Key Events In The Coming Week: Here Comes The Worst Earnings Season Since The Crisis

Tyler Durden

Mon, 07/13/2020 – 09:42

In looking at the week’s main events, DB’s Jim Reid writes that the week’s highlight is the EU summit on Friday where leaders will gather to discuss the recovery fund. In addition to this, we’ll also see the ECB, the Bank of Japan and others make their latest monetary policy decisions. Meanwhile, earnings season kicks off, including a number of US financials reporting. Economic data includes China’s Q2 GDP reading along with a number of June releases out from the US.

Looking at these in order of importance, the EU leaders summit in Brussels on Friday and into Saturday will discuss the recovery fund in response to the pandemic, as well as the EU’s new long-term budget. The baseline expectations from WS economists is that there will be a deal on the recovery fund at this meeting, but it remains a close call. If an agreement weren’t to be reached there, then they still expect one within weeks. It’s worth remembering that there are number of complex issues to be worked out, including the ratio of grants to loans, with the so-called “frugal four” of the Netherlands, Austria, Sweden and Denmark looking for there to be loans rather than grants. Their support for the fund will be necessary as it requires the unanimous approval of the member states.

The ECB a day earlier should be a non event with maybe some focus on any comments from President Lagarde on the German Constitutional Court, now that the German Bundestag has passed a motion on proportionality. The BoJ meeting on Wednesday should also be a relatively tame affair. Also in the world of central banks the Canadian, Korean and Indonesian policy makers meet and the Fed release their Beige Book on Wednesday.

Moving on to data releases, the main highlight is likely to be China’s Q2 GDP release on Thursday. DB’s economists are expecting a notable rebound in GDP growth to +3% year-on-year in Q2, following the -6.8% contraction in Q1. At the same time, there’ll also be the release of retail sales and industrial production for June, where the expectation is for a jump in retail sales of +0.7% yoy in June (vs. -2.8% in May), and IP growth of +4.5% (vs. +4.4% in May).

Turning elsewhere, the US also has a number of data releases out next week, including an increasing amount of hard data for June. The highlights include the June CPI reading on Tuesday, before the industrial production number on Wednesday, retail sales on Thursday, and housing starts and building permits data on Friday, which should give us a clearer indication of how the economy has performed into the end of the quarter. Meanwhile the U.K. sees a number of data releases, including GDP for May, CPI for June, and unemployment in the three months to May. Another thing to look out for in the UK will be the release of the Office for Budget Responsibility’s Fiscal sustainability Report tomorrow, which will present alternative scenarios for the economy and public finances.

Earnings season – which consensus expects to show the biggest EPS drop since the financial crisis – kicks slowly into gear as 32 S&P 500 companies report along with a further 57 from the STOXX 600. The highlights include PepsiCo today, JPMorgan, Citigroup and Wells Fargo tomorrow, UnitedHealth Group, ASML, Goldman Sachs, US Bancorp, BNY Mellon on Wednesday, Johnson & Johnson, Netflix, Bank of America, Abbott Laboratories and Morgan Stanley on Thursday and on Friday, there’s Danaher, Honeywell International and BlackRock.

Below are the key events day by day, courtesy of Deutsche Bank:

Monday

- Data: Japan May tertiary industry index, US June monthly budget statement

- Central Banks: BoE Governor Bailey and Fed’s Williams speak

- Earnings: PepsiCo

Tuesday

- Data: China June trade balance, Japan final May industrial production, UK May GDP, Germany final June CPI, Euro Area May industrial production, Germany July ZEW survey, US June NFIB small business optimism index, CPI

- Central Banks: Fed’s Bullard speaks

- Earnings: JPMorgan, Citigroup, Wells Fargo

- Other: UK’s Office for Budget Responsibility publish their Fiscal sustainability report.

Wednesday

- Data: UK June CPI, Italy final June CPI, US weekly MBA mortgage applications, July Empire State manufacturing survey, June industrial production, capacity utilisation, import price index, Canada May manufacturing sales, June existing home sales

- Central Banks: Bank of Japan and Bank of Canada policy decisions, Federal Reserve releases Beige Book, BoE’s Tenreyro and Fed’s Harker speak

- Earnings: UnitedHealth Group, ASML, Goldman Sachs, US Bancorp, BNY Mellon, Infosys

Thursday

- Data: China Q2 GDP, June industrial production, retail sales, UK May unemployment rate, EU27 June new car registrations, France final June CPI, Euro Area May trade balance, Canada May international securities transactions, US June retail sales, July Philadelphia Fed business outlook, NAHB housing market index, weekly initial jobless claims, May foreign net transactions

- Central Banks: ECB, Bank Indonesia and Bank of Korea policy decisions, BoE’s Haldane and Fed’s Evans and Williams speak

- Earnings: Johnson & Johnson, Netflix, Bank of America, Abbott Laboratories, Morgan Stanley

Friday

- Data: Italy May industrial sales, industrial orders, Euro Area final June CPI, US June building permits, housing starts, preliminary July University of Michigan sentiment, Canada May wholesale trade sales

- Central Banks: BoE Governor Bailey speaks

- Politics: Special European Council meeting commences in Brussels, where EU leaders will discuss the recovery fund and the new long-term EU budget.

