Futures Swing In Slowmotion Overnight Rollercoaster

Tyler Durden

Mon, 06/22/2020 – 08:08

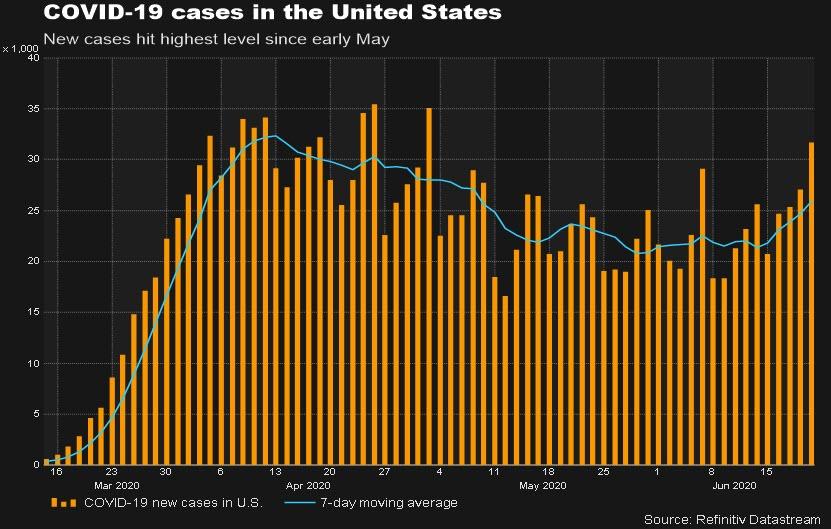

Welcome to a new week, and a new rollercoaster in illiquid overnight futures trading, which saw spoos start off sharply lower on fresh coronavirus concerns after new cases in California rose by a record (4,515) and Florida infections up 3.7% from a day earlier, compared with an average increase of 3.5% in the previous seven days, while the German R-naught surged almost 3x to 2.88 in three days. As a reminder, on Friday stocks slumped late in the day after Apple said that it will again close almost a dozen stores in the US because of a recent rise in coronavirus infections in the South and West, denting the optimism that the US recovery is in full swing.

However, sentiment reversed sharply around 9pm ET when China reported that Beijing saw only 9 new cases suggesting that the latest breakout in the capital had been contained while South Korea saw the smallest daily increase in about a month, prompting renewed optimism that everything is once again under control. Futures then continued their ascent into the early European open, when Eminis rose as high as 3,097 before once again hitting the brakes and reversing modestly lower. Despite the rise in virus cases in Germany and the U.S. states of Florida, California and Texas.

Sentiment was also lifted by the same old news, that there’s growing speculation that politicians will be unwilling to put cities back on lockdown because of the economic toll. Historical stimulus programs by the major central banks are also supporting the sentiment.

European shares also opened lower as much as 1.1% but then quickly staged a sharp rally and nudged into positive territory as a jump in Germany’s coronavirus reproduction rate over the weekend was seen as unlikely to trigger a massive second wave or new lockdowns. Germany’s coronavirus reproduction rate jumped to 2.88 on Sunday from 1.06 on Friday, health authorities said. The spike in infections was mainly related to local outbreaks including in North Rhine-Westphalia.

“I regard the German R statistic as a bit of a red herring or more of a statistical quirk,” said Chris Bailey, Raymond James European strategist. “Coronavirus at-the-margin remains an overhang but the opening up of Europe still looks on much more solid foundations than the US/Americas.”

Meanwhile Germany’s mega-fraud WireCard shed another 50% of its market cap after the company admitted $2.1 billion in cash will never be found. The plunge assured that CEO Braun is facing financial ruins as he no longer has enough shares to cover his €150MM margin loan.

Asian stocks were little changed, with communications rising and industrials falling, after rising in the last session. Markets in the region were mixed, with Thailand’s SET and South Korea’s Kospi Index falling, and India’s S&P BSE Sensex Index and Singapore’s Straits Times Index rising. The Topix declined 0.2%, with Olympic and Land Co falling the most. The Shanghai Composite Index was little changed, with Ningxia Xinri Hengli Steel Wire advancing and Guangdong Songyang declining the most.

Investors are also wary of developments in Hong Kong after details of a new security law for the territory showed Beijing will have overarching powers on its enforcement. China’s top legislative body, the National People’s Congress Standing Committee, will meet on June 28, and the Global Times reported it was likely to enact the Hong Kong security law by July 1.

