European Stocks Slide On ECB Rift, S&P Futures Flat With US Closed

Tyler Durden

Fri, 07/03/2020 – 08:29

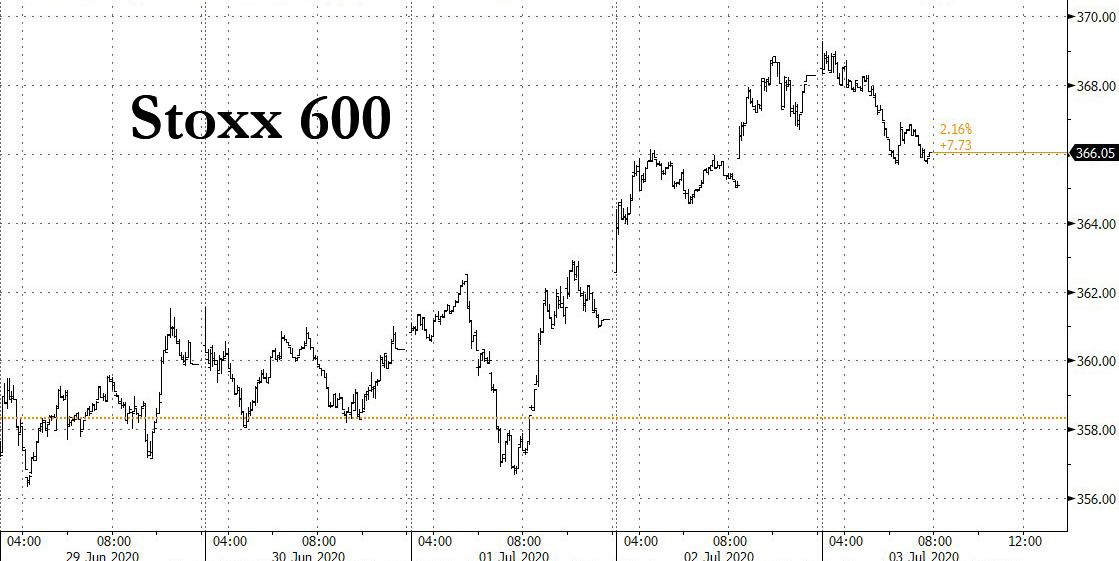

Europe’s Stoxx 600 index opened at three-week highs only to quickly see the 4-day rally reverse, and turn negative by as much as -0.8% with banks and energy indexes leading the decline with losses of 1.5% and 1.3% respectively, after Bloomberg reported that a conflict was brewing at the ECB over its “priced in” stimulus package coupled with political upheaval in France which saw a blitz-replacement to the prime minister.

According to Bloomberg, ECB President Christine Lagarde’s signature crisis-fighting tool “is becoming the focus of disagreement among policy makers in what could amount to her first major test of discipline.”

As a result, Governing Council members face a potential rift over how much their emergency bond-purchase program should stay weighted toward weaker countries such as Italy, and while the debate remains hypothetical for now, it could crystallize as the economy emerges from the coronavirus pandemic. The danger is that such friction undermines a program unveiled at the height of the crisis to reassure investors of the ECB’s resolve in defending the integrity of the euro.

That said, the fundamental landscape remains unchanged and fresh catalysts remain light, although a modest blip lower was seen upon the French PM resigning as part of President Macron’s reshuffle – a move speculated by local press in recent days. The morning also saw come comments from German Chancellor Merkel who reaffirmed her low expectations of a smooth Recovery Fund agreement, whilst again expressing concern over the Hong Kong National Security Law as Germany takes the helm of the EU presidency for the second half of the year.

In terms of individual movers, Wirecard (+8%) opened with gains of around 15% amid source reports the group’s US arm has drawn interest from payment groups and could fetch around USD 400mln. EDF (+3.6%) hold onto gains after raising FY20 nuclear output. Associated British Foods (-1.1%) shares remain subdued amid a broker downgrade at Goldman Sachs.

Not helping Europe was the latest batch of Service PMIs, which while coming slighlty better than expected, were still in contraction territory.

Meanwhile, while the US was closed for Independence Day, equity futures accelerated the late Thursday fade, while the dollar was modestly higher.

Asian stocks gained, led by IT and health care, after rising in the last session. All markets in the region were up, with Shanghai Composite gaining 2% and Hong Kong’s Hang Seng Index rising 1%. Trading volume for MSCI Asia Pacific Index members was 66% above the monthly average for this time of the day. The Topix gained 0.6%, with YAC HD and Kusuri no Aoki HD rising the most. The Shanghai Composite Index rose 2%, with CTS International and Datong Coal posting the biggest advances. Sticking with China, tensions seem to have bumped up a notch as India’s Power Minister said India will not permit imports of power equipment from China and Pakistan – a move which prompted China to state they will take necessary measures to uphold the rights of Chinese businesses in India.

As Bloomberg notes, investors continue to weigh promised stimulus measures and upbeat economic data against relentless new outbreaks of the virus. U.S. payrolls figures Thursday fueled optimism of a V-shaped recovery in the world’s biggest economy, even as Florida reported that infections and hospitalizations jumped the most yet, and Houston had a surge in intensive-care patients.

“There’s still a general positive sentiment about how quickly we’re seeing the recovery,” said Chris Gaffney, president of world markets at TIAA Bank. “But we do think you’re going to see the recovery level off, especially if we continue to see higher case numbers on the virus.”

In FX, the Euro dipped as French President Emmanuel Macron named a new prime minister after asking his government to resign. While the dollar was modestly higher, the Bloomberg dollar index headed for its first weekly drop since early June after better-than-expected economic data damped demand for haven assets. This week’s risk-on sentiment was supported by improving U.S. labor market numbers and data signaling a turnaround in Europe’s struggling economy

In commodities, WTI and Brent front month futures continue to edge lower on the final trading session of the week with volumes light amid US’ absence in the market. However, on the OPEC front, Angola may prove to be a spanner in the works regarding the extended cuts after the oil producer, via sources yesterday, noted that it is still resisting the idea of over complying to make up for its shortfalls in the prior months. Under the terms of the OPEC+ agreement in June, the continuity of extended cuts is contingent on laggards overcompensating in July, August and September. WTI August lost its USD 40/bbl handle to the downside and loiters around session lows (vs. high 40.50/bbl) whilst the Brent September contract had multiple jabs at 42.50/bbl to the downside before breaching the psychological mark (vs high 42.99/bbl). Spot gold meanwhile sees little action on either side of USD 1775/oz amid a lack of fresh fundamental catalysts. Copper sees a session of losses as China enters a season of lower demand for the red metal, whilst Shanghai stocks also printed a build, according to the exchange.

US markets are, of course, closed for Friday’s session.

via ZeroHedge News https://ift.tt/38lT9tE Tyler Durden