Stocks Surge As Bank ‘Bonanza’ Beats COVID Concerns

Tyler Durden

Thu, 06/25/2020 – 16:00

Disney delaying its parks reopening, disappointing slowdown in the improvement in jobless claims, more concerns over a second wave of COVID (directly impacting Texas and Apple), all offset by regulators easing regs on banks (and presumably hopes of no dividend cuts tonight from the bank stress tests)…

-

1000ET *BANKS GET EASIER VOLCKER RULE AND $40 BLN REPRIEVE ON SWAPS

-

1049ET *FLORIDA COVID-19 CASES RISE 4.6% VS. PREVIOUS 7-DAY AVG. 4%

-

1135ET *TEXAS GOVERNOR HALTS NEW PHASES OF REOPENING STATE’S ECONOMY

-

1140ET *ARIZONA VIRUS CASES JUMP 5.1%, ABOVE PRIOR 7-DAY AVERAGE 2.3%

-

1435ET *APPLE TO RE-CLOSE 14 MORE U.S. RETAIL STORES ON COVID-19 SPIKE

-

1510ET *CALIFORNIA HOSPITALIZATIONS NOW UP 32% OVER LAST 14 DAYS.

-

1532ET *FLORIDA‘S DESANTIS: NO PLAN TO GO TO NEXT PHASE OF OPENING NOW

-

1558ET *U.S. VIRUS CASES RISE 1.7%, BIGGEST GAIN SINCE MAY 30

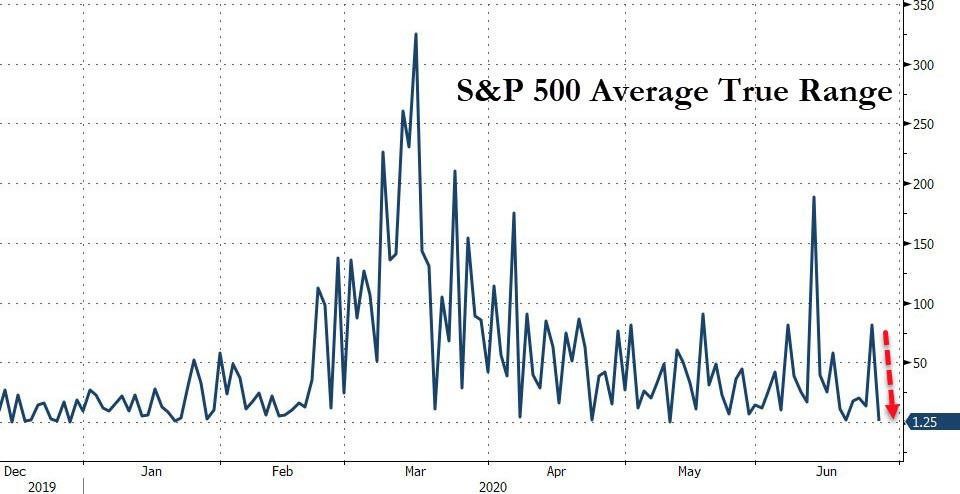

After yesterday’s chaotic headlines, today was far calmer – despite similar headlines – making for one of the lowest range days of the year, until…