Hong Kong’s Hang Seng .HSI fell 0.5%, underperforming regional markets.

Torn between record stimulus and growing fears of a second wave of infections, global stocks have been moving sideways in recent weeks after rising more than 40% from March lows on hopes the worst of the pandemic was over.

“Markets have climbed back … with stocks proving the doubter wrong yet again as a world of stimulus trumps the reality of economic and health struggles,” said Joshua Mahony, senior market analyst at IG.

In rates, the 10Y TSY yield dropped to 0.685%, trading around its 50DMA, and back in sideways trading range after false breakout beginning of June. The yield on Germany’s 30-year government debt fell below zero for the first time since May. Crude oil hovered below $40 a barrel in New York. Bunds bull flattened, breaching Friday’s highs and outperforming Treasuries by ~1bp. Gilts bull steepen slightly in a subdued reaction to comments from BOE’s Bailey.

In FX, the U.S. dollar meanwhile slipped from two-and-a-half-week highs as risk appetite remained alive in a world awash with cheap money after credit rating agency Moody’s warned that the stimulus measures will leave advanced economies with much higher debt than they accumulated during the last financial crisis. “Government debt/GDP ratios will rise by around 19 percentage points, nearly twice as much as in 2009 during the GFC … the rise in debt burdens will be more immediate and pervasive, reflecting the acuteness and breadth of the shock posed by the coronavirus.” Moody’s said.

The pound rose for the first time in five days against the dollar after Governor Andrew Bailey indicated that the Bank of England would reduce the size of its balance sheet before considering interest-rate increases. The euro also headed for the first gain since June 15. New Zealand’s dollar and the Swedish krona led G-10 currency gains. U.S. stock futures dictated the market’s mood after a record increase in California’s new virus cases was followed by news that China was containing a resurgence of infections, prompting a rally.

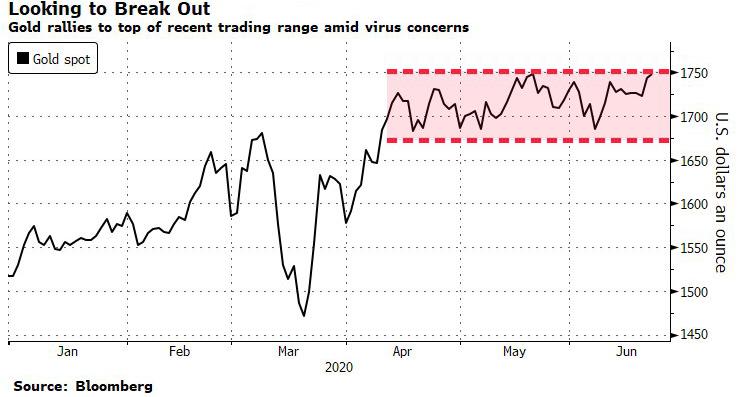

As central banks continued their unprecedented liquidity firehose, gold finally appeared reach to breach $1,750, nearing a seven-year high.

Elsewhere in commodities, oil prices steadied on tighter supplies from major producers, but concerns that the rising coronavirus cases could curb demand checked gains. Brent rose 0.2% to $42.25 a barrel, while WTI fell slightly to $39.65 a barrel.

Market Snapshot

- S&P 500 futures up 0.7% to 3,082.25

- STOXX Europe 600 down 0.2% to 364.83

- MXAP down 0.09% to 159.14

- MXAPJ down 0.06% to 513.47

- Nikkei down 0.2% to 22,437.27

- Topix down 0.2% to 1,579.09

- Hang Seng Index down 0.5% to 24,511.34

- Shanghai Composite down 0.08% to 2,965.27

- Sensex up 1.2% to 35,159.56

- Australia S&P/ASX 200 up 0.03% to 5,944.54

- Kospi down 0.7% to 2,126.73

- German 10Y yield fell 1.7 bps to -0.432%

- Euro up 0.3% to $1.1209

- Brent Futures up 0.02% to $42.20/bbl

- Italian 10Y yield fell 2.2 bps to 1.229%

- Spanish 10Y yield fell 1.9 bps to 0.474%

- Brent Futures up 0.02% to $42.20/bbl

- Gold spot up 0.2% to $1,747.44

- U.S. Dollar Index down 0.2% to 97.41

Top Overnight News from Bloomberg

- Germany’s coronavirus infection rate rose for a third day, lifted by local outbreaks including in the region of North Rhine-Westphalia, where more than 1,300 people working at a slaughterhouse tested positive.

