WTI Slides After Big Crude Inventory Build

Tyler Durden

Wed, 07/08/2020 – 10:35

Oil prices are up overnight despite API reporting a surprising crude inventory build, with WTI testing up towards $41.

“Investors are currently in wait-and-see mode with regards to increased cases in the U.S.,” said Kevin Solomon, an energy analyst at brokerage StoneX Group Inc.

“OPEC+ will continue to follow the pre-announced cuts as demand is currently anemic.”

And all eyes will be not just on inventories but signs of gasoline demand accelerating.

API

-

Crude +2.05mm (-3.7mm exp)

-

Cushing

-

Gasoline -1.8mm (-1.2mm exp)

-

Distillates -850k (-500k exp)

DOE

-

Crude +5.65mm (-3.7mm exp)

-

Cushing +2.206mm

-

Gasoline -4.839mm (-1.2mm exp)

-

Distillates +3.135mm (-500k exp)

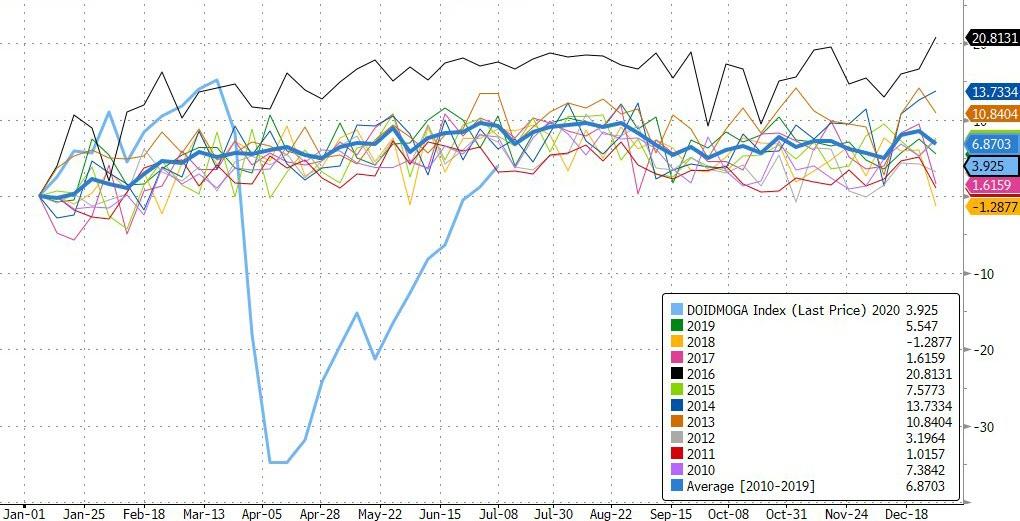

A surprise crude build last night from API went against the analyst consensus and DOE confirmed it – with an even bigger build. Additionally, Cushing saw its first build in 9 weeks…

Source: Bloomberg

US crude production stabilized after the storm Cristobal lock-ins temporarily slowed output.

Source: Bloomberg

Fuel demand has been on everyone’s mind all summer and after the big draw in gasoline, implied demand is gett8ng back to normal…

Source: Bloomberg

However, as Bloomberg notes, today’s data won’t cover the July 4 holiday weekend.

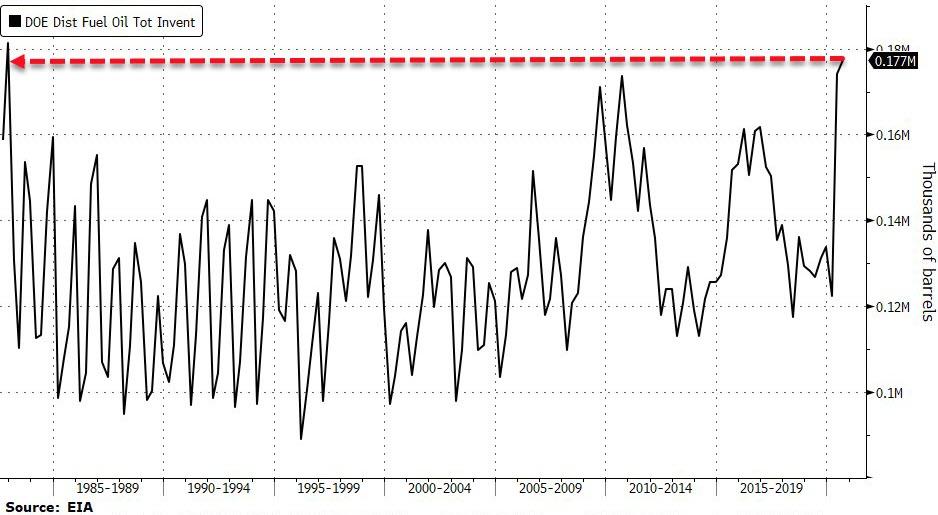

Distillate inventories are at the highest since 1983…

Source: Bloomberg

As Bloomberg warns, American exporters are still dealing with demand concerns, particularly in markets such as China where there’s been a resurgence in Covid-19. On top of that virus, the Asian nation is also battling with massive port congestion and bulging onshore inventories after a previous round of binge buying. That might put the brakes on fresh purchases in U.S. oil.

WTI was trading around $40.65 ahead of the DOE data (up from $40.30 ahead of API last night) and sold off on the bigger crude build…

Bloomberg Intelligence Senior Energy Analyst Vince Piazza concludes that while recent crude drawdowns paint a superficially bullish picture, we feel commodity markets may not be fully factoring in the risk of elevated Covid-19 infections. A stronger-than-expected second wave of the virus would further degrade demand and help to replenish those recently reduced oil stockpiles. WTI’s move above $40 a barrel may encourage some wells to be put back on line, adding supply when it’s least needed.

With heavily populated California, Texas and Florida seeing coronavirus spikes and other states slowing their economic reopenings, we see little chance of sustained improvement in domestic travel demand, which accounts for the bulk of crude consumption.

via ZeroHedge News https://ift.tt/3gDs3Rt Tyler Durden