

- Data: EZ Consumer Confidence US Existing Home Sales

- Events: China LPR, US & Russian Army Talks; Chinese, Russian & Indian Foreign Minister meeting

- Speakers: ECB’s de Guindos & Lane, Fed’s Kashkari, RBA Lowe

Tuesday

- Data: EZ, UK & US PMIs (Flash)

- Supply: UK, German & US

Wednesday

- Data: German Ifo

- Events: RBNZ Rate Decision, BoJ Summary of Opinions

- Speakers: ECB’s Lane, Fed’s Evans & Bullard, EU Commission Draft 2021 Budget presentation

- Supply: UK, German & US

Thursday

- Data: German GfK, US Durable Goods, GDP (Final), PCE Prices (Final), Initial Jobless Claims

- Speakers: ECB’s Schnabel & Mersch, BoE’s Haldane

- Supply: US

Friday

- Data: Japanese CPI, US PCE Price Index, Personal Income & University of Michigan Sentiment (F)

- Speakers: ECB’s Schnabel

via ZeroHedge News https://ift.tt/2YlERWD Tyler Durden