- Beijing reported only nine new infections, a sign that a recent outbreak is under control. China blocked poultry from a Tyson Foods plant where many workers tested positive

- The European Central Bank’s most determined attempt yet to confront the German legal headache bedeviling its quantitative easing policy may emerge as soon as this week.

- Bank of England Governor Andrew Bailey signaled a major shift in the central bank’s strategy for removing emergency stimulus, stressing the need to reduce the institution’s balance sheet before hiking interest rates.

Asian equity markets began the week cautiously as sentiment was clouded by reports of increasing COVID-19 infections rates globally in which the World Health Organization reported a record daily increase of 183k cases, while new cases in the US topped the 7-day average and Germany’s reproduction rate surged to 2.88 from 1.79. This initially pressured US equity futures at the open and also weighed on ASX 200 (U/C) and Nikkei 225 (-0.2%), although US index futures have since fully recovered and Asia-Pac bourses also retraced their early declines with outperformance seen in commodity-related sectors, in particular Australia’s gold miners after the precious metal resumed its rally and broke above the USD 1750/oz level. Hang Seng (-0.5%) and Shanghai Comp. (-0.1%) were mixed with price action rangebound after the PBoC maintained its 1-year and 5-year Loan Prime Rates at 3.85% and 4.65% respectively as expected, while it also conducted a CNY 120bln net liquidity injection which was welcomed by mainland bourses. Furthermore, there were reports that China is planning to step up purchases of US farm goods following recent discussions and that President Trump deferred sanctions on Chinese officials related to Uighur minorities as it may impact the US-China trade deal, although Hong Kong lagged after the release of the draft Hong Kong National Security Law which the Standing Committee of the NPC is speculated to enact when it meets on June 28th-30th. Finally, 10yr JGB traded subdued as the intraday recovery in Japanese stocks weighed on bond prices but with downside also cushioned by the BoJ’s presence in the market for over JPY 1tln of JGBs with 1yr-10yr maturities and with the Japan Securities Dealers Association noting regional banks bought a record amount of ultra-long JGBs last month.

Top Asian News

- Hong Kong Central Office Vacancies Reach 12-Year High: JLL

- Japan Industry Group May Penalize Banks Breaking Debt Sale Rules

- Virus- Drug Nod Spurs Record Rally in India’s Glenmark Pharma

- The Most Popular U.S. Bond Market Trade Has Now Gone Global

Europe kicked the week off on the back-foot but have since nursed a bulk of its losses [Euro Stoxx 50 -0.4%] as initial downside stemmed from second wave woes amid record daily increases recorded by the WHO, Germany’s R-number jumping amid cluster outbreaks and with the US cases rising above its key 7-day level. Nonetheless, stock markets continued on its upwards trajectory since the cash open despite light fundamental news-flow. Note, the EU-China summit is underway but with expectations low. Sources noted there will be no joint communique between the sides this year – but, the meeting with Germany could prove to be interesting as the country will be taking the baton of rotating EU presidency in H2 2020; note, Germany has previously signalled a tougher EU line towards China. Nonetheless, bourses regain earlier lost ground alongside sectors – now mixed following an all-negative open – but still fail to indicate a clear risk tone. The sectorial breakdown also provides little clarity on this front as Oil & Gas, Travel & Leisure and telecoms remain the laggards. In terms of individual movers, Wirecard (-36%) shares continue to suffer after the group announced the missing EUR 1.9bln likely never existed, whilst it withdrew its prelim FY19 and Q1-2020 results. Separately, former CEO Braun – who was the largest individual shareholder – is reportedly unloading a large amount of his 7% stake in the Co. Elsewhere, Lufthansa (-6%) shares are weighed on after its CEO stated that the EUR 9bln state-backed aid is at risk of not passing the upcoming shareholder vote as only around 40% of shareholders have registered to vote at the EGM thus far vs. required 2/3 majority for it to pass. On the flip side, BT (+1.9%) remains supported by reports that the Saudi Public Investment Fund is said to have been acquiring a stake in the Co. through open-market purchases over the last few weeks, according to sources.

