Strategist: May Existing Home Sales Will Crash Below Expectations

Tyler Durden

Mon, 06/22/2020 – 09:22

Submitted by Christophe Barraud

According to the Bloomberg consensus, Existing Home Sales should decrease by 5.6% MoM to 4.09M, which would be the lowest level since November 2010.

→ EHS will surprise downward due to technical and fundamental factors:

- Buyers signed contracts in April for most May sales. As a result, lockdowns made it impossible for the rebound in closings to be finalized before June.

- Local and state reports confirm that many sellers waited before putting their homes on the market, restricting supply (and choices for buyers).

→ EHS will rebound sharply in June as suggested by first data related to pending home sales.

* * *

1. Data construction implies that May will reflect the worst of the crisis

Most of economists never looked at the construction of EHS data which explains a large part of miscalculation. According to the Census Bureau, “the majority of transactions are reported when the sales contract is closed. Most transactions usually involve a mortgage which takes 30-60 days to close. Therefore, an existing home sale (closing) most likely involves a sales contract that was signed a month or two prior.” In other words, most buyers placed their offers in April (and to a lesser extent in March), during the height of stay-at-home orders. As a result, May existing home sales will reflect the worst of the crisis, with a print likely below 4.00M.

2. Local/state data showed that sales decline was broad-based across the country

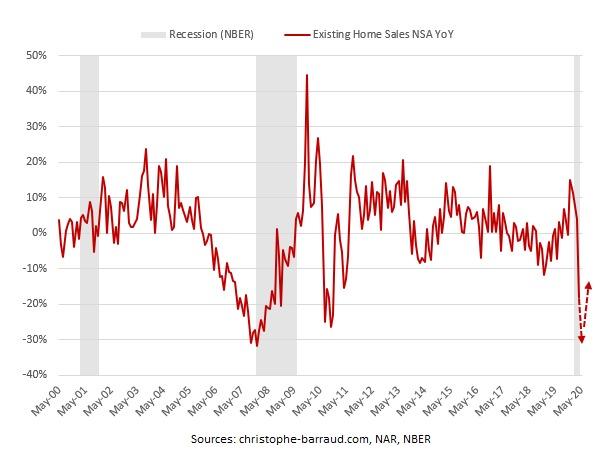

Local/state figures and other proxies suggest that national existing home sales (non-seasonally adjusted: NSA) are likely to plunge by more than 30% YoY in May (which could be close to the largest decline ever). However, it’s worth noting that the crash was amplified by calendar effects, namely fewer business days in May 2020 (compared to May 2019).

These results look coherent with Redfin estimates which highlighted a 30.8% YoY drop after seasonal adjustment (the decline would have been larger on a NSA basis) in May. On the inventory front, Redfin also noted that new listings of homes for sale “are still about 20% below February’s level”, confirming that supply has been constrained over the past few months.

3. Local/state data suggest that pending home sales will rebound sharply in May amid normalization and lower mortgage rates.

On the positive side, local reports suggest that pending home sales (seasonally adjusted: SA), a leading indicator for existing home sales, rebounded on a MoM basis in May. As a matter of fact, Redfin lead economist Taylor Marr revealed that “Although the housing market was still mostly stalled in May, it’s worth noting that homes under contract to be sold jumped 33% between April and May after two consecutive months of decline.”

A sharp increase of EHS seems very likely in June a context where the situation started to normalize in several states (reopening), with purchases’ applications rising significantly. CNBC reported on June 17 that “Mortgage applications to purchase a home rose 4% last week from the previous week and were a remarkable 21% higher than one year ago, according to the Mortgage Bankers Association’s seasonally adjusted index. That was the ninth consecutive week of gains and the highest volume in more than 11 years.” The article also underlined that “Buyers were also fueled by a new record low mortgage rate. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.30% from 3.38%, with points decreasing to 0.29 from 0.30 (including the origination fee) for loans with a 20% down payment.”

via ZeroHedge News https://ift.tt/3fHxRsE Tyler Durden