China Caixin Service PMI Unexpectedly Soars To 10 Year High

Tyler Durden

Fri, 07/03/2020 – 10:05

Just days after reporting that its industrial profits soared in May, rising compared to a year earlier which was a clearly ridiculous inflection considering that the profit-leading PPI has continued to plunge, resulting in a huge divergence between the two series and confirming once again that China will manipulate any number just to “represent” its economy as having fully recovered from the covid pandemic…

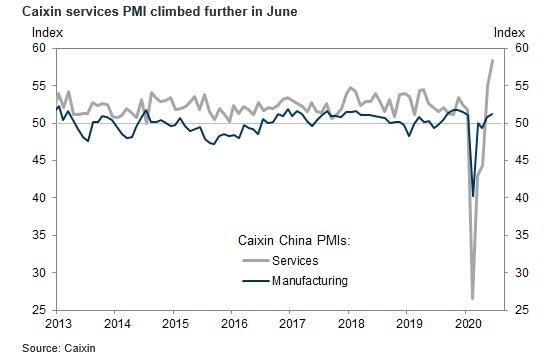

… China’s campaign to really prove to the world that “all is well” continued overnight when the Caixin services PMI soared to 58.4 in June, the strongest reading since May 2010 and much higher than market expectations of a 53.2 print (from 55.0 in May), urgently telegraphing an accelerated recovery in service activity in June, at least according to surveys.

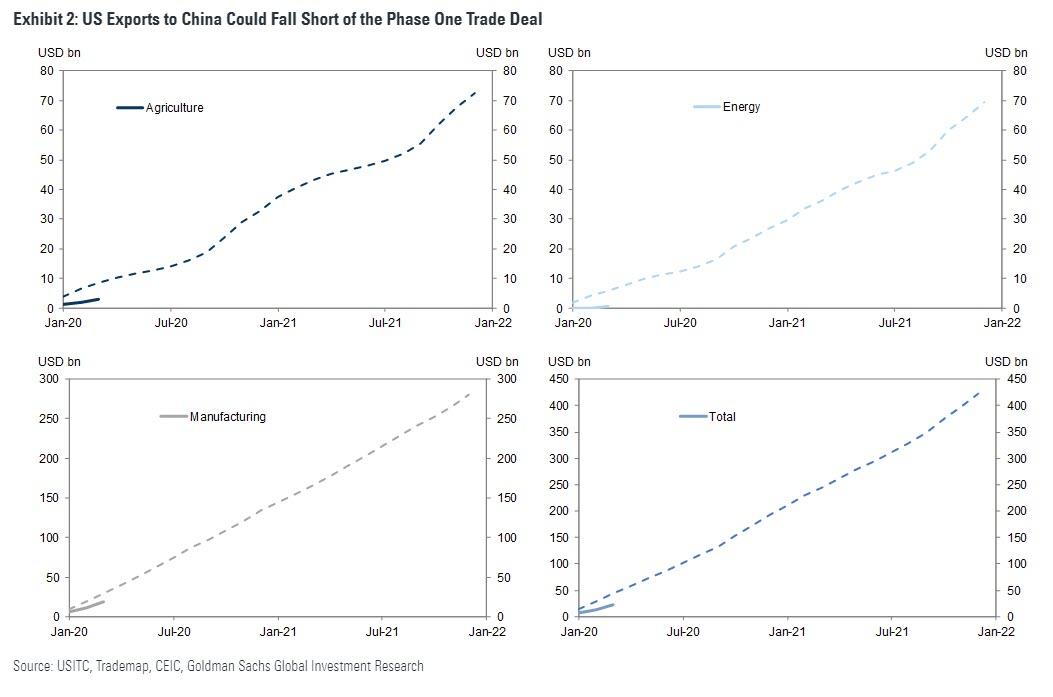

Virtually all sub-indexes also suggested stronger overall new businesses, as well as improvement in new export businesses. Now if only imports were also rebounding just as strongly to allow China to finally comply with its obligations under Phase One of the trade deal, which it clearly refuses to do.

Some more details from the report via Goldman:

- The Caixin services PMI pointed to a substantial improvement in service activity in June. Surveyed companies cited further easing in policy restrictions related to the virus control and improved demand conditions as the main reasons behind the strong recovery. The labor market remained soft however.

- The overall new business index rose to 57.3 from 55.8 in May, the strongest reading since August 2010. New export businesses improved significantly to 52.0, the first expansion (above 50 reading) since January this year. On the other hand, the labor market continued to be weak — the employment sub-index declined to 48.2 from 48.9, in comparison with the pre-coronavirus level of 50.1 in January / 50.9 in 2019 on average.

- Price indicators suggest tailwinds to service providers’ profit margins. The output prices sub-index rose to 50.1 from 48.3, while the input prices sub-index fell to 49.5 from 49.9. Probably related to the surge in new businesses, the outstanding business index was modestly higher at 50.6, vs. 49.1 in May. Surveyed companies reported strengthened business confidence — the business expectation index went up to 60.1 (after seasonal adjustment), the highest since June 2017.

In summary, yet another made up print by Beijing which is eager to “prove” just how capable it has been in rebooting the Chinese economy ‘unlike Trump’, and even Goldman admits the numbers make no sense as “service activities stayed below trend in June according to our high-frequency trackers.”

via ZeroHedge News https://ift.tt/3itCrwU Tyler Durden