Top European News

- Lufthansa Braces for Portentous Week With Future on the Line

- Turkish Stocks Erase 2020 Losses After Wave of Local Buying

- Halkbank, Involved in U.S. Case, Jumps After Berman Resigns

In FX, the Greenback is weaker across the G10 board with only the Yen underperforming, and then only marginally vs the scale of recovery gains forged by other majors. Further increases in coronavirus infections and fatalities appear to be weighing on the Buck even though the US is far from alone in terms of suffering fresh outbreaks. Indeed, the KCDC is reportedly classifying the situation in South Korea as a 2nd wave as the global tally hit the highest level so far for a single day, according to the WHO and Germany’s R value rebounds to 2.88. However, the DXY has slipped back below 97.500 to a 97.287 low from last Friday’s 97.727 high ahead of May’s national activity index, existing home sales and a late speech from Fed’s Kashkari.

- AUD/NZD/GBP/SEK/EUR – The Aussie is back within striking distance of 0.6900 vs its US counterpart and not too unsettled by comments from RBA Governor Lowe overnight reiterating that rates are likely to remain at current levels for years, as he also seemed unfazed by the Aud’s present valuation. Meanwhile, the Kiwi has reclaimed 0.6400+ status ahead of the RBNZ policy meeting with markets all but ruling out any chance of a change in rates, but Sterling’s comeback from the low 1.2300 area towards 1.2435 is somewhat less easy to reconcile and may have more to do with Eur/Gbp flows/direction as the cross pulls back from 0.9065 to test bids said to be sitting at 0.9025. Note also, 1.85 bn option expiries at 0.9060 may be capping the cross ahead of the NY cut after Sterling shrugged off an improvement in CBI trends. Elsewhere, the Swedish Crown is also perky against the single currency and perhaps drawing some traction from the latest Riksbank business survey revealing stabilisation in May and June, though the Euro has clawed back gains vs the Dollar from circa 1.1168 to hover between decent expiry interest at 1.1200-05 (1.9 bn) and 1.1245-50 (1.24 bn) ahead of flash Eurozone consumer confidence and ECB speeches via de Guindos and Lane.

- CAD/CHF/NOK – Also on a firmer footing to at least start the new week, with the Loonie nearer the top of a 1.3560-1.3630 range vs its US peer awaiting comments from BoC Governor Macklem, the Franc back above 0.9500 in wake of latest weekly Swiss bank sight deposits showing a dip in both domestic and total balances and the Norwegian Krona consolidating post-Norges Bank advances either side of 10.8000 against the Euro.

- JPY/XAU – As noted above, the Yen is bucking the broad trend, but still keeping its head over 107.00 and Gold has lost some steam after surging above Usd 1750/oz and stalling ahead of the next major bullish technical target around Usd 1765 from May 18.

In commodities, WTI and Brent August contracts remain choppy and reside within a tight range, albeit the benchmarkes have nursed opening losses of around 1%, which originally emanated from COVID-19 second wave woes as the WHO reported a record daily increase of 183k cases, while new cases in the US topped the 7-day average and Germany’s R-rate spiked to 2.88 from 1.79. Meanwhile, Nigeria and Angola will be presenting their respective over-compliance plans today after failing to do so last week – with a presser expected following a review of the strategy – albeit, this has not been confirmed. Meanwhile, a new study shows that US shale companies could be forced into writing down at least USD 300bln of assets in Q2 as producers account for the oil price collapse earlier this year on balance sheets, which will be based on an oil price around USD 35/bbl according to the FT. WTI August fluctuates on either side of USD 40/bbl (vs. 39/bbl low) whilst its Brent counterpart tested resistance at USD 42.50 (vs. 41.58/bbl low) earlier in the session. Elsewhere, spot gold has given up some recent gains amid the recovery in stocks, but nonetheless currently remains underpinned by a weaker USD – with the yellow metal trading on either side of USD 1750/oz early-doors before printing a marginal new session low at USD 1741.90/oz. Copper prices are supported by the softer Buck and continues to trend higher amid support from draws in LME and China inventories. In terms of bank commentary, Citi sees gold prices at an average of USD 1702/oz this year and USD 1761/oz next year, whilst the bank forecasts copper at USD 5654/t in 2020 and 5850/t in 2021.

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, prior -16.7

- 10am: Existing Home Sales, est. 4.09m, prior 4.33m; Existing Home Sales MoM, est. -5.59%, prior -17.8%

DB’s Jim Reid concludes the overnight wrap

Hard to believe we’re now going to have to deal with the nights slowly getting darker again here in the northern hemisphere. We spent the longest day yesterday at the beach and I think we’ll be discovering sand in various places across the house, car and bodies for the next week. It’s a horrendously messy thing to do, especially when the showers were closed for social distancing reasons. It is amazing what the bracing sea air does though as bed time went without incident last night, which is a rarity. They were all shattered.

