Central Banks Have Wrecked Most Hedge Fund Strategies, New Study Finds

Tyler Durden

Wed, 07/15/2020 – 15:00

Ever since our creation, we have mocked the obsolescence of the concept of hedging in a centrally-planned, Fed controlled market (hence our name) saying – for example in 2015 – that “we are confident that as long as the Fed and central banks double as Chief Risk Officers for the market, “hedge” funds will be on an accelerated path to extinction, quite simply because in a world where a central banker’s money printer is the best and only “hedge” (for now), there is no reason to fear capital loss.”

But while hedge funds may be obsolete in a world in which there is no need to protect downside risk if central banks will inject trillion in liquidity any time there is even a modest pullback, then running a value investing strategy has been outright masochism, as fundamentals ceased to matter once the only thing that did matter is the Fed’s balance sheet, something we first pointed out back in 2010:

Take home message from Value Investor Congress: we are sick of looking at the Fed’s H.4.1 statement for investment decisions

— zerohedge (@zerohedge) October 13, 2010

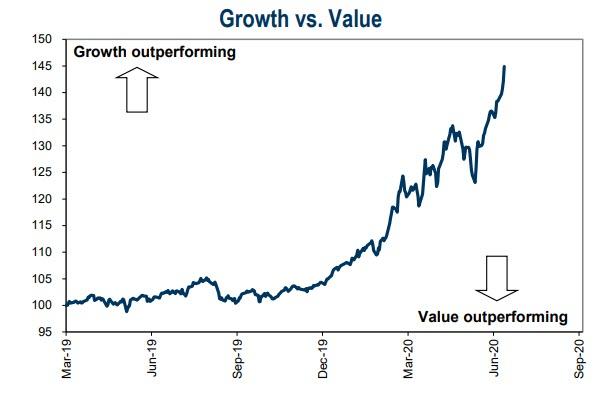

This is especially true if paired with a short growth trade as the following chart make all too clear:

Now, a new scientific study confirms that our suspicions were correct all along, and that it is indeed the Fed whose market intervention has crippled hedge funds returns over the past decade.

A report from Alexei Orlov of the US SEC and Massimo Guidolin of the Bocconi University titled “Are Unconventional Monetary Policies a Priced Risk Factor for Hedge Fund Strategies?” tested 10 investing strategies against 18 unconventional monetary policy announcements from the Federal Reserve and European Central Bank between 2008 and 2016. And, as Bloomberg summarizes, it found that central bank policies are directly hitting more than half of the strategies, and indirectly whiplashing virtually the entire industry.

“The aim is to test whether – and how (i.e. positively or negatively) – each hedge fund index is exposed to monetary policy shocks,” the authors wrote in the introduction to their paper. The answer: pretty much everywhere.

The findings showed that central bank announcements “represent a risk factor that leads to negative, precisely estimated exposures” for six of the 10 strategies, which makes perfect sense: after all by definition hedge funds hedge, and with central banks intent on only one thing, i.e., to push stocks higher, it implicitly takes away at least half of the hedge funds’ expected returns, or at best forces them to become plain vanilla “long onlies.”

The strategies affected are convertible arbitrage, dedicated short bias, emerging markets, equity market neutral, fixed-income arbitrage and multi-strategy. And while global macro, equity long/short, managed futures and event driven strategies avoided that list, when the researchers looked at the indirect effects of policy pronouncements, it transpired there was virtually nowhere to hide.

In short, the Fed’s central planning of the market has meant that professional money managers of all stripes are now irrelevant, begging the question why pay 2 and 20 to have them manage money.

Meanwhile, 2020 is the 11th year in a row in which hedge funds struggle to outperform either their benchmarks or the broader market, with everything from overcrowding to Covid-19 hurting returns and shuttering funds.

It gets worse: as Bloomberg notes, Orlov and Guidolin found “breaks” in the conventional characteristics that help determine the return of each strategy, known as factors, which corresponded to the UMP dates. That’s a tell-tale sign that Fed and ECB announcements are having such a large impact on the market as a whole it disrupts the foundations upon which hedge fund returns are built.

This means that in their attempts to prop up markets, central banks have broken it.

“Not only do we find that each of the 10 strategies and the industry as a whole feature a number of structural change episodes in risk exposures, but we also find that most of the endogenously determined break dates match, or nearly match, the UMP announcement dates,” they wrote.

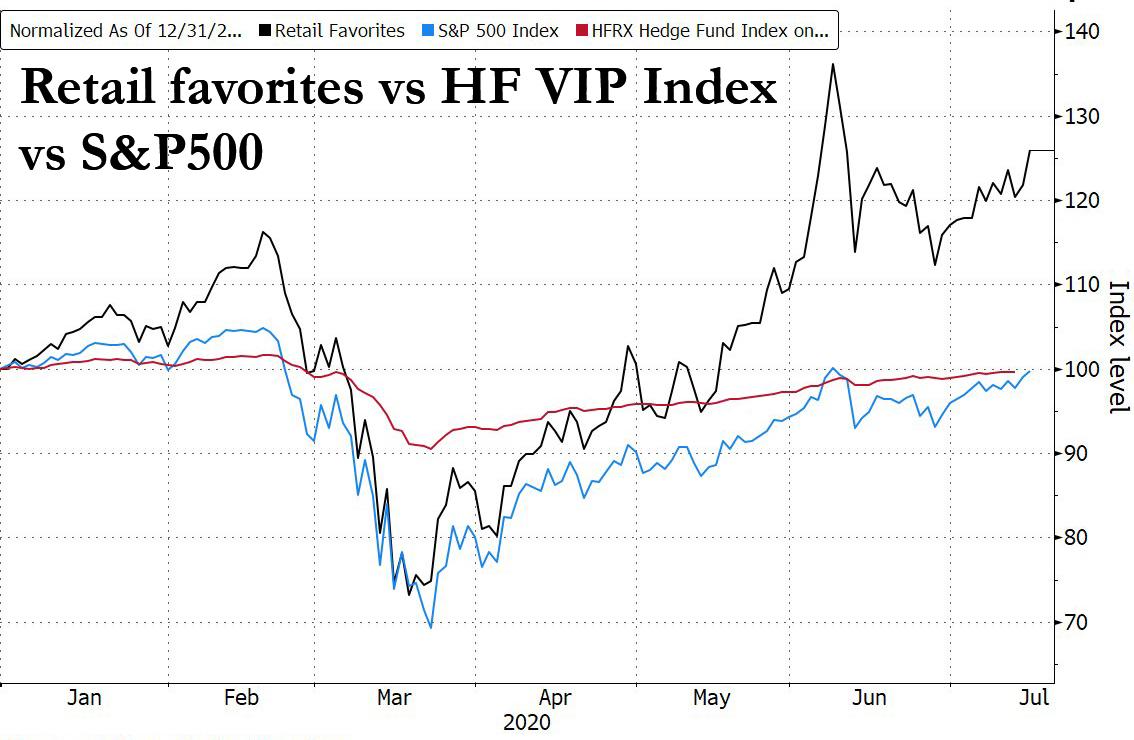

So for all those wondering what to do in a world where finance professionals are totally clueless, here is a suggestion: with the Fed hell bent on making idiots the best performers out there, just give your money to the local neighborhood Robinhood trader. As the following chart shows, a basket of the 50 Retail Favorite stocks is up almost 30% YTD, massively outperforming both the S&P500 and a basket of Hedge Fund VIP stocks.

via ZeroHedge News https://ift.tt/2WmY60e Tyler Durden