US Manufacturing Survey Jumps By Record In June (In Contraction & Expansion)

Tyler Durden

Wed, 07/01/2020 – 10:05

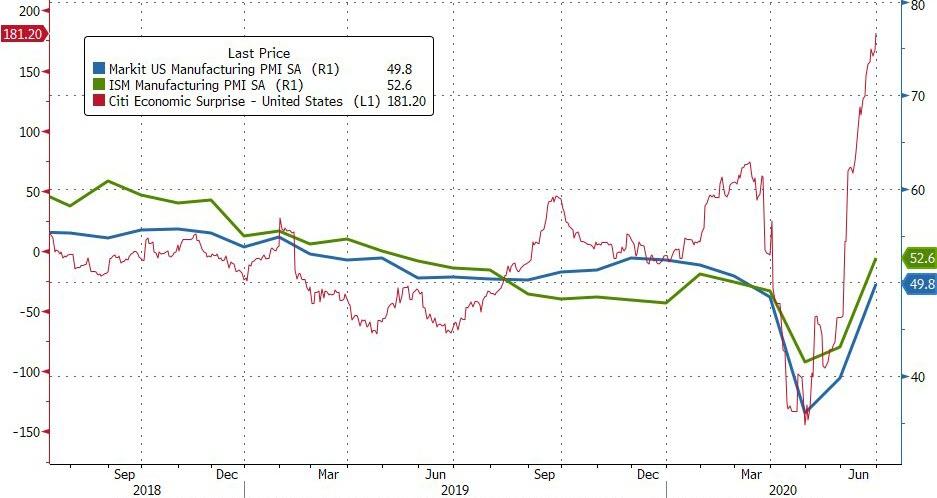

Despite the record surge in the US Macro Surprise Index, May’s rebound in ‘soft’ survey data was much more mixed than many prefer to cherry-pick (PMI rebound much more dramatic than ISM), but flash PMIs suggest June saw the re-opening euphoria is set to accelerate…

-

ISM Manufacturing in Expansion – 52.6 vs 49.8 expectations and 43.1 prior – best since April 2019

-

PMI Manufacturing in Contraction – 49.8 vs 49.6 expectations and 39.8 prior – a record 10 point jump

Source: Bloomberg

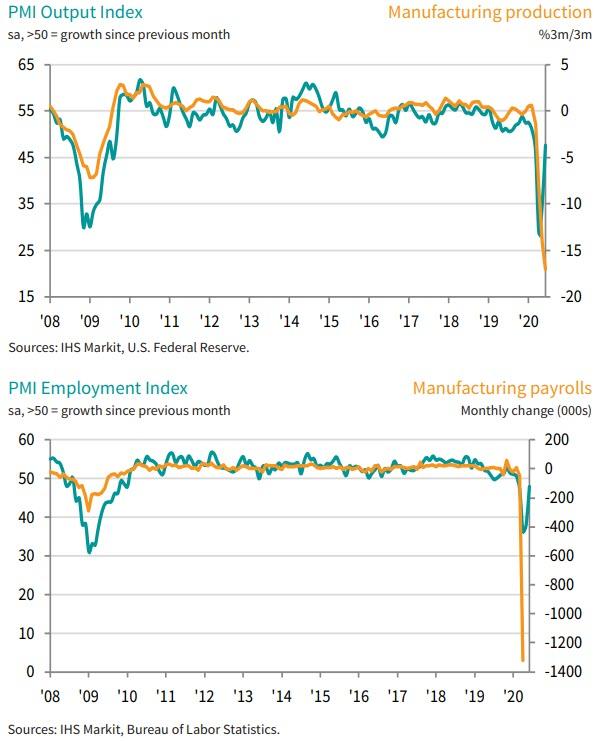

Markit’s PMI noted that employment across the manufacturing sector declined for the fourth month running in June, as firms shed workers at a moderate pace following subdued demand. Signs of excess capacity remained evident as manufacturers registered a sharp reduction in backlogs of work. However, the overall loss of jobs was considerably weaker than those seen in the prior two months.

