US PMIs Disappoint With Labor Weakness Continuing, Hope Remains High

Tyler Durden

Tue, 06/23/2020 – 09:50

Hot on the heels of the Eurozone’s dramatic v-shaped recovery in its soft survey data, Markit’s US business surveys were expected to rebound even more dramatically (tracking the massive spike in US macro surprises recently).

However, while both surveys did increase notably, they both missed expectations…

-

Markit US Manufacturing 49.6 vs 50.0 expected and 39.8 prior

-

Markit US Services 46.7 vs 48.0 expected and 37.5 prior

Source: Bloomberg

The June survey meanwhile signalled further cuts to workforce numbers across the private sector, albeit at only a modest rate. Where an increase was noted, some businesses reported the return of furloughed staff. That said, hiring freezes and relatively weak demand led many other companies to shed employees in an effort to cut costs.

Service providers were generally optimistic of an increase in activity over the coming year at the end of the second quarter. Hopes that demand will return to previously seen levels came amid the reopening of states and client businesses.

Globally, it’s a V-shaped recovery in soft survey sentiment…

Source: Bloomberg

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said:

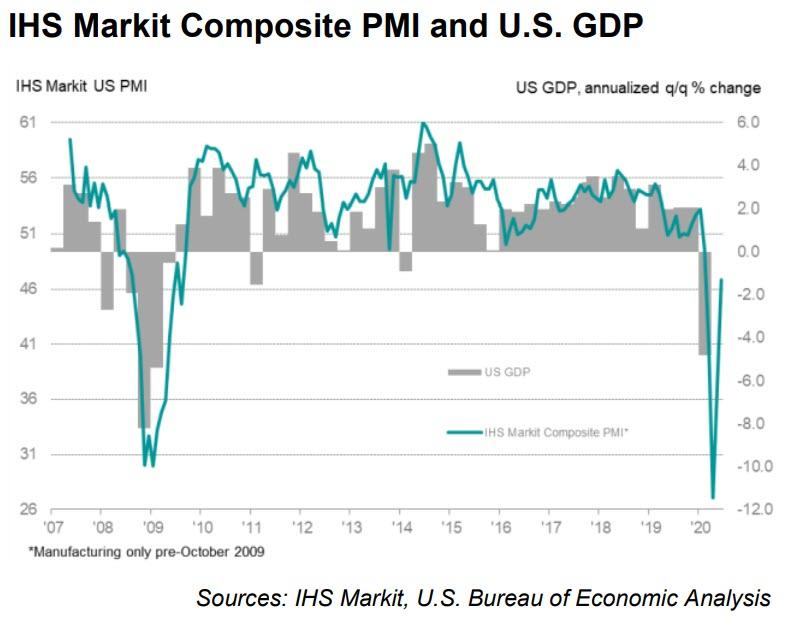

“The flash PMI data showed the US economic downturn abating markedly in June. The second quarter started with an alarming rate of collapse but output and jobs are now falling at far more modest rates in both the manufacturing and service sectors. The improvement will fuel hopes that the economy can return to growth in the third quarter.

“However, although brief, the downturn has been fiercer than anything seen previously, leaving a deep scar which will take a long time to heal. We anticipate that the US economy will contract by just over 8% in 2020. The coming months will therefore see the focus turn to just how much recovery momentum the economy can muster to recoup this lost output.

“Any return to growth will be prone to losing momentum due to persistent weak demand for many goods and services, linked in turn to ongoing social distancing, high unemployment and uncertainty about the outlook, curbing spending by businesses and households. The recovery could also be derailed by new waves of virus infections. Continual vigilance by the Fed, US Treasury and health authorities will therefore be required to keep any recovery on track.”

Private sector firms also reported a notable pick-up in confidence in June, with the degree of optimism about output in the year ahead reaching a fourmonth high. Expectations of a rise in activity over the coming year contrasted with negative sentiment seen in April and May. The reopening of states and reports of client interest reportedly sparked the return to optimism.

via ZeroHedge News https://ift.tt/2B57HBF Tyler Durden