Record 5Y Auction Size Meets Stellar Demand As Stopping Through Yield Slides To All Time Low

Tyler Durden

Wed, 06/24/2020 – 13:20

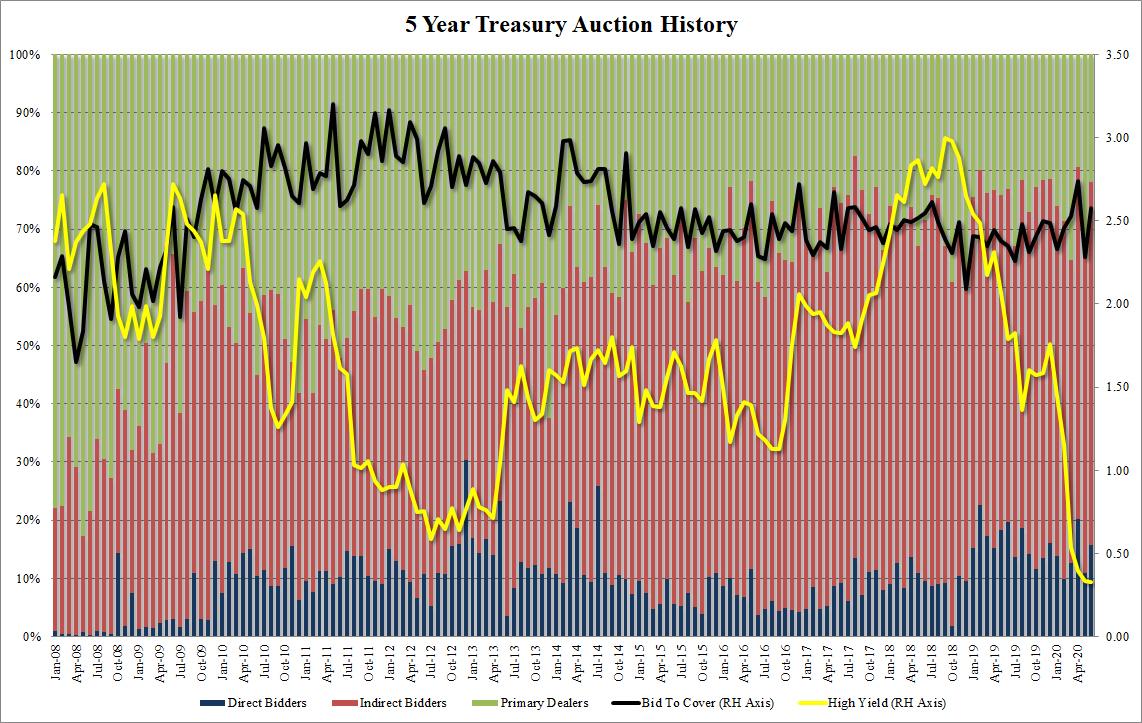

Following yesterday’s strong 2Y auction, the wave of stellar demand for US paper continued when the Treasury sold a record amount of 5Y paper at the lowest yield on record.

Today’s sale of $47BN in 5Y Note was the highest on record, as the Treasury continues to sell ever greater amounts of debt.

The high yield on the auction was 0.330%, 0.6bps through the When Issued 0.336%, down from last month’s 0.334% and the lowest yield on record, which suggests that with the Fed preparing to roll out Yield Curve Control, TSY buyers are increasingly betting that the 5Y tenor will be included in any rates cap.

The internals were solid, with the Bid to Cover jumping from last month’s 2.28 to 2.58, above the six-auction average of 2.47.

Foreign buyer demand also jumped, as Indirects took down 62.3%, the most since December, and above the 59% average. And with Directs taking down 15.8%, also above the 10.8% recent average, Dealers were left holding 22.0% of the auction.

Overall, a very solid auction perhaps facilitated by the lack of a drop in yields this morning as risk assets faded, and with little suggestion that buyers are concerned about the short-end getting dislocated in the near future despite the coming avalanche of new debt issuance.

via ZeroHedge News https://ift.tt/3fVY8DW Tyler Durden