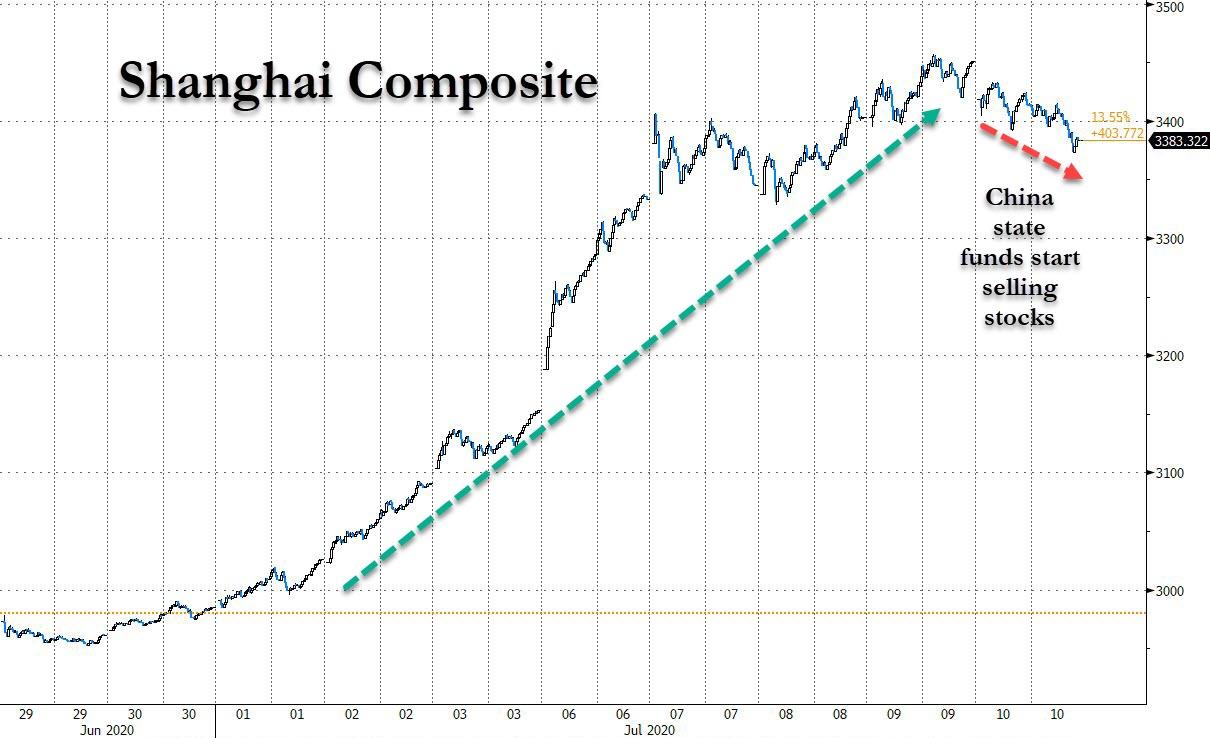

Futures Slide, Follow China Lower After Beijing-Owned Funds Start Selling Stocks

Tyler Durden

Fri, 07/10/2020 – 08:02

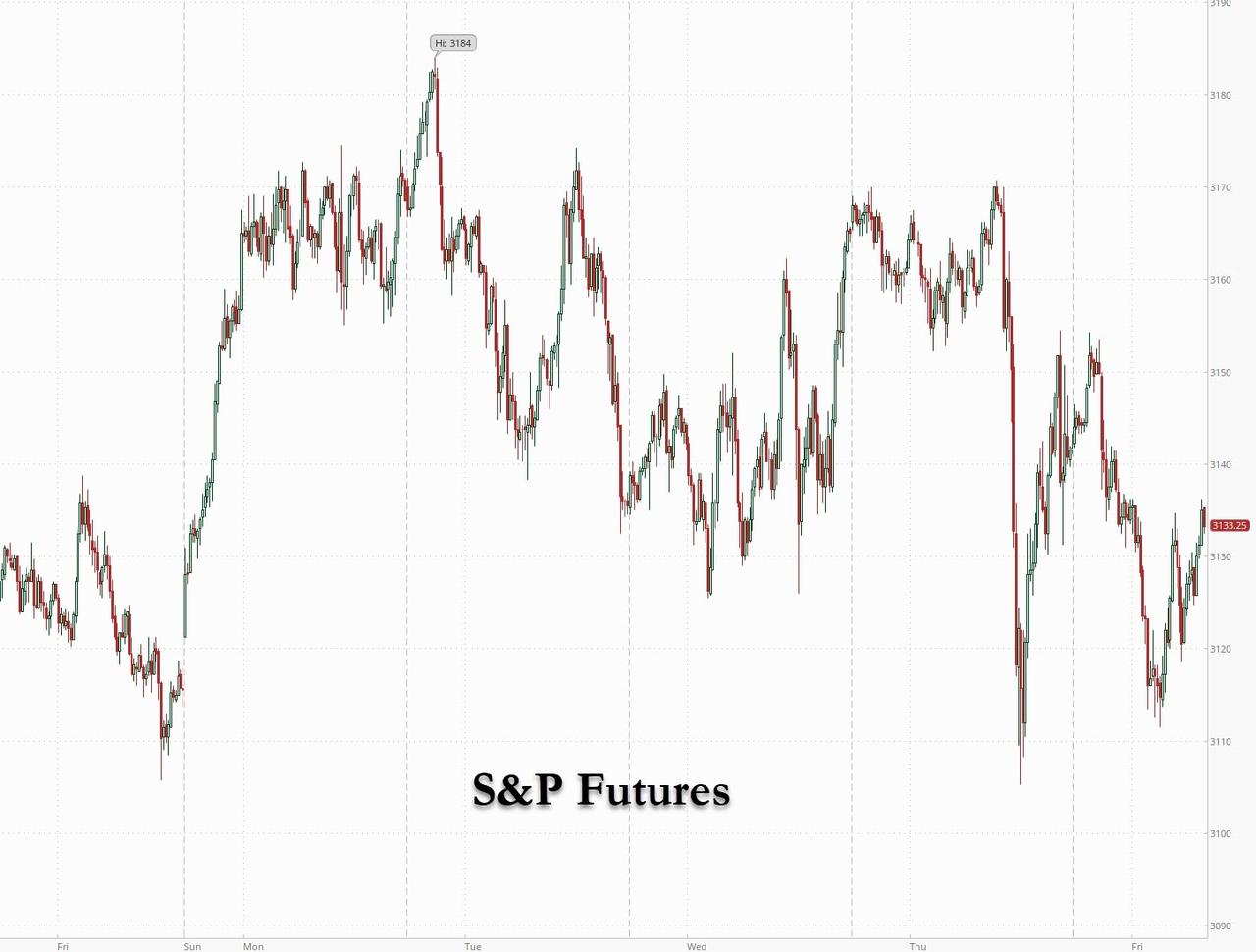

US stock futures slipped on Friday as the buying frenzy in China fizzled and fears re-emerged that record increase in coronavirus cases could lead to another hit to Corporate America with several states delaying the easing of business restrictions. Treasuries jumped, sending five-year yields near a record low.

Chinese stocks slumped for the first time in over a week after Beijing acted to cool the speculative frenzy in its $9.5 trillion stock market, ending a euphoric eight-day surge that had fueled worries of a new bubble in the making. The selling in the Shanghai Composite started after Bloomberg reported that two government-owned funds announced plans to trim holdings of stocks that soared this week.

China’s National Council for Social Security Fund – the country’s national pension fund – said Thursday it intends to sell a stake of as much as 2% in People’s Insurance Company (Group) of China Ltd. The fund, which oversees about 2.2 trillion yuan ($314 billion) in assets, said the sale was part of its “regular divesting activities.” The stock dropped 7.4% in Shanghai, the most in five months. Additionally, the National Integrated Circuit Industry Investment Fund Co. – a smaller state-backed semiconductor fund aimed at fostering China’s homegrown chipmakers – announced plans to offload shares in three firms. Textile maker Wuxi Taiji Industry Co., Shenzhen Goodix Technology Co., and Beijing BDStar Navigation Co. fell at least 3.8%.

Separately, on Friday the state-run China Economic Times warned about the dangers of a “crazy” bull market, while Caixin reported that regulators had asked mutual fund companies to cap the size of new products. Meanwhile, foreign-based funds turned net sellers of Chinese shares for the first time this month on Friday, dumping a net 4.4 billion yuan, the most since late March. They had pumped a net 63 billion yuan across the border via exchange links in July.

