WTI Jumps After Biggest Crude Inventory Draw Since 2019

Tyler Durden

Tue, 06/30/2020 – 16:34

A rollercoaster day saw WTI ramped to $40, fail and fade back to close red on the day (but ends more than 90% higher for the quarter, but still down nearly 36% year to date).

“As we move into the second half of the year, the energy rebound is showing signs of stalling, however, as traders assess the threat of the recent resurgence in COVID-19 cases and the looming possibility of more economic shutdowns in the back half of the year,” said Tyler Richey, co-editor at Sevens Report Research. .

API

-

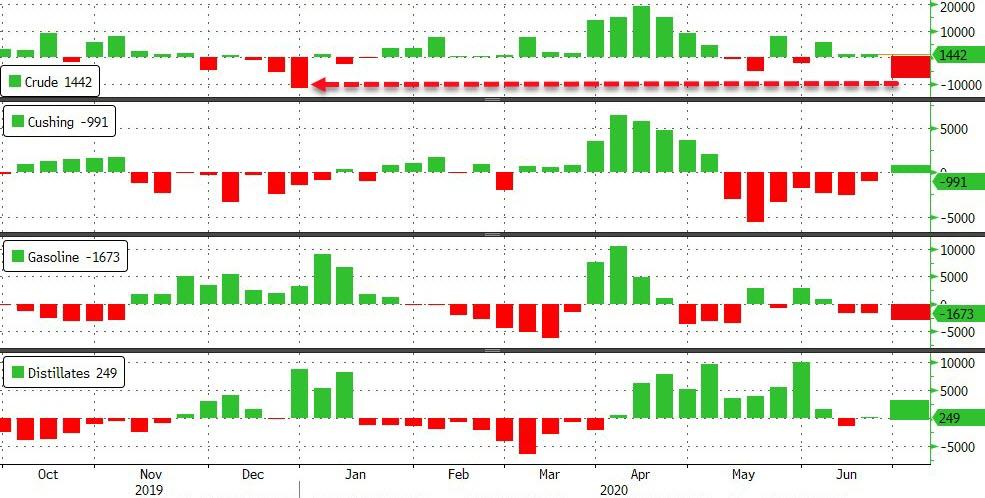

Crude -8.156mm (-2.7mm exp)

-

Cushing +164k

-

Gasoline -2.459mm (-2.7mm exp)

-

Distillates +2.638 (+900k exp)

After two weekly surprise builds in a row, US crude stocks saw a major draw of over 8mm barrels – the most since 2019…

Source: Bloomberg

WTI hovered around $39.30 ahead of the API print and spiked higher on the surprisingly large draw…

As Richey told MarketWatch,

“The second quarter will not soon be forgotten by energy traders given that WTI crude oil futures plunged into negative territory for the first time in history, and decidedly so, in the month of April.”

That was “due to logistics issues in the physical supply chain, most notably a critical lack of available storage for freshly lifted crude barrels in the U.S.”

On April 20, WTI oil futures fell 306% to settle at negative $37.63.

“Since then, oil and refined product markets have staged an equally historic rebound… due to a swift recovery in consumer demand as well as sharp output cuts by global oil producers,”

via ZeroHedge News https://ift.tt/2Zs02FJ Tyler Durden