Why Hedge Funds Buy Pet Rocks In Times Of Crisis

Tyler Durden

Mon, 07/13/2020 – 23:05

Authored by Eddie van der Walt, macro commentator at Bloomberg

Even when hedge funds have a world of risk-protection products at their disposal, such as going short the S&P 500 or going long the volatility of volatility, many still buy gold. Why? Because it offers broad protection against unknowns, rather than targeted insurance against identified risks.

During the darkest days of March, the supposed haven metal fell alongside equities and other risky assets as investors rushed to the liquidity of short-end Treasuries. Even forgiving that failure, it’s a blunt instrument compared with other forms of portfolio insurance.

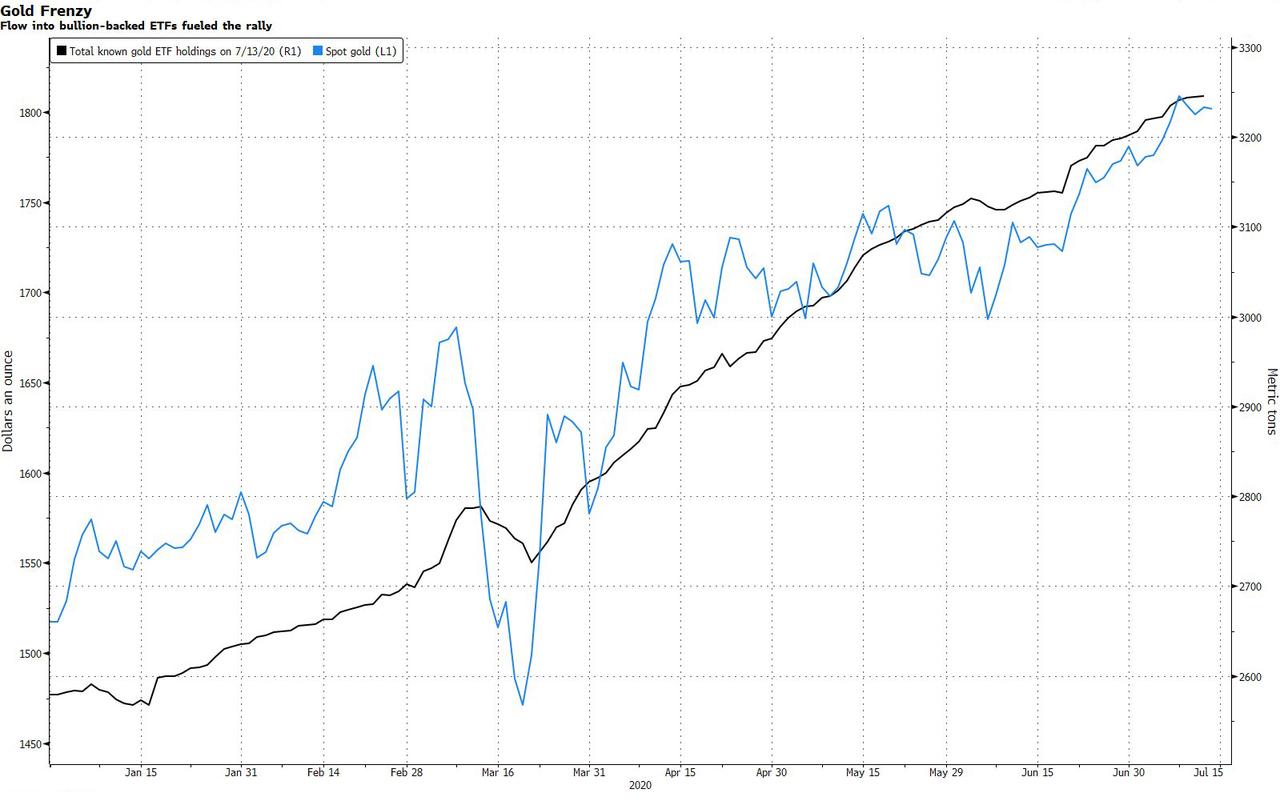

Yet the price of gold has been chased to eight-year highs above $1,800/oz. Investors in exchange-traded funds built a stockpile large enough to supply global gold demand for three quarters of a year. And luminaries including Paul Singer, David Einhorn, and Crispin Odey have told backers they’re bullish.

