Is This The Real Reason For China’s Massive Market Meltup?

Tyler Durden

Mon, 07/06/2020 – 21:43

Now that Hong Kong is facing a creeping monetary boycott by the US, and more importantly, by the US financial system as a result of its de facto annexation by China, a pesky question has emerged: how will China procure those much needed dollars which are oh so critical to keep the Chinese financial system, all $40 trillion of it, functioning smoothly.

While there has been surprisingly little discussion of this critical topic in the financial media, which looking at soaring stocks in China and the US is left with the false impression that all is well, one person who has continued to hammer this topic home has been Rabobank’s Michael Every, who this morning once again raised the alert level over China’s USD access:

Note this South China Morning Post article titled “Time for China to decouple the yuan from US Dollar, former diplomat urges”. Zhou Li, a former deputy director of the CCP’s International Liaison Department is “the latest in a series of voices in China” to warn the USD Weapon is real and “has us by the throat”, will pose an “increasingly severe threat” to Chinese development –USD oil sanctions seen as a key area of vulnerability– and so preparations for gradual decoupling and CNY internationalisation should begin “now”. Li adds China should “give up the illusion” of friendship and instead prepare for full-fledged conflict with the US.

His specific proposal is to increase cross-border payments and clearing, local FX settlement, and maximize CNY usage in industrial supply chains. The problems in internationalizing CNY are manifold, however, which is why the USD weapon exists. The capital account would need to be opened, precipitating a collapse in CNY as money floods out.

So with the natural gateway for more inbound dollars suddenly clogged up, China has to find other, just as effective ways to attract US dollars into its economy: by drawing foreign investors into its stock market. Here is Every again:

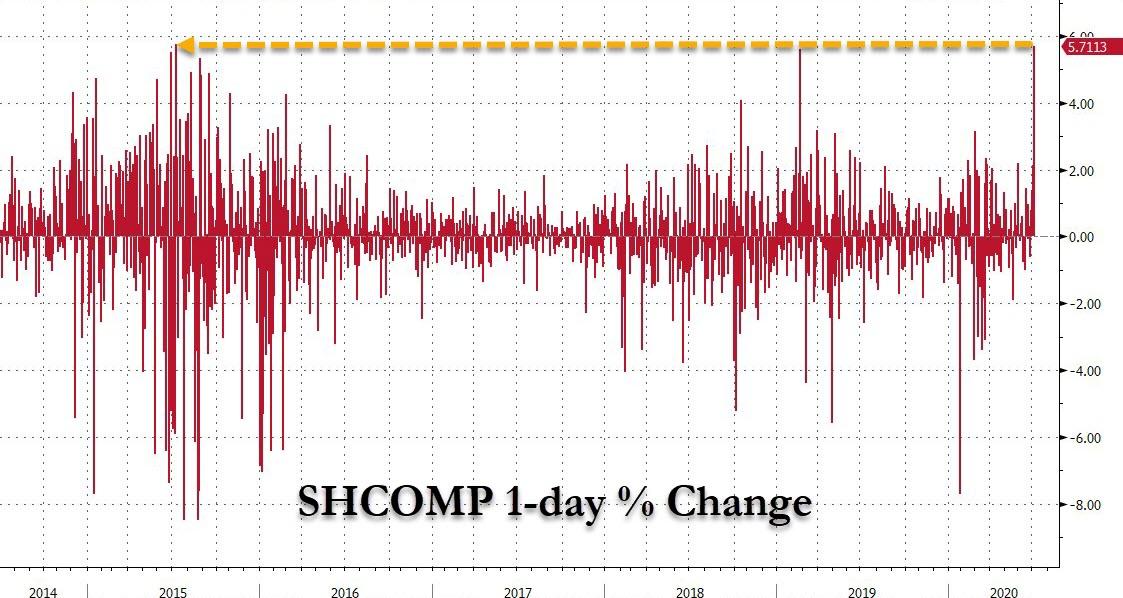

To try to counter that, it’s China bubble time again – not just in property, but in stocks: the Shanghai exchange was up 4% at time of writing today, and 7% last week, as Chinese press openly talk up a new bull market –despite a flat economy– going so far as to imply this is part of the struggle between the “world’s powers”, according to Bloomberg: with different percentages, the same dynamic is of course true in the US. Yet for both this is lethal can-kicking at best that only creates far larger problems.

