WTI Tumbles Below $39 On Crude Build, Rebound In Production

Tyler Durden

Wed, 06/24/2020 – 10:35

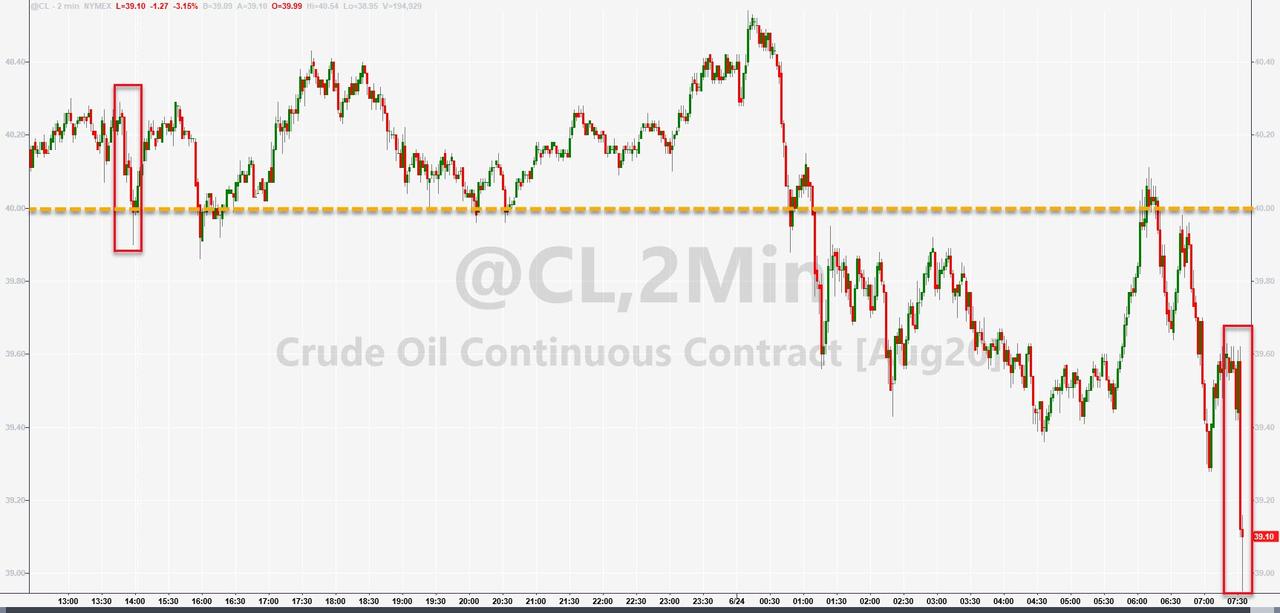

WTI prices fell back below $40 this morning following a surprisingly large crude build reported by API overnight., as fears of a second-wave of COVID-19 (and perhaps lockdowns) stymie hopes for a rebound in demand amid record inventories.

While the “focus lies on the inventory data,” there’s also persistent anxiety around the growth of the pandemic, said Hans van Cleef, senior energy economist at ABN Amro.

“Hopes for a rise in demand are counterbalanced by fears regarding new Covid-19 spread.”

As Bloomberg notes, anxiety over trade also weighed on the market, with the U.S. mulling new tariffs on $3.1 billion of exports from France, Germany, Spain and the U.K., adding to an arsenal of measures against the European Union that could spiral into a wider transatlantic trade fight later this summer.

API

-

Crude +1.749mm (+1.5mm exp, Platts -100k exp)

-

Cushing -325k

-

Gasoline -2.605mm (-1.9mm exp)

-

Distillates -3.856mm (+100k exp)

DOE

-

Crude +1.44mm (+1.5mm exp, Platts -100k exp, BBG WHIS -595k exp)

-

Cushing -991k

-

Gasoline -1.673mm (-1.9mm exp)

-

Distillates +249k (+100k exp)

Official EIA data confirmed API’s reported build in crude stocks last week, and the smallest draw at Cushing since May. The build in distillates also pours cold water in any pick up in jet fuel or diesel (trucking) demand.

Source: Bloomberg

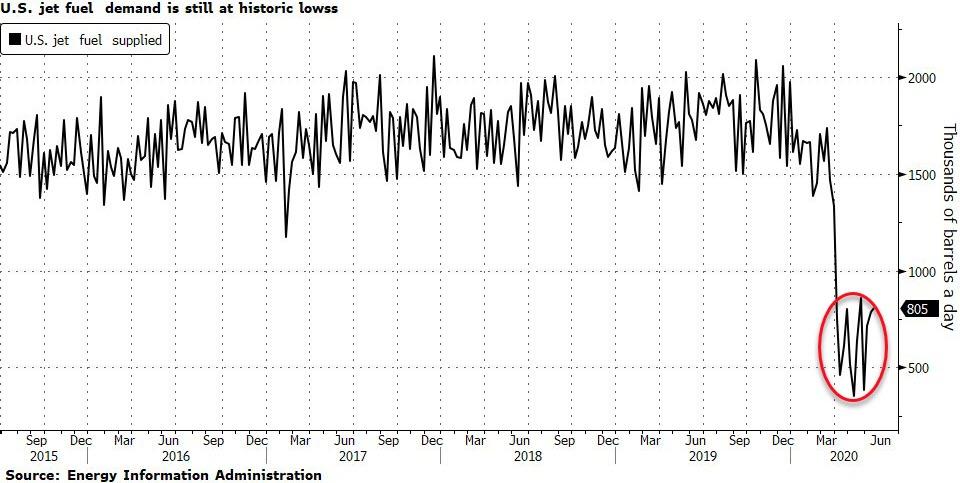

Gasoline demand is also closely-watched as an indicator of the speed of recovery in the economy, and jet-fuel demand remains low…

Source: Bloomberg

US Crude production tumbled the prior week due to storm Cristobal shut-ins, and that drop was erased last week, back up to 11.0mm b/d…

Source: Bloomberg

WTI briefly traded back above $40 overnight but was hovering around $39.50 ahead of the DOE print and tumbled to the lows of the day after the data…

There are also signs that some funds could be pulling out. Trend-following funds that follow technical signals are nearing levels where they would reverse their current bullish positions, according to Keith Wildie, senior commodities broker at R.J. O’Brien.

Bloomberg Intelligence Senior Energy Analyst Vince Piazza notes that the risk of crude inventories exceeding storage capacity remains a concern, and we think commodity markets don’t fully appreciate the risk of a second wave of Covid-19 infections depressing demand.

via ZeroHedge News https://ift.tt/2A4686y Tyler Durden