US Recovery Stalls As Pandemic ‘Second Wave’ Threatens To Unleash Double-Dip Recession

Tyler Durden

Mon, 07/13/2020 – 22:05

The US economy has stalled as the virus pandemic flares up. Real-time data shows slowdowns in consumer foot traffic, restaurant foot traffic, discretionary income, and overall economic activity as virus cases rise in 38 states.

The US reported its largest single-day caseload increase on Friday, with more than 67,000 new confirmed cases. Six states (Arizona, California, Colorado, Florida, Michigan, and Texas) have seen a surge in cases over the last month – governors in these states are reversing reopening plans, with 15 more states pausing reopenings.

On top of rising cases, the death toll in the US rose last week for the first time in months, as hospitals in the sunbelt and coastal states become inundated with virus patients. The country reported 4,200 deaths in the last seven days. Virus-related hospitalizations have surged to levels not seen since May, a troubling sign for hard-hit states that suggest the trend will worsen through July.

The reemergence of the virus cases, forcing governors to pause or reverse reopening plans have stalled out economic activity and risks the shape of the recovery being downgraded from a “V” to “U” or even the dreadful “L.” Also, a looming fiscal cliff risk crashing consumption as more than a quarter of all personal income is reliant on direct deposits from the government.

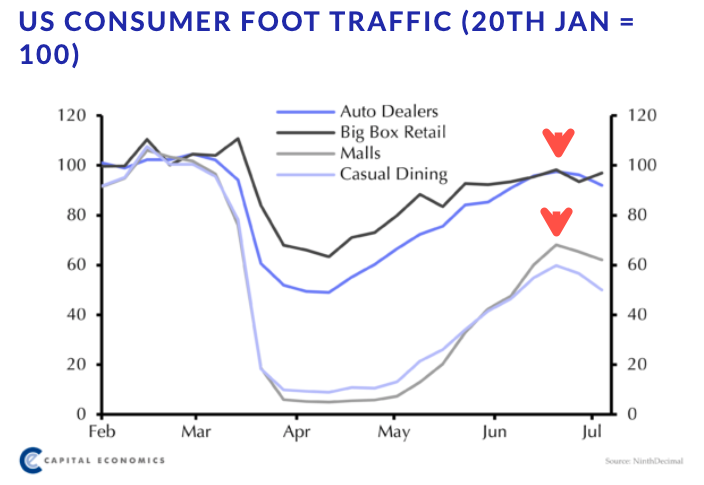

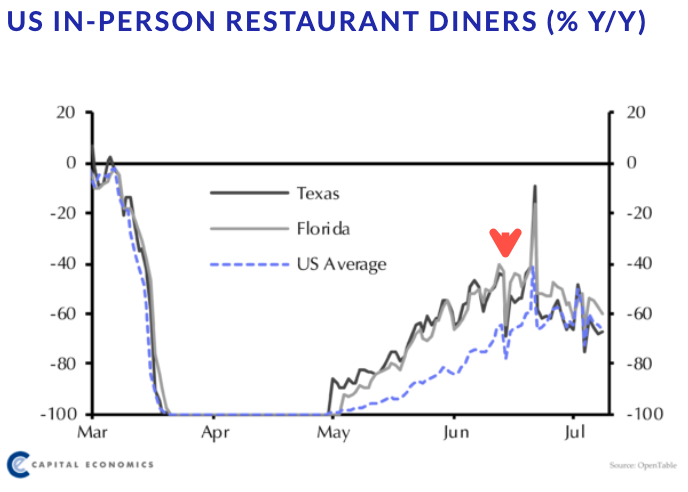

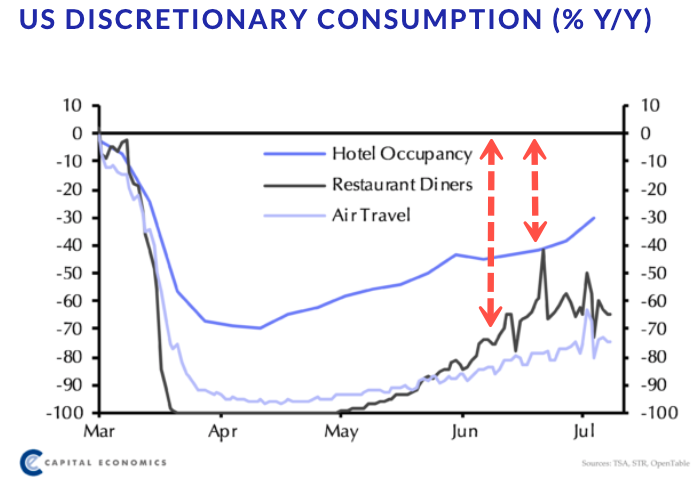

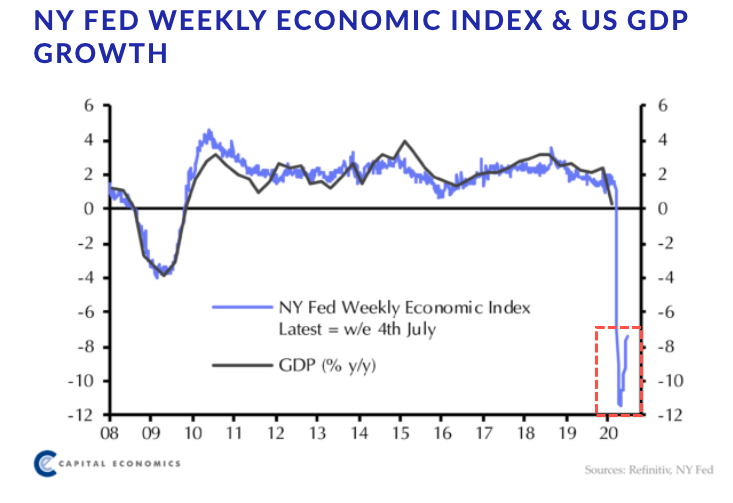

Courtesy of Capital Economics, which has compiled a handy breakdown of real-time US indicators, we can see the full extent of how the recovery has stalled.