“The signal could not be clearer — stocks have just become too hot for the regulators’ liking,” said Niu Chunbao, a fund manager at Shanghai Wanji Asset Management Co. “A slight dip or so may put their minds more at ease at this point.”

As a result, the Shanghai Composite closed down 2% and the SSE 50 Index of Shanghai’s largest stocks ended the day 2.6% lower. The index had closed Thursday within 2% of its intraday peak in 2015.

The end of China’s rally sent a shockwave around the globe sending US index futures modestly in the red and almost wiping out all of the week’s gains, while traders also focused on record deaths in Florida, Texas and California from the virus. 41 of the 50 U.S. states have reported an increase in COVID-19 cases over the last two weeks, while the country registered the largest single-day increase in new infections globally for the second day in a row on Thursday. The surge has forced Americans to take new precautions, with several states backpedaling on reopening plans but likelihood of a lockdown similar to February and March seems unlikely, according to market experts.

“We’re going to see intermittent periods of shutdowns over the next year or so while we’re still grappling with this virus,” Erin Browne, a multi-asset portfolio manager at Pacific Investment Management Co. said on Bloomberg TV. “But I wouldn’t expect we’re likely to see a wholesale shutdown of the U.S. economy like we saw earlier this year.”

At 7:45 a.m. ET, Dow e-minis were down 89 points, S&P 500 e-minis were down 9.25 points, and Nasdaq 100 e-minis were down 21.50 points. Energy stocks Occidental Petroleum and Exxon Mobil dropped 1.7% and 1% respectively in premarket trading, as oil prices retreated on concern about the pace of economic recovery and fuel demand.

In Europe, tech shares helped the Stoxx Europe 600 Index erase an earlier decline after Apple chipmaker TSMC posted revenue just above estimates for the June quarter. Carlsberg A/S climbed after it said the slump in western European beer sales has moderated. European stocks climbed to a session high, rising 0.7% as of noon London as all industry sectors turned positive. Autos lead gains, up 1.6%, with technology, chemicals and real estate among other subgroups rising 1% or more.

As noted above, Asian stocks fell, led by finance and materials, after rising in the last session. Trading volume for MSCI Asia Pacific Index members was 47% above the monthly average for this time of the day. The Topix declined 1.4%, with Voltage and Nomura falling the most. The Shanghai Composite Index retreated 1.95%, with Zheshang Bank and Genuine New posting the biggest slides

Attention now shifts to the second-quarter earnings season, which will begin with reports from big banks on Tuesday. Overall profits for S&P 500 firms are expected to plunge the most since the financial crisis.

In FX, the Dollar remains elevated after yesterday’s swift and sudden rebound on deteriorating sentiment surrounding fresh coronavirus outbreaks in the US and elsewhere, with the DXY getting very close to 97.000 again having fallen to a 96.233 low and failing to derive any initial momentum from encouraging weekly jobless claims data. However, the Greenback is paring some gains vs major counterparts ahead of PPI and the weekend as crude prices bounce on an upgrade in the IEA’s 2020 global oil demand forecast due to a smaller Q2 drop than previously envisaged. The yen rose versus all G-10 peers followed by the Swedish krona and Danish krone as the interbank market cleared out long positioning into the weekend, according to Asia-based FX traders. “The resurgence of the coronavirus, especially increased death tolls, is seen as a risk-off catalyst,” said David Lu, director at NBC Financial Markets Asia in Hong Kong. “That’s leading to yen buying.”

In rates, Treasuries resumed bull-flattening Friday as S&P 500 E-mini futures followed Asian equities lower weighing on risk sentiment. Even as 5-year yield touched a record low 0.256%, long-end outperformance sent 5s30s curve below 100bp for first time since May 15, approaching 100-DMA, support since mid-March. Treasury yields were lower by 1bp to 5bp across the curve, 10-year 0.586% after touching 0.568%, lowest since April 22 and within 3bp of a presumed convexity trigger level; it’s ~8bp lower on the week.

Elsewhere, oil traded around $39 a barrel in New York. In the U.K., yields on two- and five-year notes hovered near all-time lows amid speculation that the Bank of England may further ease monetary policy.

