Dumbfounded By Tesla, Morgan Stanley’s Jonas Cites “The Power Of Hope”, Issues $1800 Price Target Range

Tyler Durden

Thu, 07/09/2020 – 09:06

It’s been a running joke for as long as we can remember that sell side analysts are behind the eight ball. They are notorious for upgrading and downgrading stocks after a large move has already taken place.

But at least they used to do their best to try and spin a yarn explaining the move so their bank’s investment banking clients wouldn’t feel like total idiots for missing the move after paying tons of money for research – just slightly less than total idiots for at least having an explanation.

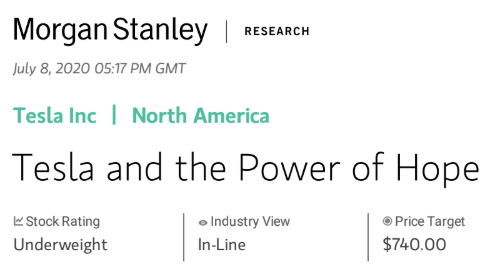

Well apparently that bar for sell side analysts has been lowered again. And for proof, look no further than Morgan Stanley’s Adam Jonas’ last note on Tesla. Jonas, who has watched Tesla blow through most of his price targets for the last few months, continues to try and play catch up: he has raised his Tesla target to $740 (which would represent downside of almost 50% at this point) and has pinned the stock’s move on “the power of hope”.

“Hope is a powerful force,” Jonas’ latest mindless brain-fart begins, “and for millennia has driven mankind to reach for what was never before thought possible. Does anyone doubt how hope has changed the world? The power of hope, the formation of capital and the movement of share prices have long co-existed in a symbiotic relationship. Hope is the fuel of democratic capitalism. It doesn’t always work out, but when it does… it’s special.”

Great. But what the hell does that have to do with equity valuation?

Jonas then writes: “In the case of Tesla, in addition to the company’s proven leadership in EVs and sustainable transport, we believe investor hope has been playing an increasingly important role in driving a higher stock price.”

The diatribe continues: “Folks… we’re not pretending to have discovered a genre of behavioral economics and psychology in financial markets about which much has been written over the decades. We just wanted to highlight, based on our discussions with investors and other stakeholders, that this important engine of hope appears to be a contributing factor at work behind the increase of Tesla’s share price currency, further expanding the collective investor imagination of what is possible.”

Yeah. Hope and extremely interesting out of the money call option purchases that are taking place on a near-daily basis.

But after the feel good sell-side note introduction of the year, Jonas reverts to his “Underweight” stance, choosing to finally address reality as his “analysis” barely bleeds into a second page. He brings up the very real concerns of:

China

2Q deliveries was further evidence of how much Tesla growth (and we believe profitability) is underpinned by an ability to freely/openly pursue a commercial strategy in the PRC. We harbor concerns over the sustainability of this model over the long term and believe investors should apply a discount to China growth and profit.

Competition

While investors, understandably, do not appear too concerned with the incursion of competing EV offerings to date from legacy auto OEMs, we do not believe that is where the biggest threat comes from. We continue to follow Amazon’s building of its captive transportation network that we ultimately see as becoming a formidable competitor to Tesla in many key markets. We urge investors to prepare for similar moves from the likes of Alphabet/Waymo, Apple and others.

“High Expectations”

At $1,400, we estimate the current price is discounting 2030 volume of at nearly 5 million units or more than 10x the volume the company appears on track to achieve this year. On our calculations, the earnings power embedded in the current market cap would imply group EBITDA margins in the 20% range or higher. We’re not saying these are assumptions are not possible, but they are a very big leap ahead from what the company has proven to date and implies a level of commercial success in a global EV market at less than 2% penetration today.

Caution About Full Self-Driving, Which We Again Remind You Does Not Exist

As one of the earliest firms to analyze the AV market in our 2013 Blue Paper, Autonomous Cars: Self-Driving the New Auto Industry Paradigm (6 Nov 2013), we have worked across multiple sectors and engaged with numerous parties in the AV value chain. While we see significant long-term potential for the technology, we are extremely cautious on adoption rates over the next decade where we forecast full self-driving to be less than 0.3% of global miles traveled by 2030. Our concerns around the moral, ethical, legal/regulatory and even the technological hurdles that must be overcome appear largely ignored by the market, in our opinion. Tesla may be a leader in the field, but we believe realization of the TAM for AVs will disappoint investors in the near to medium term.

For added laughs, Jonas also throws in a $2070 bull case for the stock, nearly 3x his price target. “Our bull case valuation for TSLA is $2,070 and our bear case is $281,” the note concludes.

This gives Jonas a nice, wide $1800 price target range to get it right before his next “update”.

If Jonas wants a real explanation, perhaps his time would be better served looking into the mechanics of the options market instead of feeling forced to drop a Tesla note every time the stock makes a profound move that he failed to predict would happen, leaving him to opine on it after the fact.

via ZeroHedge News https://ift.tt/2AMdQ5C Tyler Durden