“We’re Losing Millions” – Norwegian Salmon Farmers Face Price Plunge As Searches For “三文鱼” Break The Web

Tyler Durden

Tue, 06/23/2020 – 03:30

Prices for salmon are poised to continue their two-week slide, with exporters facing stockpiles of salmon from the double-whammy of large harvests and negative press from both China and Germany…

As Intrafish.com reports, the recovery in Norway’s farmed salmon prices earlier this spring has been all but wiped out.

Average prices are rapidly moving toward the NOK 50 ($5.22/€4.66) per kilo mark, according to executives in the salmon farming sector.

“We’re sitting on a lot of fish,” one exporter said.

“This is extremely serious for exporters, and overall a sad situation. We’re losing millions.”

One farmer said the market is bracing itself for turbulence.

“We’ll have to take both the ups and downs,” one farmer said.

Another farmer agreed that the market is erratic given not just the China challenges, but also currency fluctuations.

The media loves a good food scare and this week it was brought uncomfortably close to home for the seafood sector when farmed salmon became the target of Chinese media attention after its alleged link to a new outbreak of the coronavirus from a Beijing wet market.

As Intrafish.com notes, unfortunately for the global seafood sector, few countries react in quite the dramatic way China does when it comes to consumer-product related risks.

Artistic licence: Salmon is depicted floating over giant coronavirus virions in a Chinese news story. Photo: IntraFish

Think China doesn’t care about food safety?

There is a common misconception that China is unconcerned with food safety. While images of wet markets — often pinpointing the most rural examples, with cages of pangolins, cats and dogs — have been prevalent in the press and give the impression of a lack of caution, the reality is far different.

Those images reinforce the offensive stereotype of Chinese consumers somehow being willing to eat anything, when the fact is, Chinese consumers are extremely focused on food safety. The country has a history of terrifying food-related crises, with unscrupulous manufacturers and foodservice operators taking advantage of a lack of enforced regulation. Just do a search for melamine-tainted milk, fake bottled water or sewer oil and you will get a taste of what it is like to live in the head of a Chinese consumer and why food scares leave a lasting bad taste in the mouth.

There’s never been a better time for Chinese journalists to do a little ‘farmed salmon’ internet searching and drag out the good old sealice pictures. Photo: IntraFish

So when a chopping board in a Beijing wet market shows traces of a virus that has killed 450,000 people in the last six months and the product last on that board was a piece of salmon, it is no wonder that fear and a need to urgently remove any possible risk is the first reaction.

After all, there is enough past evidence of far worse breaches of food safety to want to avoid any kind of risk, proven or otherwise.

Not just China…

And while it is easy enough to shrug off a couple of bad headlines in the Chinese press, we’re in a global information age, and already plenty of mainstream Western publications have picked up the story, from Bloomberg to Fortune to The New York Times, and the headlines are a variation on a theme: coronavirus linked to salmon.

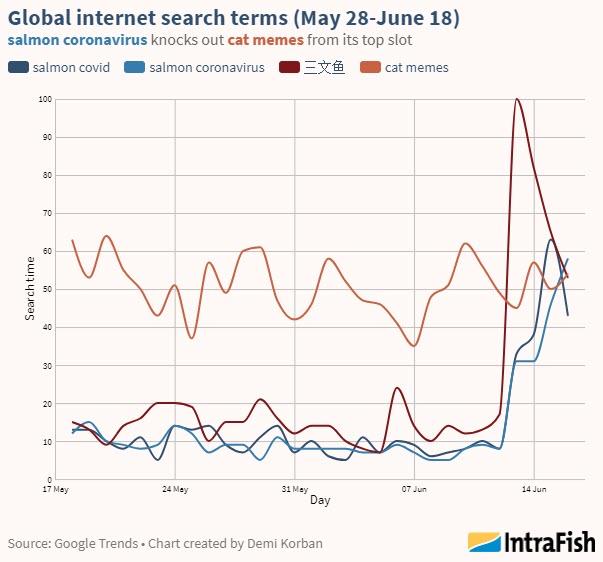

Trending, for exactly the wrong reasons…

Google Trends, which tracks search terms across the globe on Google.com, offers a stark look at what happens with a media scare.

Just last week, the terms “salmon coronavirus” “salmon covid” and “三文鱼” — the Mandarin characters for salmon — were just a blip on the search radar, dwarfed by terms such as “cat memes.”

But last Friday as news of the chopping board discovery spread like wildfire, those searches surged, with consumers both in and out of China desperate for clarification in a time of extreme paranoia and fear.

While many news sources attempt to dispel fear around the product, it seems likely that by the very association, the damage has been done. And if Rabobank consumer foods analyst Michelle Huang is correct, it could be two to three years before confidence in the product – in what was previously thought to be a huge potential market – is restored.

via ZeroHedge News https://ift.tt/2VbZRwZ Tyler Durden