Looking at the day ahead, the data highlights include French and Italian industrial production for May, along with the Canadian jobs report for June and the June PPI reading from the US. We will also hear from the ECB’s Hernandez de Cos, while Singapore is holding a general election. Finally we could get more commentary on the Recovery Fund in Europe from the ECOFIN meeting press conference due at 13.15 CET.

Market Snapshot

- S&P 500 futures down 0.6% to 3,122.75

- STOXX Europe 600 up 0.2% to 364.52

- MXAP down 1% to 164.70

- MXAPJ down 1.1% to 547.53

- Nikkei down 1.1% to 22,290.81

- Topix down 1.4% to 1,535.20

- Hang Seng Index down 1.8% to 25,727.41

- Shanghai Composite down 2% to 3,383.32

- Sensex down 0.5% to 36,542.83

- Australia S&P/ASX 200 down 0.6% to 5,919.22

- Kospi down 0.8% to 2,150.25

- German 10Y yield fell 1.5 bps to -0.478%

- Euro up 0.02% to $1.1287

- Italian 10Y yield rose 2.2 bps to 1.097%

- Spanish 10Y yield unchanged at 0.408%

- Brent futures down 2.3% to $41.37/bbl

- Gold spot up 0.2% to $1,806.42

- U.S. Dollar Index little changed at 96.72

Top Overnight News

- China acted to cool the speculative frenzy in its $9.5 trillion stock market, ending a euphoric eight-day surge that had fueled worries of a new bubble in the making.

- The European Central Bank isn’t done expanding its bond-buying program yet, according to economists, despite recent remarks by policy makers that the outlook has brightened slightly.

- Oil fell as the International Energy Agency said a jump in Covid-19 cases could derail the market recovery, while Libya signaled the potential restart of crude exports.

Asian stock markets were negative following a lacklustre performance across global peers amid lingering coronavirus concerns and as US-China tensions were stoked by several escalatory reports such as the US enacting sanctions on 4 Chinese individuals for human rights abuses including the Xinjiang security bureau director and a top member of the Chinese Communist Party. ASX 200 (-0.6%) was led lower by underperformance in the energy sector after the recent pullback in oil prices and amid ongoing lockdown headwinds, with the Victoria state Treasurer anticipating GDP to decline 14%, although the downside for the index was stemmed by resilience in the tech sector which continued to ride on the work from home bandwagon. Nikkei 225 (-1.1%) was subdued by the weight of the haven currency inflows and with some large retailers pressured including Fast Retailing, Seven & I and Lawson after weaker earnings. Hang Seng (-1.8%) and Shanghai Comp. (-2.0%) underperformed after PBoC inaction resulted to a total CNY 290bln liquidity drain this week and as anti-China sentiment persisted with the Trump administration said to be finalising regulations this week that will bar US government from purchasing goods and services from several Chinese tech firms including Huawei and ZTE. Furthermore, it was also reported that China state funds were also said to plan cutting holdings in some companies including PICC. Finally, 10yr JGBs were slightly higher due to the weakness in stocks and following the bull flattening stateside in the aftermath of a blockbuster 30yr auction, while the BoJ were also present in the market today for JPY 870bln on JGBs with an emphasis on 1-3yr and 5-10yr maturities. China state funds are said to be planning to cut holdings in PICC and other China-listed firms, with China’s National Council for Social Security Fund planning to sell up to 884.5mln A-shares in PICC or a 2% stake valued around USD 1bln during the next 6 months, citing the need for asset allocation and investment.

