Morgan Stanley Says Goldman Is Wrong: A Democratic Sweep Is Also Bullish As Nothing Can Stop Printer Going Brrrr

Tyler Durden

Sun, 06/21/2020 – 17:29

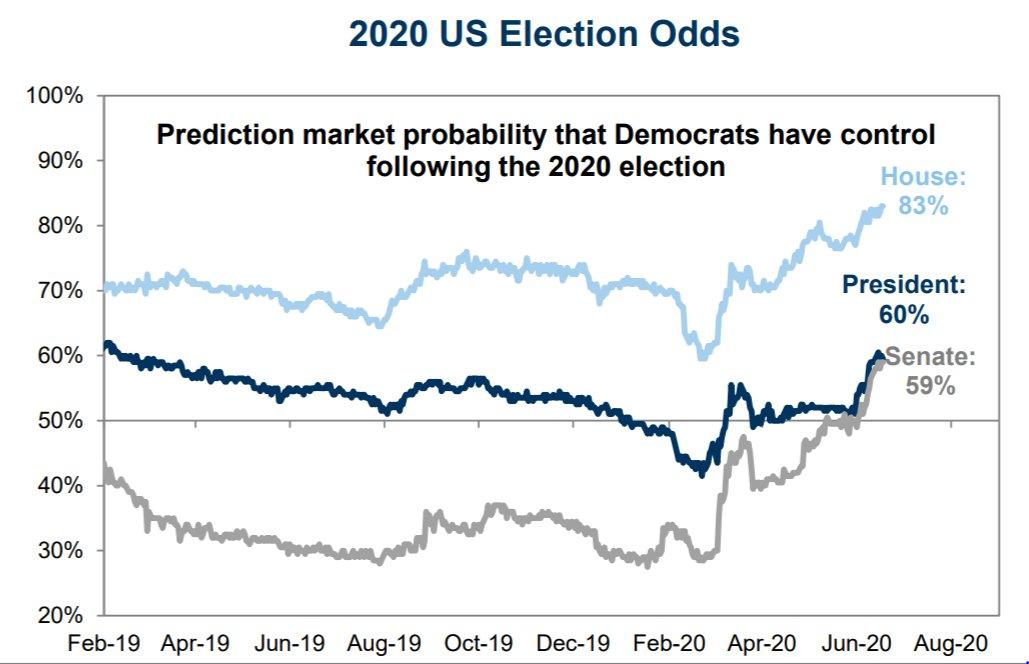

Two weeks ago we reported that with PredictIt showing growing odds of a Democratic Sweep after the November election…

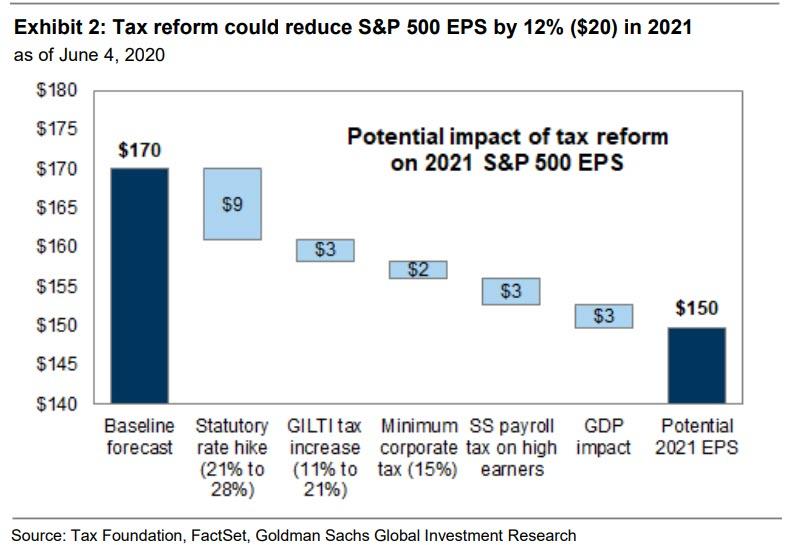

… Goldman’s clients were becoming increasingly concerned what this would mean for the stock market. David Kostin’s response only added fuel to the fire: the chief Goldman strategist warned that if Biden’s tax proposals are enacted, this would reduce Goldman’s S&P 500 earnings estimate for 2021 by roughly $20 per share, from $170 to $150, resulting in a substantial hit to the bank’s S&P forecast.