It was amazing how busy the beach was but people generally practiced social distancing unless they were just deliberately keeping out the way of my horrors. It’s a strange period where life is getting slowly back to some kind of normality, but with major constraints and with everyone waiting to see what happens next. Indeed the virus spread continues to create a lot of uncertainty in markets. For example, does it matter that the troublesome US states are continuing to see case numbers increase or does it provide some good news that economies can stay open as cases rumble on? It’s possible that with more knowledge on the virus, the vulnerable are now being better protected which will dramatically reduce the fatalities if successful.

Even in countries that are perceived to have had a good response to the crisis are having issues. Last week we highlighted the reports out of Germany of a meat factory closing due to a rash of infections. Over the weekend, the Robert Koch Institute estimated that the effective reproduction factor of the virus was now 1.79 in the country after being 1.06 on Friday, and below 1.0 earlier in June. Yesterday there were over 600 new cases in the country, with the 7 day average of new cases over 500 for the first time in 5 weeks. It will be interesting to see how they deal with this small uptick that has shades of a second wave. China is also seeing a mini second wave with the country now having averaged around 40 new cases per day for the last week, after seeing low single-digit new cases per day all through May and early June. Beijing has closed schools and asked those who can to work from home when possible. In a positive sign, Beijing reported only 9 new cases overnight.

Elsewhere Brazil is still engulfed in their first wave passing 1 million total cases over the weekend, and registering 54,711 new cases on Friday, the most new cases in one day for any country in the world. They did have a small reporting backlog though. Nevertheless cases have risen by 3.3% per day over the last 7 days, in line with the 7 day period prior at 3.4%. The other virus hotspot is the US. After registering multiple days with daily case growth under 1.0% in the early part of June, cases have been rising at 1.5% per day on average over the last week, higher than the 1.2% average for the period previous. The majority of these cases are in large Southern states like Texas, Florida, and Arizona, but California continues to have similar problems. All four states currently have a 7-day average of new cases higher than the period prior, implying that the virus spread is accelerating and no longer even flat.

Using rtlive’s estimates, whose underlying methodology was updated over the weekend, 24 of the 50 US states now have effective transmission rates over 1.0. Of the main focus states, California has been trending higher for the last month and after falling back below 1.0, it is now at 1.05. Florida is at 1.39 and Texas at 1.16.

So plenty of worrying news on the virus at a global level but there are still signs that technicals in the market look supportive. Doing my weekend reading of DB research it was interesting to read our equity strategist Binky Chadha’s latest view where he suggested positioning in US equities has dipped again to the 5th percentile. He suggested that such low positioning is historically associated with strong performance of the market 1 week and 1 month forward. See here for more. A reminder that when Binky discussed the low positioning a few weeks ago one of the main justifications for that during a big rally was the emergence of new retail investors into the market with institutional investors remaining relatively on the sidelines.

A quick check on markets this morning now where broadly speaking most Asian bourses have pared a weak open. The Nikkei (+0.31%), Shanghai Comp (+0.28%) and ASX (+0.47%) are now showing modest gains while the Kospi is flat and the Hang Seng down -0.32%, likely not helped by news over the weekend that China has proposed a national security law that would allow the Beijing to override Hong Kong’s independent legal system. Elsewhere, futures on the S&P 500 are trading up +0.65% after erasing losses at the open of c. -1%.

In other weekend news, a Bloomberg story has argued that a change in the composition of Germany’s Constitutional Court has the potential to be less confrontational towards the ECB. Astrid Wallrabenstein, seen as more EU friendly, will replace Andreas Vosskuhle, president of the court whose term has expired and made the May 5 ruling on the ECB bond purchases while, Stephan Harbarth, a conservative lawmaker from 2009-2018, will become the new president. German daily Frankfurter Allgemeine Sonntagszeitung has already reported Wallrabenstein saying that it could be in the interest of the court to take an easier stand if the “demands are being taken seriously” and the actions taken by politicians, the German central bank and ECB “go into the right direction.” This comes on the back of Friday’s news that the ECB is preparing papers on proportionality of the PSPP to satisfy the GCC.