Top Asian News

- China Points to Shrimp as Covid-19 Carrier After Salmon Debacle

- Tencent Is Said in Talks for Hong Kong-Listed Gaming Firm Leyou

- Philippine Lawmakers Deny TV Giant ABS-CBN’s Franchise Bid

- Empty Offices Growing in Tokyo as Virus Gives Tenants Pause

A choppy session for European equities as the region swings between gains and losses [Euro Stoxx 50 +0.2%] as sentiment somewhat improves from the downbeat APAC session in early hours. Europe opened with broad-based losses of some 0.5% but the upside coincided with the IEA oil market reported which raised its global oil demand growth forecasts which noted that demand decline in Q2 was less severe than expected. Furthermore, the unveiling of the compromise EU recovery fund underpinned benchmarks amid attempts to narrow the rift among EU members, whilst unanimous backing is not needed, thus decreasing chances of a veto. Nonetheless, major bourses are mixed with no stand-out out/underperformer. Sectors are also mixed with little by way of a risk-tone to be derived, with the detailed breakdown providing no further meat on the bone. The IT sector outperforms following numbers from chip giant TSMC which topped revenue estimates; thus propping up fellow chip names such as STMicroelectronics (+5.0%), Infineon (+2%). The energy sector meanwhile remains the underperformer. Energy names meanwhile remain subdued amid price action in the complex with Shell (-0.7%) and BP (-0.3%). In terms of individual movers, LVMH (-0.7%) and Kering (-0.2%) are subdued amid source reports US may release a French tariff list targeting French wine, cheese and handbags, however, Pernod Ricard (+0.1%) holds its ground, potentially due to the recent announcement of French aid for the wine sector.

Top European News

- England Eases Virus Rules to Open Gyms, Allow Outdoor Arts

- ECB Seen Boosting Stimulus by December to Aid Fledgling Recovery

- Italy Is Said to Be In Talks to Buy Into Telecom Italia Network

- Dufry Retreats as MainFirst Cuts to Sell, Slaps on Street-Low PT

In FX, the Dollar remains elevated after yesterday’s swift and sudden rebound on deteriorating sentiment surrounding fresh coronavirus outbreaks in the US and elsewhere, with the DXY getting very close to 97.000 again having fallen to a 96.233 low and failing to derive any initial momentum from encouraging weekly jobless claims data. However, the Greenback is paring some gains vs major counterparts ahead of PPI and the weekend as crude prices bounce on an upgrade in the IEA’s 2020 global oil demand forecast due to a smaller Q2 drop than previously envisaged.

- JPY – Notwithstanding the Buck’s renaissance, demand for the Yen has pushed Usd/Jpy down through 107.00 and a multi-month bull level at 106.90 to expose 106.75 and deeper lows, while Jpy crosses are also depressed on the aforementioned renewed risk aversion.

- AUD/CAD/NZD – Hardly a surprise to see the activity/cyclical/commodity bloc underperforming, with the Aussie back around 0.6950, Loonie pivoting 1.3600 and Kiwi straddling 0.6550 having hit peaks around 0.7000, 1.3500+ and 0.6600 respectively on Thursday. Ahead for the Cad, jobs data for June will be watched closely for more signs of recovery following a rather downbeat Canadian economic and fiscal update.

- EUR/GBP – Both narrowly mixed vs the Dollar, but struggling to keep sight of round numbers relinquished when the Usd took flight late in the EU session yesterday, and with the Euro also capped by decent option expiry interest between 1.1300-10 (1 bn) and bearish Eur/Gbp impulses. On that note, Eur/Usd is also eyeing some technical levels in the form of the 200 HMA (1.1272) and a Fib retracement (1.1262).

- CHF/NOK/SEK – The Franc is softer across the board with any sign of safe haven positioning more than offset by the fact that SNB will be on the offer, while the Norwegian Crown is lagging due to the recoil in oil rather than inflation data that was somewhat mixed vs consensus. Conversely, the Swedish Krona is bucking risk-off leanings after Riksbank minutes reaffirming a high bar for reverting to a sub-zero repo rate and more likelihood of further stimulus via QE if required

In commodities, IEA raises 2020 oil demand forecast by 400k BPD to 92.1mln BPD; demand decline in Q2 was less severe than expected; 2021 demand rise is lower than previously expected due to improved 2020 recovery view; outlook skewed to the downside. Additionally, Global oil supply fell by 2.4mln BPD in June to a 9yr low. US production in May fell 1.3mln BPD MM and June fell by 500k BPD. Highlights that Libya’s oil production by end 2020 could be as much as 900k BPD higher than today.

US Event Calendar

- 8:30am: PPI Final Demand MoM, est. 0.4%, prior 0.4%; Final Demand YoY, est. -0.2%, prior -0.8%

- 8:30am: PPI Ex Food and Energy MoM, est. 0.1%, prior -0.1%; PPI Ex Food and Energy YoY, est. 0.4%, prior 0.3%