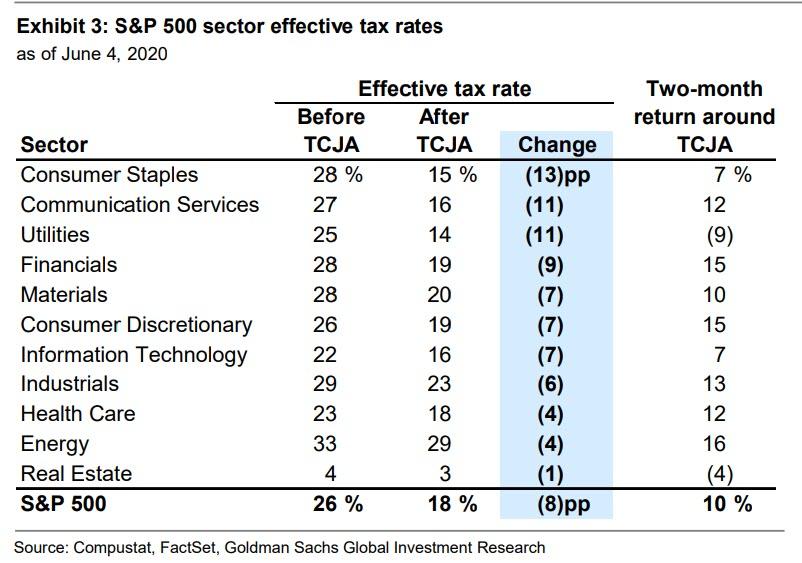

Furthermore, Kostin explained that according to a general rule of thumb, every percentage point change in the effective corporate tax rate should change S&P 500 earnings by 1.2% or $2 per share.

This ominous Goldman assessment was among the various reasons cited why in the subsequent two weeks the markets have become increasingly shaky as Biden’s PredictIt lead over Trump has continued to grow.

But now, according to a follow up response from Morgan Stanley, the bulls have nothing to fear even if Biden wins for one simple reason: no matter who ends up victorious on Nov 3, there is no stopping the Brrrrrrrrrr.

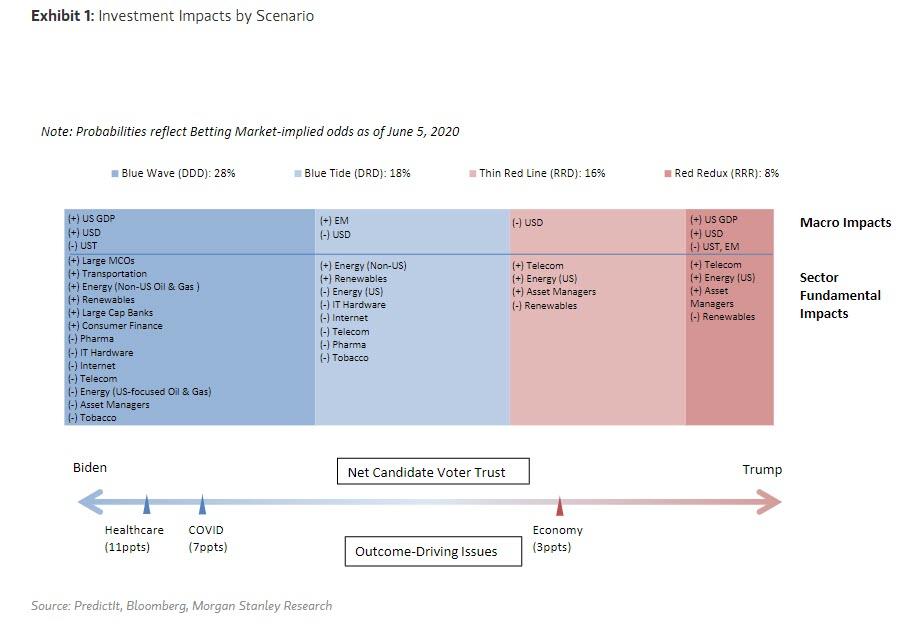

As Morgan Stanley’s in house political expert Michael Zezas writes, “if you think this election could be a game changer for the US economy and markets, we’re with you.” But – he adds – don’t make the mistake of conflating candidates’ provocative policy positions with future policy paths, or in other words, expect politicians to lie. Focusing on ‘plausible policy paths’, Zezas thinks “the impact of the election on policy supports a constructive path for risk assets and headwinds for US Treasuries, consistent with our colleagues’ positions in our recent mid-year outlook.”

In retrospect it’s is not all that surprising that we have yet another bullish note out from Morgan Stanley, which on the back of Michael Wilson’s reversal to Wall Street’s most cheerful optimist from its biggest bear three months ago, has prompted an outpouring of constant bullish notes from the bank (just as stocks increasingly appear wobbly and the Fed’s balance sheet has stopped soaring).

On the other hand, Zezas is also right that no matter the outcome of the election, there is no way that the Fed can taper the helicopter money, as the alternative would result in a market crash.