Staying with Europe, Italian PM Conte has indicated that his government would likely seek a wider budget gap as the government will focus on infrastructure projects including high-speed railways and may approve a value-added tax cut to stem the coronavirus’s impact. He said, “We will probably need to intervene for a further widening of the budget gap because the resources are not enough to cope with the impact of a horrible year both economically and socially,” while, adding that the government will present its reform plan in September. The reform plan is in response to lobby for the country’s share of a proposed EUR 750bn recovery fund.

The main highlight this week is likely to be the flash PMIs for June tomorrow, with manufacturing, services and composite PMIs coming out from around the world. Back in May, the PMIs rebounded from April’s rock-bottom prints. For example, the Euro Area composite PMI rose to 31.9 from 13.6, while in the US the composite PMI recovered to 37.0 from 27.0. For June the range of expectations across Europe/US are generally in the 40s with U.K. at the lower end and the US manufacturing possibly scraping to just over 50. Given these are diffusion indices and simply reflect whether conditions are getting better or worse then surely at some point soon these numbers are going to massively spike up regardless of the actual level of growth.

There are various other data releases but it’s not a big week for data. See the day by day calendar at the end for the full slate. Note that the IMF’s latest economic forecasts are released this Wednesday. In a website blogpost last week, their Chief Economist Gita Gopinath said that the update “is likely to show negative growth rates even worse than previously estimated.”

Looking back at last week now, Global equities finished higher but there feels like there is a bit more two way tension in asset markets now. Nevertheless, the significant amount of liquidity in the financial system and a steady drip of improving data outweighed concerns of a rise of covid-19 cases in China and Germany (albeit from low levels) as well as in the largest US states. The S&P 500 rose +1.86% (-0.56% Friday as Apple reversed a decision to reopen some stores in high case states). The index is now down -4.12% YTD. The last two weeks have seen growth stocks go back to outperforming in the US, with the tech-focused Nasdaq finishing this past week up +3.73% (+0.03% Friday). European equities also outperformed the S&P, with the Stoxx 600 rallying +3.22% (+0.56% Friday) over the five days. The rally was widespread with the DAX (+3.19%), FTSE MIB (+3.87%), FTSE 100 (+3.07%), and CAC (+2.90%) all gaining on the week. Asian indices also rose but to a lesser degree. The Nikkei rose +0.78% over the week (+0.55% Friday) while the CSI 300 was up +2.39% (+1.34% Friday), and the Kospi rose +0.42% (+0.37% Friday). The CSI 300 joined the NASDAQ as one of the few equity indices in the world that is up on the year, closing Friday +0.05% YTD.

Oil prices rallied for a 7th week out of the last 8 as OPEC+ gave reassurances on output cuts on Thursday. Expectations for demand also continues to slowly improve. WTI futures rose +9.62% (+2.34% Friday) to $39.75/barrel and Brent crude rose +8.93% on the week (+1.64% Friday) to $42.19/barrel. With risk assets rising and sentiment staying generally constructive, HY credit spreads on both sides of the Atlantic tightened on the week. European HY cash spreads were -15bps tighter on the week (+2bps Friday), while US HY cash spreads were -26bps tighter (+1bp Friday). Euro IG and US IG cash spreads were -3bps (+1bp Friday) and -12bps (-1bp Friday) tighter, respectively.

Peripheral debt tightened, with Spanish 10yr yields -12.6bps tighter to German bunds over the 5 days, while Italian BTPs were -11.4bps tighter, and Portuguese bonds tightened -8.5bps. Core sovereign bonds were little changed on the week as US 10yr Treasury yields fell -1.0bps (-1.5bps Friday) to finish at 0.694%, while 10yr Bund yields rose +2.4bps over the course of the week (-0.8bps Friday) to -0.42%.

The main highlight from last Friday was the European Council meeting where leaders were cautious, but still constructive on a Recovery Fund agreement. German Chancellor Merkel mentioned that an agreement had been reached on the mixture of grants and loans, while Austrian Chancellor Kurz said that grants would be possible, with conditionality. It feels like compromise is slowly building even if we’re not yet there. On the data front, the main two headlines were out of the UK. Public finance data for May showed the government’s debt-to-GDP ratio rose above 100% for the first time since 1963. Retail sales in the UK rose +12.0% MoM during May, well above the expected rise of 6.3% and recovering from last month’s revised -18.0% fall.

via ZeroHedge News https://ift.tt/311Ifrj Tyler Durden