DB’s Jim Reid concludes the overnight wrap

Apologies for going on about golf again but after shooting the worst round since I was 11 on Sunday (a 95 playing off 6) – the latest in a dismal run – I booked in a heart to heart with my golf coach last night as to whether we should continue to work together and complete the overhaul of my swing. He decided it was best we played on the course. He said he wanted to do things differently. He said forget everything I’ve taught you, trust it’s working in the background and just clear your head and say “back” at the top of your swing and “hit” when you’re striking the ball. He was trying to get me free of any swing thoughts apart from rhythm. I’m not a fan of this sort of new age thinking but played along. 10 holes later and 6 more than we planned, I had to walk off the course as my wife WhatsApp-ed me to not so politely enquire where I was as she had to put the kids to bed alone and dinner was ready. I for once was happy to face the music as I had parred every hole. In 35 plus years of playing golf I’m not sure how many times (if ever) i have parred the first 10 holes. Anyone that has played golf will I’m sure sympathise how maddening this game is. I was nearly in tears on Sunday and last night went to bed singing “back” and “hit” over and over again. Let’s see what happens in the second cup competition of the season tomorrow.

“Back” and “hit” were needed by the market yesterday to restore rhythm after a choppy session of rising coronavirus cases, associated fears of further economic slowdowns, and potential political volatility. By the close, the S&P 500 was down by -0.56%. However following a Supreme court ruling concerning Mr Trump and also record fatalities being announced in some heavily affected US states, the index was down as much as -1.71% just prior to European markets closing. Following Europe closing their laptops, US stocks ground higher primarily on the strength of Technology and Consumer Discretionary stocks – the latter of which was primarily driven by Amazon (+3.29% yesterday). Once again that stark outperformance of tech stocks saw the NASDAQ as one of the few global indices positive on the day, up +0.53%. Over in Europe, the STOXX 600 gave up its weekly gains with a -0.77% decline, as other bourses including the FTSE 100 (-1.73%) and the CAC 40 (-1.21%) suffered losses too. The DAX (-0.04%) was almost the exception thanks to a +3.99% advance from SAP after the company reported stronger than expected preliminary results for Q2 revenue.

Overnight markets in Asia are trading down with the Nikkei (-0.25%), Hang Seng (-1.17%), Shanghai Comp (-1.05%), Kospi (-0.67%) and Asx (-0.33%) all seeing losses. Declines for Chinese markets came with news that two state-backed funds have said that they plan to trim holdings in a sign that the government wants to slow down the rally. In FX, the US dollar is up +0.17%. Futures on the S&P 500 are also down -0.23% while WTI crude oil prices are down c. -1%.

In other news, the Fed’s balance sheet shrank for a fourth week, with the total size back below $7 tn, as emergency loans extended to primary dealers and foreign central banks to shore up dollar liquidity at the depth of the COVID-19 crisis matured. Short-term cash loans to dealers and foreign central banks repurchase agreements, fell to 0 (vs. $442bn at peak in mid-March) in the week through July 8 while Foreign-exchange swaps with the US central bank’s counterparts abroad dropped to $179 bn (from $449bn at peak in end of May). The decline underscores some normalisation in the working of the financial markets since the peak of the crisis.

Yesterday brought further negative news on the coronavirus pandemic as the case numbers continued to rise across the world. In the US, new cases were over 80,000 for the first time, rising by +2.8%, the highest daily increase since May. Fatalities are starting to rise slowly as well but still not at the pace of the first wave. Florida reported a further 120 deaths in what was a daily record, while the number of cases rose by a further 4%, compared to the average weekly rise of 5%. California recorded a record one day rise in fatalities as well, however the Governor cautioned that the data included some delayed reporting. Cases in the state rose by over 11,000, above the 8040 7-day average. In Arizona, there was a further 3.7% rise or just over 4000 cases. This was the highest daily rise in a week, while the percentage increase was in-line with the 7-day average. Hopefully the somewhat slowing caseloads in these heavily affected states means that the recent acceleration of cases is slowing somewhat following some health measures being reinstituted over a week ago.

Here in the UK, we got the news that indoor gyms and swimming pools will be reopening from July 25. While some recreational team sports can begin as soon as this weekend, starting with cricket tomorrow. The club I am the President of (I’ve kinda retired) are playing their first matches tomorrow. They are very excited. Outdoor swimming pools can reopen tomorrow as well, with beauticians, salons and spas reopening Monday. However, in spite of Chancellor Sunak’s fresh economic support package the previous day, further retail job losses were announced, including 4,000 at Boots and another 1,300 at John Lewis. That’s 30,000 retail jobs lost over the last 2-3 weeks according to Sanjay Raja in our U.K. economics team.

