Gold Spikes To 9-Year High, Bonds Bid As Stocks Skid

Tyler Durden

Tue, 07/07/2020 – 16:01

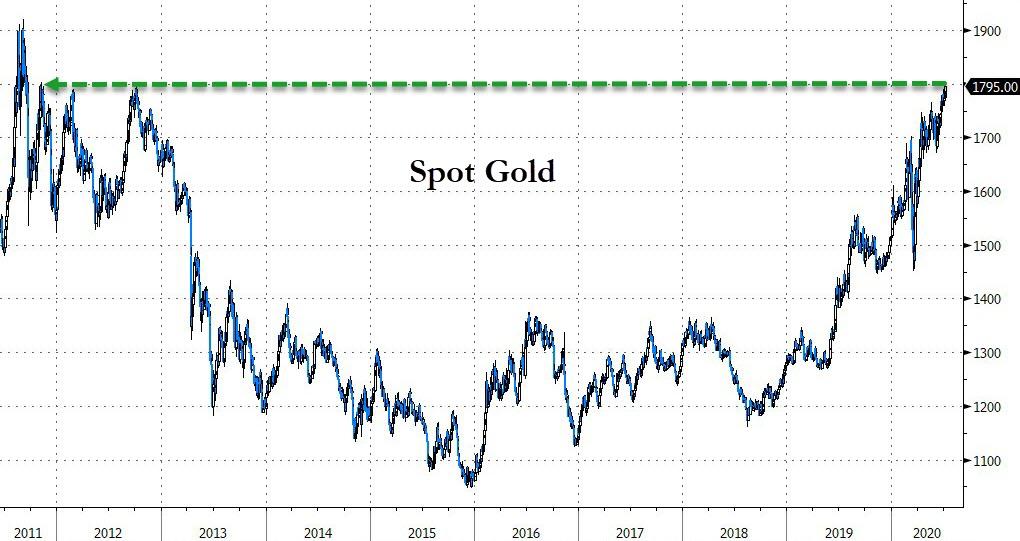

Lost in the headlines about Amazon or Tesla or Nasdaq or whatever the latest Robinhood-er is chasing higher today, is the fact that gold prices continue to rise, with futures topping $1800 once again… (some chaotic swings recently)

And spot prices back to their highest since Sept 2011…

Source: Bloomberg

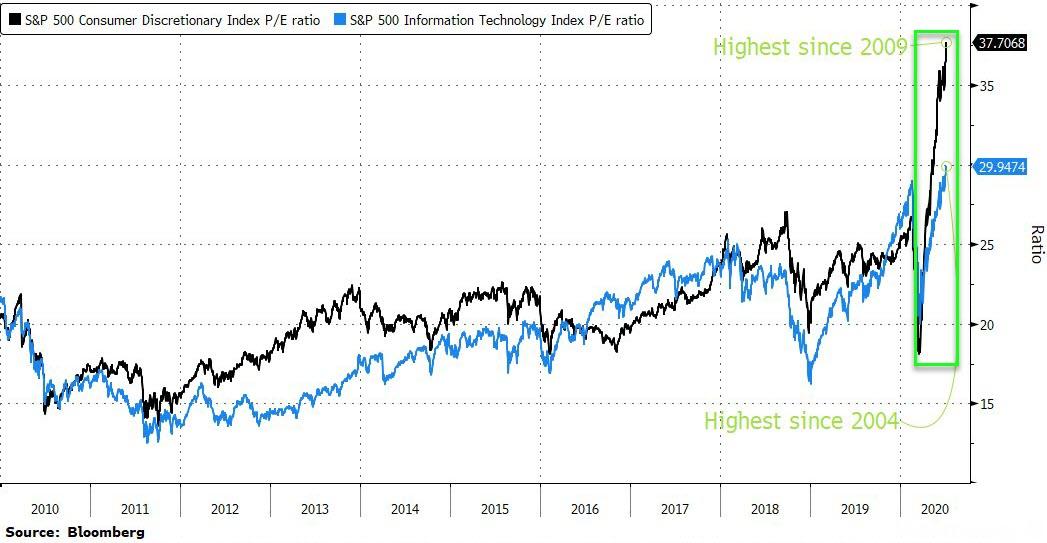

And at the same time, so-called ‘Safe Haven’ from the virus have screamed higher at or near record bubble valuations…

Source: Bloomberg

As Bloomberg’s Michael Regan notes, the trailing price-to earnings ratio of the S&P 500 Information Technology Index is about one decent rally away from cracking the 30 level, while the same ratio for consumer-discretionary stocks is fast approaching 40, in large part thanks to a record rally in Amazon.com Inc. With rising virus cases threatening to stymie the reopenings of various state economies and uncertainty over future stimulus packages, July is setting up to be a month of serious headline risk that could put to the test the Federal Reserve’s magic spell on the market, especially the most richly valued sectors.

Can the spell continue? Or will retail chasers get burned?

