Wall Street Concludes That No Matter Who The Next President Is, It Will Be Bullish For Stocks

Tyler Durden

Mon, 07/13/2020 – 15:35

Soaring coronavirus cases? Bullish.

Record number of unemployed? Bullish.

Biden winning the presidential election on November 3, undoing Trump’s tax reform and hiking corporate taxes from 21% to 28%, resulting in a huge hit to corporate aftertax income? After Goldman revealed one month ago that its clients were losing sleep over the possibility of a Democratic sweep in November – one which Goldman calculated would wipe out 20 EPS from the S&P in 2021…

… it took a lengthy refutation from Morgan Stanley to mute Goldman’s skepticism, and to convince investors that a Biden victory would also be Bullish for stocks.

However, since quite a few investors and traders remained skeptical that a Biden victory would allow the current meltup in markets to continue, Morgan Stanley was joined by more banks in its assessment that no matter who wins in November, it will be bullish for stocks.

First, a quick reminder of the Morgan Stanley punchline: this is what the bank’s policy strategist Michael Zezas wrote on June 21: “election outcomes remain uncertain, but we think their influence on current policy choices and future policy paths is supportive of risk assets today.” And this is how we “translated” this statement: “no matter who the president is, they won’t allow stocks to drop.”

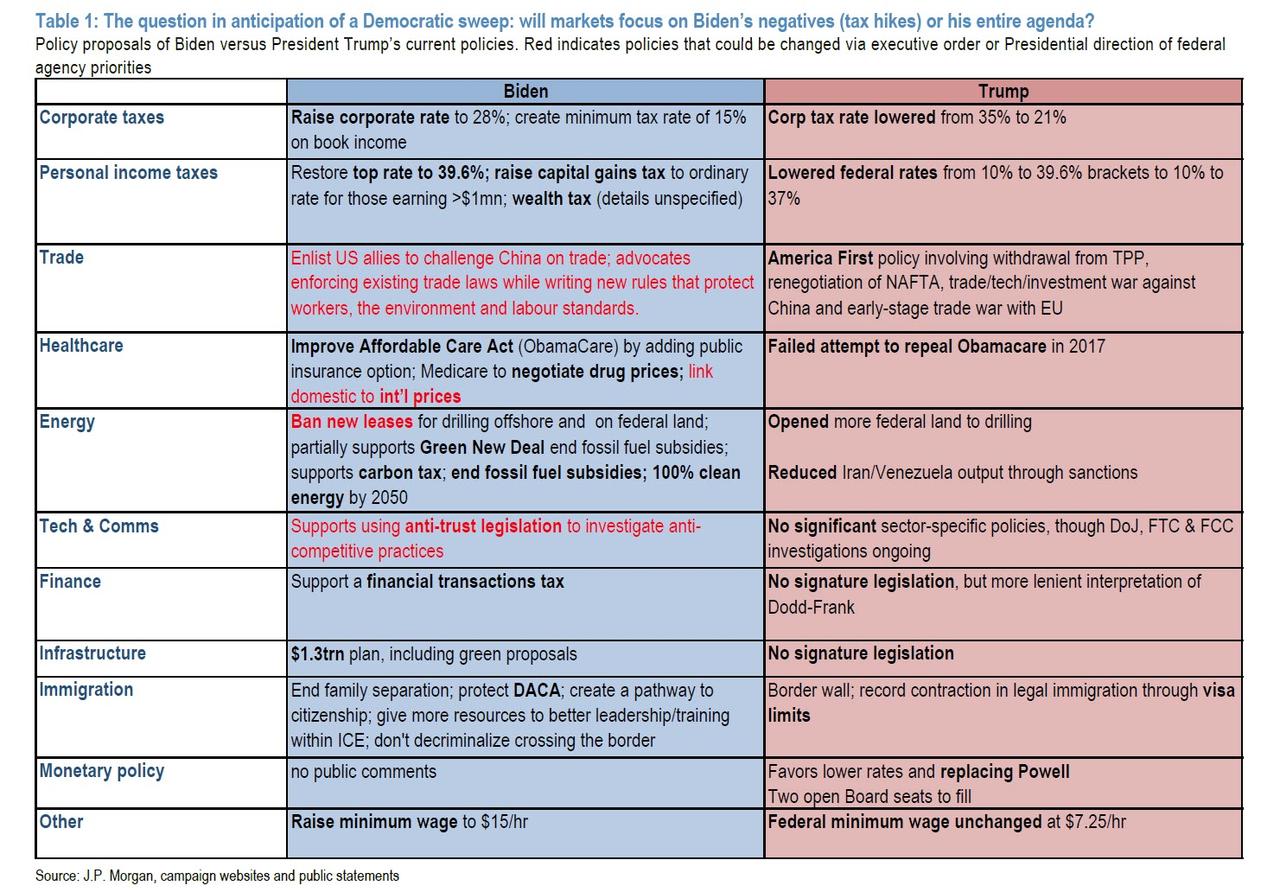

Then, last week, it was JPMorgan’s turn to claim that “Biden’s agenda backed by a Democratic Congress is less threatening in its entirety than in some of its headline components.” The bank then tried to goalseek Biden policies as favorable for stocks, saying that “his published program entails a clear hit to corporate profits through higher taxes, but with eventual offsets such as redistribution to lower and middle-income households through a higher minimum wage and broader healthcare coverage, plus a national boost via infrastructure spending.” JPM also predicted that a Biden admin would “guarantee” a less-combative foreign policy “which is bearish for volatility, though the odds of tariff rollback are tougher to handicap. Hence why our US Equity strategists have framed a Democratic sweep elections as potentially neutral-to-positive for markets.”

To be sure, spinning a Biden victory as bullish may not be quite so simple, which is why even JPM felt the need to hedge, saying that “the risk is that markets focus on the tangible negatives (corporate tax hikes) rather than the less tangible positives (foreign policy) in the weeks preceding the election or just following it.”

And now, making a full circle, none other than Goldman also concedes that despite the clear hit to after tax corporate profits as a result of Biden tax hikes, a Biden presidency would also not be all that bad.

First, presenting the bearish case, Goldman;s Tony Pasquariello, head of global HF sales, writes that “the dominant market issue in our view so far has been Vice President Biden’s proposal to reverse half of President Trump’s cut in the corporate income tax rate from 35% to 21%, which we think could become a strong possibility in the event of a Democratic ‘sweep.’ given that such a reversal would translate directly into a hit to after-tax earnings, the implication is that it would flow through to a notable hit to US equity market valuations.” However, as the Goldman partner adds next, “the picture may be more complicated, however” as “there is a good chance that any shift would be fiscally neutral and could also be phased, so the full market impact would depend on what other measures accompanied it… we think more attention should be focused on the international implications, where a Democratic presidency is likely to move away from the aggressive use of trade policy in the current administration and adopt a more favorable view of international institutions and alliances.”

In short, ignore the spike in corporate taxes and focus on the fact that the Deep State is about to take over US foreign politics, returning US policy “back to normal” and assuring that the wealth redistribution mechanism of the pre-Trump days works on all cylinders just as it used to back in the day.

via ZeroHedge News https://ift.tt/2Onb4ag Tyler Durden