WTI Steady After Surprise Crude Inventory Build

Tyler Durden

Tue, 07/07/2020 – 16:40

Oil prices fell today amid mounting fears over the recovery and the lack of gasoline demand amid the summer driving season.

“All of the problems oil has had since March are derivatives of the health issues surrounding the coronavirus,” said Bart Melek, global head of commodity strategy at TD Securities.

“There’s nothing policy makers can do on the economic side.”

“The rate at which we are unwinding inventory builds from 1Q and 2Q may be a lot slower, leaving the market in a precarious position in terms of pricing,” Melek said.

The question is, will crude inventories draw for the second week in a row providing some support for prices (with WTI bouncing off $0 intraday today)

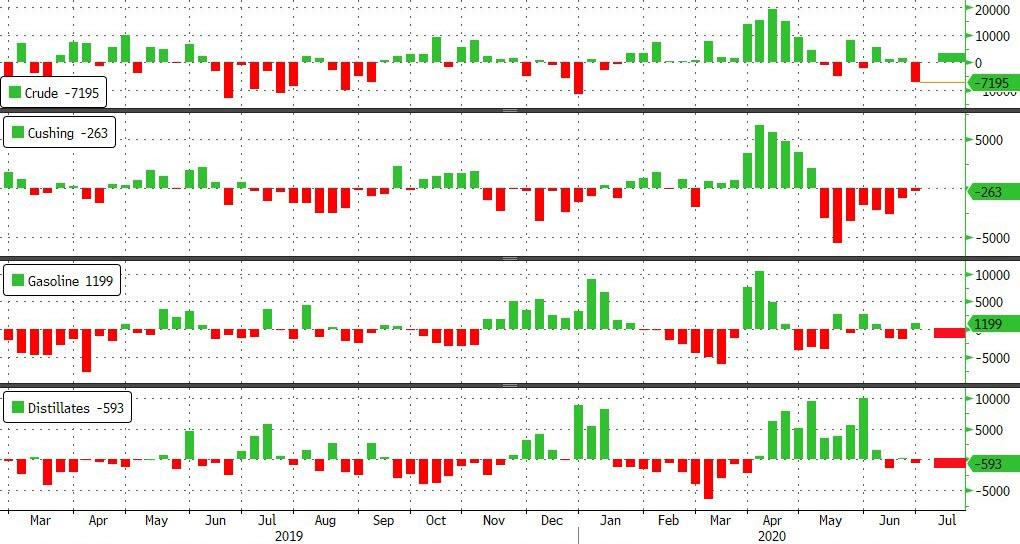

API

-

Crude +2mm (-3.7mm exp)

-

Cushing

-

Gasoline -1.8mm (-1.2mm exp)

-

Distillates -850k (-500k exp)

Crude was expected to see a second notable draw in a row this week but instead built by 2mm barrels…

Source: Bloomberg

WTI traded around $40.30 ahead of the API print (after trading between $40 and $41 intraday) and rebounded very modestly after the data…

“With rising coronavirus cases reported from all over the world and with global oil production expected to rise soon one cannot help but think the medium-term peak is not far away,” said PVM Oil Associates analyst Tamas Varga.

Finally, we note that EIA said today that it expects domestic oil production to an average 11.63 million barrels per day this year, up 0.6% from the previous view, while lifting the 2021 forecast by 1.6% to 11.01 million barrels per day.

“Changes in supply and demand have shifted global oil markets from an estimated 21 million barrels per day of oversupply in April to inventory draws in June,” Linda Capuano, EIAadministrator, said in a statement.

via ZeroHedge News https://ift.tt/2WctTkP Tyler Durden