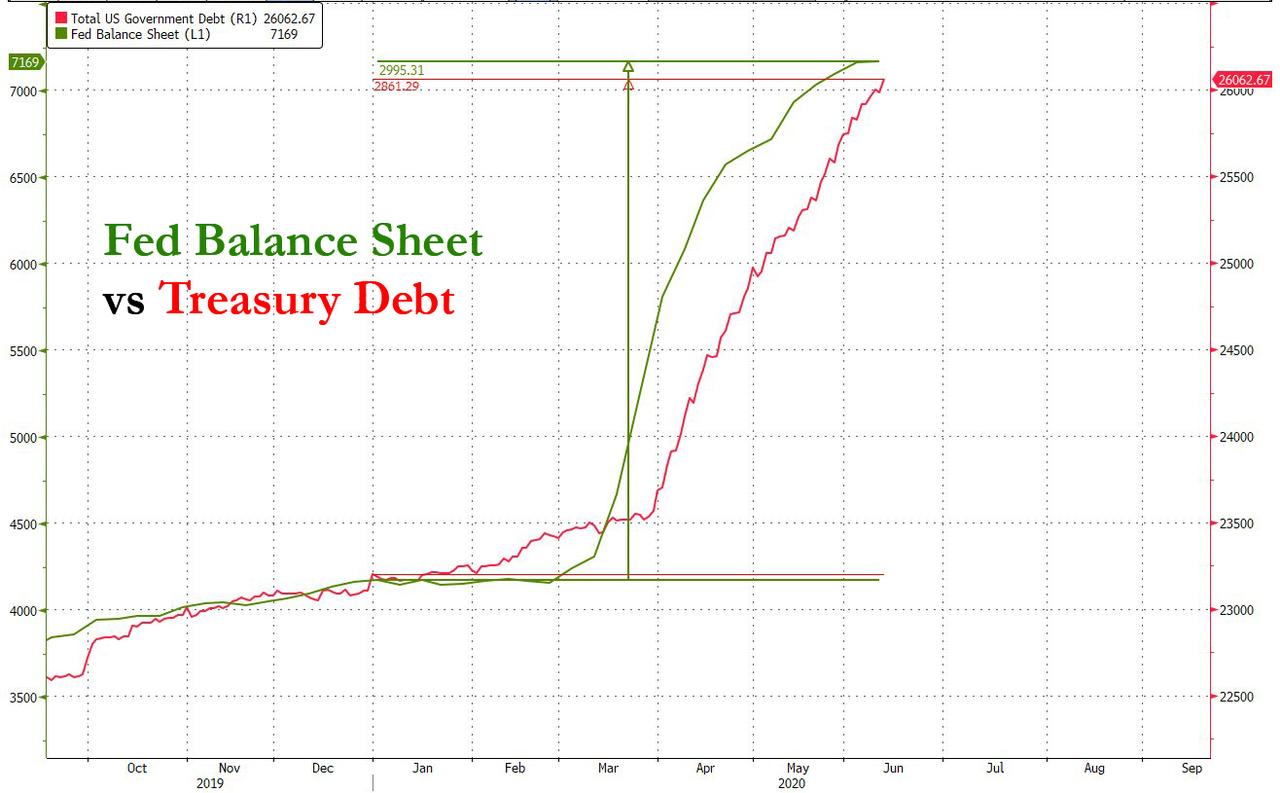

In other words, fiscal policy in the US is now completely independent of who is in charge and the US president is now nothing more than a figurehead; the only thing that matters is the Fed and whether it will continue monetizing all US debt issuance as it is doing in 2020…

… and whether it will continue to singlehandedly fund the US budget deficit.

While it doesn’t reach quite the same conclusions, here is the rest of Zezas’ note:

