S&P Futures Plunge 20 Points In Seconds On $3BN Sell Imbalance

Tyler Durden

Wed, 06/24/2020 – 15:59

It has been about three weeks since the market was so illiquid it would surge (or plunge) on news of the size of the daily market on close (MOC) imbalance. But it now appears that illiquidity is back with a vengeance because at exactly 350pm ET when the MOC closing imbalance is disclosed, the Emini puked 20 points in seconds when it was revealed that today’s imbalance was just over $3 billion for sale.

As a reminder, we have seen similar last 10 minute ludicrous action before, notably on June 2…

… when outsized MOCs forced a buying vacuum in the last 10 minutes of trading.

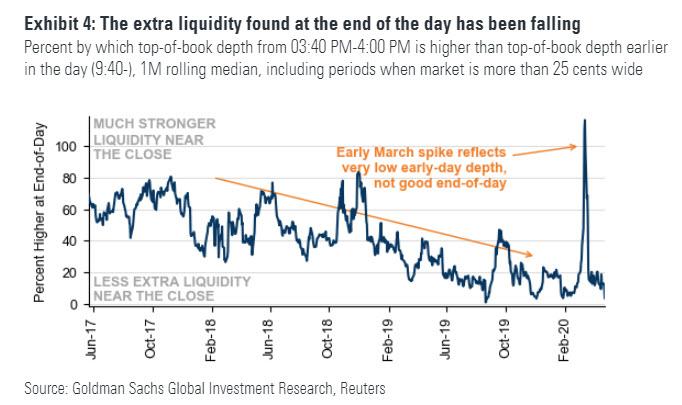

Regular readers will recall that the topic of the sudden plunge in liquidity at 3:50pm prompted none other than Goldman to highlight this curious phenomenon one month ago, when the bank said that “concerns remain centered around the final minutes of US equity trading sessions.”

Back in 2018, Goldman found that emini top of book depth was considerably stronger at the end of each trading day than earlier. However, in the past two months, ever since institutional investors stepped out of the market and left it to retail daytraders and systemic quants, this phenomenon has eroded considerably, leaving much less “extra” liquidity in the last half hour of trading, even before the coronacrisis. Weakened end-of-day liquidity was likely a potential contributor to the recent end-of-day volatility dislocation, Goldman concluded.

via ZeroHedge News https://ift.tt/2Vf3ulw Tyler Durden