Source: Bloomberg

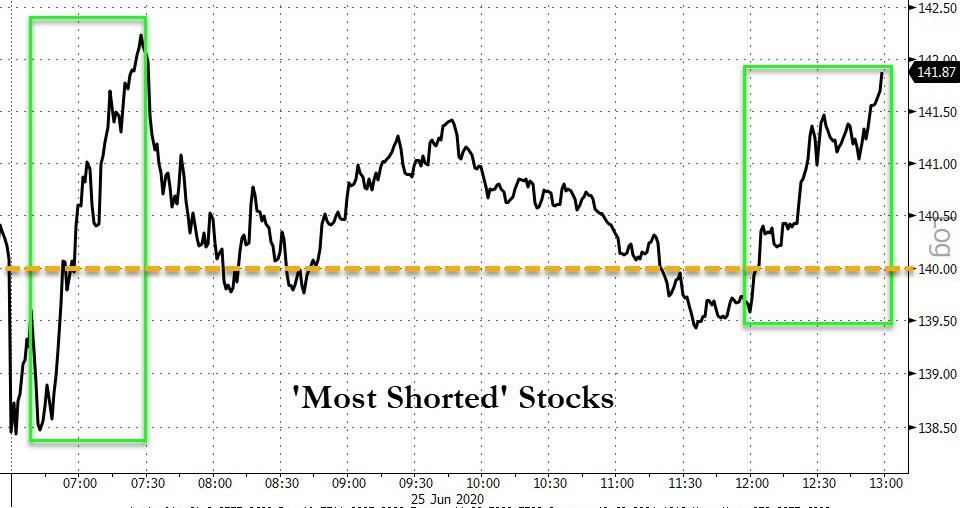

Until a huge buy program hit at 1530ET…(no news catalyst)

Source: Bloomberg

Sparking a dramatic short-squeeze…

Source: Bloomberg

Lifting everything ahead of tonight’s stress test. Four major buying moves in today’s actions but the late-day one is the most notable for its total lack of reason…TOTAL PANIC BID!!!!

Yes, small caps rallied 1.5% in the last hour of the day on nothing but bad news from a virus perspective and no news on anything else. 9th positive day in the last 10 for Nasdaq.

This seems to sum things up rather well…

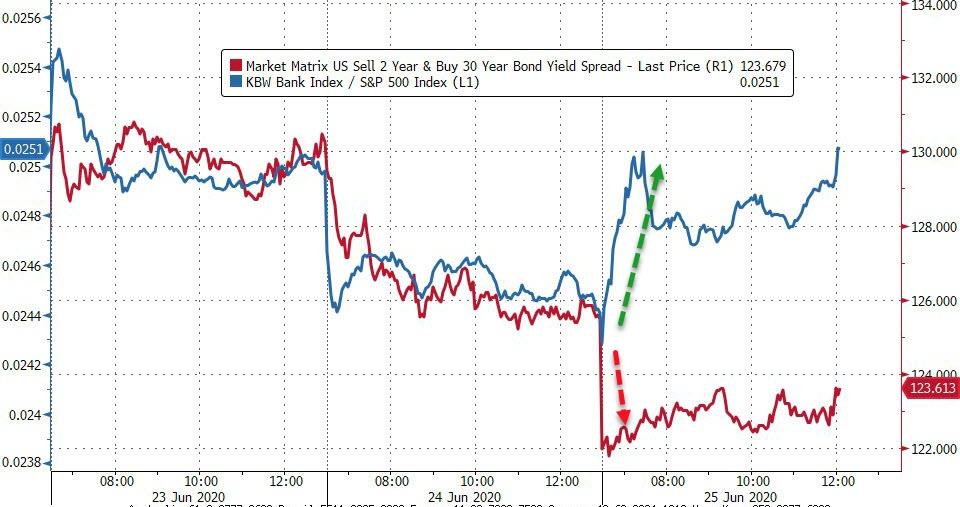

The big banks all jumped nicely at the open on the Volcker Rule easings (ahead of tonight’s stress test results)…

Source: Bloomberg

Notably financials outperformed (driving Small Caps) despite a flattening in the yield curve…

Source: Bloomberg

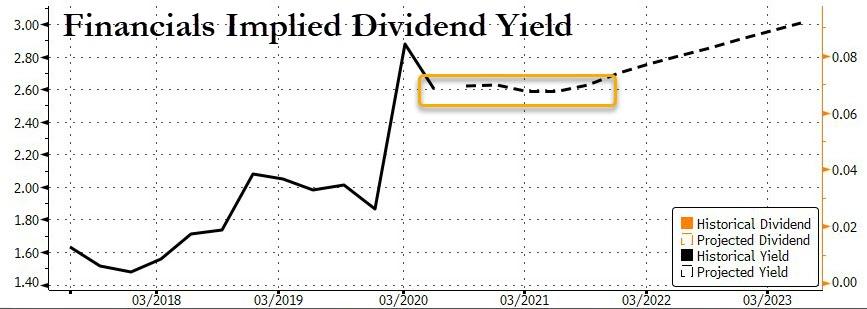

And derivatives are implying a cut next and then a flat dividend yield from banks for the next 12 months

Source: Bloomberg

Bonds were barely alive today with the long-end very marginally lower in yield…

Source: Bloomberg

The Dollar ended marginally higher, but slipped late on back into the red on the week…