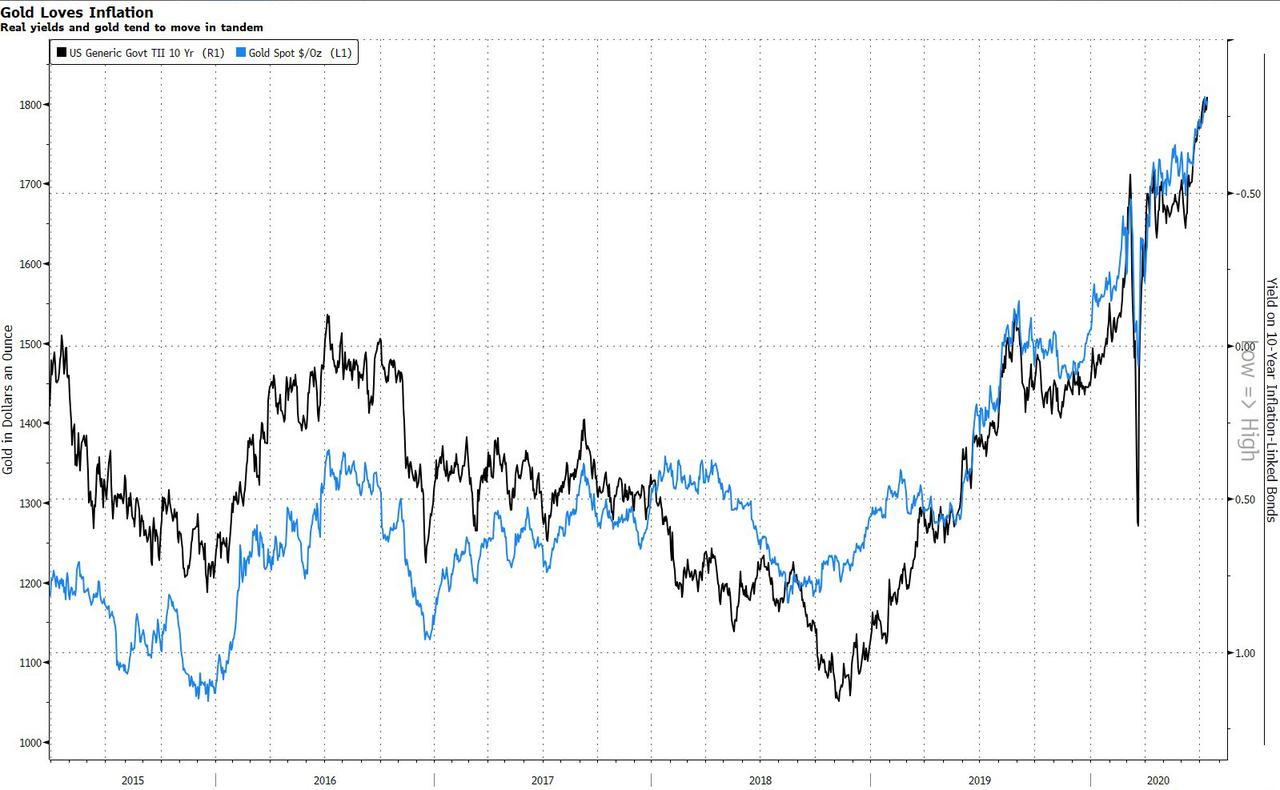

The first reason usually presented is the inverse relationship with real rates. As a non-yielding asset with perceived inflation-protection qualities, gold tends to do well when central banks turn dovish in the face of slow growth. But there are more precise ways of achieving this, for instance, via inflation swaps.

Such a trade will introduce counterparty risk, which is the second excuse often given for resorting to gold. But unless we’re talking about the collapse of the global financial system these risks can be met through collateral and clearing houses.

Instead, it’s gold’s bluntness as a tool that makes it useful. It offers broad insurance against the unknown, whereas a credit default swap offers protection against a very specific event.

This can be illustrated by how it moves relative to other assets. In normal times, the best input to explain the tick-by-tick movements in gold is the dollar, the two having a correlation of -0.5 since the turn of the century.

But it’s not stable over time. In periods of acute stress, particularly if the stress is perceived as outside the U.S., gold and the dollar can move in tandem. In fact, gold often takes the opposite side of the biggest perceived risk factor in global markets.

Anecdotally, periods of heightened uncertainty in the euro zone, including the sovereign debt crisis and then the Greek bailout referendum in 2015, saw stronger-than-usual inverse links between the euro and gold priced in that currency.

It was the same case with the pound during the Brexit vote, when the mathematical relationship between sterling and bullion priced in sterling went from its 10-year average of -0.2 to -0.84.

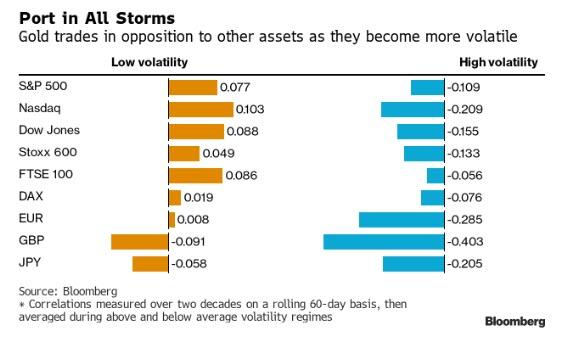

And it works on a statistical level, too. Across major equity indexes and the most liquid currencies, the correlation between gold and the counter asset becomes more inverse as the volatility of the other asset increases.

The table below shows the average correlation to gold in changing volatility regimes, with data for the last two decades compiled on a rolling 60-day basis by Bloomberg. For currencies, the cross-correlation was measured to gold priced in that currency.

This shows that the nature of gold’s protection changes as the risk factors change. Preoccupations shift from trade wars to geopolitics to hyperinflation, and gold’s offers the all-purpose protection hard to achieve with a short against the S&P 500.

So in the hyper-speed coronavirus world, it’s no wonder hedge funds still love gold.

via ZeroHedge News https://ift.tt/300usio Tyler Durden