The longest win streak of the year appears to be over despite the best efforts of the pumpers to BTFD at the cash open in the Nasdaq…Today’s selling started at the European close. There was also a notable puke in the last 10 minutes on a significant sell MoC imbalance…

Small Caps are down 1% from Thursday’s close…

Defensives have overtaken cyclicals on the week…

Source: Bloomberg

The Dow dropped back below its 200DMA…

July’s long momo, short value factor trade continues to gather pace…

Source: Bloomberg

US Treasury sold 2Y notes at a record low yield today – makes you wonder…

Source: Bloomberg

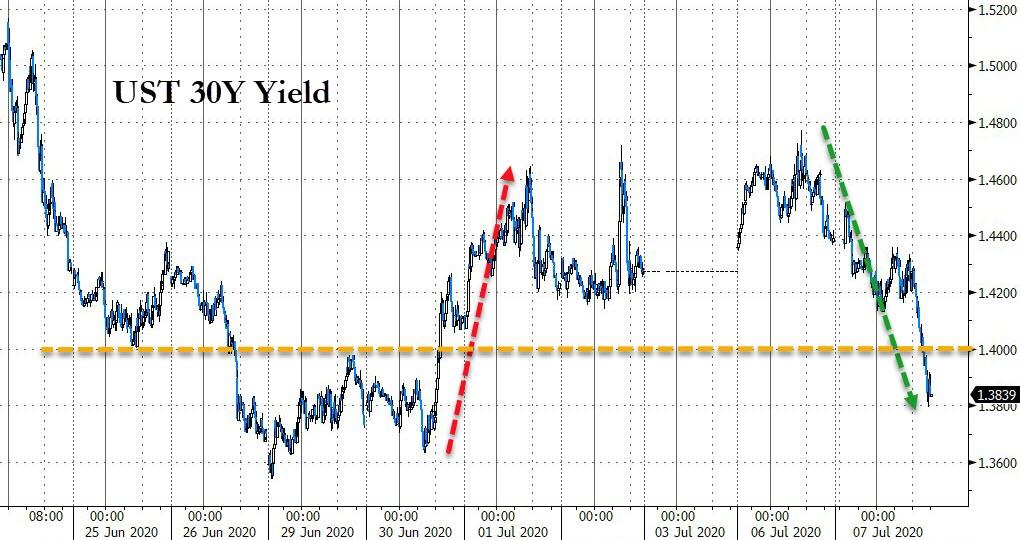

Treasury yields were lower across the curve today with the long-end most notably (30Y -5bps)

Source: Bloomberg

Pushing 30Y Yields back below 1.40%…

Source: Bloomberg

The dollar was stronger today after some weakness overnight (thanks to yuan gains)…

Source: Bloomberg

Offshore Yuan held on to gains from Monday…

Source: Bloomberg

Cryptos were relatively flat on the day…

Source: Bloomberg

big roundtrip in commodities today with copper and gold gaining as silver and crude faded…

Source: Bloomberg

WTI did bounce back above $40 ahead of tonight’s inventory data…

Finally, it’s fun-durr-mentals, stupid!

Source: Bloomberg

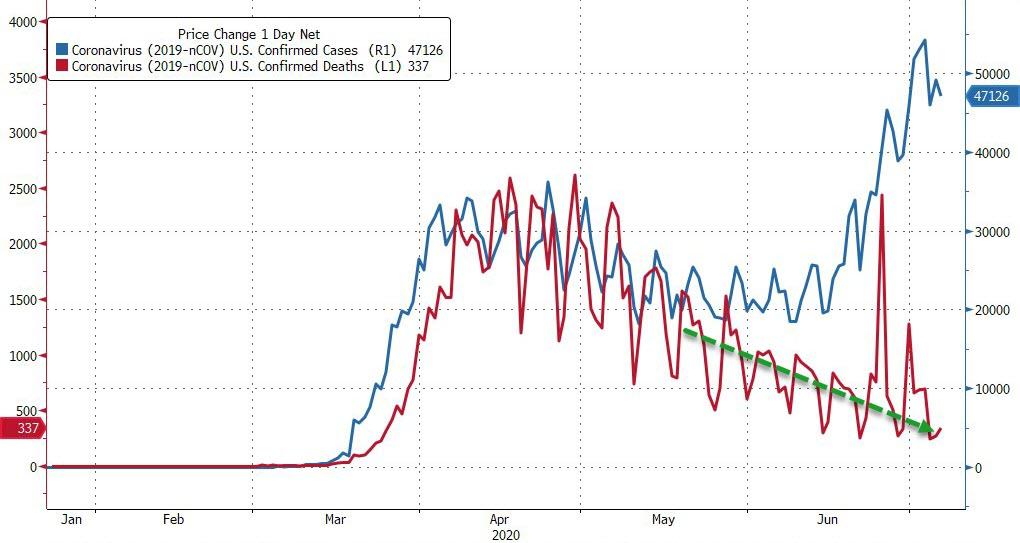

And the good news is that COVID deaths continue to trend notably lower (which may explain why today’s vaccine investment headlines didn’t juice the market 1000s of points higher)…

Source: Bloomberg

via ZeroHedge News https://ift.tt/2VVsjmS Tyler Durden