Source: Bloomberg

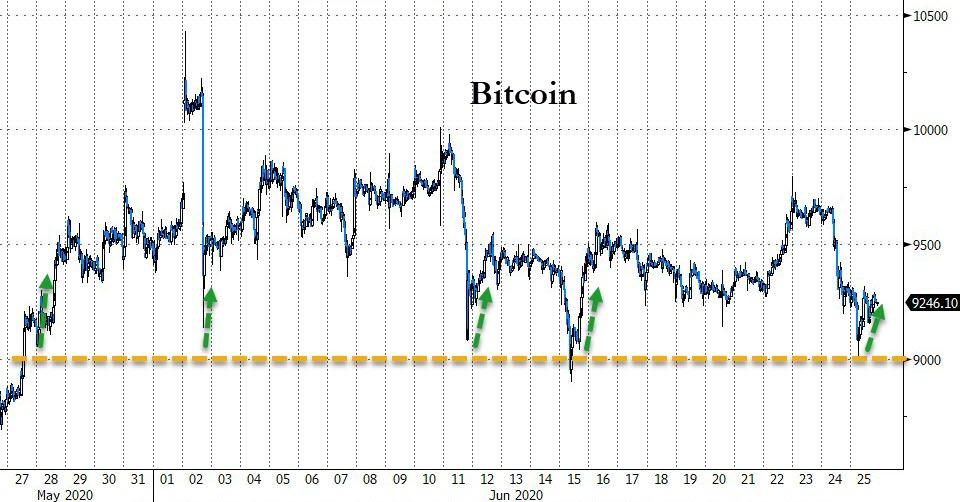

Bitcoin traded down to $9,000 intraday before bouncing back to almost unchanged…

Source: Bloomberg

Oil prices rebounded today but WTI was unable to get back to the $40 Maginot Line…

Silver managed gains on the day but failed to reach $18…

But gold ended the day marginally lower, but appears to be coiling for a move…

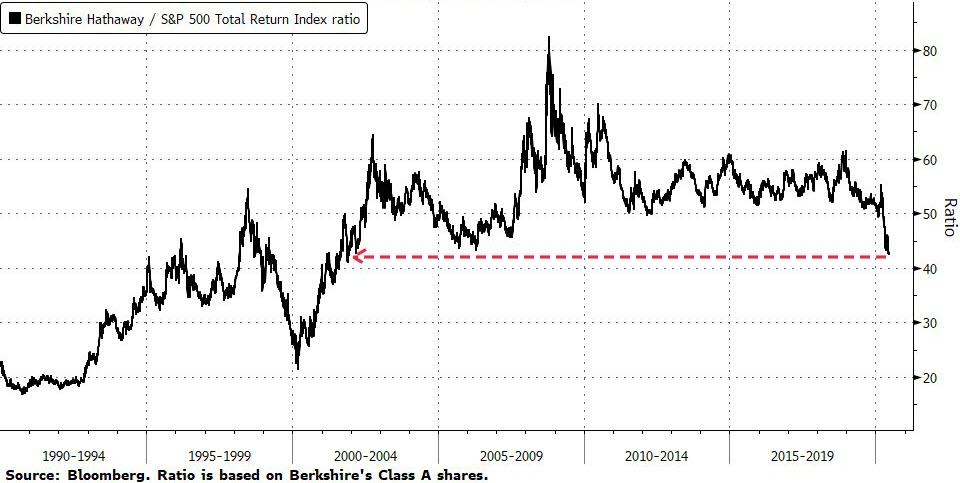

And finally, sometimes you just gotta know when to fold ’em… Warren Buffett is going through “the worst patch” of his investing career, Jim Bianco, president and founder of Bianco Research LLC, wrote Wednesday in a Twitter post.

As Bloomberg notes, Bianco cited a total-return ratio, including dividends, between Buffett’s Berkshire Hathaway Inc. and the S&P 500 Index.

Source: Bloomberg

The ratio closed Tuesday at its lowest level since November 2001 after dropping 23% from this year’s high, set March 16, according to data compiled by Bloomberg. The current reading was first reached in 1995, as cited by Bianco, who wrote that “Berkshire has turned into a mediocracy” for the past 25 years.

via ZeroHedge News https://ift.tt/3fWj25N Tyler Durden