The TVIX ETF Is Getting Delisted: Here Are The Three Implications For Markets

Tyler Durden

Wed, 06/24/2020 – 15:30

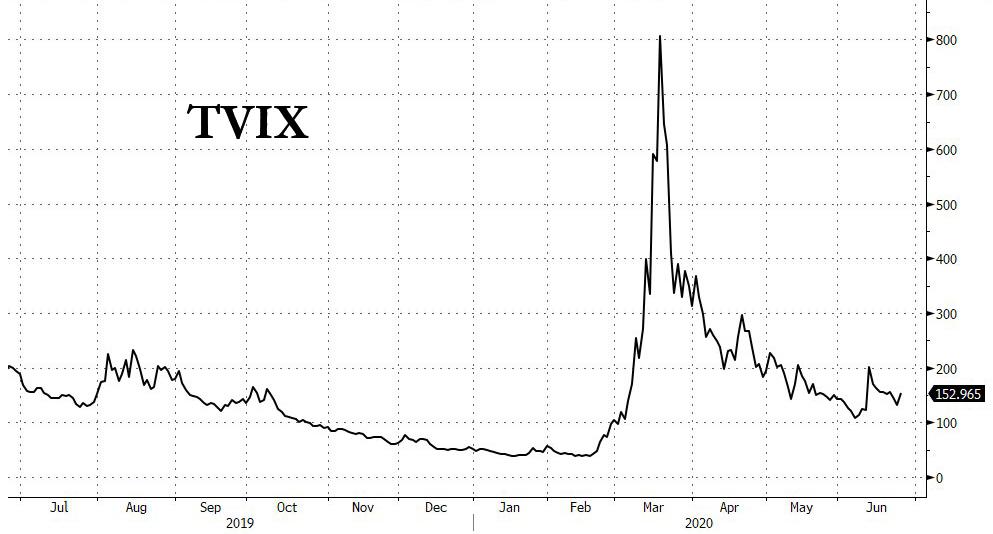

Back in February 2018, as a result of the staggering “Volmageddon” surge in the VIX, the market lost the retail favorite XIV ETN used to bet on continued declines in volatility, which was a fantastic strategy while it worked but then suddenly lost virtually all of its value in seconds. Now, it’s the turn of the XIV’s cousin, the TVIX.

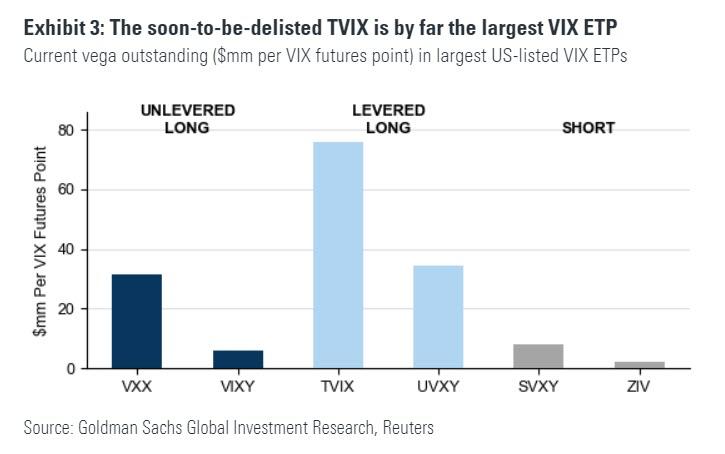

Monday’s announcement that Credit Suisse will stop taking creations and delist the TVIX (VelocityShares Daily 2x VIX Short-Term ETN) comes at a time when the product is the largest VIX ETP in both AUM ($1.4bln) and vega ($80mm) terms, and the top-performing ETN or ETF in the US equity market in 2020 (+180%).

According to Goldman’s derivatives strategist Rocky Fishman, there are three takeaways for investors:

- Reduced vol-of-vol. While far smaller than the rebalancing done by the SVXY or XIV around the 2018 VIX spike, the TVIX also buys VIX futures when they are going up and sells them when going down, a short gamma phenomenon that can exacerbate VIX future moves in both directions. Much lower VIX liquidity metrics than we had prior to 2018 leaves this impact material, even though the vega amount is lower than it was.

- Reduced VIX futures activity and liquidity. The TVIX has VIX futures exposure equivalent to roughly 1/3 of the open interest of VIX futures (80k out of 245k contracts). Given the economic similarity between the TVIX and existing long (e.g. VXX) and 1.5x levered long products (UVXY), we expect investors to switch some of their positions to comparable products, though if done on a dollar-for-dollar basis there will be a drop in total vega exposure. The activity generated by hedging of the TVIX itself (10k futures on average if fully hedged by VIX futures), and by secondary trading of ETP shares (equivalent to 90k futures/day in 2020, 60k/day in 2019) have been a significant source of volume and VIX futures markets (which have traded around 250k contracts/day in 2019-20). VIX futures liquidity has already been weakened, and this is a further negative development for VIX product liquidity.

- Vega to sell in the coming days. To the extent investors close long TVIX positions before they are delisted, there could be some pressure on volatility in the coming days.

via ZeroHedge News https://ift.tt/3dA0EOl Tyler Durden