Here Are The States Goldman Thinks Will Be Forced To Reverse Opening Plans

Tyler Durden

Thu, 06/25/2020 – 15:30

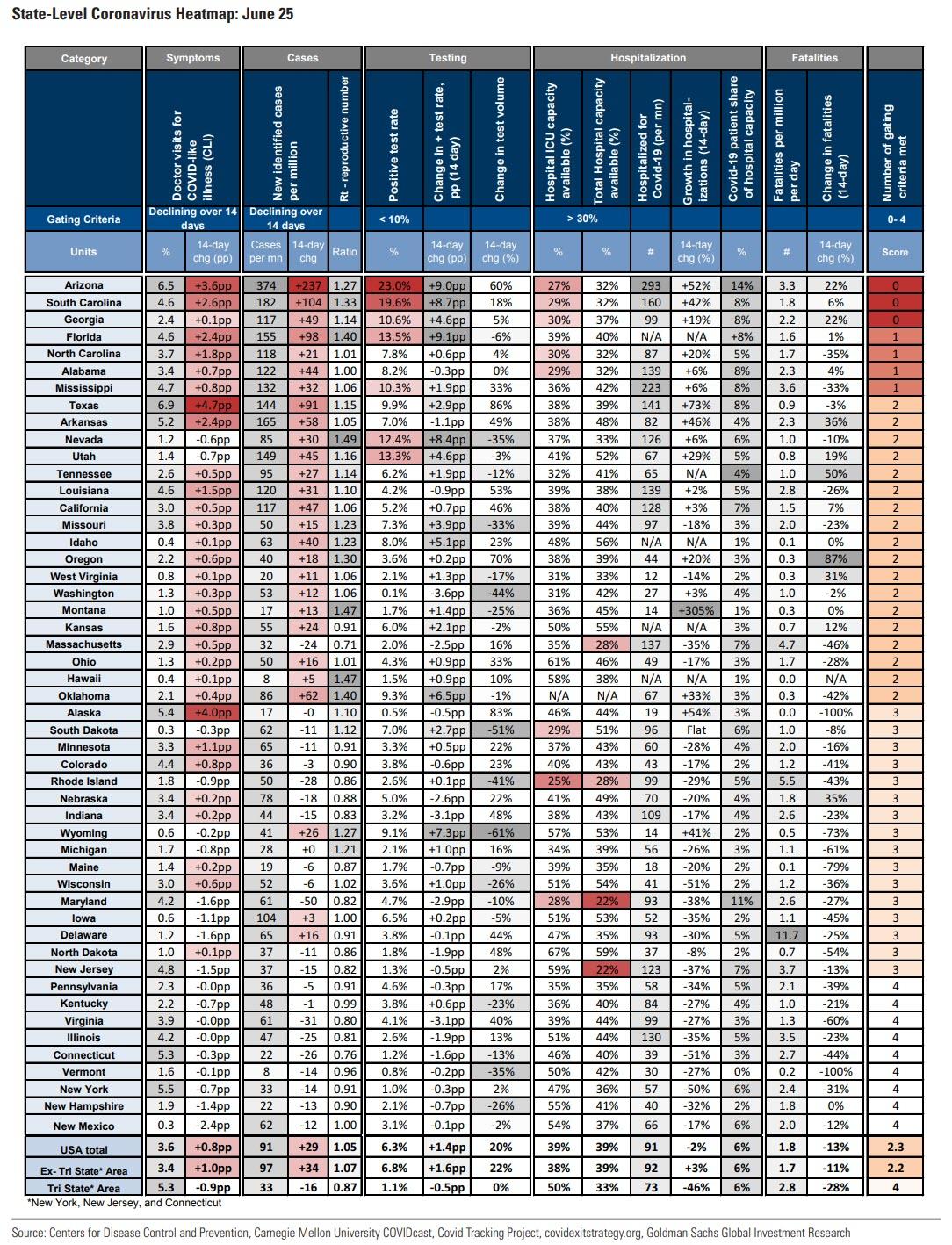

Yesterday we showed that according to Goldman calculations, the prevalence of coronavirus symptoms is rising, with the share of patients seeking care with symptoms of Covid-like illness at 3.5%, up 0.4% from 2 weeks ago. Daily confirmed have risen steadily over the past several days to 86 per million, ending a 2-month decline, and clearly spooking the market. A big part of this is due to increased testing: indeed, the volume of daily coronavirus tests has risen 23% over the last two weeks, while the positive test rate has risen by 1.3pp to 6.2%. On the flipside, fatalities have declined over the last two weeks (-12% to 1.9 per million), although fatalities lag new cases by multiple weeks.

