Cross-Asset Valuations Suggest That The Market Is Deeply Suspicious Of Growth Returning To Normal

Tyler Durden

Sun, 07/12/2020 – 18:00

Authored by Morgan Stanley chief global economist, Andrew Sheets

Will there be a V-shaped global recovery? Probably no financial question is more important, or more poorly defined. The intensity of investor debate over which letter the economy will resemble, with no broad agreement on what those letters mean, remains a major challenge. Morgan Stanley’s forecast for a V-shaped recovery has US and DM growth returning to pre-recession levels by 4Q21, faster than consensus and much faster than the recuperation from the global financial crisis. But it will still be 18 months before growth returns to normal; even a V-shaped recovery takes time.

That slog would seem to stand in sharp contrast to action in the financial markets, which, free to look ahead, have roared back from the lows. Global equities are up almost 40% since late March, causing a healthy amount of scepticism that “markets have run ahead of the fundamentals”. We see this concern in investors’ positioning, read it in the financial press, and hear it in client conversations. There’s just one problem with this view: if markets are pricing a ‘V’, they’re going about it in an odd way.

Since there’s no common definition for ‘V-shaped’, we’re going to support the home team and use Morgan Stanley’s above-consensus economic forecasts. They assume a modest second wave of infections this winter, widespread availability of a vaccine in the US by mid-2021, and continued support from fiscal and monetary policy. They expect that pent-up savings will support consumer spending next year even as businesses are slower to respond, and that the global economy won’t suffer a lasting, deflationary shock.

Markets have other ideas. Cross-asset valuations suggest that the market is deeply suspicious of growth returning to normal, worries about ongoing market volatility, and expects deep scarring in the US and global economy for years to come. There are many ways to describe such a scenario, but ‘V’ isn’t among them.

Let’s start with expected growth. Greater optimism on the recovery should boost demand for smaller, more cyclical businesses, which have more gearing to economic activity. It should reduce the discount for lower-quality companies and credits, as a rising tide lifts more boats. It should lead to higher yields, as economic normalcy removes the need for extremely accommodative policy.

That’s not exactly happening. Relative valuations for global small caps versus large caps are well below average, and low-quality stocks have almost never been cheaper to high-quality ones. The basis between BBB and A rated credit, and B and BB rated credit, remains elevated. And developed market yields are still within a whisker of all-time lows, despite the improvement in stock markets and economic indicators.

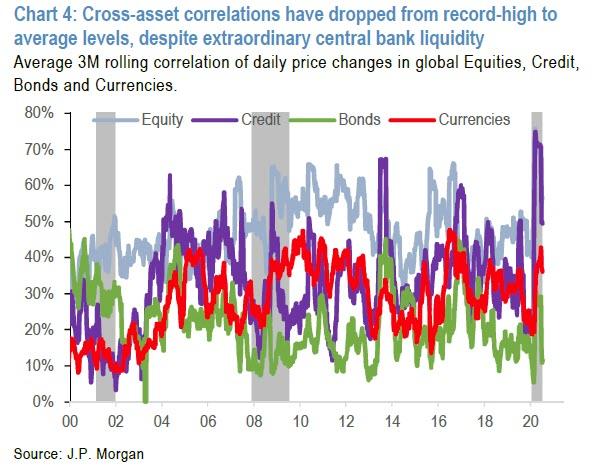

Volatility markets also suggest scepticism about a return to normal. Implied equity and credit vol sit in the top 15% of all observations of the last 20 years (the very opposite of ‘normal’), while skew, a measure of how much extra investors are willing to pay for disaster protection, has rarely been higher. Neither suggest a market that’s pricing a return to normal any time soon.

And then there’s the long term. Looking beyond 2021 may feel like a luxury, but what market pricing implies is still remarkable: a Fed that won’t raise interest rates until 2024. A US 10-year yield that’s sub-2% past 2035. US CPI inflation averaging ~1.6%Y, well below the Fed’s inflation goal, through 2050.

All this means that we don’t think markets are priced for our economists’ forecasts for a V-shaped recovery. It also makes three events this month important:

- 2Q earnings season kicks off next week, and my colleague Mike Wilson thinks it will more likely help than hurt. Companies should be able to report a better trajectory of business since the March lows, leading to a sustainable bottom in earnings revisions. Banks, which have lagged the market, will be among the first to report.

- The European recovery fund, which my colleagues Reza Moghadam and Jacob Nell expect to be approved by the end of the month, and which my colleague Graham Secker sees as a positive catalyst for European equities.

- Further US fiscal stimulus, which my colleague Michael Zezas believes will amount to another ~US$1 trillion, to be approved near month-end. The failure of such a measure would mean significantly higher risk for markets.

After July, these catalysts will be behind us and the tactical environment looks more challenging: First things first; we think that positive events still lie ahead over the next several weeks, and among the various risks facing markets, ‘priced for a V’ isn’t at the top of our list.

via ZeroHedge News https://ift.tt/3eiaXXL Tyler Durden