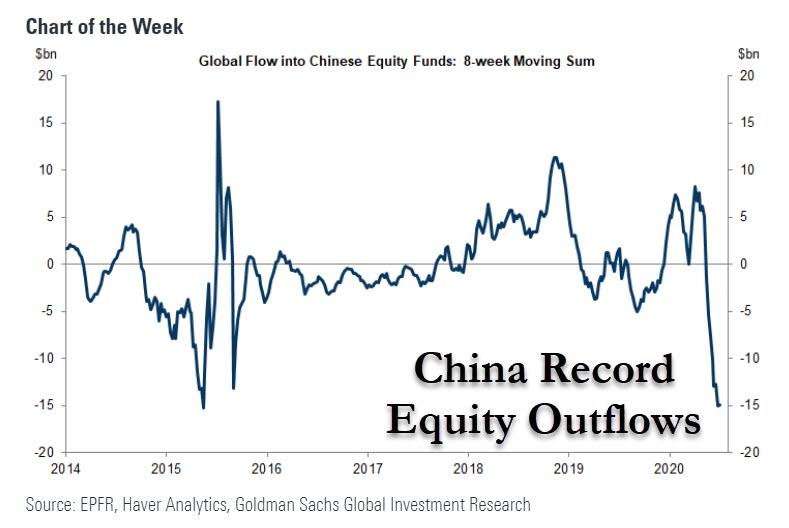

There is just one problem: if Beijing relies on existing inertia it will fail miserably, because as the following Chart of the week from Goldman shows, China-dedicated equity funds saw an 11th consecutive week of net outflows.

And as a result of the substantial outflows, Goldman believes that “underweight positioning may have contributed to the outsized gains in Chinese shares and the Yuan at the start of this week.”

Maybe, but what is far more likely is that Beijing turned on turbo boost in the infamous National Team, aka China’s Plunge Protection Team, which led to a stunning rally in Chinese equities since March, with the CSI300 surging 32% since its Q1 troughs, and 14% in the past 5 trading days, while the Shanghai Composite soared almost 6% on Monday, its biggest one day gain since the bubble of 2015.

So why the massive intervention and ramp of stocks by Beijing officials?

The answer is simple: taking a page of the Robinhood playbook, China is desperate to halt and reverse the massive equity outflows as it urgently needs the flow of US Dollars to reverse into Chinese markets, instead of away from. To do that, it needs to create an initial upward momentum in prices which halts the selling/outflows and prompts a reappraisal of Chinese asset values. Ideally, it will also capture the euphoria of US daytraders who will buy Chinese, not US stocks.

Whether China succeeds is unclear, however it simply has no option and must follow through this plan until the bitter end, even if it means blowing an even bigger stock bubble than in 2015.

And as we reported this morning, Beijing is clearly on board: realizing that the economy is far weaker than a SHCOMP print of 3,400 will support, Beijing still sent a message to the Chinese population when a front-page editorial in the state-owned China’s Securities Journal said that fostering a “healthy” bull market after the pandemic is now more important to the economy than ever.

Why? Because without the “bull market” the equity outflows would continue, and soon China will run out of dollars, an outcome which would have far more catastrophic financial, monetary and geopolitical consequences for both China and the the entire world than a 2nd (and 3rd and 4th) Covid wave, coupled with a Biden win and a permanently jammed Fed money printer.

And so far it’s working: the Shangai Composite is up 2% in early trading…

via ZeroHedge News https://ift.tt/2ZEIXZc Tyler Durden