Today, in an update to its tracker, the bank writes that as a result of diminishing available hospital capacity, some states will be forced to reconsider their reopening plans. According to Goldman, a decline in hospital capacity below 20% could pressure states to consider slowing or reversing reopening. In this context, according to the latest CDC data, Alabama and Maryland currently have 23% of ICU beds available (with Covid patients accounting for 7% and 13% of occupancy respectively), and Arizona has 25% available (with Covid patients accounting for 11%).

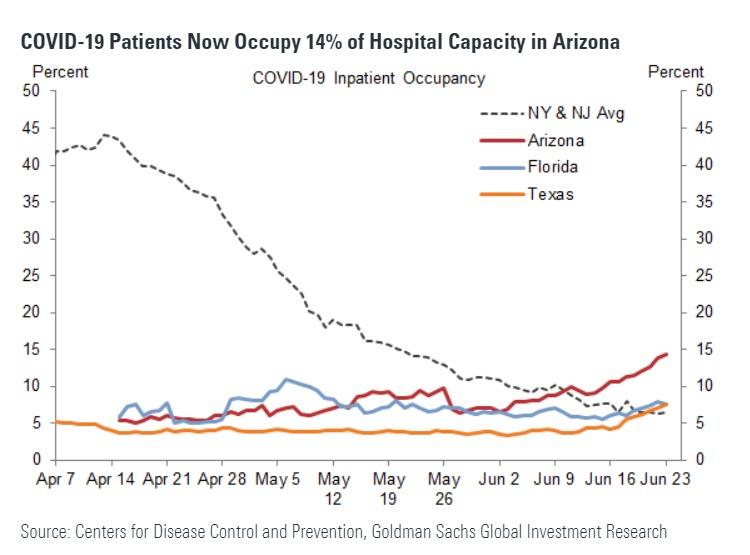

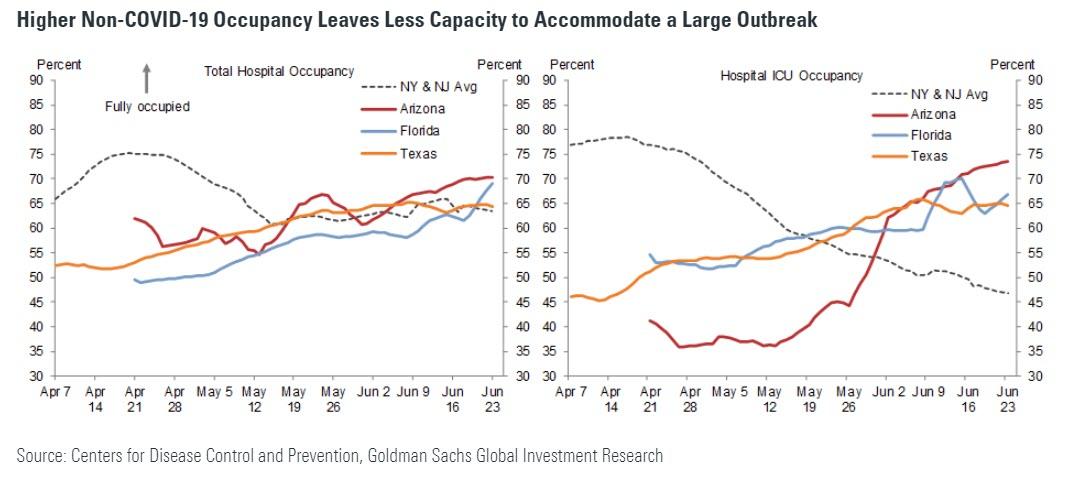

The bank also notes that the COVID-19 patient share of total occupancy has risen steadily to 14% in Arizona, accounting for most of the increase in total occupancy this month. In Texas and Florida, new cases have risen sharply, but the COVID-19 share of hospital occupancy has only edged up. Hospitalizations lag other indicators such as symptoms and new confirmed cases.

Just several weeks into reopening in these states, Goldman predicts that “it would take relatively small increases in COVID-19 patient occupancy to take total occupancy to very high levels.” The bank also notes that while in New York and New Jersey at the peak outbreak in April, COVID-19 patients occupied nearly 45% of hospital capacity, total occupancy reached only about 75% as bans on elective procedures and state lockdown measures resulted in more patients hospitalized for COVID-19 than for other reasons. Today, in Arizona, Florida, and Texas non-COVID-19 occupancy is much higher, leaving less spare capacity the bank cautions.