- Earnings: Danaher, Honeywell International, BlackRock

* * *

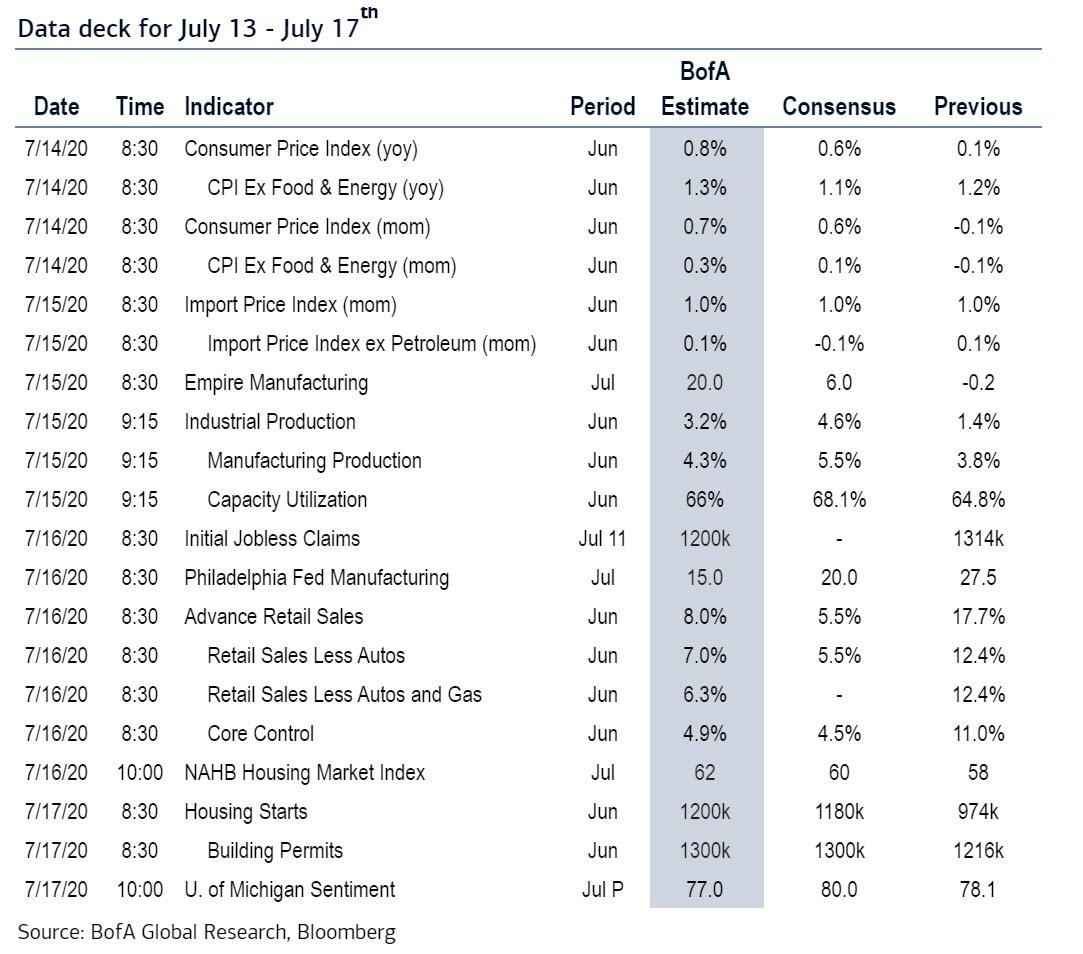

Looking at just the US, the key events this week are the CPI report on Tuesday, industrial production report on Wednesday, retail sales report, jobless claims report and Philly Fed manufacturing survey on Thursday, and the University of Michigan consumer sentiment survey on Friday.

Monday, July 13

- 11:30 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams takes part in a discussion at an event jointly hosted by the Fed and Bank of England. Prepared text and moderated Q&A are expected.

- 01:00 PM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will take part in a virtual discussion on the economy hosted by the National Press Club.