One piece of more positive news yesterday came thanks to a better-than-expected reading from the US initial weekly jobless claims, which fell to 1.314m in the week through July 4 (vs. 1.375m expected). That’s the 14th consecutive week of falls since the peak of 6.867m back at the end of March, and the -99k reduction on the previous week is the biggest in 4 weeks. Furthermore, the continuing claims number for the previous week through June 27 was also better-than-expected at 18.062m (vs. 18.8m expected), with the insured unemployment rate falling to 12.4%, easing fears that the labour market recovery could be at risk of stalling. Nevertheless, it’s worth noting that the 1.314m initial claims figure is still well above the pre-Covid record of 695k, so there’s still a long way to go before a return to labour market normality.

Staying with the US, yesterday saw Democratic presidential nominee and former Vice President Joe Biden unveil the first part of his economic plan, with the tagline “Build Back Better”. The message was delivered in the swing state of Pennsylvania, not far from his childhood hometown of Scranton. Former VP Biden called for stricter new rules to “Buy American”, while leveraging tax and investment policy to create manufacturing jobs in the US, and reduce reliance on foreign supply chains. Mr. Biden’s plan specifically proposed a $300bn increase in government spending on research and development for new technologies like electric vehicles and 5G cellular networks, as well as an additional $400 billion in federal spending on US manufactured products. On the topic of paying for his economic plan as well as the recovery from the coronavirus, Mr. Biden has proposed to offset much of spending plans with nearly $4tr in tax raises. These would largely be done by reversing some of President Trump’s tax cuts.

Markets are likely to pay increasing attention to the former VP over the coming weeks, since his continued strong performance in the polls has forced investors to consider the implications of a Biden presidency, not just on domestic policy but also on what it could mean for global trade and the USA’s relations with China and the EU. Biden now leads President Trump by 9.5pts according to the FiveThirtyEight polling average, and this frontrunner status has been increasingly reflected in betting and prediction markets too, with both PredictIt (60%) and the Betfair Exchange (63%) now putting him in pole position for the White House. Meanwhile, the President got news that he will most likely be able to keep his personal financial records out of public record until after the November election, after the Supreme Court ruling blocked Congress from subpoenaing his records. The court ruled that federal appeals courts needed to close scrutinise Trump’s contentions that the document demands are unnecessary and would be too intrusive. In the other case, the Supreme Court ruled that a New York grand jury could receive President Donald Trump’s financial records, with the Chief Justice Roberts saying, “No citizen, not even the president, is categorically above the common duty to produce evidence when called upon in a criminal proceeding.” Regardless it is unlikely, Mr. Trump will see those documents unsealed prior to November. As noted above, the S&P fell -0.5% following the initial ruling, before the losses accelerated as elevated cases numbers were announced. The latter continues to be the potentially more damaging factor for the President’s reelection odds.

Turning elsewhere, core sovereign bonds rallied yesterday as investors sought out safe assets, with 10yr Treasury yields falling -5.1bps to close at 0.614%, their lowest level in over 2 months, just as the dollar strengthened by +0.28% in its biggest move up in 2 weeks. Bund yields saw their own -2.3bps move lower, while in the UK 5yr gilt yields fell by -1.9bps to a fresh record low of -0.06%. While we’re on the UK, we should mention that once again there seemed to be little progress in the Brexit negotiations, with the EU’s chief negotiator Michel Barnier tweeting yesterday that the latest discussions this week “confirm that significant divergences remain”.

One safe haven that didn’t manage to sustain its advance yesterday was gold, which fell -0.30% to come down from its 8-year high the previous day. Other commodities struggled too, with Brent Crude (-2.17%) and WTI (-3.13%) both suffering in line with the broader move lower in risk assets. Copper prices continued to power forward for an 8th straight day however, climbing to a fresh 5-month high.

To the day ahead now, and the data highlights include French and Italian industrial production for May, along with the Canadian jobs report for June and the June PPI reading from the US. Otherwise there isn’t a great deal happening, though we will hear from the ECB’s Hernandez de Cos, while Singapore is holding a general election. Finally we could get more commentary on the Recovery Fund in Europe from the ECOFIN meeting press conference due at 13.15 CET.

via ZeroHedge News https://ift.tt/2ChFfg5 Tyler Durden