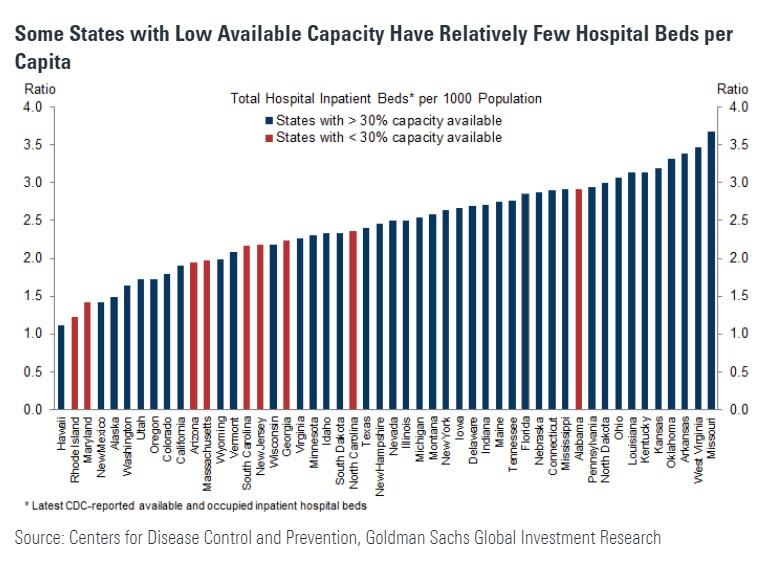

Available hospital capacity is not just tied to the spread of the coronavirus in a state, though. States with less capacity per capita should see higher occupancy rates in an outbreak. As a result, some of the states not meeting federal guidance to proceed with reopening (at least 30% available capacity) have below-average capacity per capita.

Regional data could also pressure states or cities to modify their phased reopening policies. For example, available hospital capacity in Houston, Texas is 8pp lower than the already-low state average.

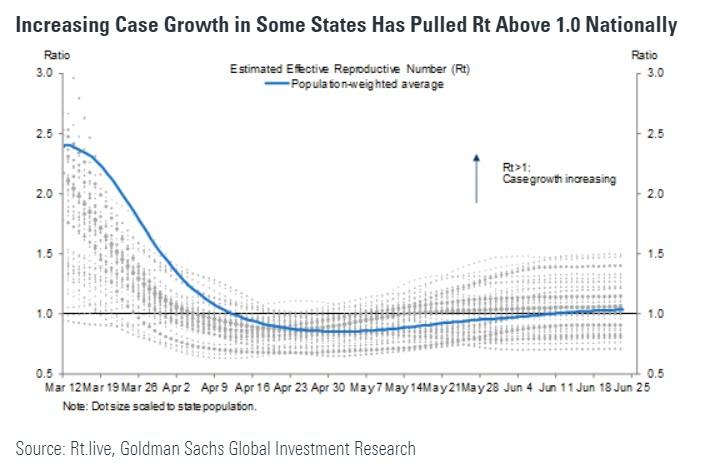

Finally, as a result of the rising virus spread in some states, Goldman’s Blake Taylor calculates that the estimated effective reproductive number (Rt), which measures the change in growth in new confirmed cases adjusted for testing volume, has risen back above 1.0 on a population-weighted basis, indicating an acceleration in case growth nationwide.

Why is all of this important? This is what we said yesterday:

Whether one believes the official virus data or is willing to dismiss it as a “plandemic”, is irrelevant for two reasons: i) markets still respond to every incremental headline, fully aware that it will shape fiscal and monetary policy especially with various Fed speakers warning yesterday that a second wave would lead to even more Fed intervention, and ii) the global coronavirus pandemic stopped being about epidemiology long ago and has since become a political weapon to be used at will by those with a certain agenda. It’s also why various states will be eager to use whatever data is published to pursue their political intentions, which according to many involve a new round of shutdowns some time in the late summer and in any case, ahead of the elections to encourage another economic meltdown and further crippling Trump’s re-election changes despite the administration’s solemn vows that a “second wave” shut down is not coming.

And while there is some time before the elections and anything can still happen, the ongoing jump in new cases is just what the Fed will need to trigger even more aggressive monetary stimulus in the coming months, which will have a profound impact on risk assets, and may explain why most banks are rather eager for the worst case outcome, if only from a pandemic standpoint.

via ZeroHedge News https://ift.tt/3dsuXqo Tyler Durden