Tuesday, July 14

- 06:00 AM NFIB small business optimism, June (consensus 98.0, last 94.4)

- 08:30 AM CPI (mom), June (GS +0.74%, consensus +0.5%, last -0.1%): Core CPI (mom), June (GS +0.20%, consensus +0.1%, last -0.1%); CPI (yoy), June (GS +0.88%, consensus +0.6%, last +0.1%); Core CPI (yoy), June (GS +1.16%, consensus +1.1%, last +1.2%): We estimate a 0.20% rebound in June core CPI (mom sa), which would leave the year-on-year rate narrowly unchanged at +1.2%. Our monthly core inflation forecast reflects a rebound in apparel, hotel lodging, and airline prices, as well as second-derivative improvement in car insurance inflation following steep declines in the spring. We also look for flat-to-down used car prices. We estimate a 0.74% increase in headline CPI (mom sa), reflecting higher energy and food prices.

- 02:00 PM Fed Governor Brainard (FOMC voter) speaks: Fed Governor Lael Brainard will discuss the economy and monetary policy during a webinar hosted by the National Association for Business Economics. Prepared text and moderated Q&A are expected.

- 02:30 PM St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will take part in a virtual discussion on the economy and monetary policy hosted by the Economic Club of New York. Media and Audience Q&A are expected.

Wednesday, July 15

- 08:30 AM Empire State manufacturing index, July (consensus +8.4, last -0.2)

- 08:30 AM Import Price Index, June (consensus 1.0%, last 1.0%)

- 09:15 AM Industrial production, June (GS +4.6%, consensus +4.3%, last +1.4%); Manufacturing production, June (GS +6.0%, consensus +5.8%, last +3.8%); Capacity utilization, June (GS 67.7%, consensus 67.7%, last 64.8%): We estimate industrial production rose by 4.6% in June, reflecting a continued rebound in manufacturing output. We estimate capacity utilization rose by 2.9pp to 67.7%.

- 12:00 PM Philadelphia Fed President Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will take part in a virtual discussion on the economic outlook hosted by the Center City Proprietors Association. Prepared text and audience Q&A are expected.

- 02:00 PM Beige Book, June FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In the June Beige Book, we look for anecdotes related to growth, labor markets, wages, price inflation, and the economic impacts of the ongoing coronavirus outbreak.

Thursday, July 16

- 08:30 AM Retail sales, June (GS +4.9%, consensus +5.0%, last +17.7%); Retail sales ex-auto, June (GS +4.9%, consensus +5.1%, last +12.4%); Retail sales ex-auto & gas, June (GS +4.0%, consensus +5.0%, last +12.4%); Core retail sales, June (GS +2.5%, consensus +3.9%, last +11.0%): We estimate that core retail sales (ex-autos, gasoline, and building materials) rebounded by another 2.5% in June (mom sa), reflecting the reopening of the economy and as indicated by continued gains in credit card spending and other high-frequency data. We expect particularly strong monthly gains for restaurants and gas stations but less pronounced increases in the retail control categories. In fact, we estimate declines in the grocery and non-store categories. We expect a 4.9% increase in both the headline and ex-auto measures, given the rebound in car sales, gasoline prices, and gallonage.

- 08:30 AM Philadelphia Fed manufacturing index, July (GS 27.5, consensus 19.1, last 27.5); We estimate that the Philadelphia Fed manufacturing index remained unchanged at 27.5 in July.

- 08:30 AM Initial jobless claims, week ended July 11 (GS 1,300k, consensus 1,250k, last 1,314k): Continuing jobless claims, week ended July 4 (consensus 17,550k, last 18,062k): We estimate initial jobless claims declined but remain elevated at 1,300k in the week ended July 11.

- 10:00 AM NAHB housing market index, July (consensus 60, last 58)

- 10:00 AM Business inventories, May (consensus -2.3%, last -1.3%)

- 11:00 AM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will take part in a virtual discussion at the Rocky Mountain Economic Summit. Audience Q&A is expected.

- 11:10 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will take part in a webinar hosted by the Financial Research Advisory Committee. Prepared text and moderated Q&A are expected.

Friday, July 17

- 08:30 AM Housing starts, June (GS +22.0%, consensus +20.9%, last +4.3%); Building permits, June (consensus +6.9%, last +14.1%): We estimate housing starts increased by 22.0% in June. Our forecast incorporates a large increase in building permits and stronger construction job growth.

- 10:00 AM University of Michigan consumer sentiment, July preliminary (GS 78.5, consensus 79.0, last 78.1): We expect the University of Michigan consumer sentiment index edged up by 0.4pt to 78.5, as further reopening and stock market gains could potentially boost sentiment, while deteriorating virus news could weigh on sentiment.

Source: DB, Goldman, BofA

via ZeroHedge News https://ift.tt/2WfQ7lN Tyler Durden