Consumer foot traffic for casual dining and malls have yet to revert to pre-corona levels as the bounce stalled in late June. Foot traffic for auto dealers and big-box retailers have almost returned to January levels but plateaued in the same period.

Restaurant foot traffic (measured in person % Y/Y) remains collapsed with recovery stalled through June and reversing in July.

Discretionary consumption (% Y/Y) shows continued depression for air travel, restaurant diners, and hotel occupancy.

The NY Fed’s Weekly Economic Index does not support the V-shape narrative the Trump administration routinely touts on Twitter.

The stalled recovery is set to pressure employers who will be forced to layoff another round of folks. Americans will be staying home this summer and not traveling as the virus-induced recession has wrecked their finances.

It’s becoming evident the virus and or the emergence of cases can influence economic recovery shape. Damage from the downturn is widespread, with permanent job loss and deep economic scarring set to derail the recovery.

Here’s Gary Shilling, the president of A. Gary Shilling & Co., take on what could be next for markets as investors figure out the shape of the recovery is an “L.”

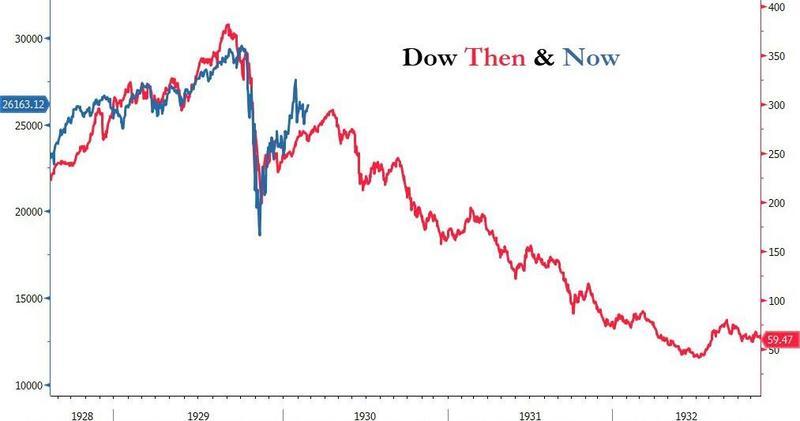

“I think we’ve got a second leg down and that’s very much reminiscent of what happened in the 1930s where people appreciate the depth of this recession and the disruption and how long it’s going to take to recover,” said Shilling.

Shilling said today’s stock market bounce from March lows resembles the initial dip then rebound in 1929 – and we all know what happened next…

The Fed and Trump administration better unleash another round of MMT or a double-dip recession is ahead for the back half of the year.

For more color on the stalled recovery via real-time data, here is Bank of America’s latest credit and debit card spending trends.

via ZeroHedge News https://ift.tt/32lxUY1 Tyler Durden