US Election: The Art of the Plausible

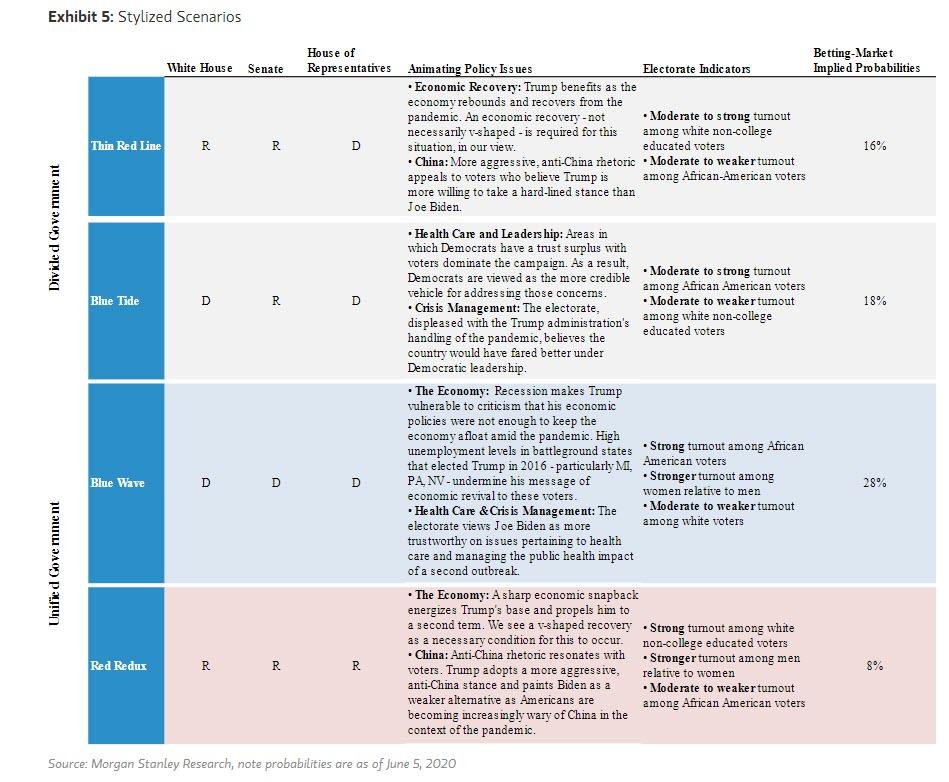

First, a policy lesson from recent history. Ahead of the 2016 election, the conventional wisdom held that a Trump victory would be a risk-off event. The key mistake was conflating the outcome of the presidential race with overall government policy. The election resulted in a Republican sweep, but their plausible policy path for governing was limited by what they could deliver. That included tax cuts and deregulation, but not the spending cuts and healthcare repeal they also promised. This added up to an economically supportive fiscal expansion, and it only took hours for the markets to put two and two together.

In this election cycle, we see investors making similar mistakes, focusing on the candidates’ provocative positions and overlooking the plausible policy paths. We differ from consensus in three key areas:

- We expect more fiscal stimulus even though it’s an election year. We continue to get pushback on our view that Congress will deliver follow-up stimulus to the recent CARES Act this summer. Some believe it is in the Democrats’ interest to deny Republicans the electoral benefit of a strong economy. We disagree. First, there’s only weak evidence that a strong economy guarantees reelection of the incumbent. Second, government assistance in times of crisis is core to the Democrats’ policy brand. Third, though fiscal expansion is rare in a divided government, it is common in reaction to a recession. While growth has turned positive, high unemployment is likely influencing the political calculus. Hence, we think the parties’ areas of agreement could add up to a US$1 trillion package.

- A Democratic win doesn’t have to be ‘risk off’. Investors responding to our election survey seem most concerned with a situation where Democrats take back both the Senate and the White House, clearing a path for Biden’s proposals of more than US$3 trillion in new taxes and tighter regulation. However, we think that fails to consider what is practically achievable. First, enacting these proposals would likely require the end of the filibuster – a strong possibility, but a major assumption. Second, Democrats likely have much more scope to spend than to raise taxes. In a sweep, Senate control will come via key wins by moderates, who are less likely to support an array of tax hikes. However, limited tax increases may not keep Democrats from their spending ambitions. Our AlphaWise Battleground States survey shows that Democratic voters are keen on healthcare spending, with moderate-to-liberal voters overwhelmingly supporting the effort even if it means expanding the deficit. Hence, investors may be too focused on the tax side of the equation, overlooking the support for aggregate economic demand from fiscal expansion.

- Don’t overreact to China tensions. We’ve recently heard investor concerns that the current US administration will re-escalate tariffs to boost its election prospects. We’re more inclined to see the election as a reason why the US will not take this path. Our survey shows that voters are skeptical about China’s role in the global arena, but more concerned about the domestic economy. Since polls suggest that, on net, voters favor President Trump on the economy, the administration likely views a V-shaped recovery as essential to reelection. Hence, heightened rhetoric and fresh non-tariff actions may be in the cards, but we think that tensions will likely stop short of tariff re-escalation.

Hence, election outcomes remain uncertain, but we think their influence on current policy choices and future policy paths is supportive of risk assets today [ZH translation: no matter who the president is, they won’t allow stocks to drop].

More fiscal expansion this year bolsters our economists’ call for a V-shaped recovery, and further fiscal support in a range of election scenarios could pave the way for sustained economic recovery. While this poses a challenge to US Treasury duration, we think it helps to extend recent gains in US equities and US credit. At the equity sector level, we highlight the potential for financials – an out-of-consensus favorite of our equity strategists – to outperform. They expect value stock outperformance and see positive exposure to a steeper yield curve from fiscal expansion, factors that we think would endure in a variety of November outcomes.

via ZeroHedge News https://ift.tt/3fCJCRk Tyler Durden