The PMI recorded its largest increase since August 1980, when it increased 10.5 percentage points. Among the big six industries, three of the industry sectors expanded. New Orders and Production returned to expansion, and at respectable levels. Supplier Deliveries reached a normal level of tension between supply and demand. Five of the 10 subindexes registered expansion, a marked improvement from previous periods.

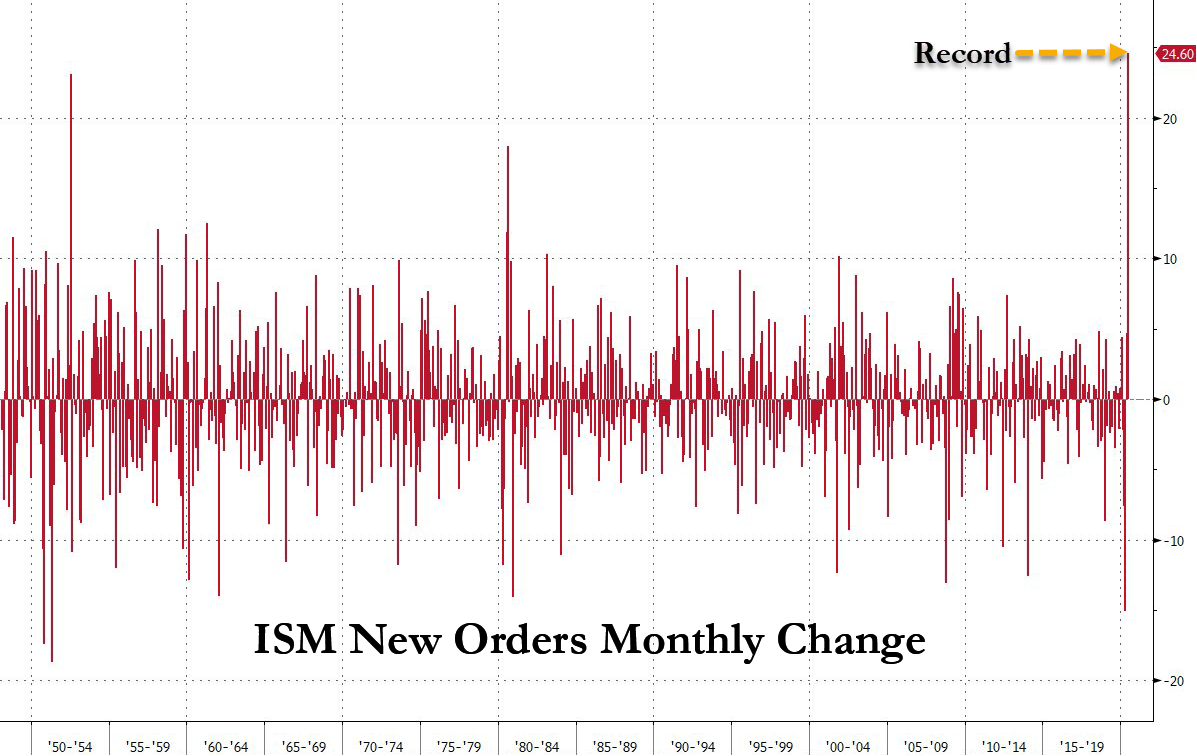

ISM’s data showed a surge in new orders but far less of a jump in employment…

Source: Bloomberg

This is the biggest increase in new orders ever…

Source: Bloomberg

Chris Williamson, Chief Business Economist at IHS Markit said:

“US manufacturers have reported a marked turnaround in business conditions through the second quarter, with collapsing production and demand in April at the height of the COVID-19 lockdown turning rapidly to stabilisation by June. The PMI posted a record 10-point rise in June amid unprecedented gains in the survey’s output, employment and order book gauges.

“The record rise in the New Orders Index, coupled with low inventory holdings, bodes well for a further improvement in production momentum in July. A record upturn in business sentiment about the year ahead likewise hints that business spending and employment will start to revive.

“However, while the PMI currently points to a strong v-shaped recovery, concerns have risen that momentum could be lost if rising numbers of virus infections lead to renewed restrictions and cause demand to weaken again.”

It would appear hope is back as a strategy, but overall take your pick – is the US manufacturing sector expanding or contracting?

via ZeroHedge News https://ift.tt/2BSnKTx Tyler Durden